原作者:錢德勒,前瞻新聞

The countdown to the 2024 US presidential election has begun.

根據 數據 from NBC News, as of 2:00 a.m. local time on October 30, more than 50 million voters across the United States have cast early votes for the 2024 presidential election.

As the election campaign heats up, voters are increasingly focusing on the future direction of the U.S. economy and differences in policy choices. Morgan Stanley analysts Monica Guerra and Daniel Kohen analyzed the potential impact of the 2024 U.S. presidential election on the market in a recent report, pointing out that economic signals are mixed and investor uncertainty is increasing.

Fluctuating consumer sentiment and persistently high prices are influencing voter opinion, while traditional market indicators are unable to provide a clear prediction of the election outcome.

Economic signals remain mixed as consumer confidence fluctuates and price pressures persist, while election delays and tense situations in swing states have heightened expectations of market volatility. Differences and disagreements in the policies of the two parties will undoubtedly become key points of discussion in this context.

根據一個 new Fairleigh Dickinson University poll cited by Coindesk, 加密貨幣currency holders said they are more likely to vote for Trump than for Vice President Harris. Half of cryptocurrency holders said they plan to vote for Trump, while only 38% of cryptocurrency holders prefer Harris.

Among non-crypto holders, Harris leads by 12 points: 53% of non-crypto voters say they will vote for Harris, while 41% plan to vote for Trump.

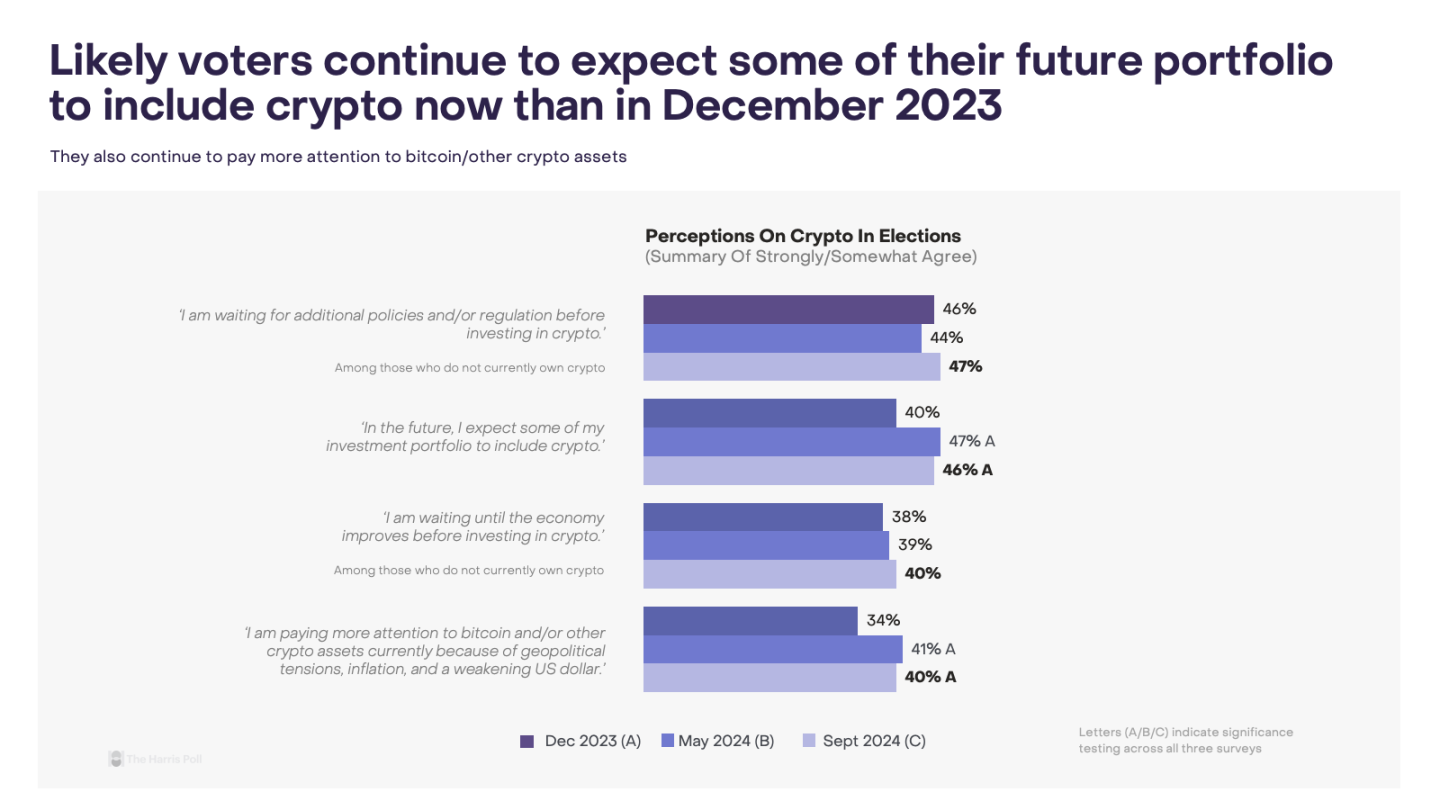

Grayscales mid-year poll report shows that voters have paid more attention to Bitcoin in the past six months due to geopolitical tensions, inflation and dollar risks. Due to macro dynamics and Bitcoins own maturity, nearly half of voters (47%) increasingly expect some of their portfolios to include cryptocurrencies (this proportion was 40% at the end of last year).

As in the first phase of polls this year, respondents ranked inflation as their top issue in the election (28%), again highlighting the potential value of assets with a transparent and strict supply, such as Bitcoin.

In this U.S. presidential election cycle, the crypto industry’s political influence is reflected not only in the expansion of its voter base, but also in its growing weight in political donations.

Data shows that as of July 2024, the crypto political action committee (super PAC) Fairshake has raised more than $200 million, becoming one of the largest super PACs, raising more than $25 million in June alone. In August, Fairshake announced that it would spend $25 million on a television advertising campaign to support 18 House of Representatives candidates from both parties.

In addition, according to data released to the public by the Federal Election Commission on Sunday, Crypto Political Action Committee PAC Fairshake allocated nearly $29 million in September, making it one of the organizations with the highest spending among all industries in this election cycle. $15 million of that was donated to the Defend American Jobs PAC, which focuses on cryptocurrency and blockchain policies and supports the Republican Party; $5 million was donated to the Protect Progress PAC, which only supports the Democratic Party.

Fairshake has also donated more than $1.9 million to Rep. Patrick Ryan (D-NY), more than $1.7 million to Rep. Steven Horsford (D-NV), and nearly $1 million to Rep. Angela Dawn Craig (D-MN). The remainder of the money has gone to candidates in Illinois, Colorado, Oregon, Iowa and Arkansas.

In this context, crypto assets, as an emerging financial and technological force, are entering the political agenda of both parties in an unignorable manner, becoming one of the key factors affecting the policy statements of candidates. However, the Democratic and Republican parties show distinct differences in policy priorities, regulatory directions, and tolerance for innovation, which is also one of the important reasons why this round of elections affects the future development of the crypto industry.

The Democratic Party’s crypto stance and policy orientation: prudent regulation

During the Democratic administration under Biden, the United States regulatory stance on the crypto industry was mainly cautious, aiming to improve regulations and maintain market order. In March 2022, Biden signed the Executive Order on Ensuring Responsible Innovation in Digital Assets, marking the first time the U.S. government formally proposed a strategic framework for the cryptocurrency industry.

The order directed federal agencies to conduct a comprehensive review of the potential risks and regulatory needs of digital assets, and in September 2022, released a detailed digital asset development framework that further clarified the regulatory direction.

This cautious attitude was also deeply influenced by the chain reaction caused by the last bear market and the collapse of FTX. The 2023 Presidential Economic Report, released in March 2023, made a severe assessment of the value and risks of crypto assets, pointing out that crypto assets are too risky to be used as a payment tool or to effectively expand financial inclusion, and warned that such assets may bring continued risks to financial markets, investors and consumers.

Subsequently, the U.S. Securities and 交換 Commission (SEC) and the Commodity Futures Trading Commission (CFTC) launched strict law enforcement against crypto companies such as Binance, Kraken and Coinbase, reflecting the Biden administrations high attention to industry risks and strong intention to regulate market order.

In 2024, the Democratic Partys regulatory stance on the crypto industry gradually changed. The Democratic Partys stance on cryptocurrencies is no longer unified, and the strict regulatory approach promoted by radicals such as Senator Elizabeth Warren no longer has full support. Some Democratic lawmakers gradually tend to be more pragmatic and pay attention to the negative impact of limited innovation.

On May 16, 2024, a group of Democratic senators and Republican lawmakers jointly passed a bill to repeal SAB 121, which originally required banks that custody crypto assets to hold an equivalent amount of cash, placing a heavy burden on financial institutions. The move to overturn SAB 121 is seen as a new trend within the Democratic Party against excessive intervention by the SEC, suggesting that the crypto regulatory stance is shifting from radical to neutral.

In addition, more and more members of the Democratic Party are gradually recognizing the economic and technological value of the crypto industry, especially the appeal of cryptocurrencies among young voters.

On May 23, the SEC suddenly changed its attitude towards the spot Ethereum ETF, and this change was interpreted as a friendly signal released by the Democratic Party under the pressure of the general election. Faced with Trumps public support for the crypto industry and the support of a large number of crypto voters, the Democratic Party had to re-examine its position on crypto policy to avoid losing the support of young voters and crypto industry practitioners.

市場 signals and campaign pressure have also accelerated policy adjustments. The Democratic Party is aware that overly extreme cryptocurrency regulatory policies may lead to negative market reactions and weaken its support in key swing states.

On October 14, presidential candidate and Vice President Kamala Devi Harris proposed a new plan to provide loans to black entrepreneurs and others who face barriers to financing. According to Harris campaign outline for black male voters, the plan will provide 1 million loans with up to $20,000 forgiven. Harris also promised to support a cryptocurrency regulatory framework to provide more investment certainty for the 20% of black Americans who own or have owned digital assets.

In addition, California Governor Gavin Newsom is seen as an important supporter of the campaign team within the Democratic Party. In terms of cryptocurrency regulation, Newsom signed an executive order in May 2022 to establish a licensing framework for cryptocurrency companies in California. Although he vetoed a bill aimed at establishing a regulatory framework for cryptocurrencies in September 2022,

But in October 2023, the Digital Financial Assets Act was signed. The bill is widely regarded as a benchmark for New Yorks BitLicense system, showing that California is competing with New York in cryptocurrency regulation and striving to take the lead in this emerging industry. Among the potential Democratic candidates, Newsom may be the leader who knows the crypto industry best, which means he may have strong policy-making capabilities and is willing to work with the crypto industry to jointly develop national policies and education programs.

In general, the Democratic Partys regulatory stance on the crypto industry has gradually shifted from radical to neutral in recent years. However, overall, despite some relaxation in regulatory policies, the Democratic Party still prioritizes traditional issues such as macroeconomic stability and social equity. The crypto industry does not occupy a core position in its policy agenda and is not prominent in its policy priorities.

Republicans’ Crypto Stance and Policy Orientation: Positive Commitment

Trump has shown an extremely rare optimistic and friendly attitude towards the crypto field in this round of presidential campaign. In order to win more votes and financial support from the crypto field, Trumps campaign team announced that it would accept cryptocurrency donations and said that this move was to unite those who oppose the Biden administrations control of the U.S. financial markets.

根據 to the Wall Street Journal, Trumps campaign raised a total of $331 million in the second quarter, of which cryptocurrency donations accounted for about 1%, most of which were Bitcoin and Ethereum, worth about $3 million. Between May and the end of June, about 100 people donated cryptocurrency to Trumps campaign.

In terms of specific policy support, the Republican Party expressed support for a number of favorable encryption policy measures in its official party platform for the 2024 US election, vowing to end the illegal and un-American crackdown on the US encryption industry.

At the same time, Trump also appointed Ohio Senator JD Vance as the Republican vice presidential candidate. Vance, a former venture capitalist, has publicly supported cryptocurrencies many times and criticized the SECs regulatory model. Last month, he also drafted a draft bill on reforming the way digital assets are regulated. He disclosed in his annual report submitted last year that as of 2022, he held between $100,000 and $250,000 worth of Bitcoin through Coinbase.

Trump himself also attended the 2024 Nashville Bitcoin Conference on July 28 and delivered a speech, at the same time making it clear that if elected, he would fire the current SEC Chairman Gary Gensler and significantly reform the regulatory policy on cryptocurrencies to get rid of the current governments suppression of the crypto industry.

Trump promised to provide more electricity resources to Bitcoin miners to ensure that the United States becomes the center of global cryptocurrency. He compared the development of Bitcoin to the rise of the steel industry a hundred years ago, and believed that Bitcoin will bring huge potential and growth opportunities to the US economy, just like the steel industry.

Trump also praised the pioneers of the crypto industry, appreciating the builder spirit they embody, and emphasized that the United States should dominate the future of Bitcoin, otherwise it will be surpassed by China and other countries. In his vision, the United States will become a global superpower in Bitcoin and cryptocurrency, and American electricity and resources will support this goal.

In his speech, Trump reiterated his strong opposition to CBDC, promised to stop the CBDC project, and defend citizens right to self-custody. He believes that decentralized assets such as Bitcoin will not only not threaten the US dollar, but are an important tool for maintaining US financial sovereignty and freedom.

Trump made it clear that after returning to the White House, he would stop the current governments persecution of the crypto industry, promote a fairer and clearer regulatory framework, and provide a stable environment for the development of the crypto industry. He proposed the idea of a strategic reserve of Bitcoin to keep the Bitcoin assets held by the United States as a permanent national wealth. His commitment shows that Bitcoin and cryptocurrency are part of the revitalization of the American Dream, giving the Bitcoin community strong support and trust.

In addition, the Trump family has also begun to refresh its presence in the encryption field. Trumps eldest son Donald Trump Jr. and second son Eric Trump are deeply involved in and launched the encryption project World Liberty Financial (WLFI). Trump himself serves as the chief cryptocurrency advocate and supports the WLFI project, although he did not express specific opinions on the details of the project itself.

There are even sources who say that WLFI plans to issue its own stablecoin, which is still under development and may take some time to launch. The team is simultaneously developing the main project components of World Liberty Financial, including stablecoins, to ensure that these features are ready to launch in due time.

This round of Trump is also deeply tied to Musk. As an active advocate in the field of encryption, Musk is known for his promotion of Bitcoin payments and the use of Dogecoin (DOGE), which echoes Trumps policy inclinations. Earlier in Trumps campaign speech, he proposed the establishment of a Department of Government Efficiency (DOGE), and planned to be led by Musk to conduct a comprehensive federal government financial and performance audit to reduce improper spending.

Musk expressed his support and promised to perform his duties without compensation. The abbreviation of this organization cleverly echoes the name of Dogecoin. This pun, which involves both politics and encryption, makes the inclination of the two in the field of encryption self-evident.

The US Election and the Future of Cryptocurrency Policy

In summary, the differences between the two parties in the United States on crypto asset policies have a profound impact on the future of this industry. The Democratic Partys policy stance tends to be cautious, aiming to protect consumer rights and maintain market stability through strict supervision. Although it has gradually turned to neutrality in recent years, the Democratic Partys attention to the crypto industry is still limited, and the priority is still the overall economic and financial stability.

In contrast, the Republican Party advocates reducing regulatory restrictions and is committed to supporting innovation in the crypto industry, viewing it as a key way to enhance the competitiveness of the United States in the global financial market. Republican candidates such as Trump have tried to attract support from the crypto industry and accelerate its development in the United States by actively supporting crypto assets such as Bitcoin and promising to reform the SEC regulatory model.

This policy difference directly affects market dynamics. On the one hand, if the Democratic Party continues to implement prudent regulatory policies, it may increase the compliance costs of crypto companies and increase market entry barriers, thus potentially inhibiting industry innovation. However, this move may enhance market trust, strengthen investor protection, and have a positive effect on long-term stable development.

On the other hand, the Republicans loose policies may accelerate capital inflows, promote the United States leading position in global crypto innovation, and attract more projects to the United States. However, a more relaxed regulatory environment may also be accompanied by higher risks, leading to increased market volatility.

The future direction of cryptocurrency policy is crucial to the United States position in global financial innovation. Among the worlds major economies, the United States faces fierce competition from Europe, Asia and other regions in promoting fintech and crypto innovation. To maintain its leadership in this emerging field, the United States may need to achieve bipartisan coordination in future policies to develop a more inclusive, transparent and forward-looking policy framework.

At the same time, by coordinating the relationship between various regulatory agencies and industry organizations, the United States can strike a balance between ensuring innovation and managing risks and promote the healthy development of financial innovation.

This article is sourced from the internet: Countdown to the US election: Crypto stances and policy orientations of both parties

原作者:Frank,PANews 自空投以來,ZKsync 就一直受到壞消息的困擾。生態數據迅速下滑,代幣價格也一路下跌,從上線後的$0.29跌至$0.08,跌幅達72.8%。不僅如此,據報道還有16%員工被解僱。不過,自9月以來,ZKsync的新動態不斷被報道,例如向Solana聘請首席行銷長、推出鏈上治理系統、歡迎Treasure DAO遷移等。 ZKsync 似乎正在經歷復興。 PANews對ZKsync近期的發展狀況進行了全面分析,看看這個曾經紅極一時的明星L2是否即將迎來復興?從擴大朋友圈開始ZKsync的改變…