The U.S. presidential election, held every four years, has attracted billions of viewers globally this year. Recently, news of the debate between Trump and Harris flooded social media. The U.S. presidential election has a long-term impact on global affairs, while in the short term, it influences global stock markets and the 加密貨幣 industry. Surrounding the election, events such as Trump’s attack, the GOP and Democrats wooing crypto voters, and Zuckerberg revealing that he was once asked by the Biden administration to censor information, appear unprecedented.

One website that has been repeatedly mentioned in relation to the U.S. election is the prediction market, Polymarket.

- Polymarket has attracted close to $1 billion in bets on the outcome of the U.S. presidential election, capturing 85% of the U.S. election betting market.

- Why is it called a prediction market rather than a casino or betting platform? A “prediction market” forecasts the likelihood of future events (such as who will become the U.S. president) and is considered a tool of social cognition that can generate valuable predictions and insights. A “casino” provides entertainment with random outcomes that generally do not produce additional informational value. The most direct difference is that in a “prediction market,” participants with knowledge and insight can profit over the long term, whereas in a casino, most participants lose over time.

- Unlike previous prediction markets that were usually confined to small circles, Polymarket’s U.S. presidential election data has been recognized and used by mainstream media, including The Wall Street Journal and Bloomberg Terminal. It has even partnered with popular AI app Perplexity.

- Polymarket is a decentralized prediction market built on the Polygon blockchain, where users place bets using USDC. Its partnership with Moonpay allows fiat deposits, creating a user-friendly experience, making Polymarket one of the most mainstream Web3 applications.

Numerous analytical articles about prediction markets and Polymarket are available, so I will not elaborate here. Instead, what interests me more is Polymarket’s founder, Shayne Coplan.

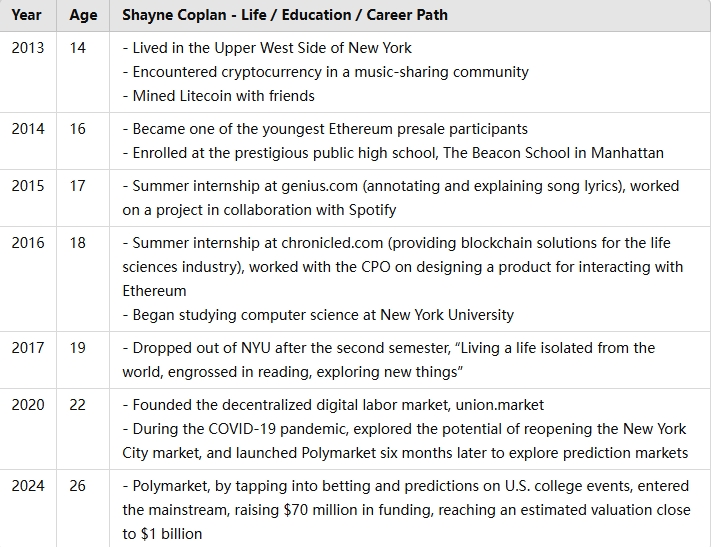

Shayne Coplan is 26 years old this year but has 12 years of experience in the crypto space:

- He first encountered cryptocurrency at age 14, mining Litecoin with friends.

- At 16, he participated in the Ethereum presale, one of the youngest participants at that time.

- He enrolled at New York University at 18 but dropped out after the second semester. Three years later, he founded Polymarket, which has since grown into the largest prediction market, even influencing the U.S. election.

As a content creator, crypto enthusiast, and father, I can’t help but wonder:

- What kind of environment did Shayne Coplan grow up in?

- What influences shaped Shayne Coplan’s development, allowing him to discover crypto at 14, participate in Ethereum’s presale at 16, and launch Polymarket at 22?

- What can we learn from his journey that could help in raising the next generation of entrepreneurs?

I researched all available interviews with Shayne Coplan to answer these questions, and here’s the resulting article. Enjoy!

Growing Up in a Well-off New York Neighborhood and Encountering Crypto through Music

Shayne Coplan grew up in the Upper West Side of New York City, a famous residential area in Manhattan. His mother is a film professor at NYU, suggesting a privileged upbringing. The area is steeped in culture, close to the Lincoln Center, Broadway, and the MoMA.

In 2013, at 14, Coplan discovered cryptocurrency while downloading music unavailable on iTunes in a file-sharing community. At that time, the most popular P2P file-sharing protocol was BitTorrent, one of the earliest peer-to-peer protocols embodying decentralization. The title of Bitcoin’s whitepaper, “Bitcoin: A Peer-to-Peer Electronic Cash System,” reflects similar principles.

P2P file-sharing and cryptocurrency communities were closely related due to the shared philosophy of decentralization and the use of anonymous cryptocurrency for transactions in the face of governmental censorship.

Interest in Assets and Participation in Ethereum Crowdfunding at 16

In addition to mining, Coplan was intrigued by the concept of “colored coins,” which provided a cheap and simple way to create provably scarce assets such as stocks and bonds. This interest naturally led him to Ethereum, which allowed building various financial applications.

In 2014, when Ethereum launched its fundraiser, Coplan had just turned 16 and participated in the presale at $0.30 per ETH. He also entered Manhattan’s renowned public high school, The Beacon School, and interned at genius.com in his sophomore year and chronicled.com the following summer.

Dropping Out of NYU to Live in Isolation, Reading and Exploring

After a promising start, Coplan’s life took a turn during his second semester at NYU, where he decided to drop out in 2017. Unlike other notable dropouts with clear entrepreneurial goals, Coplan described this period as “living a life isolated from the world, engrossed in reading and exploring new things.”

During this time, two influential works inspired him: Friedrich Hayek’s “The Use of Knowledge in Society” and Robin Hanson’s concept of “Futarchy.”

Developing His Prediction 市場, Polymarket, During COVID-19

With an interest in market mechanisms, Coplan initially launched union.market, a multi-chain stake delegation 市場. However, COVID-19 disrupted everything, and trapped at home, Coplan became skeptical of mainstream media, leading him to develop his prediction market, Polymarket, in 2020.

Polymarket raised $4 million in seed funding, led by Polychain Capital, and attracted major figures in the crypto space, such as Naval Ravikant and Balaji Srinivasan.

Lessons for Raising the Next Generation of Entrepreneurs

Reflecting on Coplan’s journey, four qualities stand out:

- Early Awareness of the World: Coplan’s interest in crypto and colored coins at 14 was rooted in his understanding of scarcity and assets.

- Curiosity: His deep curiosity led him to explore P2P communities, where he discovered crypto.

- Self-learning Ability: Coplan learned to code, design products, and delve into economic theories independently.

- Independent Thinking: Instead of following trends, Coplan pursued his interests, developing Polymarket when prediction markets weren’t mainstream.

Coplan’s journey as a “global super-individual” provides inspiration and lessons for future generations.

好的

漂亮