Curve leads the DeFi market, what other related tokens are worth paying attention to?

原作者:Alex Liu,前瞻新聞

Curve leads DeFi

Bitcoin stagnated at the psychological level of $100,000, while Alts caught up, causing BTCs market share to fall below 55%.

The DeFi sector performed well, rising by more than 20% in the past 7 days, and Curve Finances token CRV led the DeFi sector with a weekly increase of more than 50%. Among large-cap DeFi tokens, its performance was second only to THE, which was positively affected by Binances listing, and Curve ecosystem protocol Convex token CVX.

Why can CRV rise, what is its potential, and what other related tokens in the ecosystem are worth paying attention to? The author built a position in CRV below 0.3 and has been CX for several months. The following is a brief explanation of the logic of holding CRV.

Direct factors: news of institutional entry

After the news was released, CRV rose from 0.5 USDT to 0.8 USDT. Institutions such as BlackRock bet on the Ethereum ecosystem and entered DeFi through the BUIDL fund. Curve is the infrastructure for DeFi stablecoin pairs and pegged currency exchanges. The market bets on Curves potential for institutional adoption.

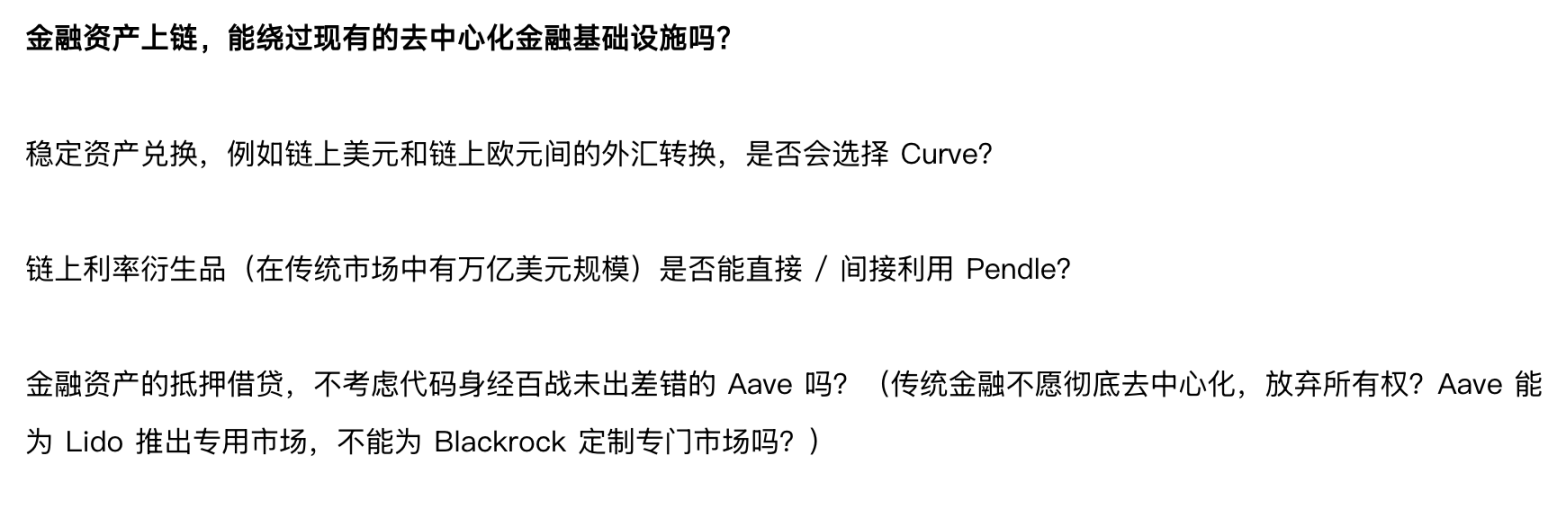

In my article Viewpoint: To get out of the altcoin bear market, a DeFi revival is needed in August this year, I predicted that traditional finance would be put on the chain through the existing DeFi infrastructure, and used Curve, Pendle, and Aave as examples. Since then: Aave has established cooperation with the Trump family, and Curve has introduced RWAs such as BUIDL. Pendle may be the next target worth betting on.

Looking back, the negative selling pressure has been exhausted

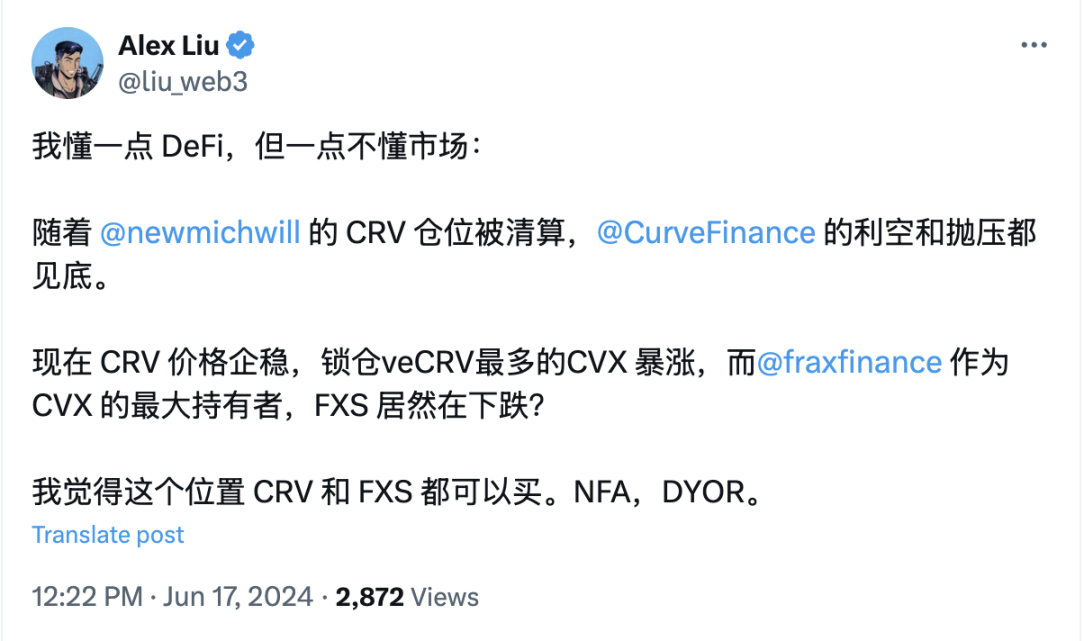

Why did I dare to buy the bottom when CRV was falling? In June this year, I judged that the negative news and selling pressure of Curve Finance had bottomed out.

Note: Currently, Frax Finance has become the second largest holder of CVX, and the largest holder is CLever. The logic of FXS holdings is shown below.

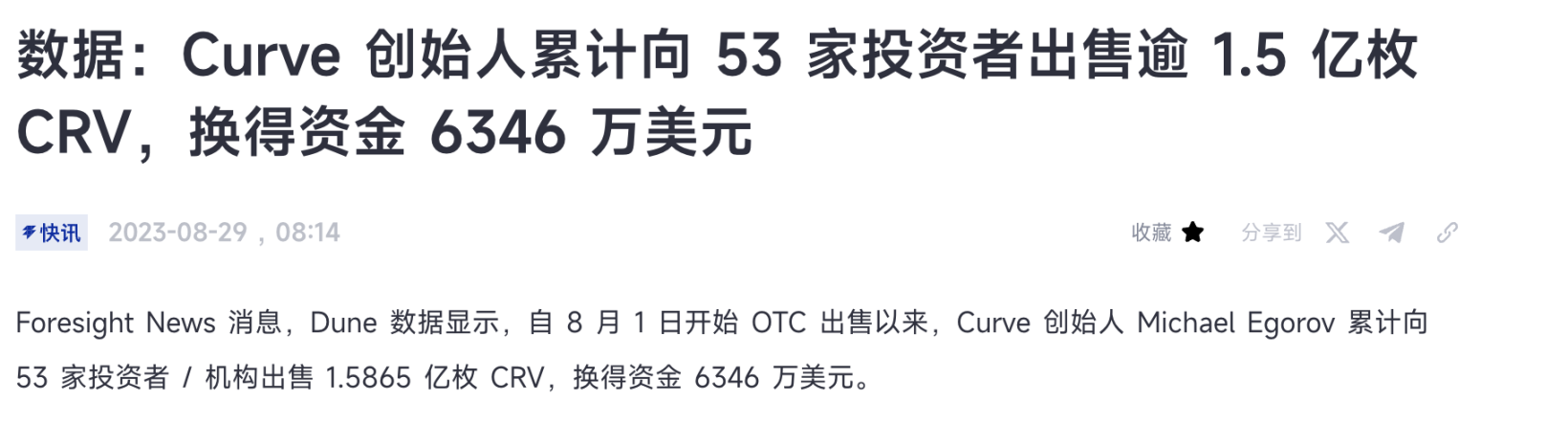

For a long time, the biggest hidden danger of Curve Finance has undoubtedly been the huge lending positions of its founder Michael Egorov, who pledged CRV tokens to borrow stablecoins. These positions were completely liquidated in June.

Some people call liquidation a clever cashing out because there may not be enough liquidity to support the sale of such a large amount of tokens, so the loan positions are liquidated step by step to cash out. But another perspective is that the project founders were forced to sell most of their tokens at the bottom.

Curve founder Michael Egorov also has locked CRV. If you put yourself in his shoes, the way to maximize benefits is to work hard on BUIDL so that the CRV token has a higher value when unlocked, and the long-term value of the team and the protocol token is highly bound.

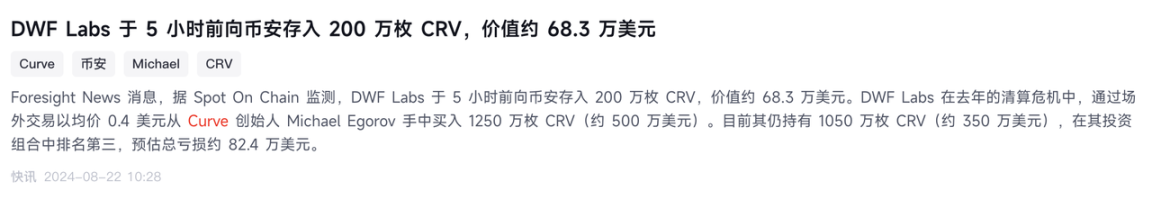

Michael Egorov sold nearly 1.6 CRVs at 0.4 USDT OTC during the liquidation crisis in August last year. He bought them at the end of June, and his cost price was lower than that of most institutions/big players, and many institutions have already cut their losses and left the market.

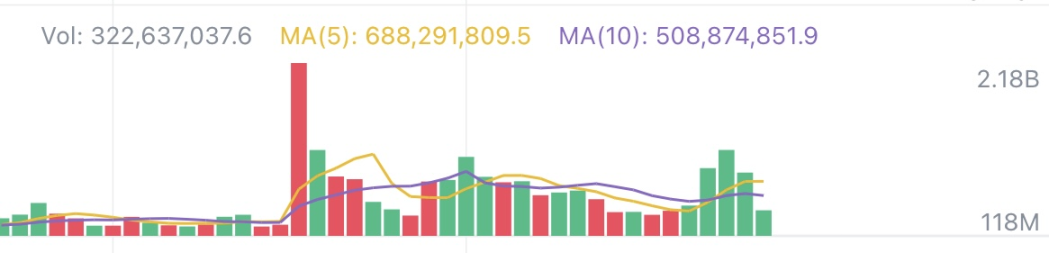

CRVs trading volume on CEX was once much higher than tokens of the same market value for a long time, but the price continued to move sideways, which suggests that it has experienced sufficient chip turnover.

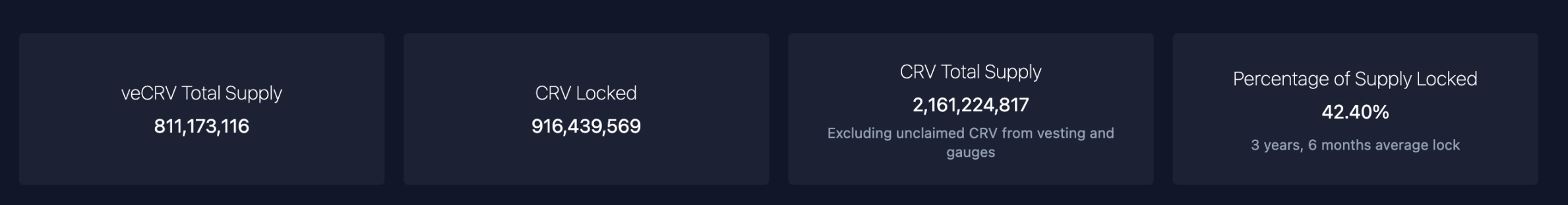

Curve has been online for 4 years, and the inflation rate has dropped to 6.3%. Based on the lock-up rate of 42.4%, the actual inflation of CRV entering circulation is only about 3%.

Looking to the future, innovation and growth points

市場 hype is expected, what innovations and growth points will Curve Finance have in the future?

Potential on-chain foreign exchange products, soft liquidation mechanism lending LlamaLend, crvUSD. Since its launch, crvUSD has generated nearly $150 million in revenue for the Curve protocol.

The launch of scrvUSD will help promote the adoption of crvUSD. What are the advantages of crvUSD and soft liquidation mechanism lending? Recommended reading:

如何擁有無盡的金錢? No need to work, just lie down and enjoy yourself.

Curve Finance is also expanding its ecosystem beyond EVM.

Ecological projects, benefits gradually spread

Convex (CVX)

Convex holds the most CRV and has the right to Curves earnings. Whenever the value of CRV rises, the intrinsic value of each CVX also rises accordingly. It is close to the leveraged version of CRV, and its increase in this round of rise is higher than CRV.

CLever (CLEV)

Holding the most CVX, further nesting dolls. The market value is relatively low.

Frax Finance (FXS)

Frax Finance is the second largest holder of CVX. It also has L2 chain Fraxtal, stablecoin product FRAX, dual-currency model staking products (sfrxETH, frxETH), lending products… everything. Frax has the opportunity to close the loop and build a self-sufficient DeFi ecological flywheel. The ultimate form is a decentralized on-chain central bank (of course, it is still a long way off).

This article is sourced from the internet: Curve leads the DeFi market, what other related tokens are worth paying attention to?

Skates Road to the Future Previously, in the Skateboard Workshop on the Nollie testnet, we showed users how to have a unified and smooth single application experience across different chains and blockchain virtual machines. Now, with the Shadow mainnet, we are about to launch a decentralized trust engine to protect all Stateless applications, including: – Hub Chain on the mainnet – Pre-confirmed AVS on Eigenlayer mainnet – The first Stateless pilot project: Enabling Polymarket on TON Skate Hub Chain is officially launched As the core processing unit of the Stateless application model, Skate Hub Chain is now online. It will run as an Ethereum L2 network, improving scalability and adaptability through the dual data availability solutions of Avail and EigenDA. Hub Chain manages and hosts the unified state and core…