SignalPlus Macro Analysis Special Edition: The Fox Guarding the Hen House

As BTC approaches the $100,000 mark, it seems like every macro observer has become an expert on MSTR convertible bonds over the past week, and 加密貨幣currencies have once again been in the news, attracting the most mainstream attention since the FTX incident.

As we have mentioned in the past, the “easy phase” is over and future market volatility will increase significantly as late-comers enter the market with large amounts of leverage.

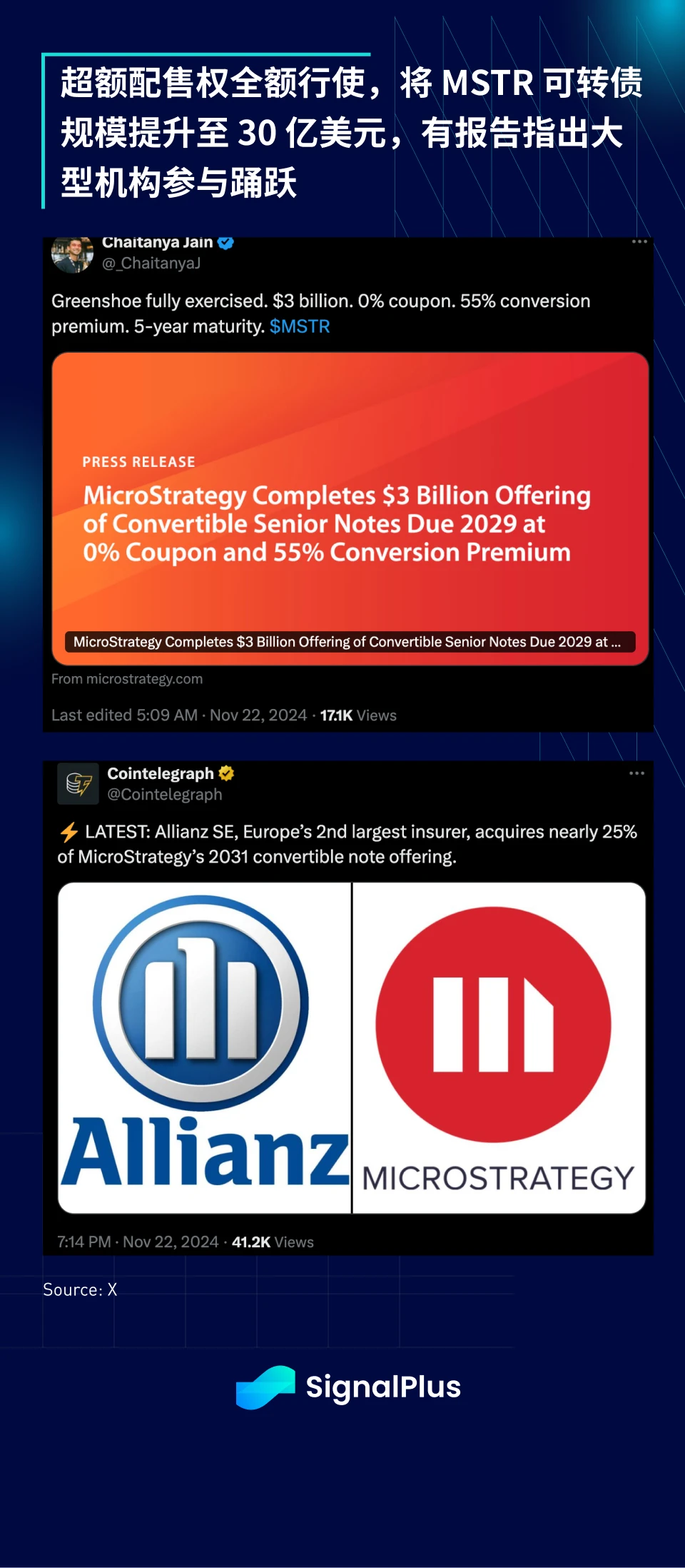

Microstrategy successfully exercised its $400 million over-allotment option on the basis of its original $2.6 billion convertible bonds (0% coupon, 55% premium), increasing the final size to $3 billion. According to Cointelegraph, Allianz Insurance is one of the main participants in this transaction. The closing price of this batch of convertible bonds due in 2029 exceeded $104 on the first trading day.

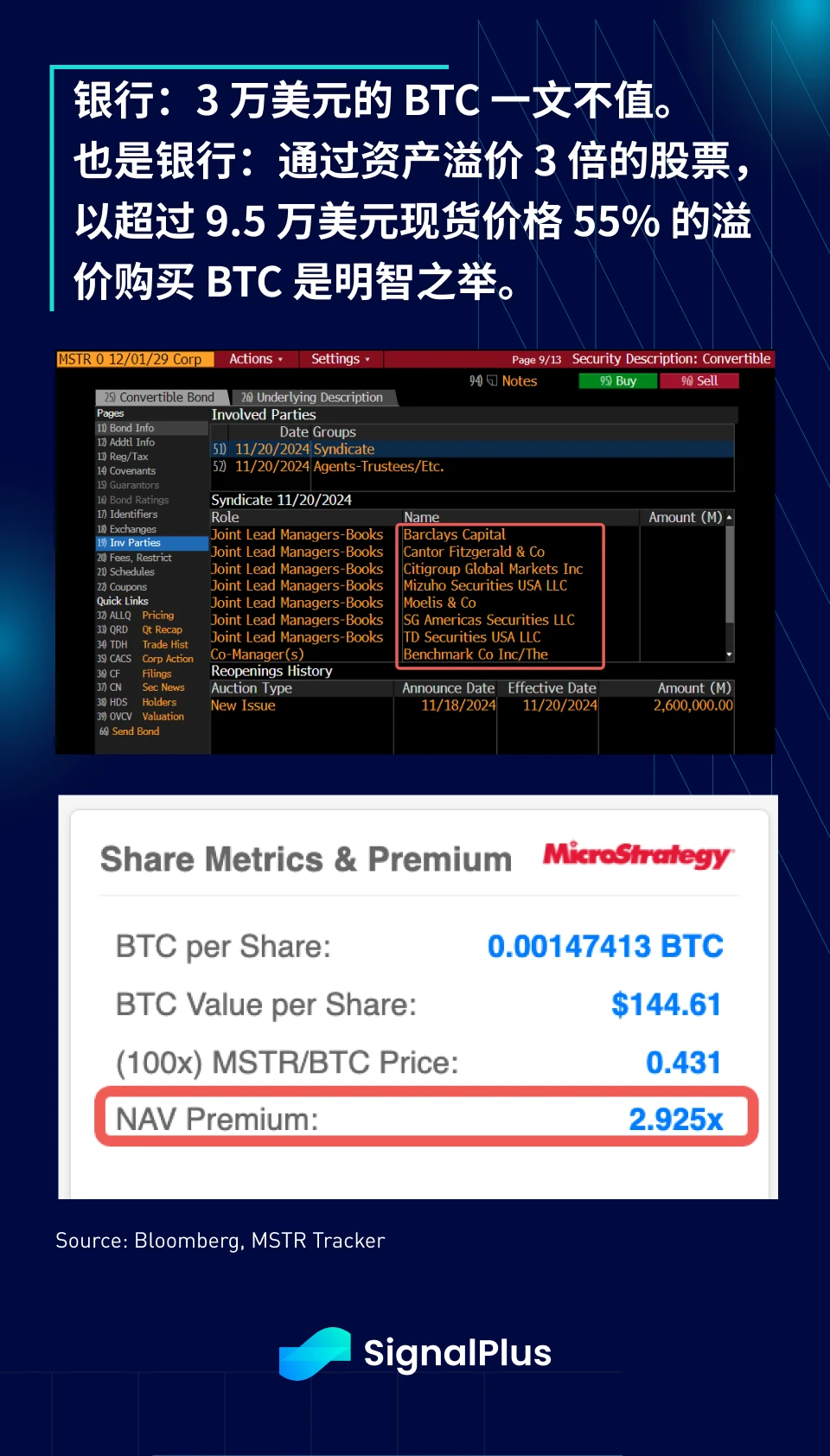

The irony of Wall Street’s involvement is obvious. After years of accusing cryptocurrencies of being highly risky and lacking fundamental value, these banks are now scrambling to lead this trade. In fact, these banks were all claiming that BTC was worthless when it was between $6k and $60k, and now these underwriters are suggesting that investors are “quite reasonable” to pay a 55% premium over the $95k price to buy BTC through an indirect equity vehicle. We won’t go into how MSTR is a convertible financing convexity vehicle for TradFi investors, but we must acknowledge that these mainstream “gatekeepers” (including regulators) are bringing mainstream investors into this market through this incredible structure, but it all seems reasonable and legal because it is done through “regulated securities”. It’s a typical traditional finance routine, right?

Mainstream institutions naturally would not miss such an opportunity and quickly launched Microstrategys leveraged ETFs (MSTX, MSTU), allowing retail investors to have more suboptimal ways to leverage BTC spot. According to Bloomberg, the high demand for these leveraged ETFs has put pressure on prime brokers responsible for securities lending, and the related asset management scale has surged to nearly US$5 billion in the past week.

(Friendly reminder: Never buy leveraged ETFs except for short-term trading. Leveraged ETFs are mathematically designed to gradually lose value over time. Please Google their daily return calculation method for more details.)

Prime brokers – the units within banks that work with clients on things like securities lending – have reached the limit of swap exposure they are willing to provide to the roughly month-old T-Rex 2 X Long MSTR Daily Target ETF (ticker: MSTU), which at launch was the most volatile ETF ever on Wall Street, by some measures. — Bloomberg

Mainstream enthusiasm has further fueled the recent market froth, with prominent TV commentators suddenly turning pro-crypto, leading to a significant increase in leverage at current levels and a sharp rise in realized volatility. According to reports, nearly $500 billion in long positions have been liquidated in the past few days as prices have failed to break out again, possibly the largest wave of liquidations in history.

As we have been reminding, the cryptocurrency market will be very volatile in the short term. BTC technical indicators show severe overbought conditions, and the public is experiencing FOMO sentiment towards this asset class. If BTC price can successfully break through the psychological barrier of $100,000, the price may have the opportunity to push further to the $120,000-130,000 range, but we are not optimistic about the prospect of a smooth price increase as the asset market is generally overbought. Selling put options as an income or target buying strategy may still be attractive in the short term (DYOR: not an investment advice).

Speaking of options, following Nasdaq’s launch of IBIT ETF options, CBOE will launch the industry’s first cash-settled options. We still expect the options market to become an important growth catalyst for the industry after 2025. SignalPlus will provide full support for your options journey!

The recent moves by Lutnick (Trump’s new Commerce Secretary) and his company Cantor in the cryptocurrency space should have a positive impact on the long-term structural development of the ecosystem. According to recent disclosures, in addition to being Tether’s custodian, the company has also invested $600 million to acquire a 5% stake in Tether (valuing the company at $12 billion). The company will also launch an (off-chain) Bitcoin financing business, providing customers with fiat loans with BTC as collateral, further strengthening Bitcoin’s role as a balance sheet asset in the mainstream ecosystem.

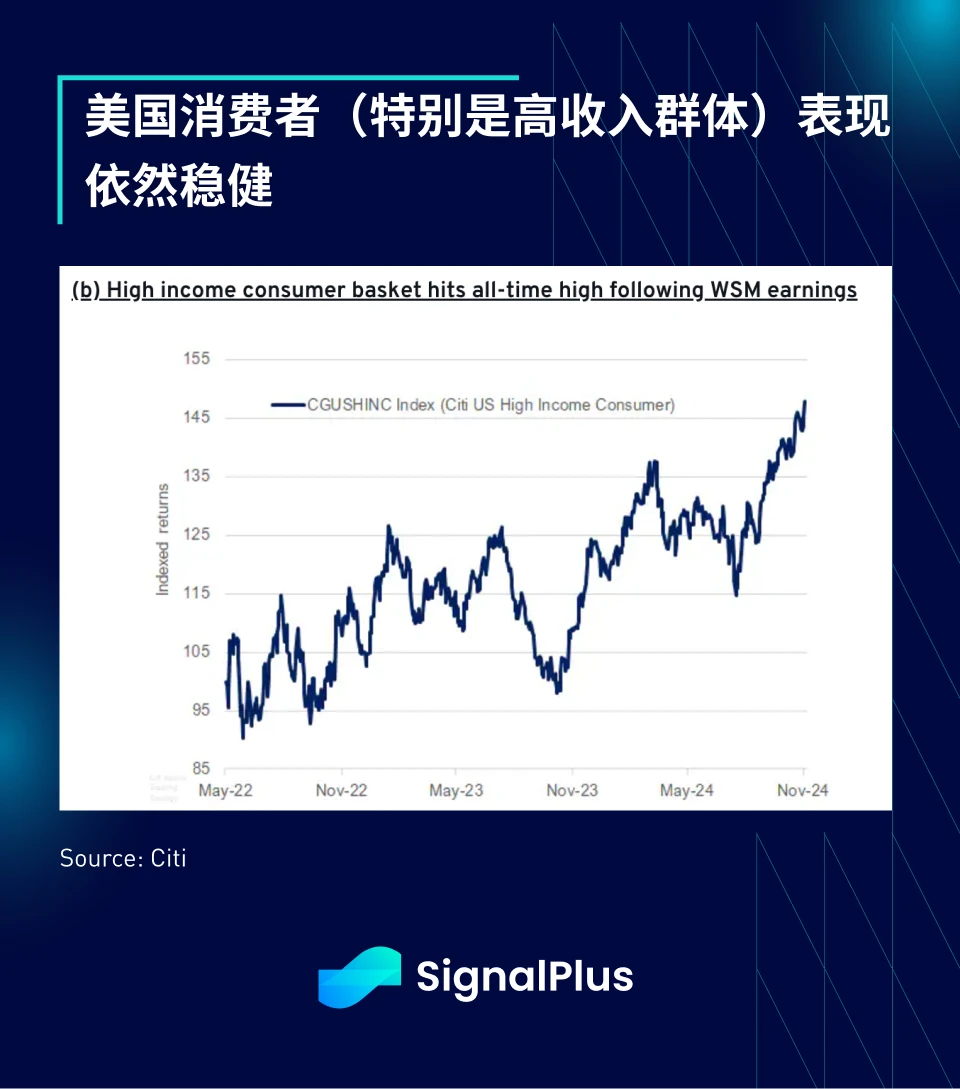

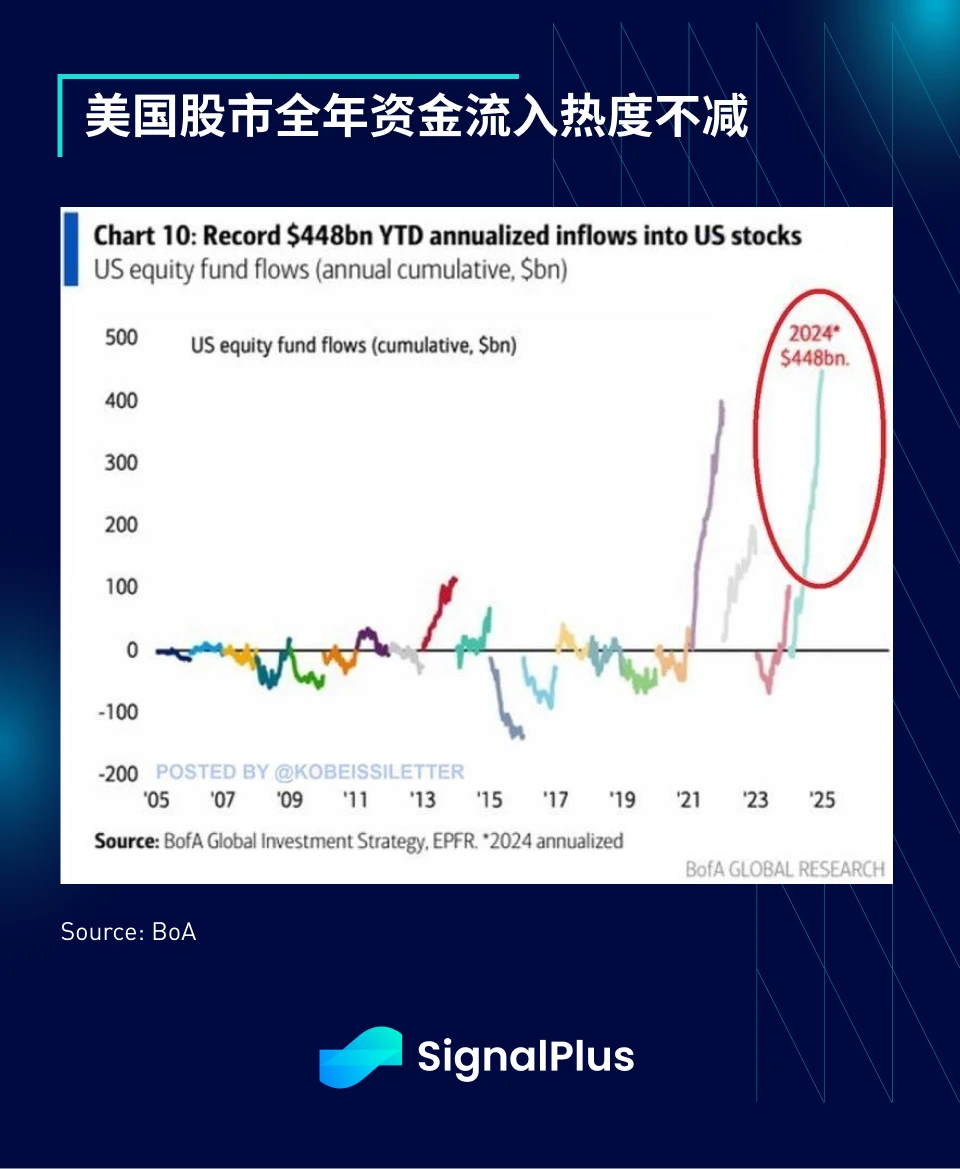

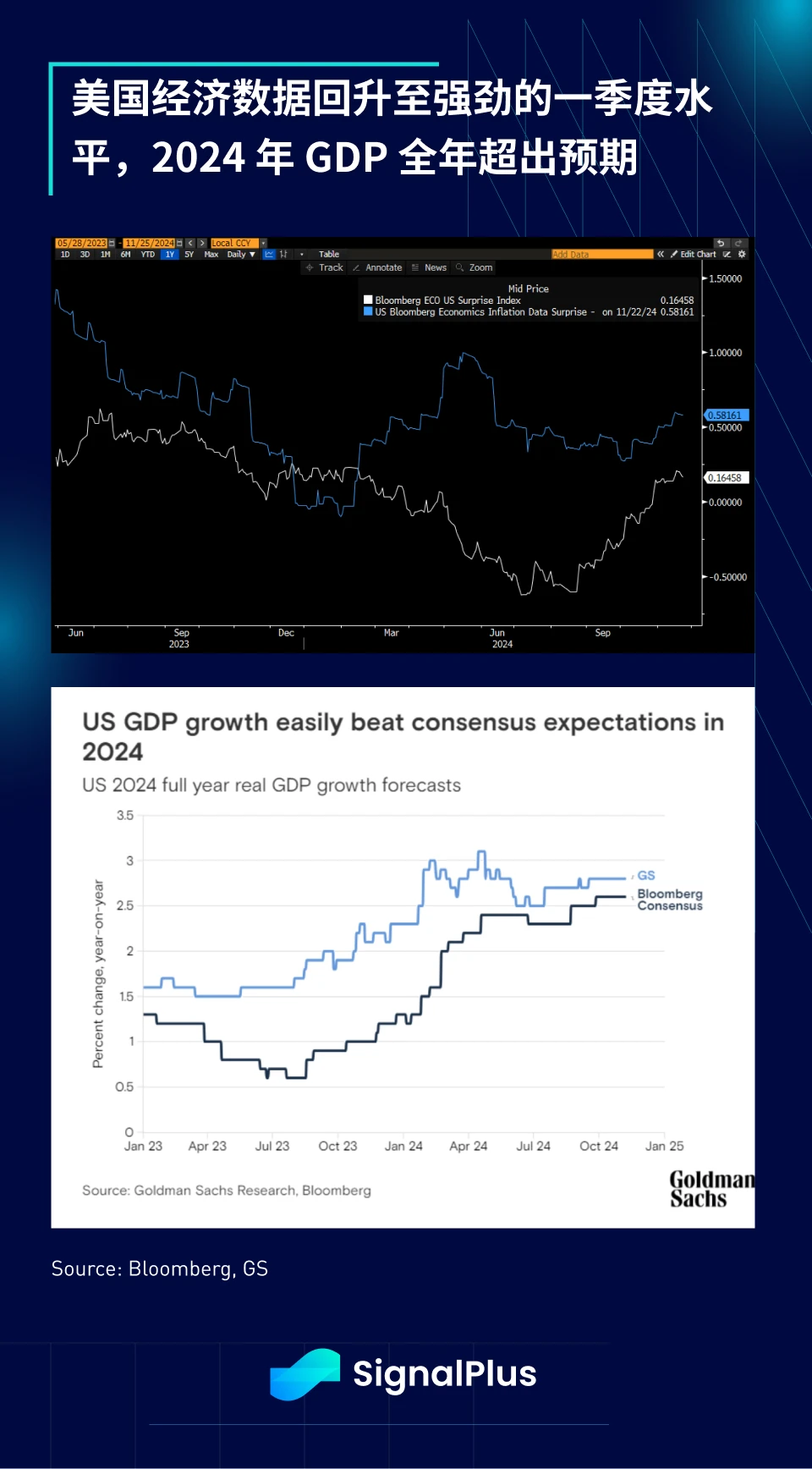

Back to TradFi, last Wednesday, Nvidias earnings beat expectations, the high-income consumer index hit a new high, reflecting the strong spending power of the (high-income) group in the United States, and the stock market rebounded strongly from the earlier pullback. The economic surprise index rebounded to a strong first-quarter level, while inflation data has not yet broken upward, keeping the possibility of a Fed rate cut (December probability = 56%), and the soft landing scenario remains solid. In addition, Bank of America reported that more than $448 billion has flowed into the U.S. stock market this year, breaking the 2021 record and reaching an unprecedented level.

Trading activity is likely to be very light this week as the US market heads into the Thanksgiving holiday on Thursday. Hopefully this will also give us some time to catch our breath as we head into the final month of the year.

您可以使用 SignalPlus 交易風向標功能 t.signalplus.com 取得更多即時加密資訊。如果您想在第一時間收到我們的更新,請關注我們的推特帳號@SignalPlusCN,或加入我們的微信群(新增助手微信:SignalPlus 123)、Telegram 群和 Discord 社區,與更多朋友交流互動。

SignalPlus 官方網站: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis Special Edition: The Fox Guarding the Hen House