原文翻譯:TechFlow

重點總結:

-

Recently, a large number of Web3-enabled smartphones have been released and attracted a lot of attention. These phones are divided into three categories based on their degree of Web3 integration: 1) Web3-enabled, 2) Web3-focused, and 3) Web3-native smartphones.

-

Web3 smartphones are expected to improve access to Web3 services and solve the high fees problem in the mobile market. However, there is still a focus on airdrop marketing rather than technological innovation, as well as insufficient hardware performance.

-

Traditional smartphone manufacturers like Samsung have leveraged Web3 technology for one-off promotions. However, the potential for broader Web3 integration on these devices continues to grow.

一、簡介

Web3-enabled smartphones have recently attracted a lot of attention in the industry. As the final link between users and new technologies, these devices are seen as a powerful tool to promote Web3 into the mainstream market. This report will examine the current status of Web3 smartphones and explore their future development direction.

2. Classification of Web3 Smartphone Projects

Web3 smartphone projects are differentiated based on the degree of their Web3 technology adoption. Tiger Research divides Web3 smartphones released by October 2024 into three categories: 1) Web3-enabled smartphones, 2) Web3-focused smartphones, and 3) Web3-native smartphones. These classifications are based on the degree of integration of Web3 technology.

2.1. Web3-enabled smartphones

Web3-enabled smartphones are similar in functionality to traditional smartphones, but support Web3 technology at a basic level. They are mainly equipped with Web3 wallet applications, such as Metamask and Petra, and 加密貨幣currency exchange applications. These devices introduce Web3 elements through experimental cooperation with blockchain mainnets, aiming to expand their ecosystems. In most cases, these devices have no special Web3 technology applications. Users can get a similar experience by installing Web3 applications on ordinary smartphones. As a result, these devices failed to demonstrate unique value and user interest quickly waned. A notable example is smartphone manufacturing startup Nothing, which once worked with Polygon to introduce NFT communities and Polygon-based IDs, but has recently stopped most of these services.

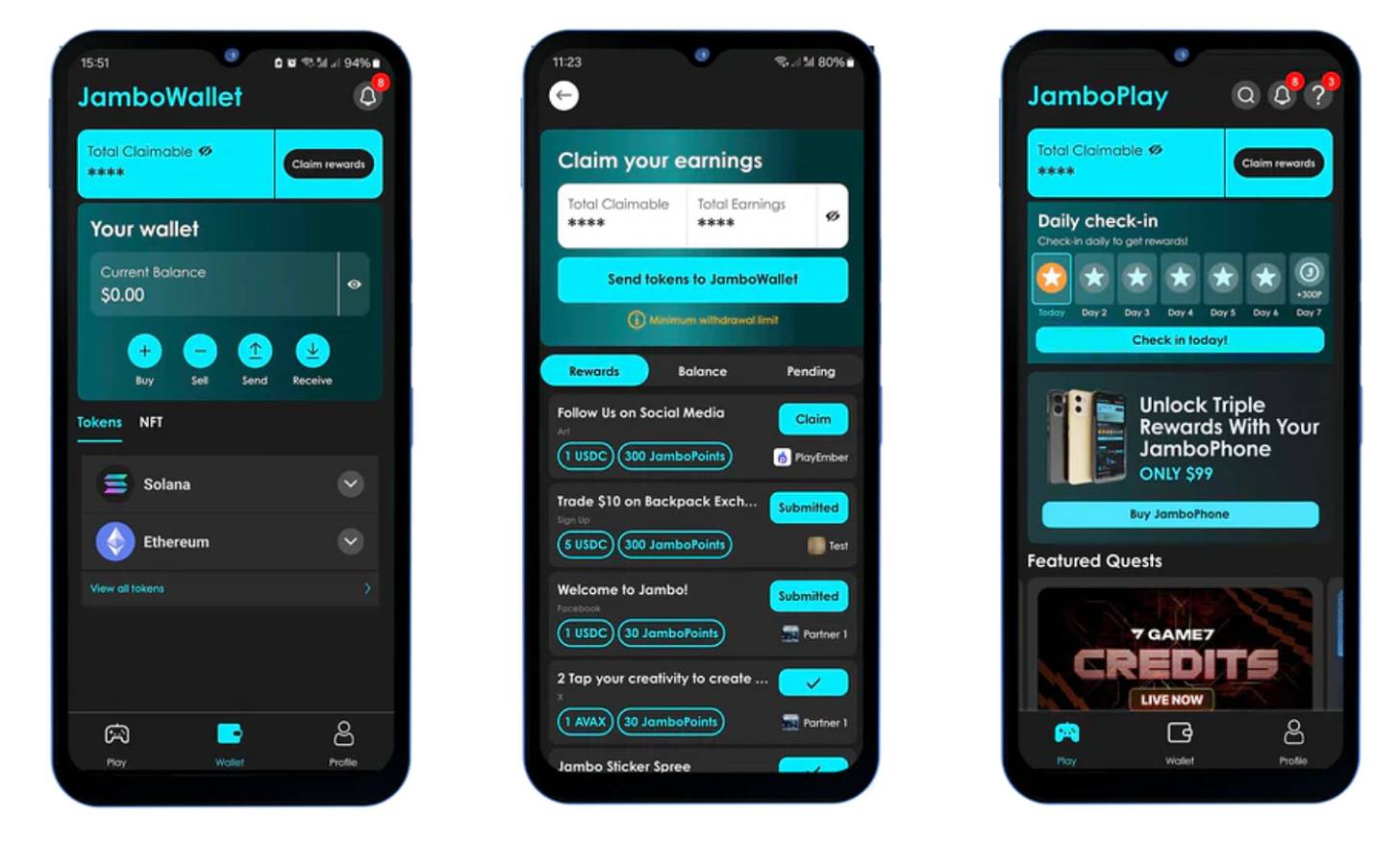

Source: Jambo Phone

Recent examples show more active adoption of Web3 features. For example, Jambo Phone offers pre-installed apps such as Web3 wallet Petra and cryptocurrency exchange OKX. It also exposes users to the Web3 ecosystem through its own app Jambo Play. The app allows users to participate in Web3 project tasks and receive cryptocurrency rewards. This approach serves as a lightweight testing platform and a model for cooperation. We expect to see more examples like this in the future.

2.2. Web3-focused smartphones

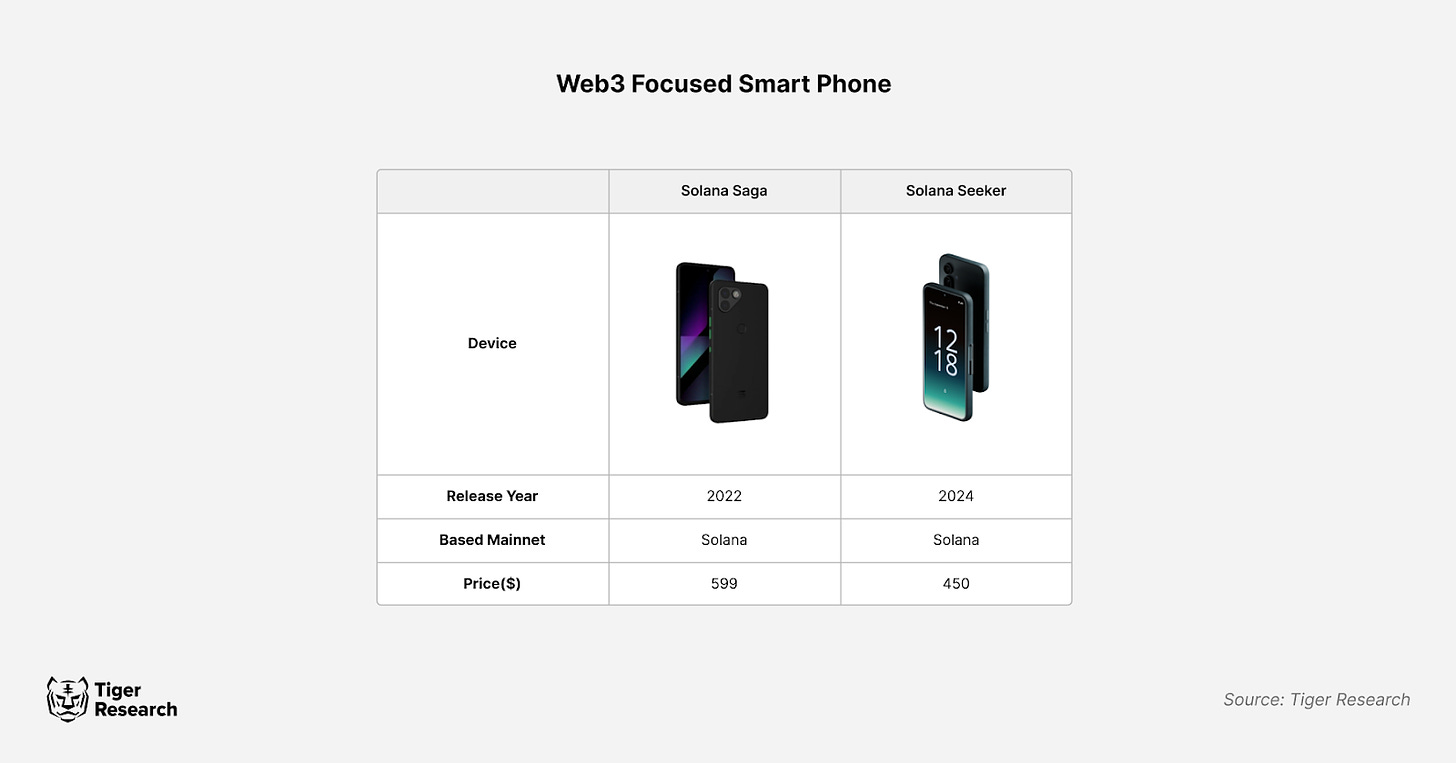

Web3-focused smartphones partially integrate Web3 technology into the device system. These phones run traditional mobile operating systems with Web3 capabilities added, providing a moderate level of integration rather than full Web3 functionality. Examples include Solana鈥檚 first-generation Saga and the recently announced second-generation Seeker.

These Web3-focused smartphones connect the traditional mobile environment with the Web3 ecosystem through a dedicated interface. Solana offers the Solana Mobile Stack (SMS) to help developers build Web3 services. The phones are equipped with Web3-optimized tools such as the Solana Pay system. The system utilizes Android鈥檚 NFC capabilities and QR codes and has a key vault for enhanced security.

Solana Seeker. Source: Solana Mobile

However, these Web3-focused smartphones are still a long way from providing a fully Web3-native experience. Users need to install a standalone Web3 wallet or use a specific browser like Brave to access Web3 services. Seeker is developed in partnership with Solflare and will have Seed Vault Wallet functionality built in. There are still many undisclosed features that could make it a truly Web3-native smartphone.

2.3. Web3 native smartphones

This can be achieved by using its own Web3 operating system, or by providing native support for core Web3 technologies such as the P2P distributed file system (IPFS), the Web3 messaging protocol (XMTP), and the blockchain-based naming system (CNS). These smartphones also have built-in light node clients, enabling users to verify transactions themselves.

ethOS Nouns version (left), dGEN 1 (right) Source: ethOS

A notable example is Freedom Factory鈥檚 ethOS. In 2023, ethOS released its first prototype smartphone with the support of NounsDAO. The device introduced an Ethereum-based Web3 operating system with full system integration. Recently, the company launched the dGEN 1 smartphone, further enhancing its Web3 native capabilities. The built-in ethOS browser supports IPFS and ENS. Its light node functionality enables users to run on-chain dApps without relying on external RPC nodes. The Web3 wallet integrated into the operating system allows users to sign transactions without switching apps or using an in-app browser. The device also offers advanced features such as SMS-based cryptocurrency transfers and the option to mint gallery images into NFTs.

Source: Up Network

Similarly, Up Mobile, developed in partnership with Movement Labs and Up Network, demonstrates a high degree of Web3 integration. Its proprietary Web3 operating system, Up OS, provides system-level integration. The device鈥檚 built-in Web3 wallet supports light node functionality and headless signing technology.

3.What are the advantages of Web3 smartphones?

Interest in Web3 smartphone projects is growing steadily, and various experiments are underway. This growth is due to the expectation that Web3 smartphones will play a key role in the large-scale application of Web3 technology while solving challenges in existing industries. The advantages of Web3 smartphones can be analyzed from the following three aspects.

First, Web3 smartphones can significantly improve the accessibility of Web3 services by leveraging the advantages of mobile devices. With built-in Web3 wallets, private key management, and dApp services, users can easily access Web3 services anytime, anywhere. This combined effect between Web3 technology and financial services is particularly noteworthy. Through these devices, users can use financial services based on crypto assets without time and location restrictions, which also makes it easier for developing countries with limited infrastructure to access financial services.

Secondly, Web3 smartphones are expected to solve long-standing problems in the mobile market. Traditional app stores currently charge fees of up to 30%. This reduces developer profits and limits market growth. Web3 smartphone projects aim to solve these problems through decentralized alternatives. For example, Solana Mobile and Up Network are developing decentralized dApp stores based on blockchain. Their goal is to create a fee-free and decentralized application ecosystem.

Finally, the combination of these two advantages is expected to bring a strong combination effect in the Web3 industry. The Web3 field has a growing demand for consumer applications, but lacks a device environment that supports daily use. Web3 smartphones are expected to overcome this limitation and promote the development of new consumer applications. Just as the shift from PCs to mobile devices led to a surge in innovative services, the rise of Web3 smartphones may trigger similar innovations. As the portability of mobile devices and various sensor functions enhance IT service applications, Web3 smartphones may bring significant disruption to the field. In particular, the fee-free dApp store environment is expected to create a more dynamic development ecosystem than the current Web 2 industry.

4. What challenges do Web3 smartphones face?

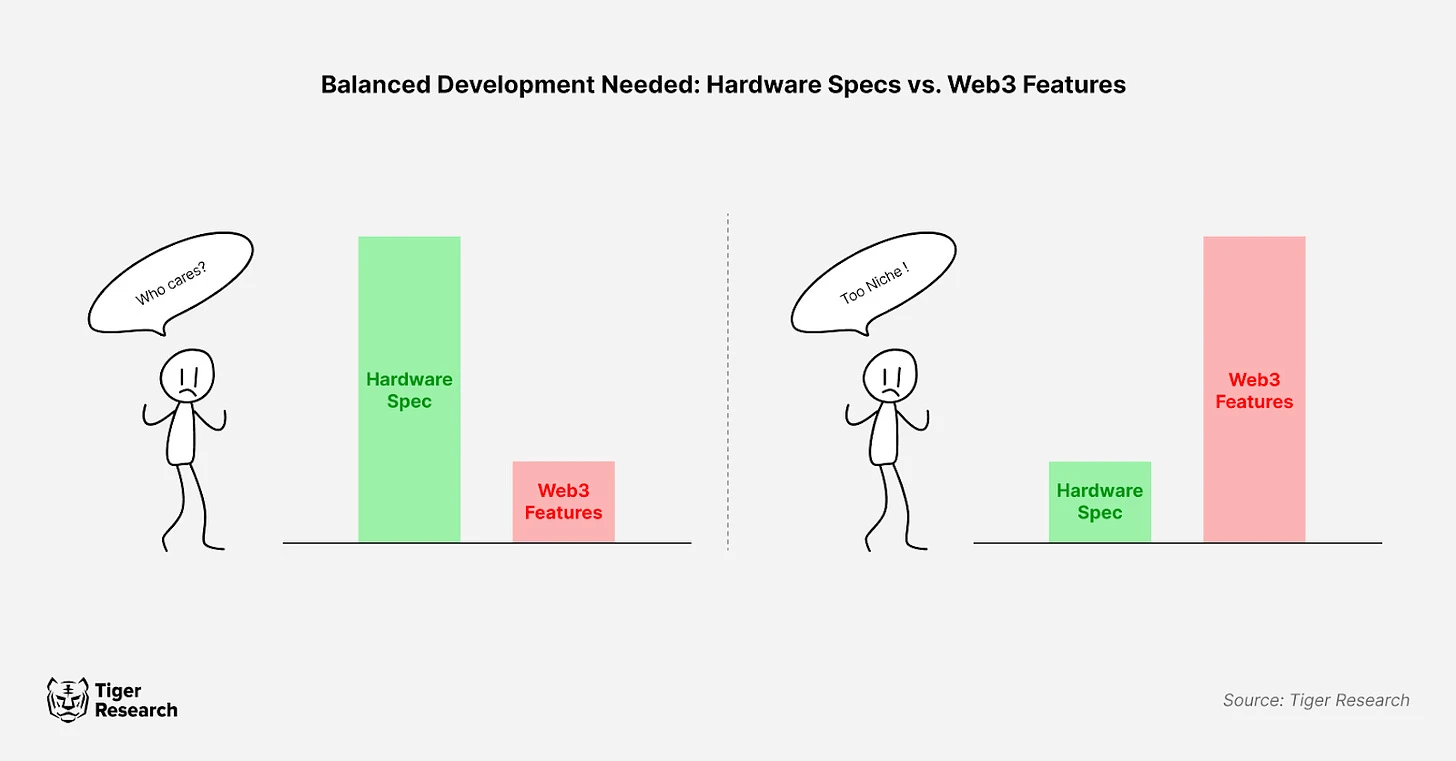

Although Web3 smartphones have great potential, there are still some challenges to overcome. First, Web3 smartphones have low hardware configurations compared to mainstream smartphones. Most Web3 smartphones perform poorly in terms of camera performance and screen refresh rate, which makes them unsuitable for the mass market. In addition, configurations that cost more than $500 appear too expensive, making it difficult for ordinary consumers to choose. The phased pre-sale system also leads to uncertainty in delivery time and reduces the accessibility of the product. Therefore, Web3 smartphones face problems in hardware competitiveness, sales, and operational improvements.

Source: Jambo Phone (left), Goosefx (right)

The second problem is that the focus on Web3 smartphones is more on rewards such as airdrops than on technological innovation. Solana鈥檚 first Web3 smartphone project, Saga, illustrates this well. Initially, Saga was forced to cut its price due to sluggish sales. When the price of the meme token $BONK that users received increased, demand surged, which caused Saga鈥檚 resale price to soar to $5,000. Pre-orders for its successor, Seeker, have now exceeded 140,000. Similarly, the Jambo Phone attracted a lot of attention by offering free Aptos-based meme token Gui Inu ($GUI). These examples show that the Web3 smartphone market is affected by speculative factors such as free tokens and resale value. This has raised concerns that Web3 smartphones may be just a short-term fad rather than a sustainable ecosystem.

Finally, Web3 smartphones face operational challenges. One concern is that the decentralized operation of Web3 smartphones may be too radical and may not fully replace the actual value provided by traditional centralized platforms. Although Google Play and Apple App Store charge fees as high as 30%, they provide important services, including preventing abuse and illegal activities, maintaining application service infrastructure such as payments, and providing customer support. The dApp experience unique to Web3 smartphones may also bring new user experience challenges. Similar to the inconvenience of pre-installed applications by manufacturers or telecommunications providers in the past, the pre-installed blockchain infrastructure and dApp configurations on Web3 smartphones may be imposed on users according to the interests of manufacturers and partners. Web3 smartphones must not only focus on technical integration, but also develop a comprehensive operational plan to address these challenges.

5. How do traditional smartphone manufacturers respond?

Galaxy S 20 Wemix Edition (left), Galaxy Note 10 Klaytn Edition, source: Samsung

Traditional smartphone manufacturers have also begun to show interest in incorporating Web3 technology into their devices. At first, most attempts were limited to one-off promotions and lacked substantial differentiation. For example, Samsung partnered with WeMade Tree (now merged with WeMade) and GroundX (former Klaytn developer) to launch a series of Web3 smartphones that came pre-installed with dApps from various mainnets. But apart from pre-installing basic wallet applications and offering cryptocurrencies, there were no significant features.

Source: Envato

However, recent practical applications of Web3 technology have shown good potential. For example, Circle announced that it will launch a Tap to Pay feature. This will allow users to pay with USDC stablecoins on their iPhones using Apples NFC technology. Although the feature is not directly developed by Apple, it shows that Web3 payments can be implemented on devices such as the iPhone.

Samsung Blockchain Wallet. Source: Samsung

Samsung has supported the integration of external Web3 wallets such as MetaMask and Coinbase Wallet through its Blockchain Keystore since 2019. It also continues to support blockchain wallet applications in its latest models. Recently, Samsung partnered with the South Korean Ministry of the Interior and Security to launch a blockchain-based mobile ID card that can be used in Samsung Pay. The potential adoption of Web3 technology by leading smartphone manufacturers may herald a new breakthrough for Web3 in the mainstream market.

六、結論

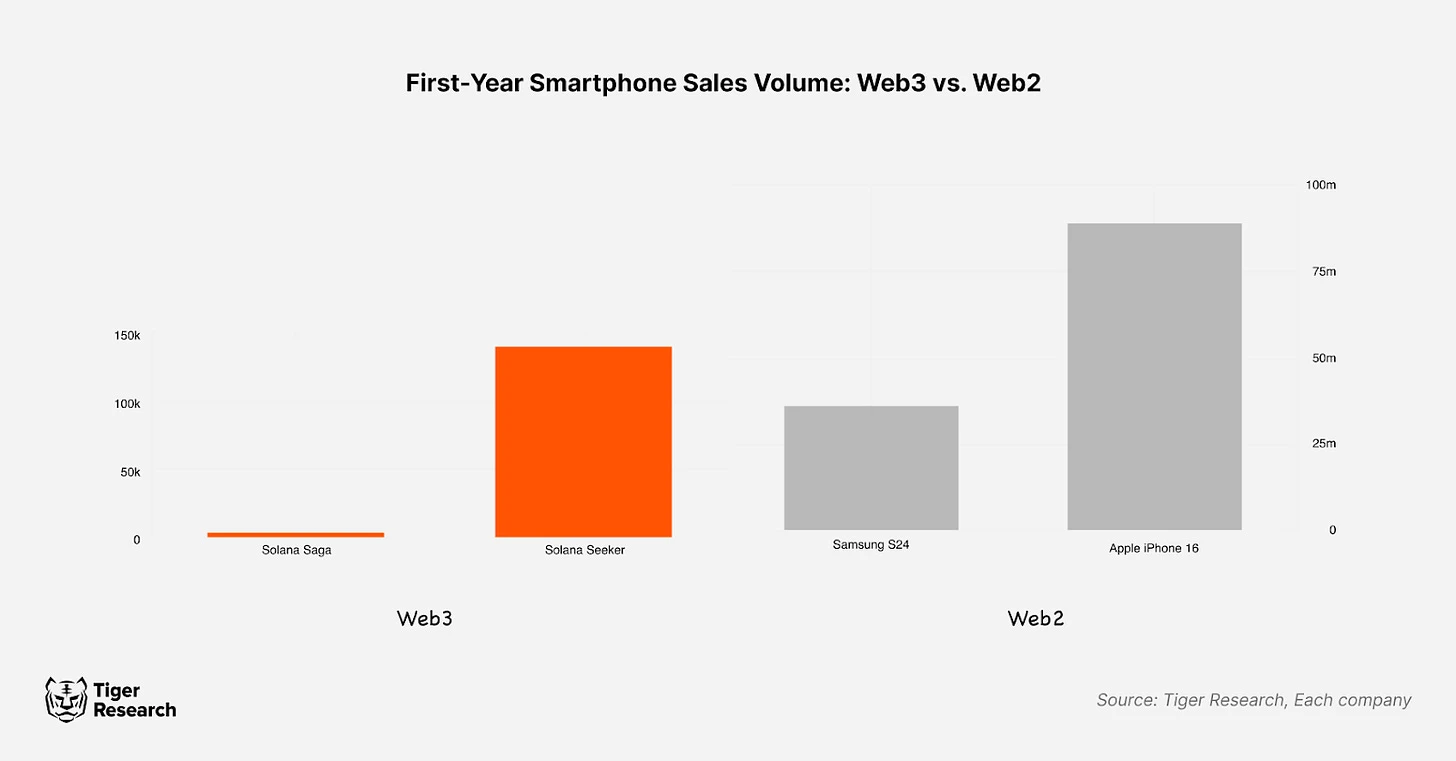

Web3 smartphones are a disruptive concept, but the market is still in its infancy. Some projects have attracted attention by offering token rewards, but the scale is still small compared to the shipments of traditional smartphones. There are 6.4 billion smartphone users worldwide, accounting for 76% of the total population, while there are only 10 million Web3 users, accounting for only 0.156%. Since the Web3 industry itself has not yet been widely popularized, the Web3 smartphone market is even more limited.

In addition, Web3 smartphones have obvious technical limitations. Compared with traditional smartphone manufacturers, their hardware performance and production capabilities are far behind. Therefore, Web3 smartphone projects may seek to establish long-term partnerships with mature mobile phone manufacturers. By leveraging the advantages of traditional manufacturers in operating systems and software interfaces, Web3 projects can supplement their hardware expertise, similar to Androids partnership with Samsung. Although there are still challenges in building a user-friendly dApp ecosystem, the combination of traditional manufacturers hardware strengths and Web3 projects software expertise may accelerate the development of Web3 smartphones.

Take a deep dive into Asia鈥檚 Web3 market with Tiger Research. Join over 4,000 pioneers and gain exclusive market insights.

This article is sourced from the internet: Current status of Web3 mobile phone market: excessive airdrop marketing and lack of technological innovation

Related: In-depth analysis of global RWA tokenization: redefining investment and ownership

Original author: Kalp Original translation: Vernacular Blockchain This article will explore the vibrant world of real-world asset (RWA) tokenization. Learn how blockchain technology is transforming the financial industry by converting physical assets such as real estate and gold into digital tokens. Dive into conversations with key industry figures, grasp emerging trends, and learn how local innovations like KALP tokenization are making waves. The blog provides in-depth insights into major players and future trends, and comprehensively shows how tokenization redefines investment and ownership. Max and Ella are discussing a blog about the growing trend of tokenizing real-world assets (RWAs), which explains how blockchain technology is changing the way people invest in high-value assets such as real estate and commodities. The blog highlights how tokenization is breaking down barriers, the latest trends,…