Key Metrics: (September 30, 4pm Hong Kong time -> October 7, 4pm Hong Kong time):

-

BTC/USD price is flat ($63,500 -> $63,500), ETH/USD is down 4.6% ($2,600 -> $2,480)

-

BTC/USD December (end of year) ATM volatility decreased by 0.7 v (56.8 -> 56.1), and risk reversal volatility decreased by 0.4 v (2.7 -> 2.3) on December 25

現貨技術指標概覽

-

In the long term, the flag resistance at the top is too strong to break through – this remains our basic judgment on market trends before the US election next month.

-

BTC鈥檚 rebound in the $65-66k range was blocked, and the escalating geopolitical situation caused the price to briefly fall below the previous $60-61k range support, but strong support near $60k stabilized the price.

-

We believe that the short-term support level of $60.5-60k should be able to hold temporarily, while the upside may be limited around $65k. Overall, the market may enter a consolidation phase, waiting for the election results as a new catalyst to clarify the direction.

市場 Events

-

The enthusiasm for China鈥檚 stimulus has faded somewhat, and the focus has shifted to the escalating geopolitical situation in the Middle East. After an Iranian missile attack on Israel (which appears to have caused more damage than Israel admitted), Israel has vowed to retaliate, although the specific form of retaliation is still unclear. The United States seems to be trying to persuade Israel to ease the situation to prevent escalation. The tense geopolitical situation has put pressure on cryptocurrency prices, with BTC/USD falling below $60k and ETH/USD falling below $2400 – cryptocurrency prices have recently been highly correlated with US stock movements (not showing any safe-haven characteristics.)

-

The US employment data exceeded expectations significantly, with the unemployment rate falling back to 4.05% and 100,000 more new jobs than expected! This boosted US stock prices and the exchange rate of the US dollar against fiat currencies last Friday, but cryptocurrencies rose due to factors related to the stock market, outperforming the impact of the US dollar and US interest rates. This shows that the stock market Beta effect is more significant, outweighing the impact of the US dollar and US interest rates.

-

US jobs data came in much better than expected, with the unemployment rate falling back to 4.05% and new jobs coming in 100k more than expected! This boosted US stock prices on Friday, while the dollar strengthened against fiat currencies. Cryptocurrencies also rallied after the release of this data, but their gains were mainly driven by the beta of the stock market, rather than the beta of the dollar against US interest rates.

-

Vance performed well in the vice presidential debate, bringing the election polls back to a 50/50 situation. Given that Vance brings more mid-term credibility to the Trump camp and supports cryptocurrencies, this will increase the possibility of a favorable election (Trump was previously lagging behind Harris in the polls, and the market was more conservative in its expectations)

ATM 隱含波動率:

-

Affected by the geopolitical situation, BTC/USD spot was liquidated and the price briefly fell below $60k, and realized volatility rebounded from very low levels. Despite this, high-frequency and fixed-term realized volatility is still only at 40-45 (up from 35 last week), while daily volatility is around 45-49.

-

With spot prices stabilizing at $60k and recovering from the US stock market rally last Friday, implied volatility fell sharply over the weekend to a new low in the recent cycle. Due to low realized volatility and lack of demand, the market is very cautious about holding positions. Realized volatility was extremely low (

-

Unless the situation in the Middle East escalates again or there is a significant anomaly in the CPI data, we continue to expect Gamma performance to remain sluggish this week (the front end of implied volatility will be under pressure).

-

Markets removed risk premiums from the implied volatility curve ahead of the weekend, causing volatility pricing for the election to fall again. With the election now just four weeks away and election odds at 50/50, market attention will soon turn to the election as the next catalyst. Event pricing is expected to rise as we get closer to Election Day.

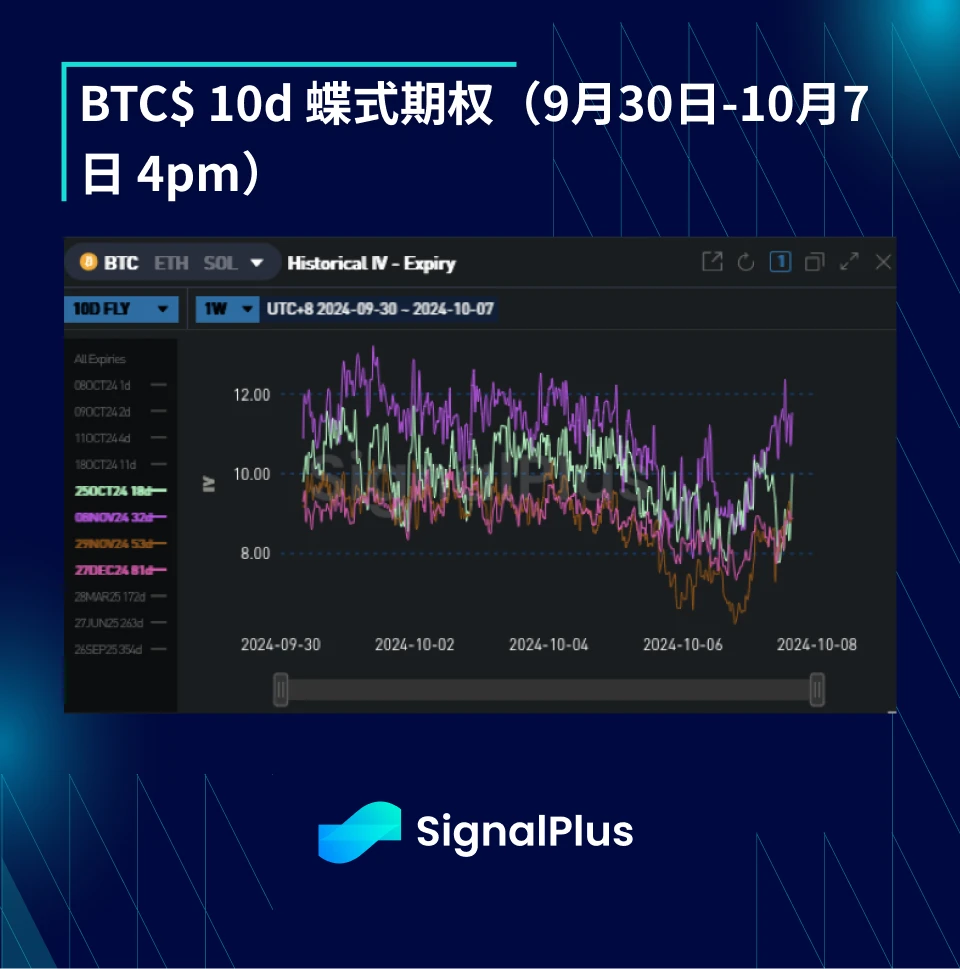

偏度/凸度:

-

This week, the skew price has retreated, and there is a large supply of December call options in the market (proportional call spreads). In addition, from the perspective of realized volatility, geopolitical news has led to more severe downward fluctuations in spot prices, making the demand for put contracts in the short-term (especially October expiration and November 8 expiration) relatively strong.

-

Convexity has remained sideways this week, with some supply of ratio call spreads offset by direct demand for wing options (strikes outside the 55/70k range).

You can use the SignalPlus trading indicator function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus 官方網站:https://www.signalplus.com

This article is sourced from the internet: BTC Volatility: Week in Review September 30鈥揙ctober 7, 2024

原文來源:Filecoin Network 在近日舉行的 Filecoin 開發者高峰會(FDS)上,來自 FilOz 的 Nicola Greco 介紹了 Filecoin 去中心化雲端服務的發展願景:Filecoin Network Services(以下簡稱 FWS)。 FWS 旨在提供一個用於部署可組合雲端服務的框架,允許將新協定推出到所有產品可以相互組合的共享產品市場。資料來源:Filecoin 網路服務– 可驗證的雲端服務生態系統,作者:Nicola G (https://www.youtube.com/watch?v=Yz5-9oP9d0Q) 超越複製證明:擴展Filecoin 的功能要了解FWS,我們首先需要回顧現有服務產品如何存在於 Filecoin 網路中。核心儲存產品複製證明(PoRep)允許儲存提供者使用唯一編碼資料的證明來表明它仍然擁有特定的資料區塊。