Original author: 0x Todd (X: @0x_托德 )

First, let’s get excited about our beloved Bitcoin hitting $98,000!

There is no doubt that the contributor to 40K-70K is the Bitcoin ETF, and the contributor to 70K-100K is MicroStrategy.

Many people now compare MicroStrategy to the BTC version of Luna, which makes me a little embarrassed because Bitcoin is my favorite 加密貨幣currency, and Luna happens to be the cryptocurrency I hate the most.

I hope this post will give you a better understanding of the relationship between MicroStrategy and Bitcoin.

First, a few conclusions are put at the beginning:

-

MicroStrategy is not Luna, and its safety cushion is much thicker.

-

MicroStrategy increased its Bitcoin holdings by selling bonds and stocks.

-

MicroStrategys nearest debt repayment date is 2027, which is more than 2 years away.

-

The only soft threat to MicroStrategy is Bitcoin whales.

MicroStrategy is not Luna, but it has a much thicker safety cushion than Luna

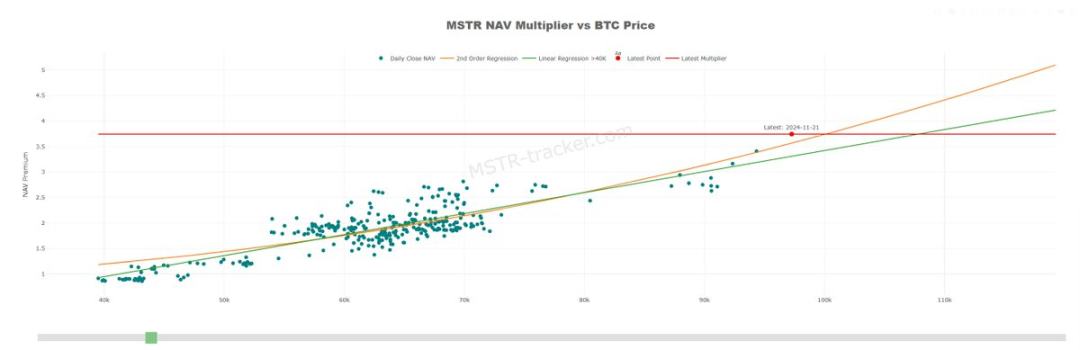

MSTR Net Worth vs Bitcoin Price

MicroStrategy was originally a software company. It had a lot of unrealized profits in its accounts and did not want to invest in production anymore, so it began to move away from the real economy and started buying Bitcoin out of its own pocket in 2020.

Later, MicroStrategy used up all the money in its account and began to leverage. The way it leveraged was over-the-counter leverage, and it was determined to borrow money to buy Bitcoin by issuing corporate bonds.

The essential difference between it and Luna is that Luna and UST print each other, and UST is essentially meaningless unanchored money printing, which is barely maintained by the fake interest rate of 20%.

But MicroStrategy is equivalent to bottom-up investment + leverage, which is the standard of borrowing money to go long, and it bet on the right direction.

The popularity of Bitcoin far exceeds that of UST, and MicroStrategys influence on Bitcoin is significantly lower than that of Luna on UST. Its a simple truth. As the saying goes, 2% daily profit is a Ponzi scheme, and 2% annual profit is a bank. Quantitative change leads to qualitative change. MicroStrategy is not the only factor that determines Bitcoin, so MicroStrategy is 去中心化金融nitely not Luna.

MicroStrategy adds to Bitcoin holdings by selling bonds and stocks

In order to raise funds quickly, MicroStrategy issued several bonds, totaling US$5.7 billion (for your intuitive understanding, this is equivalent to 1/15 of Microsofts debt).

And almost all of this money is used to continuously increase Bitcoin holdings.

Everyone has used on-exchange leverage, where you have to use Bitcoin as a deposit before the exchange (and other users in the exchange) will lend you money. But off-exchange leverage is different.

All creditors in the world are only worried about one thing, that is, debts are not repaid. Without collateral, why would anyone be willing to lend money to MicroStrategy off-market?

MicroStrategys debt issuance is very interesting. In recent years, it has issued a type of convertible debt.

This convertible bond is very interesting. Lets take an example:

Bondholders have the right to convert their bonds into MSTR shares in two phases:

1. Initial stage:

-

If the trading price of the bond falls by >2%, the creditor can exercise the option to convert the bond into MSTR shares and sell it back for the principal;

-

If the bonds trading price is normal or even increases, the creditor can resell the bond in the secondary market at any time to recoup the investment.

2. Late stage:

When a bond is about to mature, the 2% rule no longer applies, and the bondholder can get his cash back or convert the bond directly into MSTR stock.

Lets analyze it again. This is generally a sure-win business for creditors.

-

If Bitcoin falls and MSTR has money, creditors can get their cash back

-

If Bitcoin falls and MSTR has no money, creditors can still have a final guarantee, that is, convert it into stocks and cash it out;

-

If Bitcoin goes up, MSTR will go up, and creditors can give up cash and get more stock returns.

In a nutshell, this is a deal with a high lower limit and a very high upper limit, so naturally MicroStrategy raised the money smoothly.

Fortunately, no, it should be said that MicroStrategy chose Bitcoin.

Bitcoin has lived up to it.

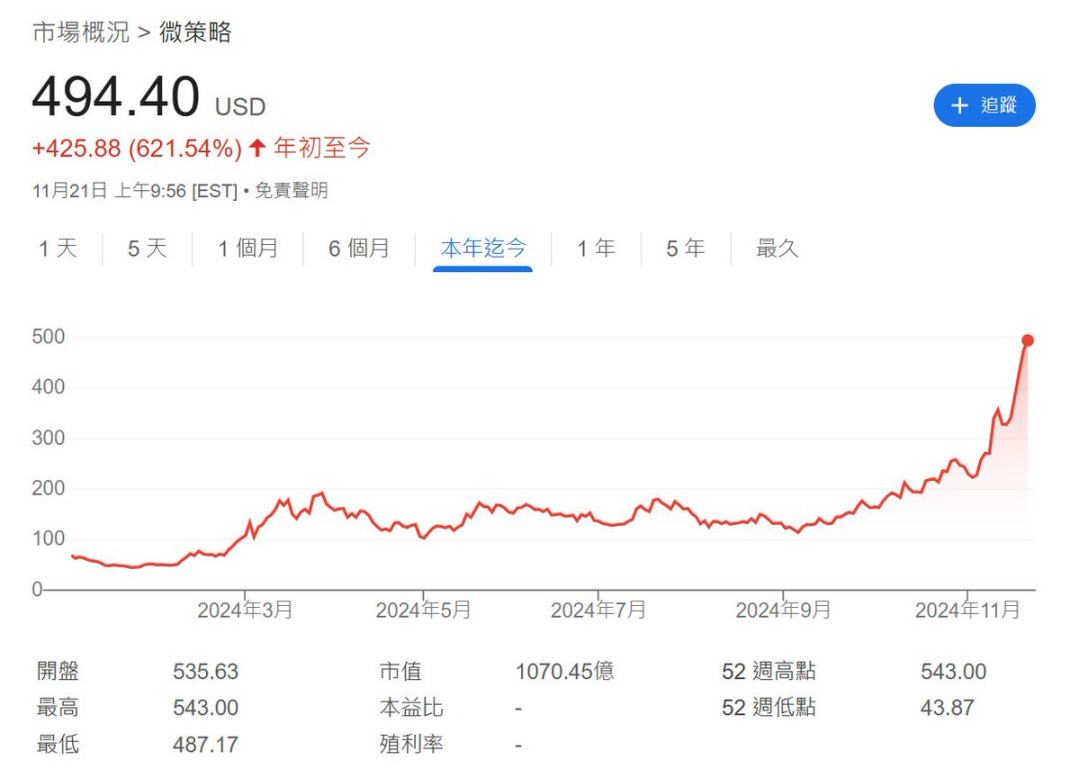

2024 MicroStrategy Stock Price Trend

As Bitcoin continues to grow, the Bitcoin accumulated by MicroStrategy in the early days has also risen in value. According to the simple and classic stock principle, the more assets a company has, the higher its market value should be.

Therefore, MicroStrategys stock price also soared through the sky.

MicroStrategys daily trading volume has now surpassed this years absolute white horse Nvidia. As a result, MicroStrategy now has more options.

Now MicroStrategy not only relies on issuing bonds, but can also directly issue additional shares and sell them for money.

Unlike many meme coins or Bitcoin developers who do not have the authority to mint coins, traditional companies can issue additional shares after complying with relevant procedures.

Last week, Bitcoin was able to rise from just over 80K to 98K today, all thanks to MicroStrategy. Yes, MicroStrategy issued additional shares and sold them for $4.6 billion.

PS: Companies with a higher trading volume than Nvidia are naturally entitled to this liquidity.

Sometimes, if you admire a company for making great profits, you need to admire its great courage.

Unlike many cryptocurrency companies that sell stocks and then cash out, MicroStrategy is as full as usual. MicroStrategy reinvested all the money from the sale of stocks into Bitcoin, pushing Bitcoin to 98K.

By now, you should have understood the magic of MicroStrategy:

Buy Bitcoin → Stock price rises → Take on debt to buy more Bitcoin → Bitcoin rises → Stock price rises further → Take on more debt → Buy more Bitcoin → Stock price continues to rise → Issue additional shares and sell for cash → Buy more Bitcoin → Stock price continues to rise…

Brought to you by the great magician MicroStrategy.

MicroStrategys next repayment date is 2027, so we still have at least 3 years to go.

As long as you are a magician, there will come a time when your magic tricks are exposed.

Many MSTR bears believe that it has now reached the left side of the standard and even suspect that it has reached the Luna moment.

However, is this really the case?

According to recent statistics, the average cost of MicroStrategy Bitcoin is US$49,874, which means that it is now close to a floating profit of 100%, which is a super thick safety cushion.

Let’s assume the worst case scenario. Even if Bitcoin drops 75% (almost impossible) to $25,000, what will happen?

MicroStrategy borrowed over-the-counter leverage and had no liquidation mechanism. Angry creditors could at most convert their bonds into MSTR stocks at a specified time and then angrily dump them into the market.

Even if MSTR is smashed to zero, it still does not need to be forced to sell these 比特幣s, because the earliest due date for the debt that MicroStrategy needs to repay is February 2027.

Look carefully, this is not 2025, nor 2026, but Toms 2027.

In other words, it will take until February 2027, and if Bitcoin plummets, and no one wants MicroStrategys stock anymore, then MicroStrategy will need to sell part of its Bitcoin in February.

All in all, there are still more than two years to continue playing music and dancing.

This is the magic of off-market leverage.

You might ask, is it possible that MicroStrategy will be forced to sell Bitcoin due to interest rates?

The answer is still no.

Since MicroStrategys convertible bonds are generally guaranteed to make money for creditors, the interest rate is quite low. For example, the interest rate for this bond due in February 2027 is 0%.

The creditors are simply after MSTRs stock.

The interest rates of several debts it subsequently issued were also 0.625% and 0.825%. Only one debt was 2.25%, which has a very small impact, so there is no need to worry about its interest.

MicroStrategys main bond interest, source: bitmex

MicroStrategys only soft threat is Bitcoin whales

At this point, MicroStrategy and Bitcoin have become mutually causal.

More companies are ready to start learning from the great David Copperfield (Saylor) of Bitcoin.

For example, MARA, a listed Bitcoin mining company, has just issued $1 billion in Bitcoin convertible bonds, specifically for the purpose of bottom fishing.

So I think the bears had better act with caution. If more people start to follow MicroStrategys example, Bitcoins momentum will be like a runaway horse, after all, there is a vacuum above.

Therefore, MicroStrategy’s biggest rivals now are only those ancient Bitcoin whales.

As many people have predicted before, retail investors have already handed over all the bitcoins they had. After all, there are too many opportunities, such as the meme trend. I don’t believe that everyone will just sit there with empty eyes.

Therefore, there are only these whales in the market, and as long as these whales do not move, this momentum will be difficult to stop. If they are luckier, the whales and MicroStrategy will form some small tacit understandings, which will be enough to push Bitcoin into a greater future.

This is also a major difference between Bitcoin and Ethereum: Satoshi Nakamoto theoretically owns nearly 1 million bitcoins mined in the early days, but there has been no news to this day; and for some reason, the Ethereum Foundation sometimes particularly wants to sell 100 ETH to test liquidity.

As of the date of writing, MicroStrategy has achieved a floating profit of US$15 billion, all thanks to loyalty and faith.

Since it is making money, it will invest more, it can’t turn back, and more people will follow suit. At the current momentum, 170K is the medium-term target for Bitcoin (not financial advice).

Of course, we are used to seeing conspiracy groups designing conspiracies in memes every day. Occasionally, we see a truly top-notch conspiracy, and we are truly amazed.

This article is sourced from the internet: $15 billion conspiracy: Where will MicroStrategy send its Bitcoin?

Original author: rennick Original translation: TechFlow Crypto VCs have significantly underperformed Bitcoin. Is crypto VC in trouble? We analyzed data since 2015 to find out. In short, the entire industry is losing money. From 2015 to 2022, the $49 billion invested in token projects has created less than $40 billion in value, a return of -19% (before fees and expenses). Meanwhile, Bitcoin is on the verge of breaking out to a new all-time high, having gained 2.3x on its 200-day moving average since its November 2021 high (see golden line). How did we come to these conclusions? We analyzed all venture capital rounds through January 1, 2023. Of the $88 billion in total investment in crypto venture capital, $70 billion (80%) was invested before this date. Why? Any more recent…