原作者: Jason Shubnell

原文翻譯:白話區塊鏈

Analysis by Matthew Sigel and Nathan Frankovitz of VanEck suggests that the outcome of the November election could have a two-fold impact on the cryptocurrency industry.

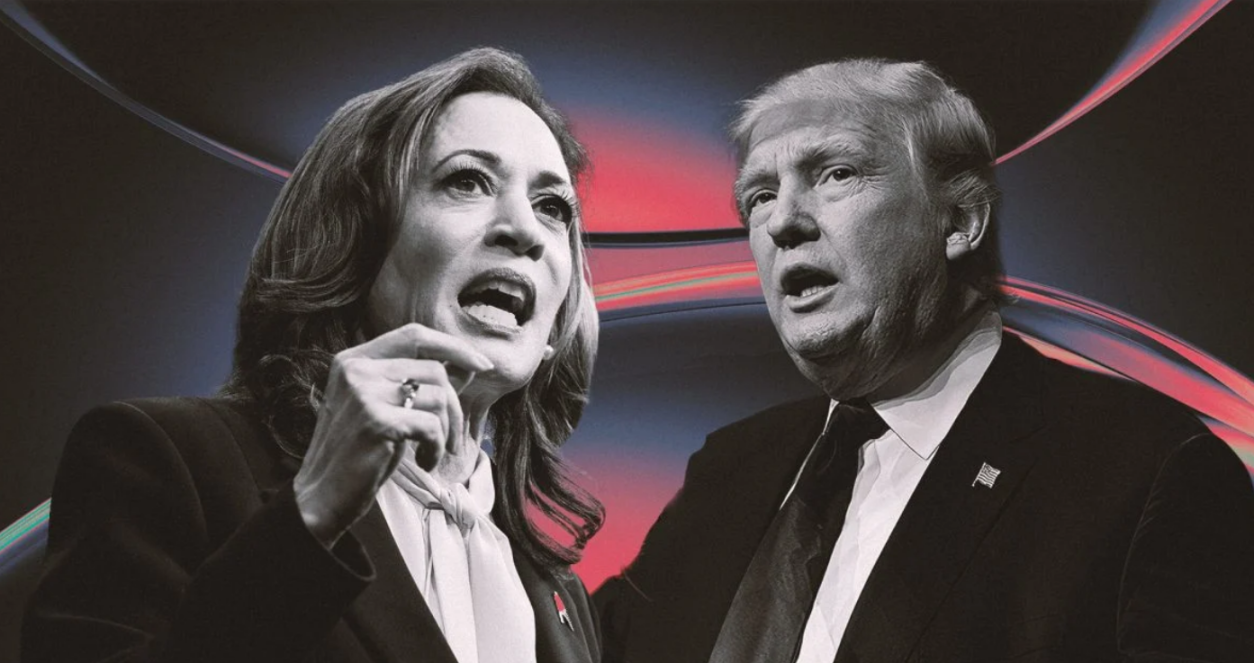

Donald Trump has been aggressive in supporting the industry this year, while Kamala Harris has been more conservative on the topic.

There has been much discussion about the impact of the cryptocurrency industry on the 2024 U.S. presidential election. Republican candidate Donald Trump even called himself the crypto president and has been supporting the industry during his campaign this year. Democratic nominee and Vice President Kamala Harris has been relatively conservative since she officially entered the race.

In terms of which election outcome is more favorable for the cryptocurrency industry, VanEck made a more invisible case.

“We believe that despite Harris and Trump’s bullish stance on Bitcoin, both have more nuanced implications for the broader digital asset market,” wrote Matthew Sigel, head of digital asset research at VanEck, and Nathan Frankovitz, digital asset investment analyst. “Both administrations are likely to maintain fiscal spending, or even accelerate it further, which could lead to further quantitative easing — especially if coupled with a worsening of anti-business policies.”

VanEck proposed a scenario in which Harris retains SEC Chairman Gary Gensler, whom Trump has said he would try to fire, and aligns her fiscal policy with the party’s Sen. Elizabeth Warren faction, which favors a more restrictive regulatory environment that could inhibit institutional adoption of digital assets.

Anthony Scaramucci, a former press secretary in Trumps first administration and founder of Paradise Bridge Capital, said earlier this week that he has teamed up with a group of cryptocurrency advocates to work with Harris campaign to try to sway Democrats away from Gensler and Warren.

“However, with respect to Bitcoin itself, we believe a Harris presidency could be more beneficial for Bitcoin, even more so than a second Trump term, as it could, in our view, accelerate many of the structural issues that are driving Bitcoin adoption in the first place,” VanEck wrote. “If this were to occur, Bitcoin’s unique regulatory clarity could make it more competitive than other digital assets.”

However, according to VanEck’s latest analysis, the entire cryptocurrency industry would benefit from a second Trump presidency. VanEck wrote: “We believe that a Trump presidency is generally positive for the entire crypto ecosystem, as it is likely to bring more deregulation and pro-business policies — especially for crypto entrepreneurs, who have been subject to increasing scrutiny from regulators over the past four years.”

However, other analysts believe that having only one candidate will be helpful for Bitcoin. Bernstein’s team predicts that if Trump wins the election, the price of Bitcoin will reach close to $80,000 to $90,000 per coin by the end of the year. On the contrary, they predict that if Harris wins the election, the price of Bitcoin will fall and test the range of $30,000 to $40,000 per coin.

“Growing fiscal deficits and rising national debt are likely to continue regardless of the election outcome,” Van Weck wrote. “This suggests the dollar is likely to weaken, which is a macroeconomic environment in which Bitcoin has historically thrived.”

According to The Block’s BTC price page, Bitcoin is trading around $63,110 at the time of publication.

This article is sourced from the internet: VanEck analyst: Harris presidency could be more favorable for Bitcoin

根據Odaily星球日報不完全統計,9月2日至9月8日,國內外共公佈區塊鏈融資事件19起,較上週數據(29起)大幅減少。揭露的融資總額約為US$4074萬,較上週數據(US$203萬)大幅下降。上週獲得投資最多的項目是Web3安全公司Hypernative($16萬); Web3電子煙Puffpaw緊追在後($6萬)。以下為具體融資事件(註:1.按公佈金額排序;2.不包括融資和MA事件;3.*表示業務涉及區塊鏈的傳統公司):Web3安全公司Hypernative完成$16百萬A輪融資由Quantstamp 領投的融資9 月3 日,Web3 安全公司Hypernative 宣布…