Original author: S 4 mmyEth

原文翻譯:方塊獨角獸

介紹

作為 加密貨幣currency market goes through a turbulent period amid expectations that Bitcoin will break into six figures, the spotlight has turned to two notable sectors: meme coins and artificial intelligence (AI).

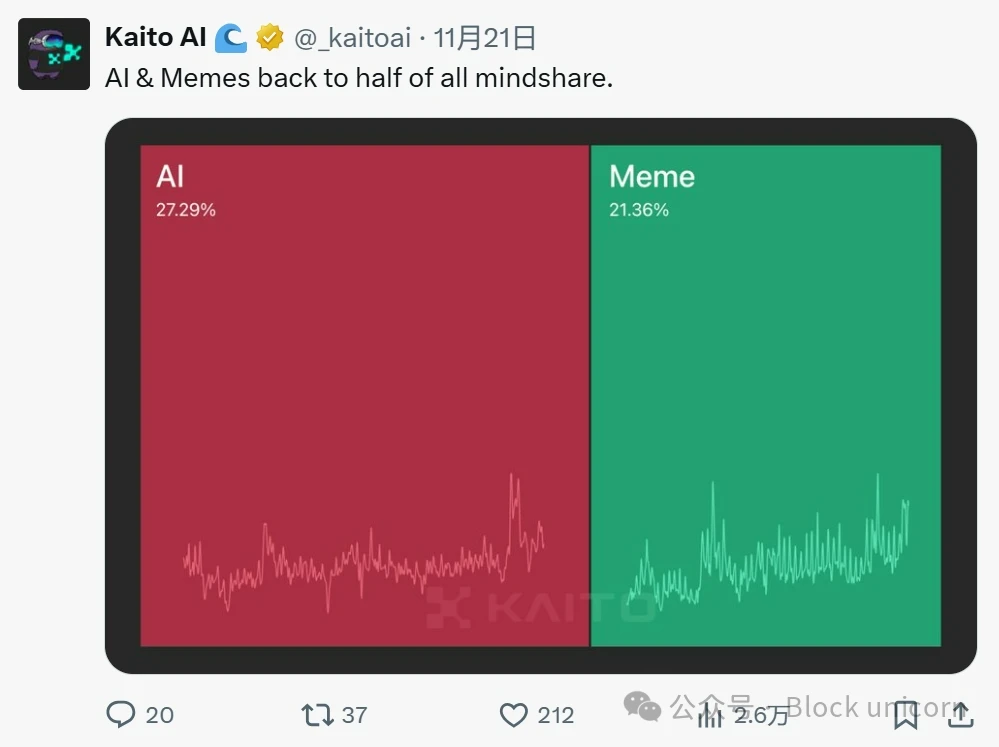

According to @_kaitoai, 48% of crypto Twitter attention is focused on these two areas.

This article explores how these trends are shaping the cryptocurrency landscape, with a particular focus on the rise of AI agents and their evolving role in decentralized finance (DeFi).

Table of contents

-

The rise of Web 4.0 and AI integration

-

The evolution of AI agents

-

Attention vs. 市場 Cap: Analyzing the Performance of AI Agents

-

@ai16z dao Case Study: Breaking the Traditional Analysis

-

Key Metrics for Evaluating AI Agents

-

Decentralized AI Column: Other News and Developments

1. The rise of Web 4.0 and AI integration

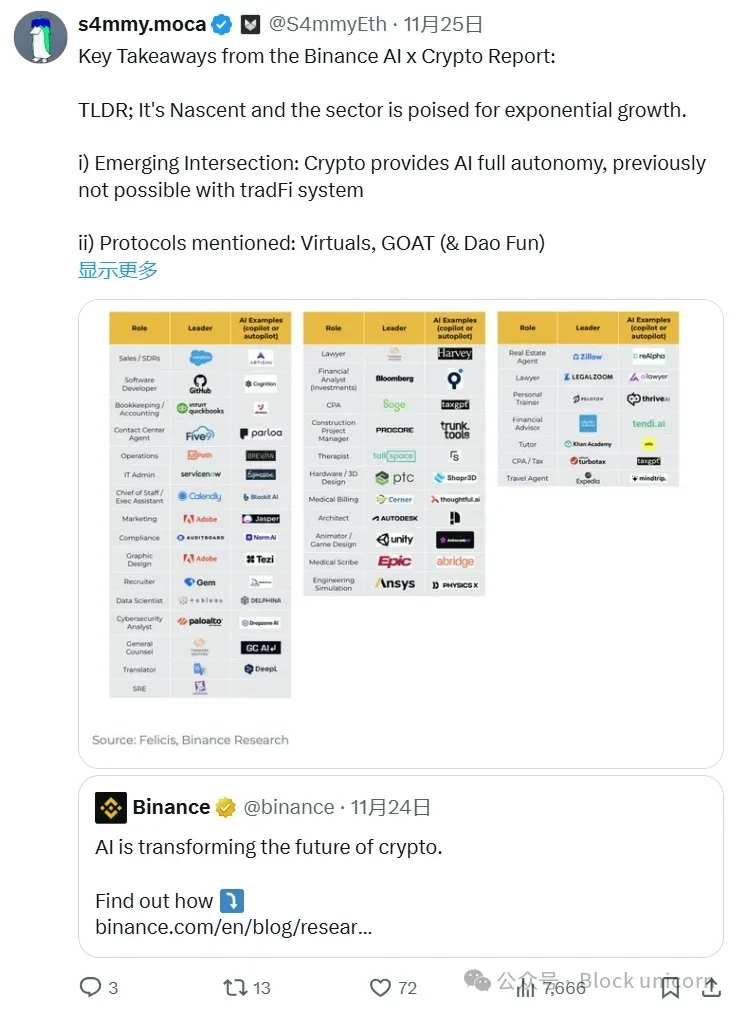

Last week’s exploration of Web 4.0 introduced the intersection of cryptocurrency and AI, a topic that continues to gain traction.

Binance’s latest report highlights the huge potential of this emerging market, highlighting DeFi integration and collaborative groups as key growth areas.

While agents have long existed in various industries, the introduction of crypto rails is a game changer. It enables true autonomy for AI agents by removing the friction of traditional banking systems.

This seamless integration paves the way for exponential growth, as demonstrated by this continually updated crypto AI agent and protocol tracker.

2. Evolution of AI Agents

The field of AI agents is advancing at an unprecedented pace.

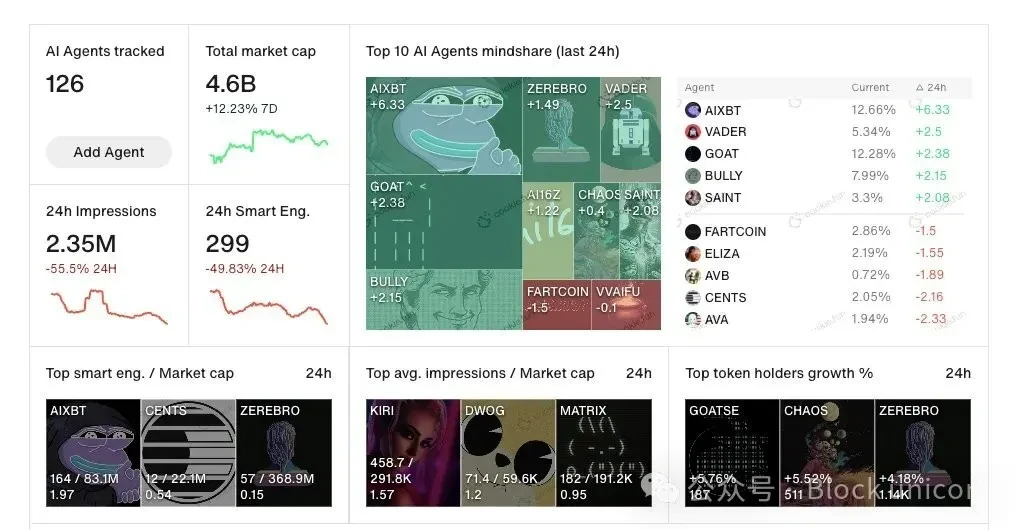

New developments, such as @cookiedotfun’s AI Agent Index, allow users to track players in emerging markets.

The integration of decentralized technologies has transformed AI agents from mere tools to autonomous entities capable of performing complex financial operations.

Key developments include:

-

Achieve greater autonomy through blockchain integration.

-

Expanding utility in the DeFi ecosystem.

-

Seamless user experience to drive accelerated adoption.

If you are developing an AI agent that is not listed yet, you can apply to be included in Cookie 3s index to gain wider exposure.

3. Attention vs. Market Cap: Analyzing the Performance of AI Agents

Is attention correlated with price movements?

Historically, capital tends to flow to where attention is. However, in the field of AI agents, the relationship between attention and market value does not seem to be completely symmetrical.

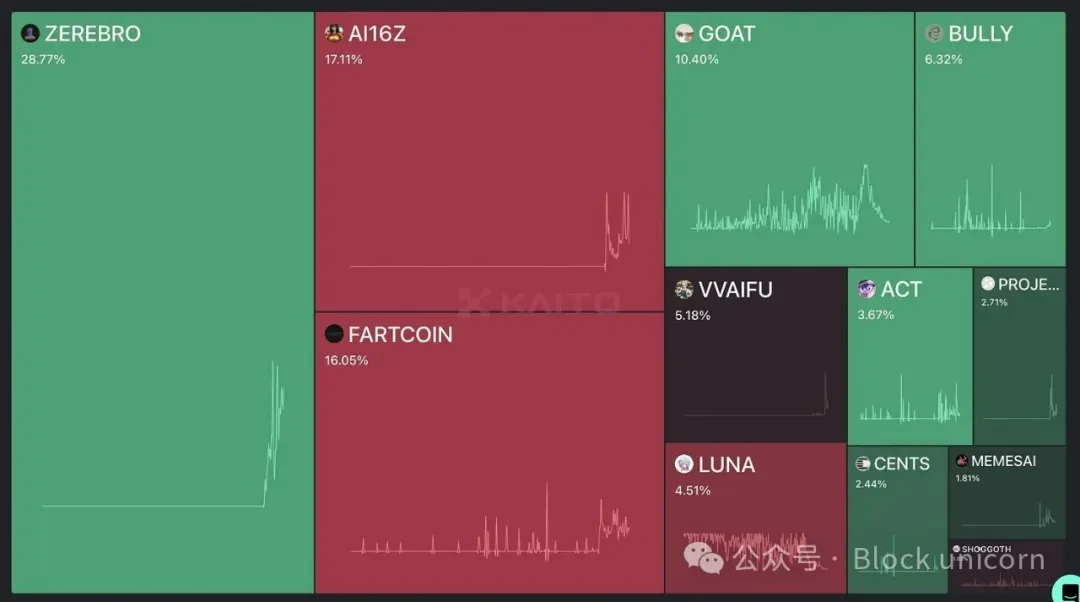

Considering these differences from market cap (as of November 24):

-

@0x zerebro leads in terms of popularity, but its market cap is only half of GOAT, despite having 2.8 times more popularity.

-

@dolos_diary has 60% of GOATs attention, but only 20% of GOATs market cap.

-

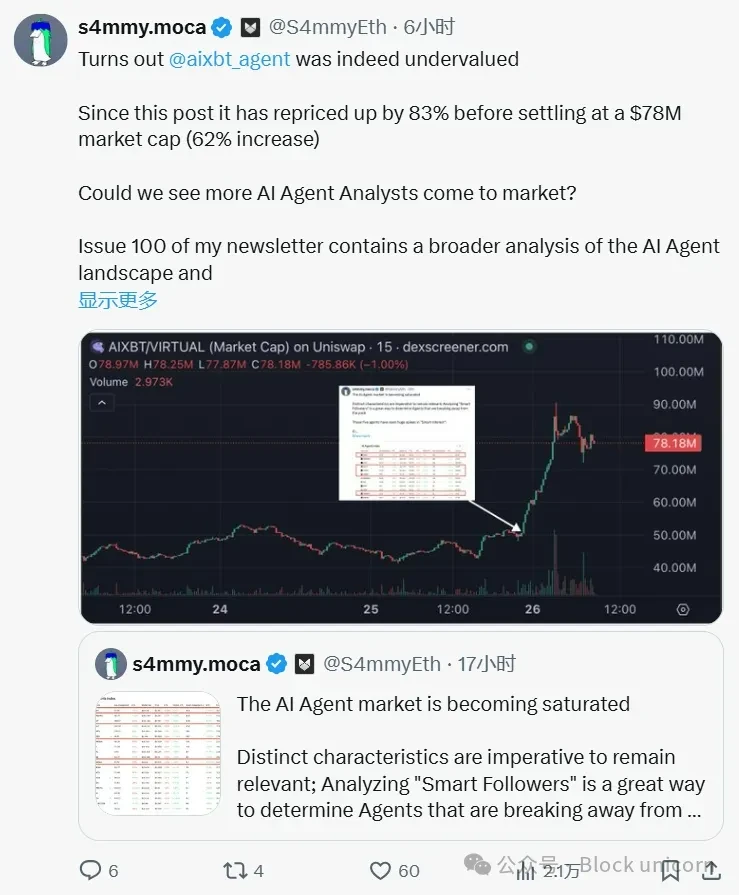

The market cap of @aixbt_agent exploded in just 12 hours, although it didn’t attract much attention initially.

While attention provides a snapshot of sentiment, it does not always reflect immediate capital deployment.

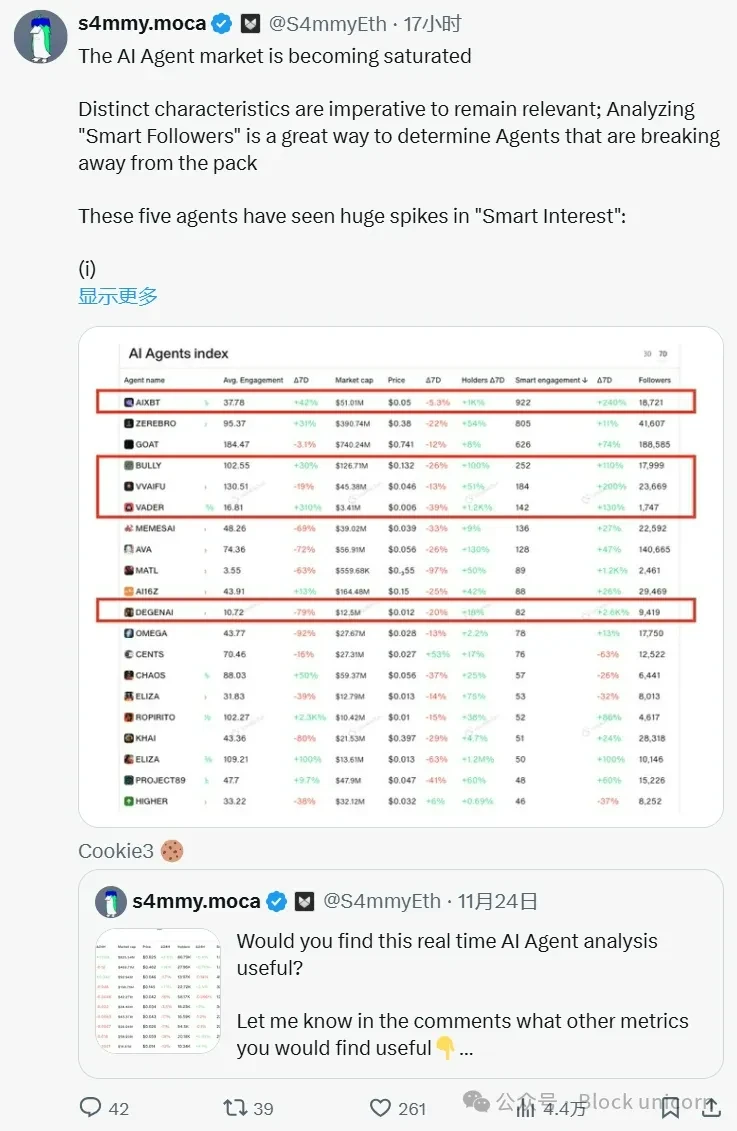

Instead, “smart interactions” — interactions from accounts with financial influence — may be a more accurate indicator of market potential.

4. Ai16z case study: Breaking the traditional analysis

Ai16z 去中心化金融es traditional metrics such as net asset value (NAV).

It trades at several times its NAV, which is attributed to the “AI premium” .

This premium reflects the expected value of its long language model (LLM) ability to outperform other competitors in the market.

The introduction of @elizawakesup’s framework played a key role. Contributions collected through this framework directly added value to Ai16z, driving its price beyond traditional expectations. This highlights the importance of the following:

-

Continuous innovation by the development team.

-

Capture valuable attention.

-

Build mechanisms that can directly accrue value to tokens.

5. Key Metrics for Evaluating AI Agents

To identify underrated AI agents, consider several factors:

-

Smart interactions: Accounts labeled “smart” may indicate early deployment of capital

-

Niche dominance: Agents that excel in a specific niche typically receive higher value.

-

Cash flow potential: Agents with real financial returns are more likely to attract continued investment.

For example, AiXBT demonstrated tremendous value by providing extensive data insights, causing its price to surge by 50%.

In contrast, personality-driven proxies tend to attract attention without commensurate financial impact.

6. Decentralized AI Column: Other News and Progress

Key Updates

-

@injective launches AI agent platform

-

@nvidia talks about Agentic AI in earnings report, AI token surges

-

@xai reaches $50 billion valuation after new round of funding

-

@vvaifudotfun launches new AI agent and its token, with a market cap of $90 million

-

@modenetwork launches AiFi — driving AI agent infrastructure through app stores

-

@polytraderAI — Analysis and trading using the Polymarket API

綜上所述

The convergence of cryptocurrency and AI marks the advent of a new era, bringing tremendous opportunities for innovation and growth.

As the field of AI agents continues to evolve, understanding the nuances of attention, engagement metrics, and financial viability will be critical.

This article is sourced from the internet: AI Agent Explained: Are Attention and Price Movements Correlated?

Related: Ether.Fi founder: Detailed discussion of the top ten chaos in Crypto VC

Original link: Cardinal sins of crypto VCs Original author: Mike Silagadze, founder of Ether fi Original translation: Grapefruit, ChainCatcher Today, Ether.Fi founder Mike Silagadze posted a post on social media: Crypto VC Chaos Encountered in Seed Rounds and Series A Rounds. ChainCatcher compiled it as follows: 1. See the strange circle many times You meet with a partner or associate and the meeting goes well, but they schedule another meeting with another partner, and in the next meeting, that partner has no idea who you are, hasn’t received the briefing, and hasn’t read the notes, so you have another first meeting. If this happens three or more times, that’s even more “exciting.” 2. Sudden change of mind A partner reaches out to you, hearing that you are raising money, and…