原作者:TechFlow

When Bitcoin broke through $90,000, all ecosystems in the 加密貨幣 market began their own carnival.

AI narratives continue to be hot, and Memes continue to create wealth… But in this carnival, only the projects in the Bitcoin ecosystem are more like outsiders: They are the ones who are having fun, and I have nothing.

Obviously, the positive effects of the rise in Bitcoin have not spilled over too much into projects within its own ecosystem.

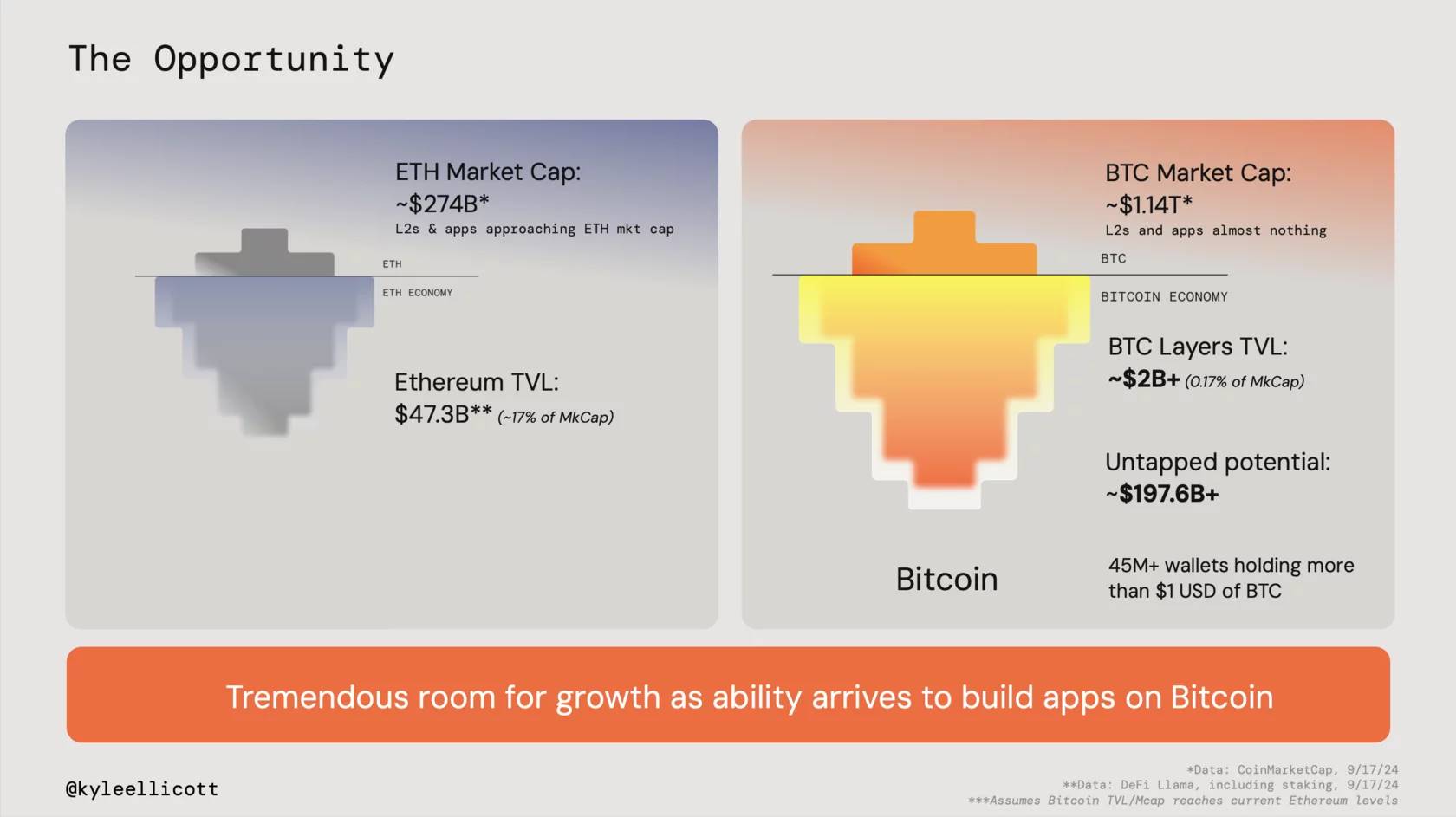

Even compared with the least promising Ethereum, the latters proud DeFi field, the entire TVL accounts for nearly 17% of Ethereums total market value; while Bitcoin basically maintains a 50% market value share of the entire market, its DeFi ecosystems total locked volume (TVL) is less than 1% of the entire market ( data from CMC research report ).

However, the crypto market has always followed the laws of attention and narrative rotation.

Too large a gap also contains periodic opportunities. After the inscription and staking gameplay, the BTC ecosystem fell into silence; in the face of a huge gap, it is also possible to be ignited at any time.

Some projects that have been deeply involved in the Bitcoin ecosystem for many years may also have their own opportunities, and many times they just lack a catalyst.

While various meme coins have been experiencing explosive growth, Stacks, as one of the earliest Layer 2 solutions for Bitcoin, has chosen a quiet path – focusing on technological transformation and finally completing the long-talked-about Nakamoto upgrade.

Don鈥檛 forget that STX also had a meme-like temperament last year, with its price once increasing 10 times.

What will this upgrade bring? Will it be a new opportunity for startup?

In the current market environment where speculation is high, how much room for imagination is there for projects like Stacks that focus on technological innovation?

A new exploration of the old store, let us once again get to know our old friend Stacks.

Nakamoto upgrade is more than just a technical reconstruction

The core of the Nakamoto upgrade is a comprehensive innovation of the PoX consensus mechanism of Stacks 2.0. To understand the significance of this upgrade, we need to first understand the limitations of the existing PoX mechanism.

In the current PoX mechanism, the confirmation of Stacks blocks needs to wait for the Bitcoin network to generate a new block before it can be completed. Although this mechanism inherits the security of Bitcoin, it also brings efficiency problems: even simple transactions need to wait for about 10 minutes of block time on the Bitcoin network. More importantly, since the confirmation of Stacks blocks depends on the accumulation of Bitcoin blocks, users often need to wait for multiple Bitcoin blocks (usually 6 blocks, about 1 hour) to ensure the finality of the transaction.

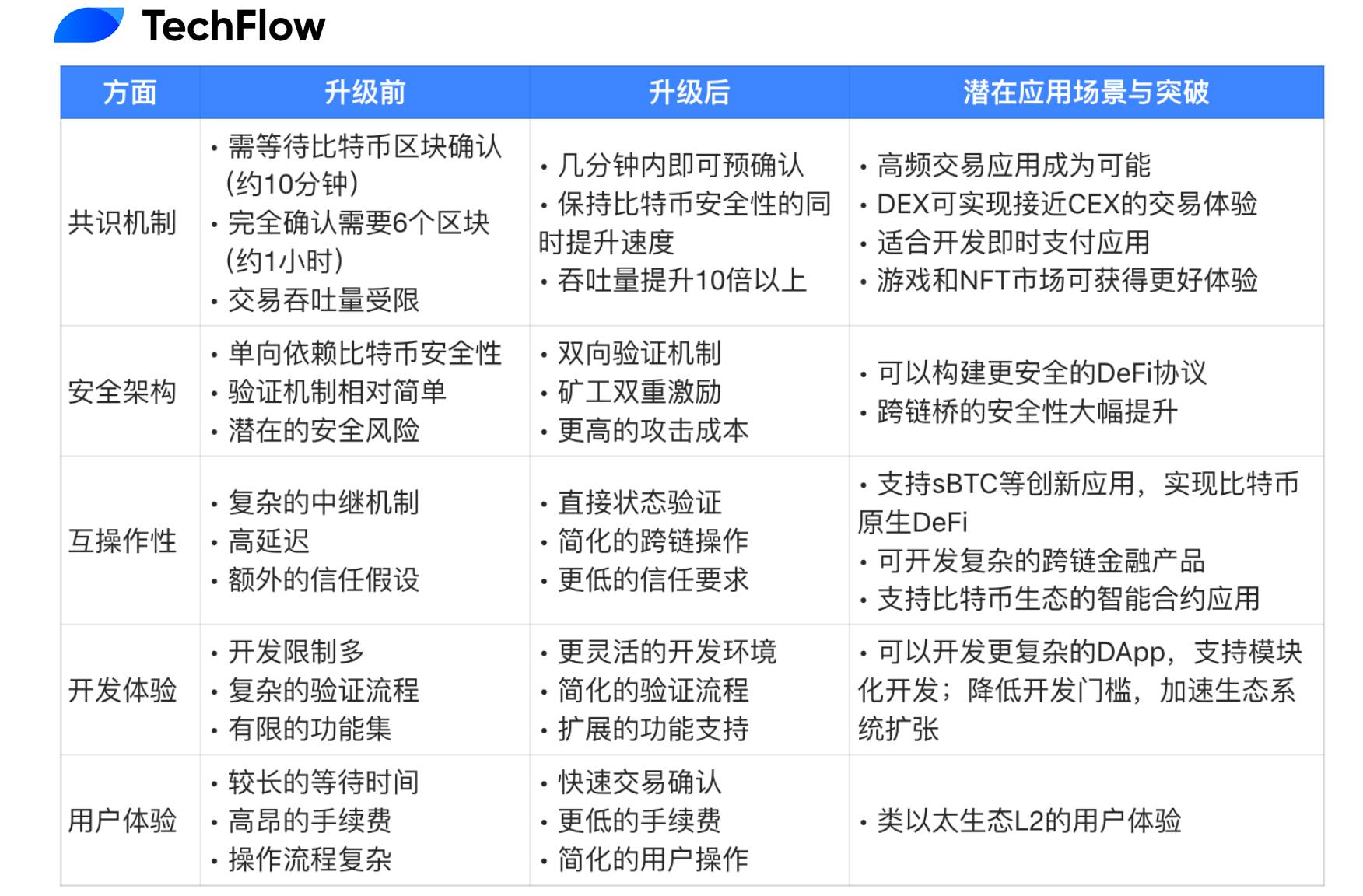

GrayScale analysis more intuitively shows the possible performance gap before and after the upgrade:

(Data source: Grayscale Research Report )

The new Nakamoto PoX solves this performance problem by introducing a fast block confirmation mechanism. The upgraded system allows transactions to be pre-confirmed through the consensus mechanism within the network while waiting for Bitcoin block confirmation. This allows most transactions to be confirmed within a few minutes while still remaining bound to the security of the Bitcoin network.

In terms of security architecture, the upgrade brings substantial improvements. Although the original Stacks writes its block hash value into Bitcoin transactions, this one-way security inheritance has potential risks. Under the new architecture, miners need to participate in Bitcoin mining and Stacks verification at the same time, creating a two-way security verification mechanism. This not only increases the cost of attack, but also ensures the honest behavior of verifiers through economic incentives.

The improvement in interoperability is reflected in the reconstruction of the underlying architecture. Before this, the interaction between Stacks and the Bitcoin network had to be completed through a complex relay mechanism, which not only increased latency but also introduced additional trust assumptions. The new architecture uses a direct state verification mechanism, allowing Stacks nodes to directly read and verify the state of the Bitcoin network, greatly simplifying the complexity of cross-chain operations. This improvement lays the foundation for subsequent innovative applications, especially the implementation of sBTC.

We can also use a table to quickly understand the details and possible significance of the Nakamoto upgrade:

At the same time, according to Grayscale鈥檚 research report, after the Satoshi upgrade, the Stacks protocol will provide unique features including:

(i) Bitcoin-collateralized stablecoins,

(ii) Bitcoin-based lending (and Bitcoin-native rewards),

(iii) Decentralized Autonomous Organizations based on Bitcoin.

Similar to how basic financial primitives drove the Ethereum DeFi ecosystem in 2017, Bitcoin鈥檚 ecosystem may also flourish now given its current high-profile status.

sBTC, an innovative application of Bitcoin on Stacks

This upgrade looks good, but what substantial changes will it bring to the ecosystem and products?

From the first-party perspective of Stacks itself, a new product that came with the upgrade is sBTC.

As a decentralized Bitcoin two-way anchoring protocol, the original intention of sBTCs design is simple: to make Bitcoin, the digital gold, more flexible and a truly programmable productive asset.

Therefore, sBTC mentioned in the above table can be understood as an innovative Bitcoin packaging protocol that allows Bitcoin to run in the form of a smart contract on the Stacks network.

An infrastructure project still needs to be closer to the issuing assets in order to gain more attention and create more gameplay.

This vision doesn鈥檛 sound new. There have been many similar attempts in the market, such as the popular wBTC on Ethereum, which has a locked-up volume of $5-15 billion even in a centralized custody model. But sBTC鈥檚 ambition is obviously more than that – it wants to be a decentralized solution that truly conforms to the spirit of Bitcoin.

The core mechanism of sBTC is actually very intuitive: when a user locks BTC on the Bitcoin mainnet, the Stacks network will mint an equal amount of sBTC, strictly maintaining a 1:1 anchor relationship. Users can use these sBTC to participate in smart contract interactions, and when they need to redeem, they only need to destroy the sBTC, and the corresponding amount of BTC will be automatically released.

It sounds simple, but the real technical challenge lies in how to ensure the decentralization and security of this process, which is also what makes sBTC different from others.

It has no preset managers, but uses an open dynamic group of signers to operate the entire system. All key operations are performed on the Bitcoin mainnet, inheriting the security features of Bitcoin.

Signers receive BTC rewards through Stacks consensus, and this economic incentive ensures that the system can continue to operate stably. More importantly, sBTC implements the price oracle function directly on the Bitcoin mainnet without relying on any external data source.

Timing is important. In the Bitcoin ecosystem, the emergence of sBTC is just in time. With the completion of the Nakamoto upgrade, the technical foundation is already in place.

From the market perspective, the TVL of Bitcoin DeFi accounts for less than 1%, which is in stark contrast to its market value. This gap means huge room for development. What is even more encouraging is that several major Bitcoin organizations have clearly expressed their support for the sBTC plan, showing the industrys recognition of this innovation.

Regarding sBTC, it is important to note that it is not a direct component of the Nakamoto upgrade, but one of the important applications supported by this upgrade. The Nakamoto upgrade provides the necessary technical foundation for sBTC through improved interoperability and security architecture.

根據 the latest news from the Stacks blog, the sBTC upgrade is expected to start in early December 2024. Currently, the community is voting on the SIP-029 proposal, which will optimize the Stacks token issuance mechanism and pave the way for the launch of sBTC.

And if you want to know more about sBTC, the official one-finger guide can basically help you quickly understand the general idea.

In the current context of Bitcoins only the price of the currency rises but not the ecosystem, the emergence of sBTC may become a catalyst to change this situation. Just as Ethereum promoted the development of the DeFi ecosystem through basic financial primitives in 2017, the Bitcoin ecosystem may just lack such an opportunity.

Ecosystem and data overview

Whether before or after the upgrade, Stacks itself is still infrastructure, and its development and progress are inseparable from the construction of ecological projects.

After the Nakamoto upgrade, the liquidity of the BTC ecosystem will be released through sBTC, Bitcoin smart contract functions and scalability improvements, and various projects in the ecosystem may also benefit from it.

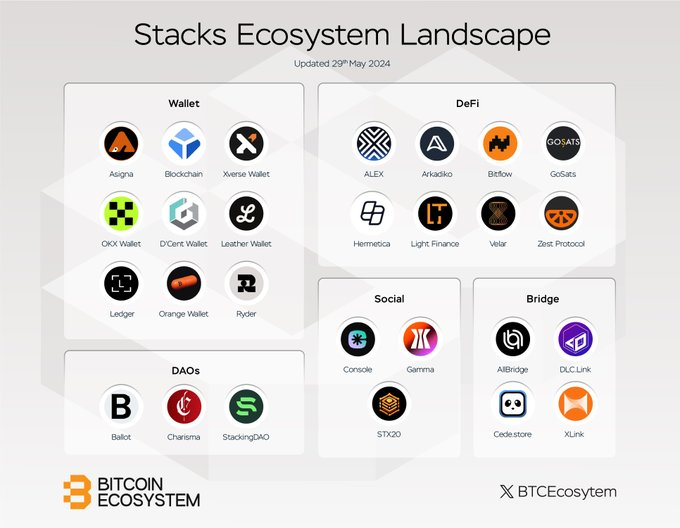

There are more than 60 DAPPs in the Stacks ecosystem, most of which are related to DeFi and NFT. Among them, DeFi protocols have received relatively large upgrade dividends, because through the Satoshi upgrade, users only need to lock their BTC to mint sBTC on Stacks and use sBTC in DeFi, such as stablecoin lending, borrowing, asset swaps, etc. For DeFi protocols built on Stacks, users can get BTC income rewards.

Some good DeFi protocols are as follows:

-

Alex Labs: Building the most comprehensive Bitcoin DeFi ecosystem through Stacks. Alex Labs expands products such as Lisa (Stacks version of liquidity staking), lanuchpad, and cross-chain bridges into the Runes ecosystem;

-

Arkadiko: Adopts the CDP (collateralized debt position, similar to MakerDAO) model, allowing users to mint stablecoins and generate Bitcoin income;

-

StackingDAO: A liquidity staking protocol on Stacks that allows staking Stacks to generate additional income;

-

Zest: On-chain lending protocol;

-

Bitflow Finance: DEX in the ecosystem;

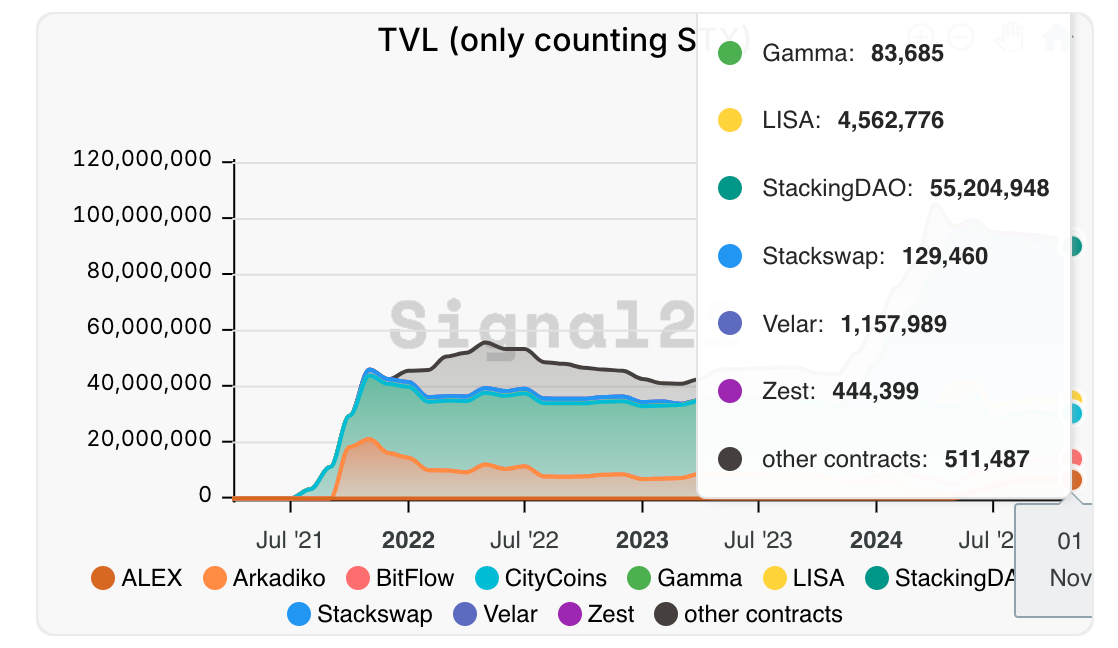

根據數據 Signal 121 , most of the currently staked STX has flowed to StackingDAO, followed by LISA and Stackswap.

Correspondingly, the current active addresses in the Stacks ecosystem are basically in the DeFi protocols in the above figure, and the funding volume of different ecological projects is positively correlated with the activity level of the addresses. The protocols with the most pledged funds often have the largest number of active addresses.

However, judging from the absolute value of the total TVL and the number of addresses, there is indeed a considerable gap between DeFi on Stacks and ETH. From another perspective, the data also confirms the point of view at the beginning of the article – what we often need is a trigger point and catalyst to turn the gap into upward space.

This gap is obviously difficult to fill with Meme. It is worth noting that there are also some Meme projects on Stacks, but their cultural attributes, influence, market value and activity are still far behind those of Meme on Solana.

Therefore, as the Stacks infrastructure matures, whether there are more asset creation methods similar to the previous wave of BTC ecosystem, such as inscriptions, will directly affect the activity of the Stacks ecosystem.

However, the bridge has been built, and it will take time to see what kind of cars will eventually run on it.

Future Outlook: When Technological Innovation Meets Ecological Incentives

In the Bitcoin ecosystem, we often discuss a question: What is the relationship between technological innovation and market recognition?

Does the market have to buy technology? The answer is of course no. In many cases, whether the market buys it depends on the projects operational ideas and planning.

The technological upgrade is just the inside, and the sBTC is ready to go outside. Encouraging more people to participate in the construction of sBTC on both the supply and demand sides is the next key move for Stacks.

Therefore, the Best Brightest program recently launched by Stacks is essentially a major innovation project solicitation activity for the Bitcoin ecosystem. In simple terms, it provides all-round support for developers and teams who want to build innovative applications on Bitcoin – a bit like a Bitcoin Ecosystem Innovation Accelerator.

This plan will be launched gradually from late November 2024, covering various important areas in the Bitcoin ecosystem, such as miners, wallets, and exchanges. It not only takes care of the growth space for individual developers, but also provides sufficient development funds for mature teams.

In order to ensure that these innovations are safe and reliable, Stacks has also specially invited the industrys top security teams to join. For example, Immunefi (an on-chain security platform that protects more than $190 billion in assets and has more than 45,000 security researchers) will hold a special Attackathon event to allow white hat hackers to test and reinforce the security of these innovative projects in advance.

Interestingly, the timing of launching this plan was just right. Just when the price of Bitcoin hit a new high and the market was generally caught in a speculative frenzy, Stacks chose a seemingly slow but potentially more visionary path: to provide more possibilities for the entire Bitcoin ecosystem through solid technological innovation and ecosystem construction.

From the perspective of institutional support, sBTC has received support from more than 20 well-known institutions including BitGo, Blockdaemon, Figment, Copper, and Asymmetric. This broad institutional endorsement is not only a recognition of the technical solution, but also a vote of confidence in the future development of the entire ecosystem.

We are likely to see a wave of innovation based on Bitcoin. This is not only related to the expansion of the Bitcoin ecosystem, but is also likely to re去中心化金融ne our understanding of Bitcoin applications.

After all, as Satoshi Nakamoto said on the Bitcoin forum: In the next few decades, when the block reward becomes too small, transaction fees will become the main compensation for nodes. I believe that in 20 years, there will either be a lot of transactions or no transactions. And now it seems that through such ecological innovation plans, Bitcoin seems to be moving in the direction of the former.

However, technological innovation ultimately needs to be tested by the market. In the current situation where the Bitcoin ecosystem is only increasing in price but not in the ecosystem, can Stacks choice be recognized by the market?

The answer to this question may have to wait until sBTC is officially launched and more innovative applications based on Stacks emerge.

This article is sourced from the internet: Stacks Completes Nakamoto Upgrade, Will BTC DeFi Be the Next Focus?

Related: Matrixport 市場 Observation: BTC briefly breaks through 89K ATH, can it reach a new high before the end of the year?

With the victory of crypto-friendly President Trump, crypto assets led by BTC have seen good gains recently. Since November 11, BTC has entered a rapid upward channel, breaking through the resistance levels of $80,000 and $82,000, and then the upward trend is unstoppable, with an amazing increase of more than 10%, standing strongly above $89,000, and reaching a maximum of $89,940. At the same time, ETH also broke through the resistance level of $3,000, forcing a 6.4% increase. As of the publication of this article, the price of BTC has slightly adjusted and fluctuated around $88,000 (the above data is from Binance spot, November 12, 17:00). The total market value of cryptocurrencies has exceeded $3.1 trillion for the first time since November 2021 (the peak of the last bull market).…