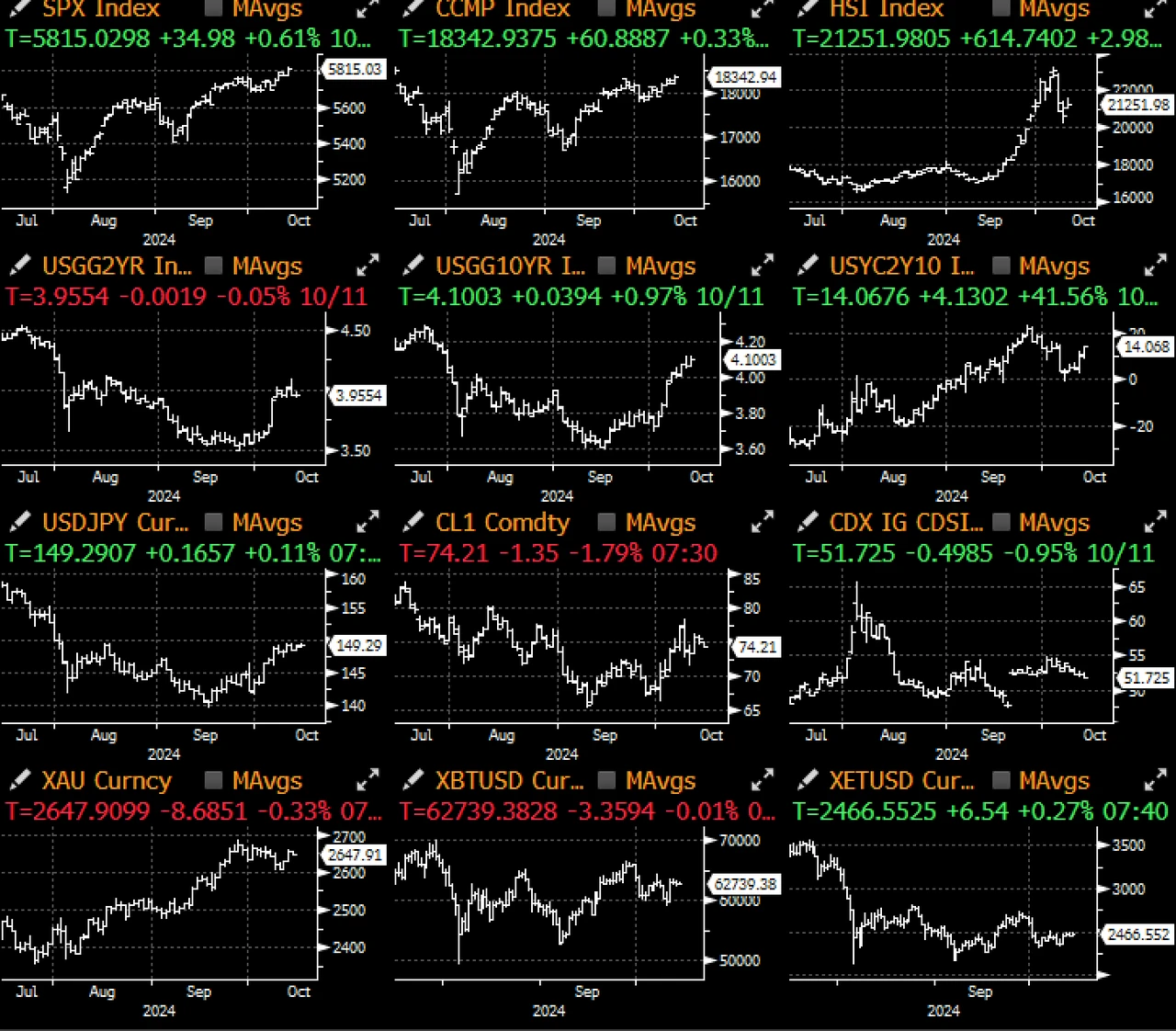

Last week, US economic data was relatively strong, with both CPI and PPI strengthening. The market was initially a bit hesitant about the impact of the data, but ultimately determined that the trend of core inflation remained unchanged, and the trend of the yield curve steepening continued. The US stock market hit a record high, high-beta stocks and foreign exchange broke further, and the market still expected a 25 basis point rate cut in December with a probability of more than 85%. Citis macro strategists expressed extreme bullishness on stocks, while Goldman Sachs has been raising its target prices for US and Chinese stocks in the past few weeks.

In China, the much-anticipated weekend Ministry of Finance press conference was mixed, with no clear mention of the specific stimulus policy size, a general lack of implementation details, and no announcement of measures to stimulate retail consumption. Although iron ore, crude oil and A shares fell in early trading on Monday, prices have rebounded strongly before the lunch break, and Chinese retail funds may still maintain strong momentum to buy on dips in the short term.

In the US stock market, JPM kicked off the third quarter earnings season with a very strong performance. The banking giants stock price rose 5% after it announced an unexpected increase in interest income and raised its revenue forecast. The overall KBW Bank Index also rose to its highest level since April 2022. It is expected that the steepening trend of the yield curve will also further drive revenue growth in the banking industry in the coming quarters.

On the crypto side, while the SPX has been hitting new highs, cryptocurrencies are doing the exact opposite, with prices still struggling to break out of a range. The U.S. stock market is doing its best to push crypto prices higher, but we still believe the road to higher prices will be long before a more exciting narrative emerges. While prices are stuck in a range for a long time, traders still prefer to sell volatility and generate gains.

With BTC prices indeed jumping above $64,000 this morning as Chinese stocks rebound from weekend disappointment, risk sentiment may remain in “buy everything” mode until things change. As we enter the final weeks of the campaign, last Friday’s strong BTC ETF inflows may be a positive sign, though patience may still be needed before prices set new highs.

您可以使用 SignalPlus 交易風向標功能 t.signalplus.com 取得更多即時加密資訊。如果您想在第一時間收到我們的更新,請關注我們的推特帳號@SignalPlusCN,或加入我們的微信群(新增助手微信:SignalPlus 123)、Telegram 群和 Discord 社區,與更多朋友交流互動。

SignalPlus 官方網站: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis Special Edition: Record #45

相關:深入分析wBTC、Ordinals和Runes的發展現狀

原作者:xparadigms wowitsjun_ (hashed_official) 原文翻譯:TechFlow * 這是探索目前擴展比特幣生態系統解決方案的四部分系列中的第三部分。在整個加密貨幣市場中,比特幣擁有最有價值的品牌和資產,而且其資產類別並不限於其原生的BTC。比特幣不僅可以打包發送到其他區塊鏈使用,還包括Ordinals、Rune協議等比特幣記名資產。此外,比特幣還擁有不斷擴大的NFT市場,該市場是透過Ordinals協議發行的。在這篇評論文章中,我們將探討比特幣生態系統中的資產類別以及每種資產的表現。 1. 背景 – 橋接 BTC 和比特幣代幣協議 1.1 橋接 BTC 截至 2024 年,比特幣仍然是最大的加密貨幣…