Original author: Joy Lou

BitDeer (stock code BTDR in the US) updated its operating figures for November. The market-focused A 2 mining machine (Sealminer A 2) began mass production, with the first batch of 30,000 units sold to the outside world.

The first growth curve: self-developed chips, sales of mining machines, and self-operated mining farms.

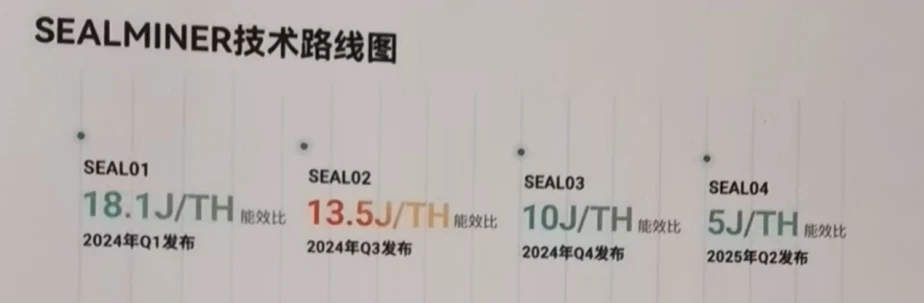

The ability to develop chips on its own has always been the core competitiveness of mining machine manufacturers. Xiaolu successfully completed the production of A2 mining machine chips and A3 mining machine chips in the past six months.

Figure 1: BitDeer Technology Roadmap

Source: BitDeer official website

Figure 2: BitDeer main mining machine parameter prediction

Source: Model forecasts, company guidance

According to public information, the current operating parameters of the A2 mining machine are at the historical leading position among all the mining machines currently on sale and in operation on the market. Although the A3 has not yet been officially released, judging from the known parameters, it will become the worlds largest single hash computing power mining machine with the leading energy efficiency ratio. The possibility of this product being sold to the outside world in the short term is extremely low, and it will be used first to deploy self-operated computing power.

Figure 3: The latest mining machine companies and mining machine parameters in the world

Source: Bitmain, BitDeer, Shenma Miner, Canaan Technology official website

In terms of power plants, as of the end of November, the company has completed the deployment of 895 MW of power plants in the United States, Norway and Bhutan. There are also 1,645 MW projects under construction, of which 1,415 MW will be completed in mid-to-late 2025. According to the minutes of Guoshengs conference call, the company has set up a special department to acquire more power plant projects, and it is expected to add more than 1 GW of power plants in 2026; the average electricity price of all self-operated power plants is less than US$0.04/kWh, which is absolutely leading compared with its peers.

Figure 4: BitDeer鈥檚 built and under-construction electric fields

Source: Company website

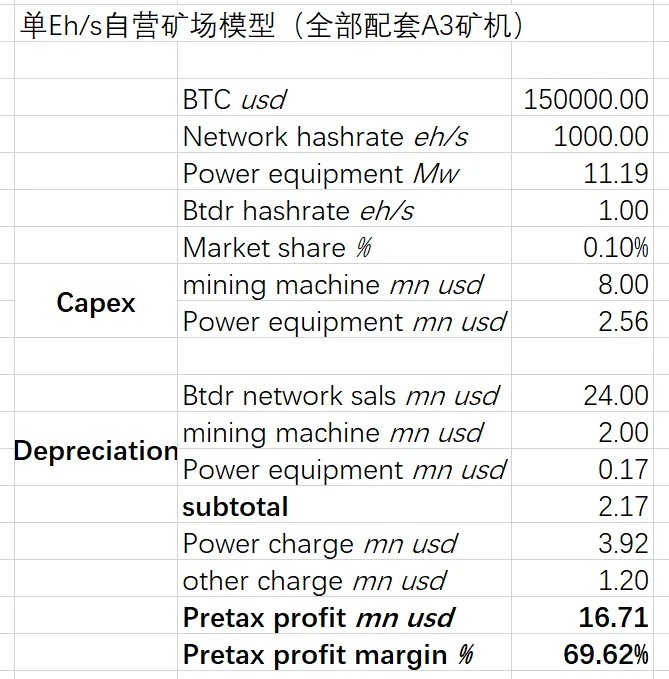

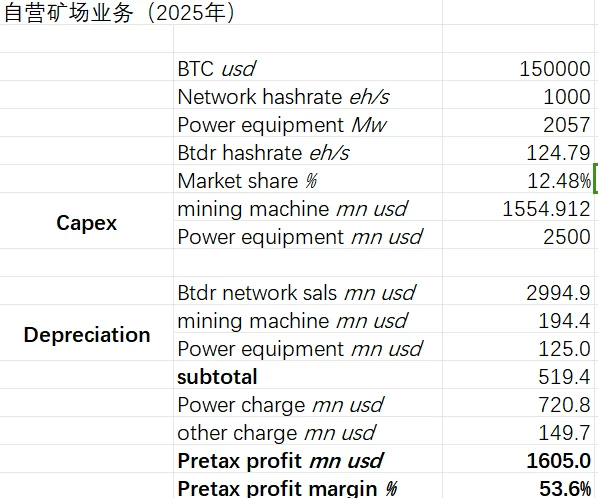

Given the above operating figures, the BitPath 1 EH/s model is as follows:

Figure 5: BitDeer single EH/s model

Source: Model predictions

The key assumptions of the model include that the mining machine depreciation period is 4 years (5 years under North American financial standards), the electric field depreciation period is 15 years (20 years under North American financial standards), and other costs (including manual operation and maintenance, etc.) account for 5% of revenue (the companys historical operating figures are only 1-1.5%). According to the model, the shutdown price of BitDeers self-operated mining farm is 35,000 US dollars in Bitcoin.

Figure 6: Relationship between pre-tax profit margin of BitDeer鈥檚 self-operated mining farm and Bitcoin price

Source: Model predictions

When the price of Bitcoin exceeds $150,000, the pre-tax profit slope of BitDeers self-operated mine will exceed the rate of increase of Bitcoin. If the price of Bitcoin reaches $200,000, the pre-tax profit margin of BitDeers self-operated mine will be close to 80%.

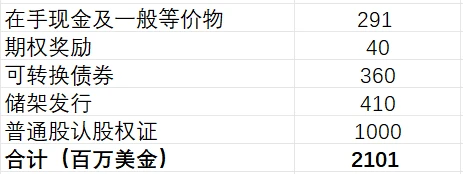

The company filed Form 6-K and Form 3-F on December 11, adjusting the shelf offering from $250 million to $580 million, and announced that it would issue $1 billion in warrants for common stock debt securities.

As mentioned above, Xiaolu is expected to reach a power reserve of 2.3 GW by mid-2025. If all the above mines are equipped with A3 mining machines, the self-operated computing power will be close to 220 EH/s (calculated according to the A3 mining machine 325 Th, corresponding to about 700,000 units). According to the linear growth of the total network computing power, it will account for about 20% of the total network computing power by the end of 2025. According to the companys third quarter report, the company has cash and general equivalents of US$291 million, US$40 million options, and completed US$360 million convertible bonds at the end of November, and then completed the issuance of US$410 million of the shelf (the original plan of US$250 million has been issued, and an additional US$330 million) and US$1 billion of warrants. The companys cash on hand will reach US$2.1 billion. According to TSMCs current wafer prices and Guoshengs latest conference call, 3NM process costs 200 million US dollars for every 10,000 wafers, corresponding to 90,000 A3 mining machines, 700,000 mining machines corresponding to 80,000 wafers, corresponding to 1.6 billion US dollars in capital expenditure. TSMCs latest quarterly financial report shows that the current 3NM production capacity is about 80,000 wafers/month, which will be increased to 100,000 wafers/month in 2025. After increasing financing efforts, Xiaolu will actively lock in future wafer production capacity to prepare for the earlier lighting of its own mines.

Figure 7: After BitDeer completes all financing and issuance, its cash on hand will reach US$2.1 billion

Source: BitDeer company announcement

Regarding the competitive relationship between Bitmain and Deer. The core of the commercial competition relationship is still the performance of mining machines and the cost of self-operated computing power. According to public data and laboratory data, Deer has sufficient competitive advantages in both the mining machines it has produced and the cost of self-operated computing power. With the development of high-end process chips, mining machines, as the downstream of the industry, will also be affected by the upstream competition pattern.

Second growth curve: AI computing power

In addition to mining machine sales and self-operated mining farms, the companys operating figures report in November showed that it has begun deploying NVIDIA H200 chips in the TIER 3 data center of intelligent cloud services for AI computing power construction.

Mr. Wu Jihan wrote an article entitled The Beauty of Computing Power in 2018: Computing power may be an effective means for mankind to reach a higher civilization, and it is also the most effective way to fight against entropy increase.

The original intention remains.

Nvidias latest 13 F report shows that by the end of the third quarter of 2024, the company has added 7.72 million shares of Applied Digital (APLD), accounting for 3.6%. The latter is committed to transforming to high-performance computing and artificial intelligence infrastructure solutions and cloud services; on December 2, Nvidia, as a strategic investor, led the additional issuance of Nebius (NBIS), a Dutch artificial intelligence infrastructure service provider. The company issued approximately 33.33 million new shares at a price of US$21 per share to accelerate the promotion of the artificial intelligence manufacturing industry. The latest research report from JPMorgan Chase predicts that global artificial intelligence capital expenditure will reach US$480 billion in 2025. Recently, major North American SAAS companies have begun to promote B-side artificial intelligence AI Agent services and will increase investment in 2025, which will improve overall ROI expectations. As a mining farm owner with abundant electricity resources, the transformation from mining business to artificial intelligence cloud services is in line with expectations. Xiaolu has now begun to contact large North American technology companies (MEGA 7) and will allocate more electricity to artificial intelligence cloud services in the medium term.

Investment advice and valuation

The right time, the right place and the right people are the best description of investing in BitDeer at the current point in time. The company has accumulated strength and is ready to make a breakthrough. The first growth curve and the second growth curve are expected to rise simultaneously, forming a synergy. It is the most cost-effective target among the current US mining stocks.

However, how to value a company and how to 去中心化金融ne the companys value in a profit model are challenging. Neither the profit valuation generated by the sale of mining machines alone nor the valuation of self-operated mines is sufficient to cover Xiaolus actual operating conditions. Therefore, two types of business models are fitted as follows:

Figure 8: Calculation of BitDeer mining machine sales model

Source: Model predictions

Figure 9: BitDeer self-operated mining farm prediction model

Source: Model predictions

The current average valuation of 170 million USD/EHs for mainstream mining companies in North America is the closest to the market consensus. It is reasonable to believe that in the next two years, Xiaolus actual self-operated mines will reach between 120 and 220 EH/s, with a market value of approximately US$20.4 billion to US$37.4 billion, which is 4.8 to 9.7 times higher than the current share price.

Figure 10: Valuations of major North American mining companies

Investment risks:

1. Bitcoin price fluctuation risk;

2. TSMC wafer risks caused by sanctions.

This article is sourced from the internet: Cycle Trading: BitDeer, original intention, rebirth, and leap

Related: BitMEX Alpha: Weekly Trader Report (November 2 – November 8)

Original author: BitMEX Brief Overview Memecoins have been having a crazy week, with the top meme coin rising more than 90% in just seven days. Meanwhile, Bitcoin continued its upward momentum, rising more than 10% and setting a new high. The memecoin craze this week was driven by two major catalysts. On the political front, the Trump administration officially announced that Elon Musk would co-lead the Department of Government Efficiency (DOGE) initiative, and Musks subsequent tweets about Dogecoin and Peanut sparked huge interest. In addition, major exchanges such as Robinhood and Coinbase listed PEPE coins – a coin they had previously hesitated to support – marking a shift in the cryptocurrency landscape after Trumps victory. In our trade analysis section, we’ll explore the latest macro picture – how our own…