原作者:1912212.eth,前瞻新聞

After 4 years, the Federal Reserve finally announced its first interest rate cut of 50 basis points at this mornings meeting. After the long-dull crypto market interest rate decision was announced, it once again ushered in a significant amplitude. Bitcoin surged from $59,000 to above $62,000, Ethereum rose from $2,200 to over $2,400, and altcoins also benefited from the boost of the market and achieved good gains. SEI soared 22% to break through $0.34, and BLUR soared 17% to break through $0.2.

According to coingrass data, the entire network had a liquidation of US$199 million in the past 24 hours, of which short positions had a liquidation of US$123 million.

From the history of the last cycle, when the Federal Reserve announced its first interest rate cut in many years in September 2019, BTC was not affected by the good news in the short term. Instead, the monthly chart ended with a drop of 13.54%, from above $10,000 to around $8,300. After this rate cut, will the crypto market repeat history, or will it usher in a rising market after liquidity improves?

The Fed will continue to cut interest rates in the coming months

This rate cut far exceeded the markets general forecast of 25 basis points, directly cutting interest rates by 50 basis points. Powell emphasized at the press conference that he did not think that the sharp rate cut indicated that the US economy was approaching a recession, nor that the job market was on the verge of collapse. The rate cut was more of a preventive action aimed at maintaining the robust status quo of the economy and the labor market.

After the dust settled, the market generally expected that interest rates would continue to be cut in November and December. It is expected that there will be another 70 basis points of interest rate cuts this year. The published dot plot suggests that there will be another 50 basis points of interest rate cuts this year.

The possibility of a U.S. economic recession, which the market is generally worried about, has become smaller, and the possibility of a soft landing is increasing.

The interest rate cut will have a lasting positive effect on risky assets. Although it may not be effective immediately, as time goes by and the interest rate cut continues, the liquidity of the market will begin to flow out of bonds, banks, etc. and flow into stocks, cryptocurrencies and other markets.

In addition, the upcoming US presidential election in early November this year will also bring short-term shocks to the crypto market. After the results are officially announced, off-market funds that have been waiting and watching may begin to continuously inject into the crypto market.

The current spot market trading volume is still in a downturn, and the overall fluctuation is around US$60 billion. Apart from the short-term sudden fluctuations caused by special macro events, the market liquidity is still mediocre.

Bitcoin has increasingly become a macro asset that reflects overall economic trends. As liquidity continues to be injected into the market, the crypto market may be able to shake off the past haze.

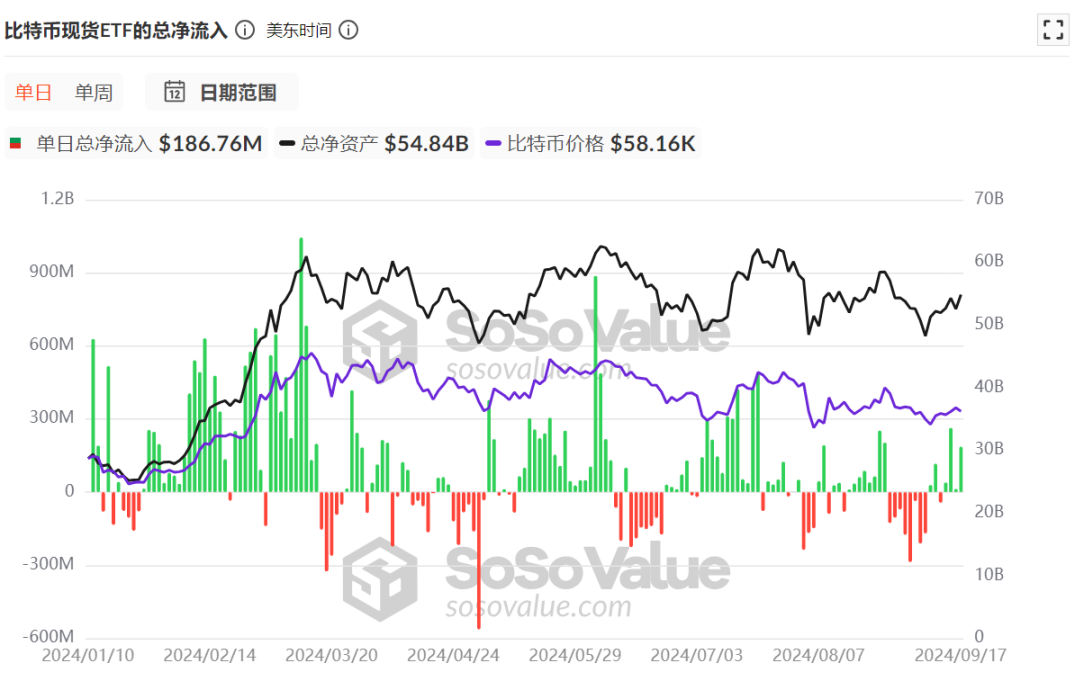

BTC spot ETFs are still seeing net inflows

As of September 17, the total net inflow of Bitcoin spot ETFs has reached 17.5 billion US dollars. The eight consecutive days of net outflows from the end of August to the beginning of September ended. Starting from September 12, Bitcoin spot ETFs achieved four consecutive days of net inflows.

When there is a continuous net inflow of BTC spot ETF, the price of Bitcoin tends to be stable and rise. However, once there is a continuous large outflow, the price of the currency tends to fall.

At present, after experiencing a long period of currency price volatility and downward trend, the confidence of off-market funds has gradually recovered and they are still buying.

The market value of stablecoins continues to rise

The total market value of USDT has increased from $117 billion to $118.7 billion in the past month, with an inflow of nearly $1.7 billion. If calculated from the total market value of $104.7 billion in April this year, during the overall consolidation and decline of the crypto market, the market value of USDT still increased strongly with an inflow of $14 billion.

The market value of another major stablecoin, USDC, rose from US$34.4 billion at the end of August to US$35.5 billion, with an inflow of US$1.1 billion in less than a month.

The total market value of fiat-backed stablecoins has also hit an all-time high and is still rising.

October is historically a strong month

The interesting thing about the crypto market is that, similar to some stocks, there are seasonal trends. For example, the market generally performs poorly in the summer, and performs well at the end and beginning of the year. Bitcoin has achieved strong positive returns in the past 9 years, except for October 2018 due to the bear market, from 2015 to 2023.

In the second half of 2023, Bitcoin has been rising since October, coupled with the expectation of approval of Bitcoin spot ETF, thus starting a bull market.

市場 View

Crypto KOL Lark Davis: 2025 will be the peak of this cycle, and you should sell in time

Lark Davis, a crypto KOL with 500,000 followers on Youtube, said in his latest video released on September 9 that 2025 will be the peak of this cycle, and you should sell and leave at that time. In response to this argument, he gave the following reasons: The global liquidity cycle is expected to peak in 2025 and then begin to decline. Chinas credit cycle is about four years per cycle, and 2025 may be the peak of Chinas credit. Currently, the yield on short-term bonds is higher than that on long-term bonds, but the yield curve is gradually returning to normal, which may indicate a shift in the economic cycle. Therefore, he believes that there may be huge market chaos in 2025, followed by a bear market.

Glassnode: The Bitcoin market is in a period of stagnation, with both supply and demand showing signs of inactivity

Glassnode, a crypto market data research organization, said in a statement that the Bitcoin market is currently experiencing a period of stagnation, with both supply and demand showing signs of inactivity. In the past two months, the actual market value of Bitcoin has peaked and stabilized at $622 billion. This shows that most of the tokens being traded are close to their original acquisition price. Since the all-time high in March, the absolute realized gains and losses have dropped significantly, which means that the overall buyer pressure has eased in the current price range.

Hyblock Capital: Bitcoin market deep exhaustion may indicate bullish Bitcoin price

Shubh Verma, co-founder and CEO of Hyblock Capital, told CoinDesk earlier: 鈥淏y analyzing the aggregate spot order book, especially the order book with a spot order book depth of 0%-1% and 1%-5%, we found that low order book liquidity often coincides with market bottoms. These low order book levels can be an early indicator of price reversals, often preceding bullish moves.

This article is sourced from the internet: The Federal Reserve announced a 50 basis point rate cut. Is the crypto market poised for a rise?

相關:23枚BAYC NFT提前兌現困難,麻吉哥4個月損失$20萬

原作者:Frank,PANews KOL @0x SunNFT 在 Twitter 上透露,他在 MEME 代幣 BAYC 上一分鐘賺了 150,000 U,這讓無數人感嘆。經過仔細研究,人們發現這可能是加密貨幣老玩家黃力成(馬吉大哥)的另一個項目。價格差異帶來的套利機會 簡而言之,@0x SunNFT 參與的專案是一個 ERC-404 協議,可以將 Bored Ape Yacht Club (BAYC) NFT 轉換為代幣。這個項目叫做APE Fi。根據專案官方介紹,1億個BAYC代幣可以兌換1個BAYC NFT。相反,持有者也可以用 NFT 兌換 1 億個 BAYC 代幣。事實上,目前 BAYC 代幣的價格維持在 $0.00030 左右,這…