原作者: 阿瑟·海耶斯

原文翻譯:TechFlow

(Any opinions expressed in this article are solely the author’s personal opinions and should not be used as a basis for investment decisions or as advice on investment transactions.)

What do you think the price of Bitcoin will be on December 31, 2024? More than $100,000 or less?

There is a famous Chinese saying: It doesnt matter if the cat is black or white, as long as it can catch mice, it is a good cat.

I will refer to the policies implemented by President Trump after his election as “American capitalism with Chinese characteristics.”

The elites who rule Pax Americana do not care whether the economic system is capitalist, socialist or fascist, they only care whether the policies implemented help maintain their power. America ceased to be purely capitalist as early as the early 19th century. Capitalism means that when the rich make bad decisions, they lose money. This was prohibited as early as 1913 when the Federal Reserve System was established. As privatized gains and socialized losses impacted the country and created extreme class divisions between the many inland-dwelling mean or lower class people and the noble, respected coastal elites, President Roosevelt had to correct course and hand out some crumbs to the poor through his New Deal policies. Then, as now, expanding government relief for those left behind is not a policy that is popular with the wealthy so-called capitalists.

The shift from extreme socialism (the top marginal tax rate on incomes over $200,000 was raised to 94% in 1944) to unfettered corporate socialism began in the 1980s under Reagan. Then came neoliberal economic policies that continued until COVID in 2020, as central banks printed money to pump money into the financial services industry in the hope that wealth would trickle down from the top. President Trump has channeled his inner Roosevelt in his response to the crisis; he has sent the largest amount of money directly to the entire population since the New Deal. The United States printed 40% of the world’s dollars in 2020-2021. Trump started the “stimulus checks” and President Biden has continued this popular policy during his term. When assessing the impact on government balance sheets, there are some peculiarities between 2008-2020 and 2020-2022.

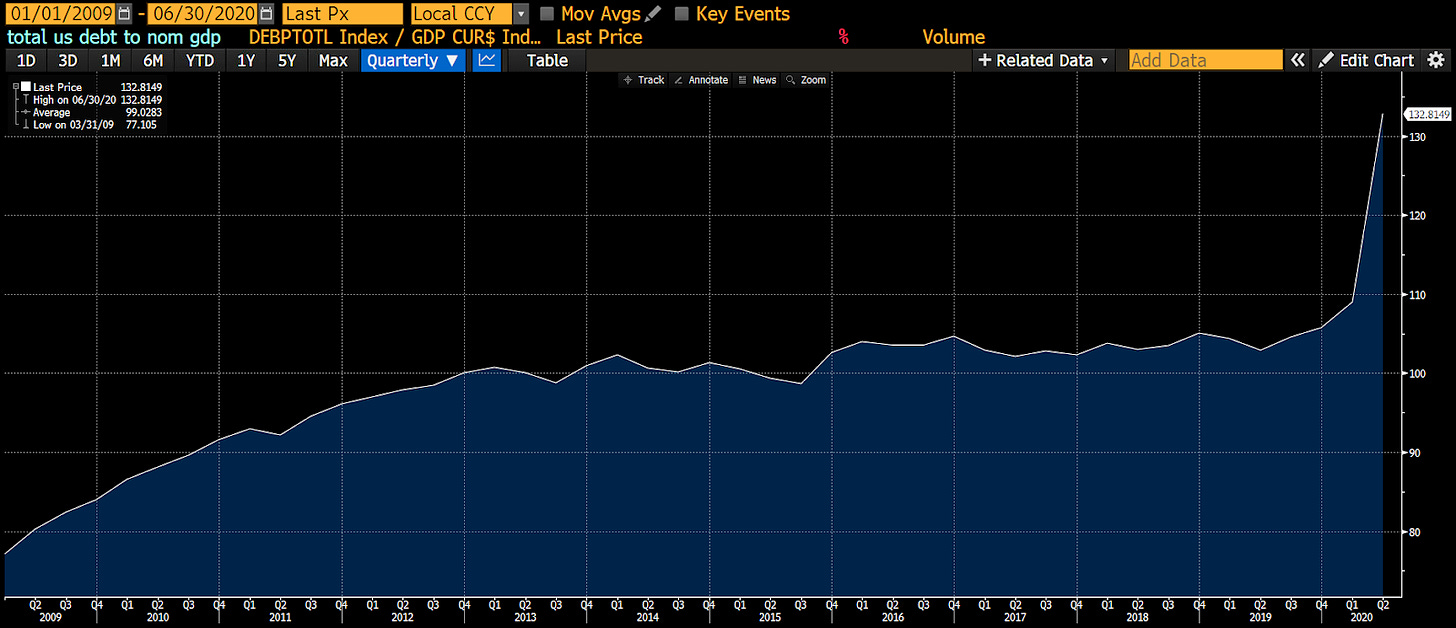

From 2009 to the second quarter of 2020, the peak of so-called trickle-down economics, economic growth during this period relied mainly on central bank money printing policies, commonly known as quantitative easing (QE). As you can see, the economy (nominal GDP) grew slower than the national debt accumulated. In other words, the rich used the money they received from the government to buy assets. Such transactions did not lead to substantial economic activity. Therefore, providing trillions of dollars to wealthy holders of financial assets through debt actually increased the debt-to-nominal GDP ratio.

From the second quarter of 2020 to the first quarter of 2023, Presidents Trump and Biden took a different approach. Their Treasury issued debt purchased by the Federal Reserve through quantitative easing (QE), but this time instead of issuing it to the rich, they sent checks directly to every citizen. The poor actually received cash in their bank accounts. Apparently, Jamie Dimon, the CEO of JPMorgan Chase, made a lot of money from the fees the government paid for the money transfers… He has been called the American Li Ka-shing, and you can’t avoid paying him fees. The poor are poor because they spend all their money on goods and services, and during this period, they did. With the velocity of money increasing significantly, the economy grew rapidly. That is, $1 of debt generated more than $1 of economic activity. As a result, the debt-to-nominal GDP ratio of the United States magically fell.

However, inflation increased because the supply of goods and services did not keep up with the growth in purchasing power that people gained through government debt. The rich who held government bonds were unhappy with these populist policies. These rich people experienced the worst total returns since 1812. To fight back, they sent in Fed Chairman Jay Powell, who began raising interest rates in early 2022 to control inflation, while ordinary people had hoped for another round of stimulus checks, but such a policy was prohibited. US Treasury Secretary Janet Yellen stepped in to offset the impact of the Feds tightening monetary policy. She exhausted the Feds reverse repurchase facility (RRP) by shifting debt issuance from long-term bonds to short-term bills. This injected nearly $2.5 trillion in fiscal stimulus into the market, mainly benefiting the rich who held financial assets; asset markets boomed as a result. Similar to after 2008, these rich peoples government handouts did not lead to real economic activity, and the US debt-to-nominal GDP ratio began to rise again.

Has Trump’s incoming administration learned the lessons of recent U.S. economic history? I believe it has.

Scott Bassett, widely considered Trump’s choice to replace Janet Yellen as U.S. Treasury Secretary, has given many speeches about how he wants to “fix” America. His speeches and columns detail how to implement Trump’s “America First Plan,” which is very similar to China’s development strategy (which began under Deng Xiaoping in the 1980s and continues today). The plan aims to promote nominal GDP growth by promoting the reshoring of key industries (such as shipbuilding, semiconductor factories, automobile manufacturing, etc.) through government-provided tax credits and subsidies. Qualified companies will be able to obtain low-interest bank loans. Banks will once again be eager to lend to these actual operating companies because their profitability is guaranteed by the U.S. government. As companies expand their operations in the United States, they need to hire American workers. Higher-paying jobs for ordinary Americans means increased consumer spending. These effects will be more significant if Trump restricts immigration from certain countries. These measures stimulate economic activity, and the government receives revenue through corporate profits and personal income taxes. To support these plans, the government 去中心化金融cit needs to remain high, and the Treasury raises funds by selling bonds to banks. Since the Fed or lawmakers have suspended the supplementary leverage ratio, banks can now re-leverage their balance sheets. The winners are ordinary workers, companies that produce qualified products and services, and the U.S. government, whose debt-to-nominal GDP ratio falls. This policy amounts to super-quantitative easing for the poor.

Sounds great. Who could object to such a prosperous era in America?

The losers are those who hold long-term bonds or savings deposits, as the yields on these instruments will be deliberately held down below the nominal growth rate of the U.S. economy. If your wages cannot keep up with higher inflation, you will also be affected. Notably, joining a union has become popular again. 4 and 40 became the new slogan, meaning a 40% pay raise for workers over the next four years, or 10% per year, to incentivize them to continue working.

For those of you who think you are wealthy, don’t worry. Here is an investment 指導. This is not financial advice; I am just sharing what I do in my personal portfolio. Whenever a bill is passed that allocates money to a specific industry, read it carefully, and then invest in stocks in those industries. Instead of keeping your money in fiat bonds or bank deposits, buy gold (as a hedge for baby boomers against financial repression) or Bitcoin (as a hedge for millennials against financial repression).

Obviously, my portfolio prioritizes Bitcoin, other 加密貨幣currencies, and stocks of crypto-related companies, followed by gold stored in a vault, and finally stocks. I keep a small amount of cash in a money market fund to pay my Ame x bills.

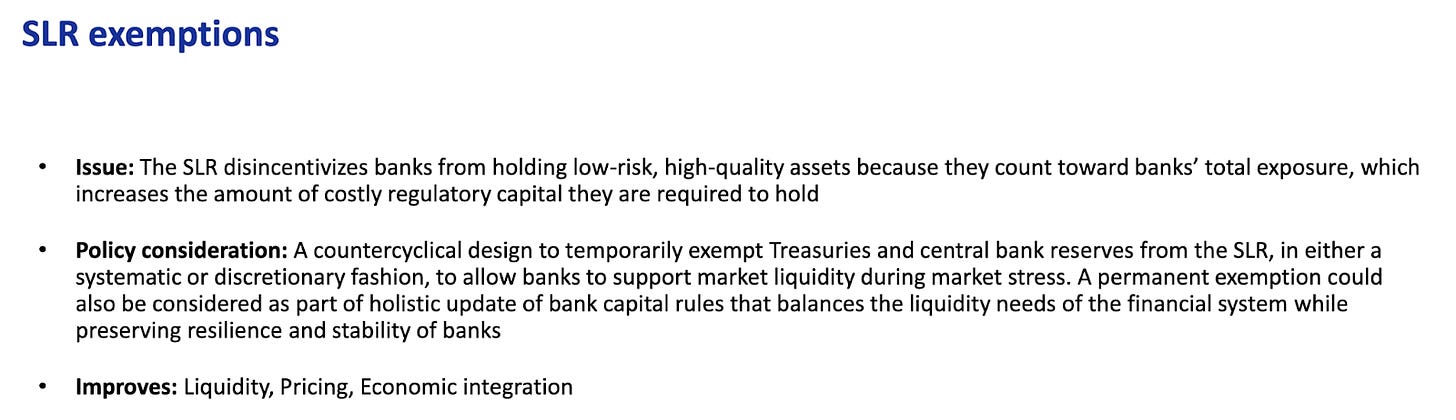

In the remainder of this post, I will explain how QE for the rich and the poor affects economic growth and money supply. Next, I will predict how the exemption of the Supplementary Leverage Ratio (SLR) for banks once again makes unlimited QE for the poor possible. In the final section, I will introduce a new index to track the supply of US bank credit and show how Bitcoin outperforms all other assets after adjusting for bank credit supply.

Money Supply

I have great admiration for the quality of Zoltan Pozars Ex Uno Plures series. I read all of his works during my recent long weekend in the Maldives while enjoying surfing, Iyengar yoga, and fascia massage. His works will appear frequently in the rest of this article.

Next, I will show a series of hypothetical accounting entries. On the left side of the T are assets and on the right side are liabilities. Blue entries represent increases in value and red entries represent decreases in value.

The first example focuses on how the Feds bond purchases through quantitative easing affect the money supply and economic growth. Of course, this example and the ones that follow will be slightly humorous to increase interest and appeal.

Imagine you are Powell in March 2023 during the US regional banking crisis. To decompress, Powell goes to the Racquet and Tennis Club at 370 Park Avenue in New York City to play squash with an old friend who is worth hundreds of millions. Powells friend is very anxious.

This friend, well call him Kevin, a senior finance guy, said, Jay, I may have to sell my house in the Hamptons. All my money is in Signature Bank, and apparently my balance is over the FDIC insurance limit. You have to help me out. You know how hard it is for rabbits to have to stay in the city for a day in the summer.

Jay responded, Dont worry, Ill get it done. Im going to do $2 trillion in quantitative easing. It will be announced Sunday night. You know the Fed always has your back. Without your contributions, who knows what America would be like. Imagine if Trump came back to power because Biden had to deal with the financial crisis. I still remember when Trump stole my girlfriend in Dorsia in the early 80s, it was infuriating.

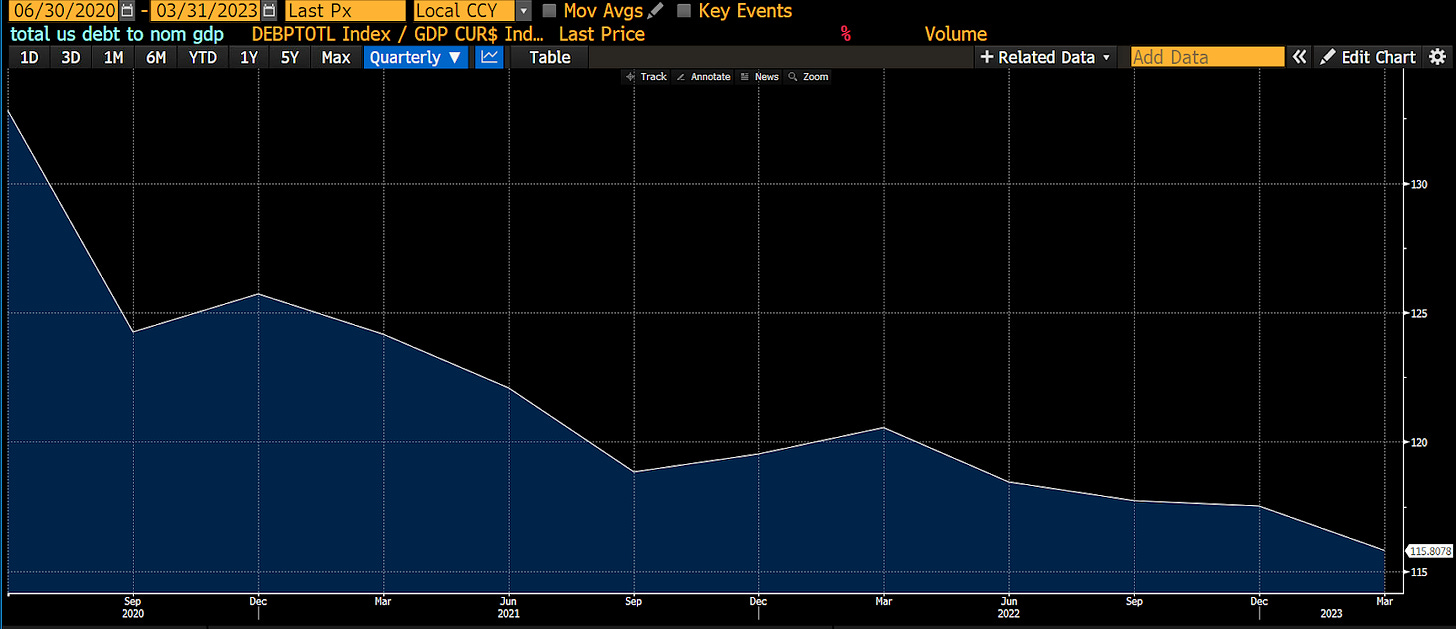

The Fed created the Bank Term Funding Program, which is different from straight up QE, to address the banking crisis. But allow me to be a little artistic here. Now, let’s look at how $2 trillion of QE affects the money supply. All numbers will be in billions of dollars.

-

The Fed bought $200 billion worth of Treasury bonds from Blackrock and paid for it with reserves. JP Morgan, as a bank, played an intermediary role in this transaction. JP Morgan received $200 billion in reserves and credited Blackrock with $200 billion in deposits. The Feds quantitative easing policy caused banks to create deposits, which eventually became money.

-

Blackrock, having lost its Treasury bonds, needs to reinvest the money in other interest-bearing assets. Larry Fink, Blackrocks CEO, usually only works with industry leaders, but at this moment, he is interested in the technology sector. A new social networking app called Anaconda is building a user community to share photos uploaded by users. Anaconda is in the growth stage, and Blackrock is happy to buy their $200 billion worth of bonds.

-

Anaconda has become a major player in the U.S. capital markets. They have successfully attracted a user base of 18 to 45-year-old men, making them addicted to the app. As these users reduce their reading time and spend time browsing the app instead, their productivity has dropped significantly. Anaconda finances stock buybacks for tax optimization by issuing debt so that they do not need to repatriate retained earnings overseas. Reducing the number of shares not only boosts the stock price, but also the earnings per share because the denominator is reduced. Therefore, passive index investors like Blackrock are more inclined to buy their shares. As a result, the aristocrats have an extra $200 billion in deposits in their bank accounts after selling their shares.

-

The wealthy shareholders of Anaconda had no immediate need to use the funds. Gagosian hosted a lavish party at the Miami Art Basel. At the party, the aristocrats decided to buy the latest works of art to enhance their reputation as serious art collectors and also to impress the beauties at the booths. The sellers of these works of art were also people of the same economic class. As a result, the bank accounts of the buyers were credited, while the accounts of the sellers were debited.

At the end of all these transactions, no real economic activity was created. By pumping $2 trillion into the economy, the Fed actually just increased the bank account balances of the rich. Even the financing of one American company did not generate economic growth because the money was used to push up stock prices without creating new jobs. $1 of QE resulted in a $1 increase in the money supply but did not lead to any economic activity. This is not a reasonable use of debt. Therefore, the ratio of debt to nominal GDP during QE has risen among the rich from 2008 to 2020.

Now, let’s look at President Trump’s decision-making process during COVID. Back to March 2020: Early in the COVID outbreak, Trump’s advisors advised him to “flatten the curve.” They advised him to shut down the economy and only allow “essential workers” to continue working, typically those who were working at low wages to keep the economy going.

TRUMP: Do I really need to shut down the economy because some doctors think this flu is bad?

Advisor: Yes, Mr. President. I must remind you that it is primarily seniors like yourself who are at risk from complications arising from COVID-19 infection. I would also point out that it would be very expensive to treat the entire over-65 group if they become ill and require hospitalization. You need to lock down all non-essential workers.

TRUMP: This will cause the economy to collapse. We should be sending checks to everybody so they wont complain. The Fed can buy the debt issued by the Treasury, which will finance these subsidies.

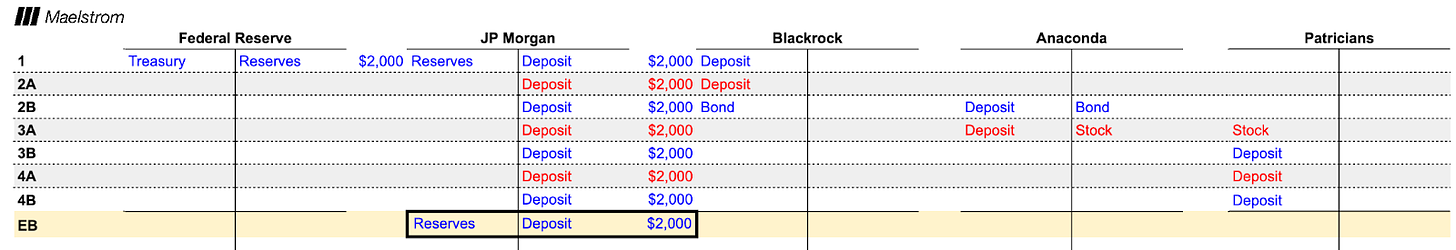

Next, let’s use the same accounting framework to analyze step by step how quantitative easing affects ordinary people.

-

Just like in the first example, the Fed used its reserves to conduct $200 billion of quantitative easing by purchasing Treasury bonds from Blackrock.

-

Unlike the first example, this time the Treasury Department is also involved in the flow of funds. In order to pay the Trump administrations stimulus checks, the government needs to raise funds by issuing Treasury bonds. Blackrock chose to buy Treasury bonds instead of corporate bonds. JP Morgan assisted Blackrock in converting its bank deposits into Federal Reserve reserves, which can be used to purchase Treasury bonds. The Treasury Department received a deposit similar to a checking account in the Federal Reserves Treasury General Account (TGA).

-

The Treasury Department sent stimulus checks to everyone, mainly the general public. This caused the TGA balance to decrease, and at the same time, the reserves held by the Federal Reserve increased accordingly, and these reserves became the bank deposits of the general public in JP Morgan.

-

The average Joe spent all his stimulus check on a new Ford F-150 pickup truck. He ignored the trend of electric cars. This is America. They still love traditional gas cars. The average Joes bank account was deducted, while Fords bank account was added.

-

Ford did two things when it sold these trucks. First, they paid the workers, which transferred deposits from Fords account to the employees accounts. Then, Ford asked the bank for a loan to expand production; the granting of the loan created new deposits and increased the money supply. Finally, ordinary people planned to go on vacation and took out personal loans from the bank, which was happy to provide them given the good economic situation and their well-paying jobs. The bank loans from ordinary people also created additional deposits, just as Ford did when he borrowed money.

-

The final deposit or currency balance is $300 billion, $100 billion more than the $200 billion that the Fed initially injected through QE. As you can see from this example, QE for Main Street stimulates economic growth. The stimulus checks from the Treasury encouraged Main Street to buy trucks. Ford was able to pay its employees and take out loans to increase production because of the demand for its goods. Employees with high-paying jobs received bank credit, allowing them to consume more. $1 of debt generated more than $1 of economic activity. This is a positive outcome for the government.

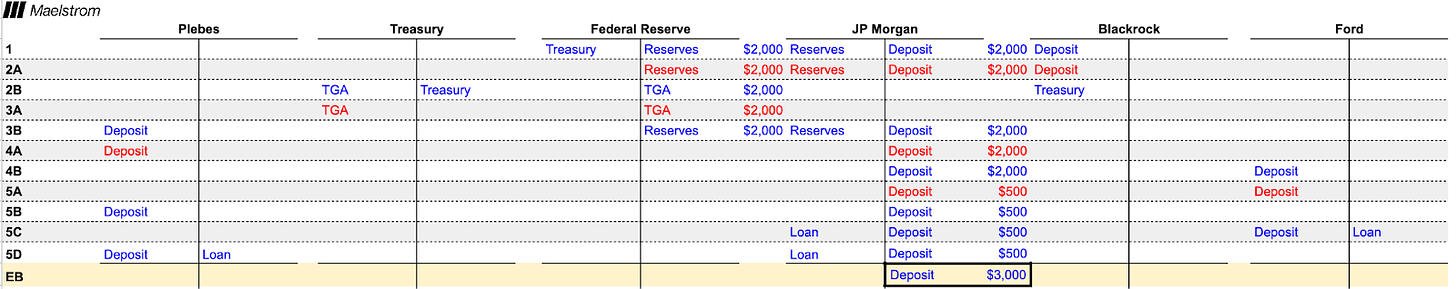

I would like to go further into how the banks can provide unlimited financing to the Treasury.

Well start from step 3 above.

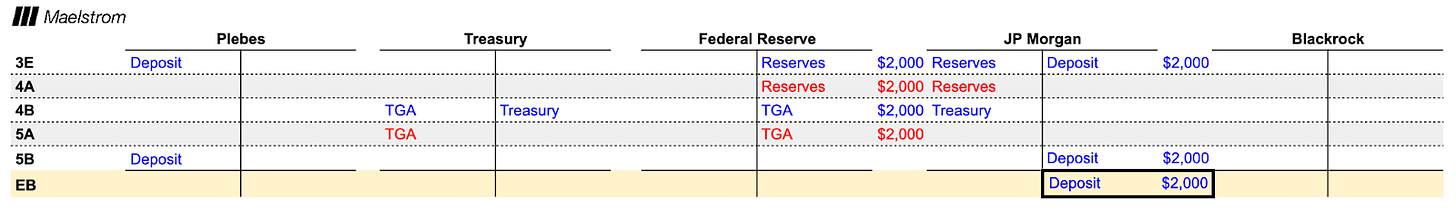

-

The Treasury Department has started to issue a new round of economic stimulus funds. To raise these funds, the Treasury Department raised funds by auctioning bonds, and JPMorgan Chase, as the main dealer, used its reserves at the Federal Reserve to buy these bonds. After selling the bonds, the balance of the Treasury Departments TGA account at the Federal Reserve increased.

-

Just like the previous example, checks issued by the Treasury Department would be deposited into JPMorgan Chase accounts by ordinary people.

When the Treasury issues bonds that are purchased by the banking system, it converts otherwise useless Federal Reserve reserves into deposits by ordinary people, which can be used for spending, thereby boosting economic activity.

Now lets look at a T diagram. What happens when the government encourages businesses to produce certain goods and services by providing tax breaks and subsidies?

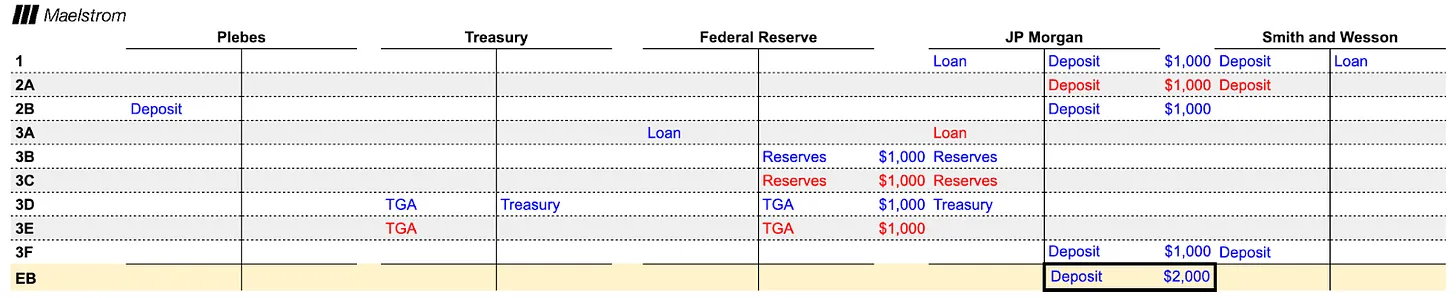

In this example, the United States runs out of bullets while filming a shootout in the Persian Gulf inspired by Clint Eastwood Westerns. The government passes a bill promising to subsidize the production of ammunition. Smith Wesson applies for and is awarded a contract to supply ammunition to the army, but they are unable to produce enough bullets to fulfill the contract and so ask JPMorgan for a loan to build a new factory.

-

When the JPMorgan Chase loan officer receives the government contract, he confidently loans Smith and Wesson $1,000. By making this loan, he creates $1,000 of money out of thin air.

-

Smith and Wesson built factories, which brought in wage income, which ultimately became deposits at JPMorgan Chase. The money created by JPMorgan Chase became deposits of those most inclined to spend, the average person. Ive already explained how the spending habits of the average person drive economic activity. Lets tweak that example a bit.

-

The Treasury needs to issue $1,000 of new debt at auction to finance the subsidy to Smith and Wesson. JPMorgan Chase attends the auction to buy the debt, but does not have enough reserves to pay it back. Since there is no longer any downside to using the Feds discount window, JPMorgan Chase uses its Smith and Wesson corporate debt assets as collateral to obtain a reserve loan from the Fed. These reserves are used to purchase newly issued Treasury debt. The Treasury then pays the subsidy to Smith and Wesson, and the funds become deposits with JPMorgan Chase.

This example shows how the U.S. government, through industrial policy, can induce JPMorgan Chase to create loans and use the assets formed by the loans as collateral to purchase more U.S. Treasury debt.

The Treasury, the Federal Reserve, and the banks seem to operate a magical “money-making machine” that can achieve the following functions:

-

It increases financial assets for the rich, but these assets do not generate real economic activity.

-

By injecting money into the bank accounts of the poor, they will typically use the money to consume goods and services, thereby driving real economic activity.

-

Ensuring profitability of some enterprises in certain specific industries enables enterprises to expand through bank credit, thereby driving real economic activities.

So, are there any restrictions on such operations?

Of course there is. Banks cant create money without limit because they have to have expensive equity for every debt asset they hold. In technical terms, different types of assets have risk-weighted asset charges. Even government bonds and central bank reserves, which are considered risk-free, require an expense of equity capital. So at a certain point, banks can no longer effectively bid on U.S. Treasuries or make corporate loans.

The reason banks need to provide equity for loans and other debt securities is that if the borrower goes bankrupt, whether it is a government or a corporation, someone has to bear the losses. Since banks choose to create money or buy government bonds in order to make a profit, it makes sense for its shareholders to bear these losses. When the losses exceed the banks equity, the bank fails. Not only do bank failures cause depositors to lose their deposits, which is bad enough, but what is even worse from a systemic perspective is that banks cannot continue to expand the amount of credit in the economy. Since the fractional reserve fiat financial system requires continuous credit extension to keep functioning, a bank failure can cause the entire financial system to collapse like dominoes. Remember – one persons asset is another persons liability.

When the banks run out of equity credit, the only way to save the system is for the central bank to create new fiat money and exchange it for the banks’ bad assets. Imagine if Signature Bank had only lent money to Su Zhu and Kyle Davies of the now-defunct Three Arrows Capital (3AC). Su and Kyle provided the bank with false financial statements that misled the bank about the company’s financial health. They then withdrew cash from the fund and transferred it to their wives, hoping that the funds would survive the bankruptcy liquidation. When the fund went bankrupt, the bank had no assets to recover and the loans became worthless. This is a fictional plot; Su and Kyle are good people and would not do such a thing ;). Signature donated a large amount of campaign funds to Senator Elizabeth Warren, who was a member of the US Senate Banking Committee. Using its political influence, Signature convinced Senator Warren that they were worth saving. Senator Warren contacted Fed Chairman Powell and asked the Fed to exchange 3AC’s debt at par through the discount window. The Fed complied, and Signature was able to exchange 3AC bonds for newly issued dollars to meet any deposit outflows. Of course, this is just a fictional example, but the moral is that if banks do not provide adequate equity capital, eventually society as a whole will suffer the consequences of currency devaluation.

Perhaps there is some truth in my assumption; here is a recent story from The Straits Times :

The wife of Zhu Su, co-founder of collapsed cryptocurrency hedge fund Three Arrows Capital (3AC), has managed to sell her luxury home in Singapore for $51 million despite a court freeze on some of the couple’s other assets.

Assuming that governments wanted to create unlimited bank credit, they would have to change the rules so that Treasury bonds and certain “approved” corporate debt (for example, investment-grade bonds or debt issued by specific industries such as semiconductor companies) were exempt from the supplementary leverage ratio (SLR) limit.

If Treasuries, central bank reserves, and/or approved corporate debt securities were exempted from the SLR, banks would be able to buy unlimited amounts of these debts without taking on expensive equity. The Fed has the power to grant such exemptions, and they did so between April 2020 and March 2021. At the time, credit markets in the United States had seized up. The Fed acted to get banks back into Treasury auctions to lend to the U.S. government, which was planning to dole out trillions of dollars in stimulus but without enough tax revenue to back it up. The exemption worked remarkably well, with banks buying up Treasuries in droves. However, the price of these Treasuries fell sharply when Powell raised rates from 0% to 5%, leading to the regional banking crisis in March 2023. There is no such thing as a free lunch.

In addition, the level of bank reserves also affects the willingness of banks to buy Treasury bonds at auctions. When banks feel that their reserves at the Fed have reached the minimum comfortable level of reserves (LCLoR), they will stop participating in auctions. The specific value of LCLoR is only known after the fact.

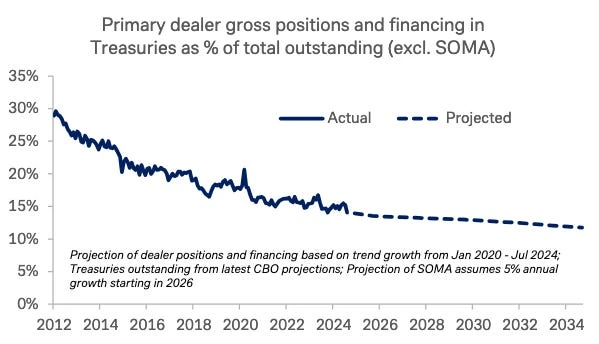

This is a chart from a presentation on the financial resilience of fiscal markets by the Treasury Borrowing Advisory Committee (TBAC) on October 29, 2024. The chart shows that the proportion of Treasury bonds held by the banking system as a percentage of total outstanding debt is decreasing, approaching the minimum comfortable level of reserves (LCLoR). This is problematic because as the Fed engages in quantitative tightening (QT) and central banks in surplus countries sell or no longer invest their net export earnings (i.e. de-dollarize), the marginal buyers in the Treasury market become volatile bond trading hedge funds.

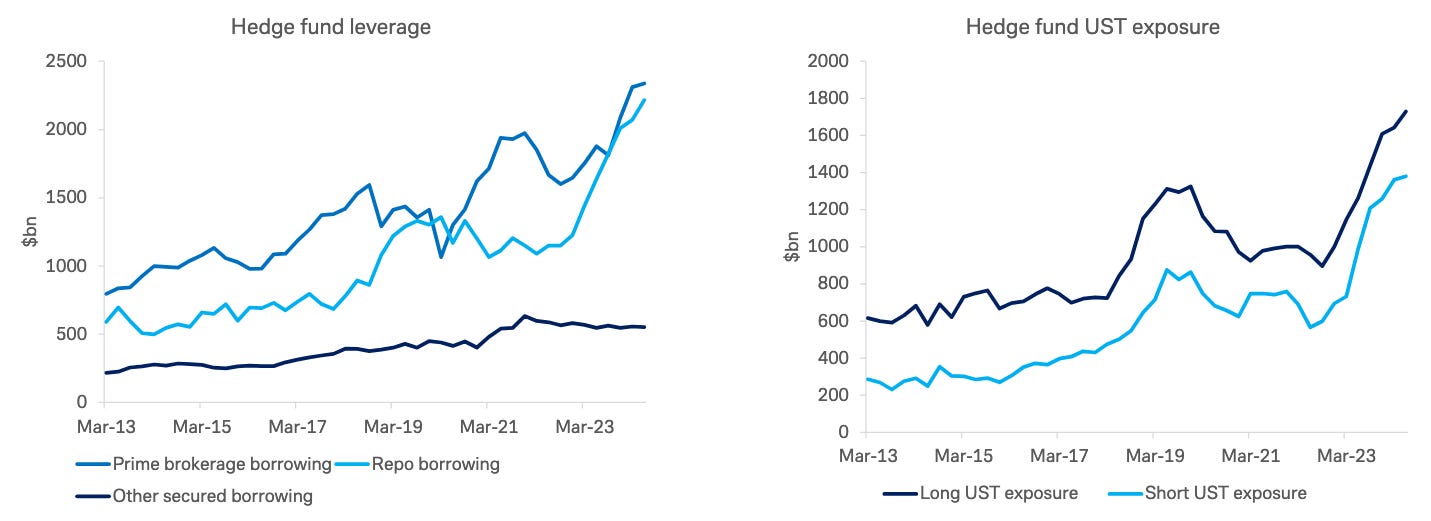

Here is another chart from the same presentation. As you can see from the chart, hedge funds are filling the gap left by banks. However, hedge funds are not actual buyers of funds. They profit from carry trades, which is buying low-priced cash Treasuries while simultaneously shorting Treasury futures contracts. The cash portion of the trade is financed through the repo market. A repo trade is an exchange of an asset (such as a Treasuries) for cash over a period of time at a certain interest rate. The repo market is priced based on the available capacity on commercial banks balance sheets when using Treasuries as collateral for overnight funding. As balance sheet capacity decreases, the repo rate will rise. If the cost of funding Treasuries increases, hedge funds can only buy more if Treasuries are cheap relative to futures prices. This means that Treasury auction prices need to fall and yields rise. This is contrary to the Treasurys goals because they want to issue more debt at a lower cost.

Due to regulatory restrictions, banks cannot buy enough Treasury bonds and cannot finance hedge funds Treasury bond purchases at reasonable prices. Therefore, the Fed needs to exempt banks from SLR again. This will help improve liquidity in the Treasury market and allow unlimited quantitative easing (QE) to be used in the productive areas of the US economy.

If youre still not sure that the Treasury and the Fed realize the importance of loosening bank regulations, TBAC clearly states this need on Slide 29 of the same presentation.

Tracking Metrics

If Trump-o-nomics works as I have described, then we need to focus on the potential for bank credit growth. Based on previous examples, we know that quantitative easing (QE) for the rich works by increasing bank reserves, while QE for the poor works by increasing bank deposits. Fortunately, the Federal Reserve provides both of these data for the entire banking system every week.

I created a custom Bloomie Index that combines reserves and other deposits and liabilities, the BANKUS U Index. This is my custom index that tracks the amount of credit held by US banks. In my opinion, it is the most important money supply indicator. As you can see, sometimes it will be ahead of Bitcoin, such as in 2020, and sometimes it will lag behind Bitcoin, such as in 2024.

More critical, however, is how assets perform when the supply of bank credit shrinks. Bitcoin (white), the SP 500 (gold), and gold (green) are all adjusted for my bank credit index. The values are normalized to 100, and you can see that Bitcoin has been the standout performer, up over 400% since 2020. If you can only do one thing to protect against a debasement of fiat, invest in Bitcoin. The math is indisputable.

Future directions

Trump and his economic team have made it clear that they will pursue a policy of weakening the dollar and provide the necessary funds to support the reshoring of American industry. Since the Republicans will control the three major branches of government in the next two years, they can push forward Trumps entire economic plan without any hindrance. I think the Democrats will also join this money printing party because no politician can resist the temptation of giving benefits to voters.

Republicans will take the lead in passing a series of bills to encourage manufacturers of key goods and materials to expand domestic production. These bills will be similar to the CHIPS Act, the Infrastructure Act, and the Green New Deal passed during the Biden administration. Bank credit will grow rapidly as companies accept government subsidies and obtain loans. For those who are good at stock picking, consider investing in public companies that produce products needed by the government.

Eventually, the Fed may ease policy and exempt at least Treasury bonds and central bank reserves from the SLR (supplementary leverage ratio). At that time, the road to unlimited quantitative easing will be clear.

The combination of legislatively driven industrial policy and the SLR exemption will trigger a surge in bank credit. I have already shown that the velocity of money flowing from such a policy is much higher than the Fed’s traditional rich-only quantitative easing approach. As a result, we can expect Bitcoin and cryptocurrencies to perform at least as well as they did between March 2020 and November 2021, and possibly better. The real question is, how much credit will be created?

The COVID stimulus injected about $4 trillion in credit. This time it will be even bigger. Defense and health care spending have already been growing faster than nominal GDP. They will continue to grow rapidly as the US increases defense spending to cope with a multipolar geopolitical environment. By 2030, the proportion of people over 65 in the total US population will peak, which means that health care spending will accelerate between now and 2030. No politician dares to cut defense and health care spending or they will be quickly voted out. All this means that the Treasury will continue to inject debt into the market just to keep the lights on. I have shown before that the combination of quantitative easing and Treasury borrowing has a money velocity above 1. This deficit spending will increase the nominal growth potential of the US.

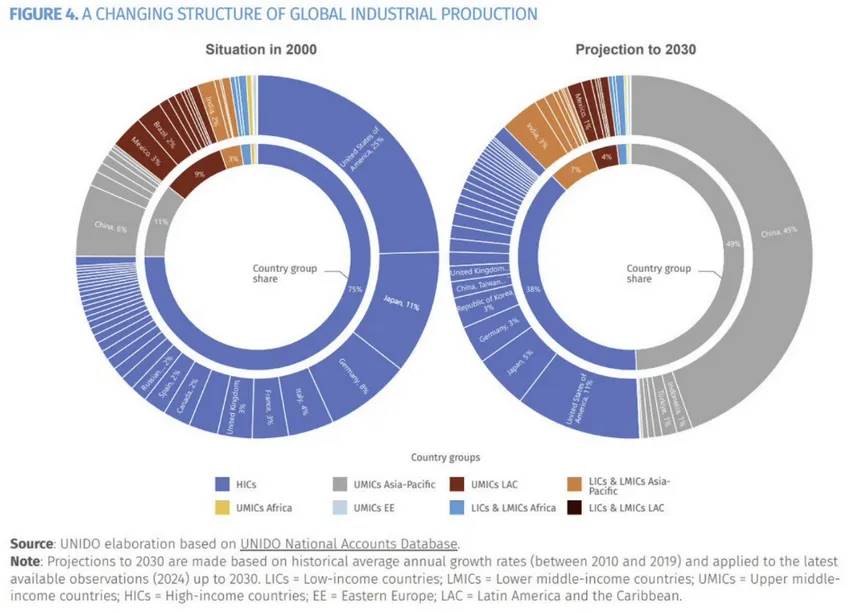

In the push to reshoring American companies, the cost of achieving this goal will be in the trillions of dollars. Since the United States allowed China to join the World Trade Organization in 2001, the United States has actively moved its manufacturing base to China. In less than three decades, China has become the global manufacturing center, producing high-quality products at the lowest cost. Even companies that plan to diversify their supply chains to supposedly lower-cost countries outside of China have found the deep integration of many suppliers on Chinas east coast to be very efficient. Even if labor costs are lower in countries such as Vietnam, these companies still need to import intermediate products from China to complete production. Therefore, reshoring supply chains back to the United States will be a difficult task and, if it is politically necessary, it will be very costly. I am referring to the need to provide trillions of dollars of cheap bank financing to shift production capacity from China to the United States.

It cost $4 trillion to reduce the debt to nominal GDP ratio from 132% to 115%. Assuming the US reduces this ratio further to 70% in September 2008, then according to linear extrapolation, $10.5 trillion of credit needs to be created to achieve this deleveraging. This is why the price of Bitcoin may reach $1 million, because prices are determined at the margin. As the circulating supply of Bitcoin decreases, a large number of fiat currencies around the world will compete for safe haven assets, not only in the United States, but also in China, Japan and Western Europe. Buy and hold for the long term. If you are skeptical of my analysis of the effects of poor peoples quantitative easing, just look at the history of Chinas economic development over the past three decades and you will understand why I call the new Pax Americana economic system American capitalism with Chinese characteristics.

This article is sourced from the internet: Arthur Hayes: The new model of quantitative easing under Trumpnomics and Bitcoins road to millions of dollars

Related: 7 Bitcoin valuation models: from $500,000 to $24 million

Original author: starzq (X: @starzqeth ) Are you willing to hold Bitcoin for 4 years to $500,000? It has increased 90 times in the past 10 years. Where will it go in the next 10 or even 20 years? The price of Bitcoin has recently reached $69,000 again. With the continuous release of crypto-positive factors in the US election and the loosening of the US economy, it has become a consensus among more and more people that the price will break through the $100,000 mark next year. https://coinmarketcap.com/currencies/比特幣/ MicroStrategy CEO Michael Saylor said in a recent interview that Bitcoin will reach 13 million US dollars in 2045, which means that the average annual increase in the next 21 years will reach 29%. As a long-term investor/hodler, I am more curious…