《每週編輯精選》是Odaily星球日報的功能欄位。星球日報除了每週報道大量即時資訊外,還發布大量優質深度分析內容,但它們可能隱藏在資訊流和熱點新聞中,與你擦肩而過。

因此,每週六我們編輯部都會從近7天發布的內容中精選出一些值得花時間閱讀和收藏的優質文章,從數據分析的角度給您帶來加密世界的新啟發,行業判斷、意見輸出。

現在,請和我們一起閱讀:

投資

In the cryptocurrency space, carry trades are often expressed as borrowing stablecoins to invest in DeFi. Although the returns are high, they also come with significant risks due to volatility. Carry trades can enhance market liquidity, but they can lead to sharp fluctuations and exacerbate market instability during crises. In the crypto market, this can trigger speculative bubbles. Therefore, risk management is critical for investors and businesses using this strategy.

Innovations such as yield tokenization and decentralized liquidity are shaping the future of arbitrage trading in cryptocurrencies. However, the potential rise of anti-arbitrage mechanisms poses challenges that require the development of more resilient financial products to address.

From the users perspective, the endless Meme and Ton mini-game projects have almost swallowed up the market. This is not just a problem for any CEX, but the entire market is going through a painful period of adjustment. Meme and Ton mini-games are like lighting a box of gorgeous fireworks. User flow, incremental funds, and attention are all immediate. The accounts look good for a while, but they are also accelerating the draining of market liquidity and overdrawing users trust in exchanges and Crypto.

The exchange is not a referee; it looks at the emotional value of the community and retail investors.

Sui ecology, CZ released from prison, AI sector, modularization.

The first minute after the announcement is the highest point within 24 hours. The most stable strategy is to hold short positions for a long time after the contract goes online.

創業精神

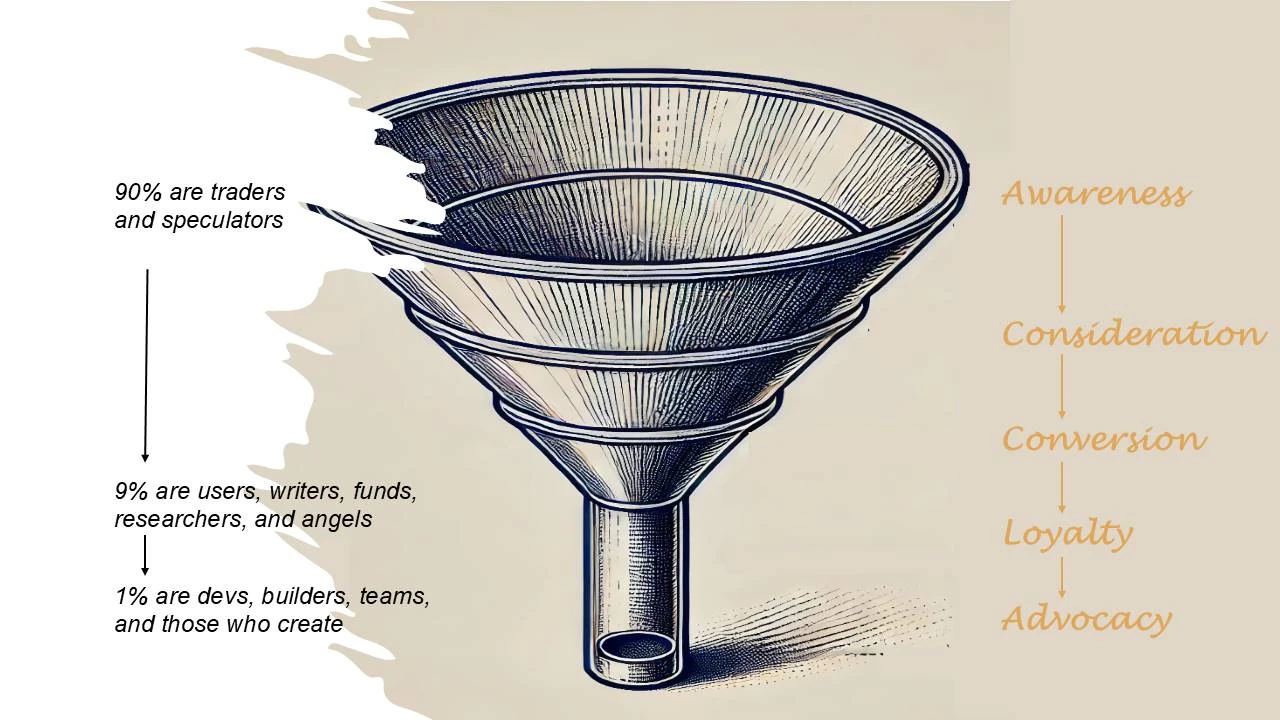

The community can be divided into three levels:

-

1% 是開發者、建構者和團隊,也是創造者。

-

9% are users, authors, funds, researchers and angel investors who are keen to observe this field and make some comments. Although they are not part of the team, they are not novices who are just passing by.

-

90% 是隨機交易者和投機者,他們通常不閱讀文件。他們關注頭條新聞,買賣加密貨幣,但不關心進行深入研究。他們並不傻,他們只是對任何投資沒有執著。對他們來說,基本面通常並不重要,他們只關注價格走勢。

A small number of high-level contributors are often more valuable than thousands of fans or critics. These core members, who are closely connected by common intrinsic values (preferably on-chain), often have a more lasting impact despite the higher upfront investment required.

直接親自參與您的社區 — 20 條恰當的私人訊息通常比向 20,000 名追蹤者發送一條推文能產生更直接的結果。雖然這種方法不易擴展,但它在建立充滿活力和健康社區的早期階段至關重要。

強大的社區不僅是豐富的招募來源,而且特別適合吸引非工程人才。如果您的專案沒有吸引社區人才,您可能需要重新考慮如何更好地將社區建設與招募工作結合。

Most consumer apps can be divided into three categories: enrichment, social, and entertainment, as well as their intersections. User onboarding and retention are two key moments for a good app, especially retention. Therefore, design for the right community from the beginning. Innovation should be reflected in the user experience, not the technology itself. Make good use of existing modules.

迷因

兩千智慧地址資料摘要以太坊Meme大贏家特色:鑽石手還是PvP |南芝製作

Characteristics of top players: super diamond hands, 40% -45% winning rate, profit and loss ratio of more than 1:5.

Prices may fall further in the short term, but as the fourth quarter approaches, PEPE is expected to have a rebound opportunity.

For investors who are optimistic about the token in the long term, the current price trend may be a good opportunity to increase holdings, and emerging Pepe products such as Pepe Unchained will also become the focus of the market. Short-term investors should remain cautious and avoid high-risk operations under the pressure of the bear market.

比特幣生態系統

洞察比特幣L2生態:側鍊和Rollups成為主流,頂級專案籌集數百萬美元

There are many Bitcoin Layer 2 projects, and even a phenomenon of inflation has appeared. The technical routes adopted by various projects are different. Well-known Bitcoin Layer 2 projects such as Stacks and Rootstock were established relatively early and have been exploring related technologies for a long time, but the projects currently lack more highlights.

As the Bitcoin basic protocol matures, projects such as Merlin, RGB++, and Babylon are making the Bitcoin ecosystem more capable of doing more, which also brings more possibilities for the development of Layer 2.

The narrowing of Layer 2 technical standards may be a trend of future development.

以太坊和擴容

Ethereum’s 10-year power transition: 3 reshuffles, “midlife crisis” and de-Vitalikization

An introduction to all the high-ranking officials in Ethereum history.

There are three catalysts for ETHs potential rebound: EigenLayers $EIGEN token is about to start trading; gas has reached its highest level in 6 months; Vitalik Buterin is active again.

了解 Puffer UniFi AVS:從預配置到以太坊的下一個十年?

Puffer UniFi AVS, as a pre-confirmation technology solution with innovative mechanism design, is the most critical step of Based Rollup+Preconfs at present:

-

對於用戶來說,Puffer UniFi AVS帶來了近乎即時的交易確認體驗,大大提升了用戶體驗,為Based Rollup的普及和廣泛採用奠定了堅實的基礎;

-

對於預確認服務商,透過鏈上登記和懲罰機制,強化獎懲機制,提高生態內的效率和可信度;

-

For L1 verification nodes, it opens up additional income channels, increases the attractiveness of participating in node verification, and further strengthens the economic incentives and legitimacy of the Ethereum mainnet.

多元生態、跨鏈

Recommended: Singapore Breakpoint Review: 43 Solana Key Project Updates .

Sui is gaining popularity. Will it become the next Solana?

On-chain data: Sui is better than Solana in 2021; Social media influence: Sui lacks a celebrity spokesperson; Grasping the trend: Solana still occupies the main market of MEME; Capital boost: The two come from the same school; 市場 performance: The market trends do have similar experiences.

也推薦: Sui sets off a meme trend, a quick article to introduce trading tools and popular tokens .

TON 亞洲發展關係總監:開發者應該在 TON 上建造什麼?

The core of TON and Telegram should always revolve around three pillars: social, payment, and finance (huge user base + seamless cross-platform functionality + powerful value transfer).

Areas to watch Promising areas include credit card cashback and gift card businesses, RWAs, Earn products, Launchpool type initiatives, or companies focused on offline QR code payment solutions.

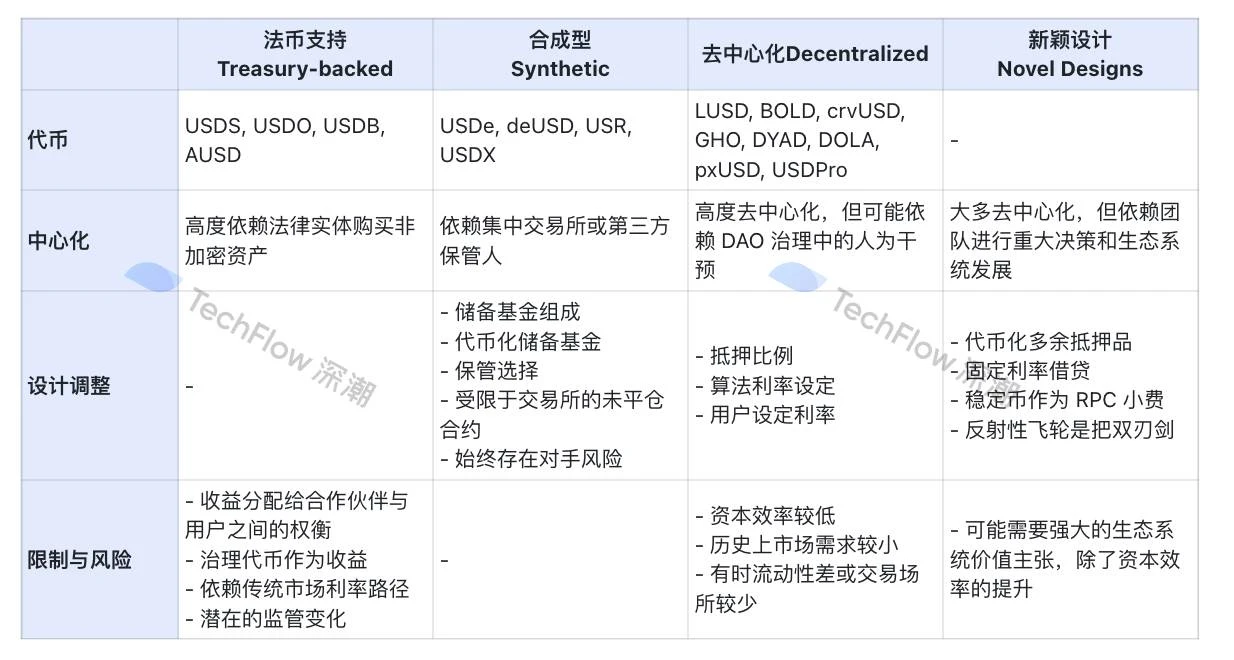

去中心化金融

DeFi Renaissance in Progress: What changes have taken place in the fundamentals of the track?

There are multiple factors that point toward a DeFi resurgence.

On one hand, we are witnessing the emergence of multiple new DeFi primitives that are more secure, scalable, and mature than they were a few years ago. DeFi has proven its resilience and established itself as one of the few sectors in crypto with real-world use cases and real adoption.

On the other hand, the current monetary environment is also supporting the revival of DeFi. This is similar to the background of the last DeFi summer, and the current DeFi indicators suggest that we may be at the starting point of a larger upward trend.

Key catalysts for AAVE to outperform other altcoins include stakers sharing protocol revenue, partnership with BlackRock, entry into Solana, leading position, and brand credibility.

Although AAVE has seen significant gains recently, its price remains undervalued.

遊戲Fi、社交Fi

Delphi Digital Report: Web3 Game Funding Declines, But Activity Remains Strong

More than 50 games were launched in 2024, including notable profitable projects such as Xai, Pixels, and Notcoin.

Shooting games are still the mainstream genre in Web3.

Among MMORPGs, the most anticipated game is MapleStory Universe.

Mobile games such as King of Destiny and Matr1x Fire have grown rapidly, attracting hundreds of thousands of users. Matr1x Fire has exceeded 3.5 million downloads.

Ronin and the TON ecosystem are at the forefront of the Web3 game.

Farcaster 名人 100 強:建立高品質的 Feed

Initially, Warpcast adopted an invitation system. Dan Romero checked Twitter private messages one by one and invited users to join. The founder manually onboarded the first 10,000 users, who were roughly divided into three categories: Coinbase, VCs such as a16z, and the Ethereum ecosystem. The freeloaders came and went, but Warpcast remained the same.

In contrast, Twitter is like public media, and Farcaster is like a circle of friends – Twitter influencers are generally encouraged to output Alpha information, project research, and industry insights, while Farcaster influencers prefer to talk about new products or ideas, life insights, and life thoughts.

本週熱門話題

In the past week, Fortune: CZ was released early , and his lawyer said he was unwilling to be interviewed immediately; Ethereum Meme reappeared a hundred dogs barking, Hippo single-handedly rescued Solana, and the zoo market hit after three years;

In addition, in terms of policies and macro markets, Biden: The Fed is expected to continue to cut interest rates ; 哈里斯 promised to make the United States dominant in the blockchain field and reiterated support for digital assets; the U.S. SEC approved BlackRocks Bitcoin spot ETF option trading ; on September 21, the RMB exchange rate against the U.S. dollar approached the 7.0 mark , and the USDT over-the-counter exchange rate fell to 6.94; the Governor of the Bank of Japan: If trend inflation rises as predicted, it is appropriate to raise interest rates ; the Japanese Financial Services Agency plans to reform crypto game regulations, which may make it easier for companies to handle in-game crypto assets; foreign media: Former Apple design director confirmed that he is developing new equipment with OpenAI , and iPhone veterans have joined;

In terms of opinions and opinions, VanEck analysts: Harris presidency may be more beneficial to Bitcoin ; Bank of America: The current market reaction to the Feds 50 bp rate cut seems to be following the script of soft rate cut or panic rate cut; US congressmen criticized Gary Gensler as the most destructive and lawless chairman in the history of the SEC; 阿瑟·海耶斯 : The accuracy rate of macroeconomic forecasts in recent years is only 25%, but crypto investments are still profitable; Vitalik: Reducing L1 slot time is worth discussing, but it needs to be done with caution to avoid damaging independent pledgers; Vitalik: The realization of the concepts of popup city and network states still requires solving governance and membership issues; Aave co-founder: There is no proposal to divest wBTC , and Sky may bear legal responsibility for forced divestiture;

Regarding institutions, large companies and leading projects, Circle CEO: IPO is being promoted and plans to move the headquarters to Wall Street next year; Binance launched pre-market trading services ; Blast launched the global deposit layer GDL, which supports deposits to any Blast address or DApp through multiple CEX and fiat currency deposit channels; 艾賽娜 plans to cooperate with Securitize to launch a new stablecoin UStb, supported by BlackRock BUIDL; 木星 is promoting the second major vote ( J4J#2 ) on the disposal of its token JUP to determine the disposal results of approximately 215 million JUP (approximately US$190 million); ether.fi Foundation: ETHFI airdrop in the third quarter is open for application; 鉛筆協議 is open for airdrop application; LayerZero: The ZRO airdrop claim period has ended , and unclaimed tokens will be redistributed; Magic Eden will launch the ME token on Solana ; Stacks Foundation: Nakamoto activation is expected to take place on October 9; 倉鼠格鬥 : 88.75% of HMSTR can be claimed on the first day, 2.3 million users were banned for cheating, and token distribution caused controversy; TERMINUS led the Mars Tide Meme coin outbreak ;

In terms of data, IntoTheBlock: USDT market value is nearly 120 billion US dollars, a record high ; Three Arrows Capital and Alameda Research need 3 years to sell all their unlocked WLD ……嗯,又是起起伏伏的一週。

隨附的 是一個入口網站 到「每週編輯精選」系列。

下次見~

This article is sourced from the internet: Weekly Editors Picks (0921-0927)

The crypto markets 85% plunge on Monday caught most people off guard. Compared with the Mentougou incident and the US and German governments selling of coins some time ago, this plunge was more sudden. There was no obvious warning signal from the news, and the market sentiment became extremely panic. The panic greed index once fell to the freezing point of 17. Fortunately, the US stock market opened on Monday night and the trend was still stable. The expected decline did not occur. The BTC daily line closed steadily above 54,000 and slowly recovered throughout Tuesday, stabilizing at 56,000. Another day has passed. As various events and clues surface more clearly, we can better review the entire decline event. This article will also sort out and interpret this market crash.…