Original author: @packyM, Not boring

原文翻譯:白話區塊鏈

In the new US presidential election in 2024, Trump was re-elected. The capital market also ushered in a wave of enthusiasm, the US dollar index hit a new high, and the 加密貨幣 market was unstoppable. The total market value of the global crypto market exceeded 3 trillion US dollars for the first time. After Bitcoin broke through the 90,000 US dollar mark, it seemed that 100,000 US dollars was within reach.

Trumps election has undoubtedly injected a dose of stimulant into the capital market, especially the crypto market. Can the various favorable expectations released during the campaign be realized? How will the future crypto market develop? @packyM has made an outlook on the Trump bubble, and Vernacular Blockchain has compiled excerpts from it.

The following is the text:

As we all know, one of the biggest risks facing crypto companies right now is that government regulation could slow down their development or even cause them to stagnate. I have been closely following the political developments in the United States over the past week and have found that the current situation has many similarities to what I usually discuss, and is more optimistic than expected. My intuition tells me that we are standing at the beginning of all bubbles – a bubble-making machine, a bubble that breeds countless bubbles: the Trump bubble.

One of the most striking things about last week’s presidential election was how many people seemed incredibly excited about Trump’s victory, and the extreme excitement some people feel about a certain vision of the future is precisely the sign that a bubble is beginning to form.

Over the weekend, I read Boom: Bubbles and the End of Stagnation by Byrne Hobart and Tobias Huber. The central idea in the book is that certain types of bubbles have a huge impact on moving the world forward. They argue that bubbles are a good solution to the problem of stagnation.

As I read the book, I noticed that the post-election reaction was strikingly similar to the productive bubbles described in the book: the Manhattan Project, the Apollo program, Moore’s Law, the golden age of corporate RD, the shale revolution, and Bitcoin.

Byrne and Tobias identified five common characteristics among all the technologies and top projects they studied:

-

Clear optimism and focus

-

The fear of missing out (FOMO) and the YOLO mentality

-

Excessive risk taking and overinvestment

-

Parallelization and coordination

-

Reflexivity and hyperbelief

Defending the Bubble

The “Trump bubble” may sound worrying. When people hear the word “bubble,” they usually think of “something that is over-inflated and destined to burst.” The word often has negative connotations, especially when it comes from some bad bubbles. But there are more than just this type of bubble. In the book “Boom,” Byrne and Tobias describe two types of bubbles:

1) Mean reversion bubble: The basic bet is that the future will continue along the current trend. For example, the subprime mortgage crisis. If you bet that the future will remain roughly the same, you can increase your bet by adding leverage.

2) Turning point bubbles: Investors believe that the future will be significantly different from the past. For example, the Internet bubble. If you believe that the future will change significantly, you will buy assets that can benefit from this change.

They argue that turning bubbles drive progress, a view similar to the one I discuss in my book Infinity Missions: turning bubbles drive progress by directing massive amounts of resources toward important projects that would otherwise be impossible to execute under normal cost-benefit analysis.

Take the Apollo program as an example:

In May 1961, when President John F. Kennedy announced that “this nation should commit itself to putting a man on the moon before the end of this decade,” no one knew how to accomplish that goal. Rockets, launch pads, space suits, hardware, software, zero-gravity food—none of it existed, and neither did the experts in the field. It wasn’t just that the space program lacked what it needed to make a moon landing a reality—scientists at the time weren’t even sure it was possible.

Turning bubbles drive future progress by concentrating huge amounts of financial and human capital on a very specific vision of the future, and allowing wasteful exploration and parallelization in pursuit of that goal that would not normally take place.

Without the bubble, some things might never happen. Byrne and Tobias point out that Moore’s Law itself is a classic bubble phenomenon: “The industry exhibits classic bubble behavior: predictions about the future—especially bold and almost irrefutable predictions—ultimately drive the behaviors that make those predictions come true.” For example, the expectation of continuous improvement in chips prompted people to design products that could take advantage of better chips, which in turn made chip manufacturers aware of the demand, thus stimulating investment in continuous chip improvements.

In other words, a compelling enough vision can make it a reality. As Stripe Press wrote on the Boom website, “Optimism can become a self-fulfilling prophecy.”

Source: Boom Website

As Peter Thiel, Byrne, and Tobias emphasize, not all optimism is positive. Excessive optimism—the mere assumption that everything will go well—can be just as destructive as pessimism. Thus, the first common characteristic of productive bubbles is explicit optimism: a belief that the future will be better, and a concrete plan to make it happen.

What exactly is a bubble?

In the early post-election period, I began to notice common features of the bubbles, and I observed that the only unanswered question was their clarity—i.e., where the attention was focused.

Simply “making everything better,” such as “making America great again,” is too vague and imprecise to meet the book’s 去中心化金融nition of a positive bubble: “The key is whether the vision includes a concrete and actionable plan to transition from now to the future.”

For example, building an atomic bomb before the Germans (or the Soviets) did was clear and specific: getting to the moon within a decade. Every bubble that Byrne and Tobias discuss is also clear and specific. But what about Trump’s bubble? What kind of bubble is it?

Elon Musk, who played a major role in Trump’s election and will likely continue to play a major role in his presidency, has called Tesla’s Gigafactory “a machine that builds machines.” If the Gigafactory works well, making cars itself becomes easy. America, like the “machine that builds machines,” has only just accumulated dirt in its gears.

America still creates great companies, and those companies still make great products. But the slogan “Make America Great Again” doesn’t resonate with me because I still think America is the greatest country in the world, even if it’s slower and clumsier than before. Comparisons with other countries mask a deeper truth: America is not as great as it could be.

If Trump’s bubble takes shape, it will be about upgrading and cleaning the dirt out of the “machine that builds the machine” so that the American machine can run at full speed. For those who believe in America, capitalism, and ourselves, there is no more inspiring vision than this. This vision looks powerful enough to blow up the biggest bubble in history.

Signs of a bubble

While the Manhattan Project and Apollo Program are two examples in the book of direct government regulation, I think Trumps bubble is more likely to develop like Moores Law.

As Byrne and Tobias write, “Moore’s Law is perhaps the most convincing and persistent example of a two-sided bubble, where the expectation of progress in one area drives development in another, which in turn fuels growth in the first.”

There is also a two-way relationship in the Trump bubble. The Trump administration is sending people the message that it will be easier to build, invest, and achieve big goals, and this expectation itself has inspired people to build, invest, and achieve big goals. The more energy and excitement people put in, the easier it will be for the government to fix the machine.

Augustus Doricko of Rainmaker expressed the sentiment perfectly: We have four years to do the best we can.

With control of the Senate, the House, and the executive branch, the government promised to streamline processes and remove friction. In return, the private sector planned to increase risk, investment, and innovation.

While actually streamlining processes and eliminating friction may be far more difficult than expected, the mere belief that it is possible is enough to trigger a bubble.

Armed with the belief that anything is possible, people are sharing what they think the government can do.

Pay attention to this meme: Make America X Again. Bryan Johnson posted a photo of himself and RFK Jr. with the caption MAHA, which stands for Make America Healthy Again.

If Bryan Johnson is a tech founder who can connect with key people in charge of the U.S. health system, doesn’t it start to feel like the government might be willing to listen to his advice on health and other matters?

You may think this is a good thing or a bad thing, but what we are looking at here is the dynamics of a bubble. The characteristic of a bubble is that people begin to think that they can influence government policy with just one tweet. This also means that more and more people begin to share their policy proposals on Twitter. Interestingly, some of these ideas may actually become reality.

Of course, the government cannot see all the proposals, consider only a small fraction of them, and implement even fewer. But like a lottery or a bounty system, it is almost certain that the government will try to push some previously unthinkable solutions, and some of these solutions may succeed. And when these succeed – such as sulphate injection to combat global warming – the government will become more daring to try things that were not thought of before.

By getting people to believe that change is possible — even if it’s just to project their hopes onto it — the Trump administration is making it cool to work with the government. Bryan Johnson is one of them, as is Elon Musk, the world’s richest man who just caught a 22-story rocket with chopsticks. Geniuses who never thought about working with the government in the past are now looking for opportunities to get involved. Sequoia’s Sean Maguire says he’s received inquiries from PhDs in physics asking how they can work in the Trump administration.

This is a national parallelization and coordination. The parallelization is that more and more entrepreneurs want to build in a more efficient American machine; the coordination is that more and more talented people want to get involved in fixing that machine because they think they have a chance to do so.

This is another example of a self-fulfilling prophecy. More talent devoted to fixing the government, with strong popular support, will make it more likely that they will succeed. This, in turn, will make those who are committed to building complex businesses — whether in crypto or energy — more successful in building their “machines.”

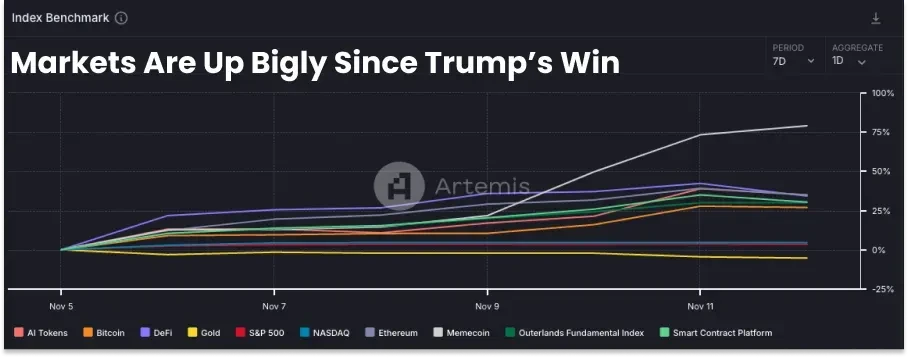

The belief that ambitious projects that are being pushed forward within the existing government framework will eventually succeed has led to a real fear of missing out (FOMO), which is particularly evident in the cryptocurrency market, where the high liquidity and rapid price fluctuations of cryptocurrencies make this anxiety even more palpable.

As of November 12, 2024. Source: Artemis Terminal

Investors are asking what cryptocurrencies can actually accomplish if the SEC stops trying to exclude them through means that currently lack clear legislation.

Interestingly, this process also bred a mini bubble. In their book Boom, Byrne and Tobias mentioned the case of Bitcoin, pointing out that “the value, security, and network effects of any currency are driven by adoption, and Bitcoin is no exception.”

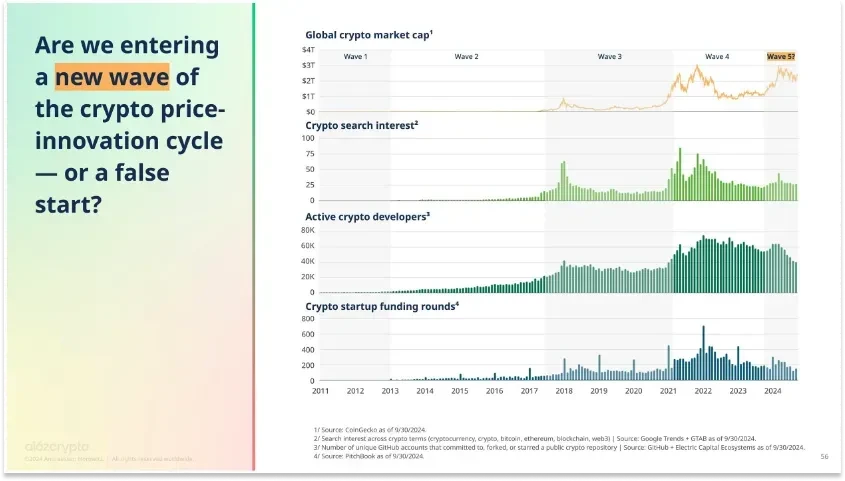

a16z Crypto has long emphasized the price innovation cycle in cryptocurrencies: when prices rise, it attracts more attention and developers, who then build products, making the cryptocurrency more valuable over time.

The state of cryptocurrency in 2024, source: a16z crypto

This cycle is particularly evident in cryptocurrencies, which are inherently liquid, but similar dynamics play out in all industries: rising prices attract talent, and talent creates things that support rising prices. This is hyperstition and reflexivity.

I think the reason why the Trump bubble is so powerful is that it has spawned these small bubbles everywhere, like a bubble-making machine.

When it becomes legal to build cryptocurrencies, more people will get involved and create more valuable crypto products; when the approval process for new nuclear reactors becomes feasible, more companies will start building them; when SpaceX can launch rockets freely without interference from the FAA, it will launch more rockets.

This brings us back to the concepts of FOMO (fear of missing out) and YOLO (you only live once). If you’re paying attention, it’s hard not to feel as if something big is happening and you need to get involved. I also feel like I’m not getting enough, financially of course, but I also mean something deeper, a spiritual feeling. I felt like I was doing enough but now realize I should be doing more and need to work harder to catch up — and this mentality is characteristic of a bubble.

In their book Boom, Byrne and Tobias note that bubbles are often accompanied by a spiritual quest. They write: “To identify areas of future technological progress, one can start by looking at the sense of spiritual transcendence they bring.”

It does feel like we have an unprecedented opportunity to truly build the future we want, to bring our vision of the future to fruition. It’s just that no matter how much you put in, there’s always someone who’s putting in more. It’s this dynamic that aligns thousands, if not millions, of people to participate in this great project, whether it’s improving the existing system or creating a new, more accessible system. It’s almost certain to lead to the excessive risk-taking and overinvestment that characterizes a bubble.

Despite the growing appreciation for “hard core tech” (i.e. vertically integrated companies), many investors still prefer to proceed with caution, viewing these technologies as uncertain and capital intensive to build, despite the extremely high returns if they succeed. However, I expect that in the coming months, we may see overinvestment similar to the cryptocurrency market in sectors ranging from nuclear power to aerospace.

But this is actually a good thing! The beauty of a bubble is that even though some investors may suffer losses, it does not cause a systemic collapse, and the world still makes progress in solving major problems. In the end, companies that might not have survived otherwise will emerge and move the world in a better direction.

Of course, all this will not be smooth sailing and will inevitably be full of fluctuations and uncertainties. But I firmly believe that this process will bring extraordinary results.

How the Foam Machine is Made

In 2021, Musk shared his five-step method for improving the manufacturing and design process in a very famous video with Everyday Astronaut:

來源: https://www.youtube.com/watch?v=t705r8ICkRwfeature=youtu.be

-

Make the requirements more reasonable

-

Remove unnecessary parts or processes

-

Simplify or optimize

-

Faster cycle times

-

automation

If you think of the United States as a “machine that builds machines,” then Musk’s approach to building SpaceX, a “machine that builds machines,” is not only noteworthy, but also very interesting, because it is very similar to the Trump administration’s stated plan:

-

Make requirements more reasonable → Regulatory reform (e.g. NEPA, NRC)

-

Remove unnecessary parts/processes → Eliminate agencies like the Ministry of Education

-

Simplify/Optimize → Streamline the remaining processes

-

Faster cycle time → faster approvals

-

Automation → Modernizing government systems

Obviously, these changes may come with some risks! For example, SpaceX rockets sometimes explode, showing that overly radical innovation can run into problems.

But once these improvements and optimizations are implemented, a lot of things will run much more smoothly. Thats why people are so enthusiastic because they believe this is the first government in many years that is really pushing the envelope and testing the limits of the existing system.

But more importantly, this breaking the rules approach symbolizes an attitude of re-embracing risks.

概括

On November 13, Trump announced that Elon Musk and Vivek Ramaswamy would co-lead the newly established Department of Government Effectiveness.

According to Trump, DOGE will clear bureaucratic obstacles for my administration, cut excessive regulations, reduce wasteful spending, and reshape federal agencies. He also said that this will create an unprecedented entrepreneurial approach to government management and unleash the vitality of our economy. In short, the purpose is to repair the machine that makes the machine and promote a series of changes.

Can you understand why people are so excited? I mentioned Musk’s process for fixing the machine in the last section, and I thought the metaphor was a little too “right” at the time. As a result, right after I finished writing it, Trump appointed Musk to co-lead the organization responsible for “fixing the machine.” Musk was undoubtedly the best person for this position, and he gladly accepted the task.

While many have pointed out that DOGE has no actual decision-making power and can only make recommendations, this is not the point. The point is that both supporters and opponents have begun to believe that the government may actually become more efficient. Even if Musk and Vivek cannot directly cut agencies and regulations, they can at least reveal the most wasteful parts of the federal government and promote change through the power of the public.

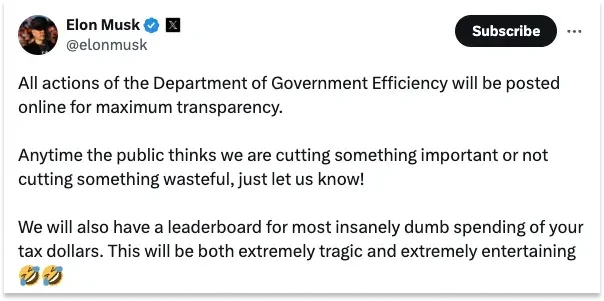

This is a long-awaited opportunity for people to feel that they can personally participate in making the American big machine run more smoothly. Musk also said on the X platform that they will share all DOGE actions publicly.

Vivek said on Twitter that DOGE will collect public opinions through crowdfunding: Americans voted for radical government reform, and they should have the opportunity to help fix it.

This is what I said before. Any good and healthy bubble can inspire people to participate. People will feel that they can really fix the government, so they will invest more energy in trying to improve it. The specific manifestation may be submitting suggestions or calling members of Congress to encourage them to adopt DOGEs suggestions.

Whether or not the final outcome is exactly as expected is not the most important thing. The key is that when a bubble forms, people firmly believe that things will develop in this direction, and this belief itself will shape their actions.

The issue now is no longer Democrats versus Republicans, no matter what the discontent and differences in peoples hearts are, but more importantly, the actions between those who believe that the American people can change the status quo and make America and the world better, and those who believe that the government bureaucracy should do these things for us. This is much more important than a simple political struggle!

No one wants to pay more in taxes to fund a wasteful bureaucracy. No one wants to feel like their country is broken and there is nothing they can do about it. No one wants to see things move 100 times slower than they should, or cost 100 times more than they should. There are many things we can agree on.

This is a meta-bubble that may give rise to turning bubbles in the next few decades. Welcome to the Trump bubble.

This article is sourced from the internet: Trump Bubble: What’s Next for Bitcoin?