Original title: How should project founders approach the Korean market?

Original author: Ash

原文翻譯:Ismay、BlockBeats

Editor’s note: The just concluded KBW conference in South Korea produced many interesting stories. Zhu Su, co-founder of Three Arrows Capital, once posted on social media, “I heard that tickets for the blockchain conference Korea Blockchain Week (KBW) are in short supply, which is a bullish signal.” Crypto KOL introduced how crypto projects can enter the Korean market from many aspects in this article, which is worth collecting.

以下為原文內容:

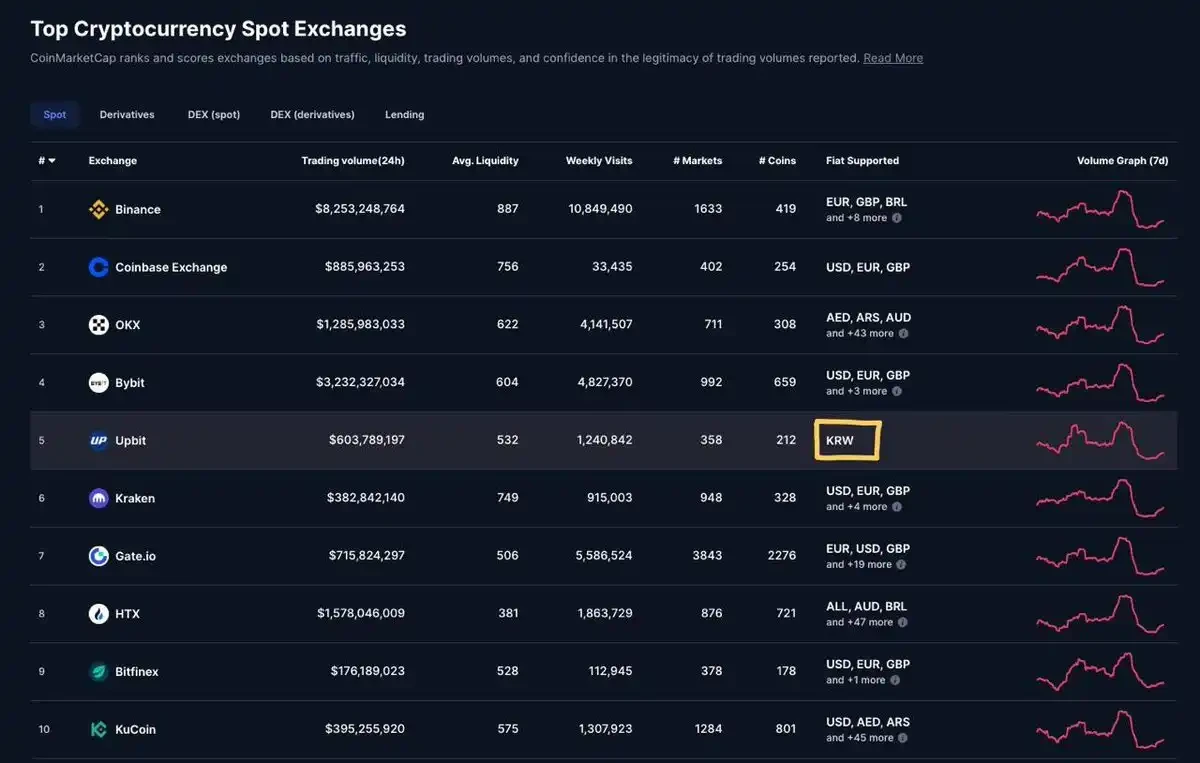

South Korea’s cryptocurrency exchanges process a staggering $2 billion in trading volume, which presents a unique opportunity for projects. I had the opportunity to speak with local stakeholders at the @kbwofficial conference this year and have summarized some key insights to help you develop your entry strategy.

Content breakdown:

• Overview of Koreas Ecosystem

• Planning marketing campaigns

• Understanding Korean retail investors

• other

Save this guide!

Overview of Koreas Ecosystem

This section covers the local ecosystem, including centralized exchanges (CEX), media, research and consulting, investment, projects, and KOLs. According to multiple sources, about 10%-15% of Koreans (6 million-9 million people) use centralized exchanges for trading!

a) Centralized Exchanges

There are three major centralized exchanges in South Korea (Upbit, BitThumb, and Coinone), of which Upbit and BitThumb account for 95% of the market share.

An interesting fact is that these exchanges are all connected to banks to support the in and out of funds:

• UpBit connects to KBank

• BitThumb connects to Nonghyup Bank

• Coinone connects to KakaoBank

The Korean Won (KRW) has the largest trading volume on every exchange, so most projects should strive to have their tokens listed in trading pairs with the Korean Won.

I found that the reasons why the trading volume of local centralized exchanges is so large are:

• Local gambling culture* and strong purchasing power of Korean retail investors

• Koreans do not like self-custody and therefore prefer to trade on centralized exchanges

• Koreans view cryptocurrencies as a speculative asset class (similar to stocks) that focuses on hype narratives rather than fundamentals (e.g. associations with big brands, e.g. Ondo with Blackrock, Doge with Elon Musk)

*After talking to some people, I would say this is the dark side of South Korea, where current economic conditions (soaring real estate market, low wages, weak stock market, and monopolistic economic structure) force people to escape poverty through high-risk gambles in the hope of becoming rich overnight.

b) Media

Due to language barriers, Korean users often rely on local publications to get the latest news and updates. In addition to @official_naver’s blog, well-known media platforms include:

@eBlockmedia

@CoinnessGL

@bloomingbit_io

@FACTBLOCK

@tokenpostkr

For non-Korean projects, it can be challenging to work directly with these media companies, which is where the next stakeholder comes in handy.

c) Research and Consulting

South Korea has a thriving research and consulting ecosystem, with many companies acting as bridges between projects and users, as well as mediating between international projects and Korean audiences.

To develop a successful Korean market entry strategy, it is essential to work with a reputable company. I have divided these companies into two main categories:

i. Consultants

• @Xangle_official

• @DeSpreadTeam

• @0x undefined_

• @INF_CryptoLab

• @Edward__Park

• @EncodingLabs

• @Whitewater_Labs

• @ 071 _labs

ii. Research

• @FourPillarsFP

• @Tiger_Research_

Having clear goals can help founders choose the right company more easily. For example:

• Want to establish connections with Korean institutions:

@Xangle_official

• Connect with Korean developers and increase research exposure:

@FourPillarsFP

• For Degen or retail users:

@DeSpreadTeam

• Keep up with local regulations:

@Tiger_Research_

d) Investment

South Korea’s capital market is small, with only a few major players, which can be divided into two categories:

i. Venture Capital Funds

• @hashed_official

• @nonceclassic

• @LECCAVentures

• @blocore_vc

• @ROKCapital

• @SamsungNext

ii. Market Makers (MMs)

• @presto_labs

• @alphanonce

• @hyperithm

*Please note that due to regulatory reasons, market makers cannot open corporate accounts on centralized exchanges in Korea.

e) Project

• DeFi:

@MitosisOrg, @keplrwallet, @Exponents_Fi

• Ecosystem:

@KaiaChain, @initiaFDN, @StoryProtocol

• game:

@delabsOfficial, @WemixNetwork, @MaplestoryU

• Validator:

@dsrvlabs, @a 41 _allforone

*I am sure I missed a lot of items, please dont blame me.

f) KOL

• @Edward__Park

• @kimyg 002

• @0x ProfessorJo

• @delucinator

Marketing campaign planning

Many projects are eager to enter the Korean market, attracted by the huge trading volume and strong purchasing power of Korean retail investors.

However, this narrow-minded way of thinking is disrespectful to Korean participants, who are not easily manipulated to provide exit liquidity. Especially after the Terra Luna/Anchor incident, Korean Degen investors are more cautious and knowledgeable.

Koreans place great value on transparent marketing and genuine intentions. Projects with charismatic but humble founders that inspire trust tend to attract large followings in Korean culture, similar to the influence of cults or religions in South Korea.

Before entering the Korean market, develop a comprehensive marketing plan to ensure:

• Have clear key performance indicators (KPIs)

• Contains executable user action items

• Provide a clear roadmap for the future (including pre- and post-TGE plans)

A simple marketing campaign can be planned like this: define clear marketing goals and set specific actions for users → work with media agencies and consulting firms to conduct SEO optimization and launch research reports translated into Korean → plan KOL promotion activities to expand influence.

In a saturated market, most traditional marketing strategies are no longer enough to stand out. Korean investors are increasingly tired of the constant stream of mission events and token/node sales. To stand out, you must be creative and offer real value, such as attractive incentives or financial gain opportunities.

Understanding Korean retail investors

Koreans are known to be trendsetters and enthusiasts for the latest hot topics, as evidenced by their active fashion scene, obsession with luxury brands, and devotion to K-Pop. This means projects must constantly update their marketing materials and present innovative and appealing narratives to maintain the interest of retail investors.

Korean users can be divided into the following three categories:

• 空投 users: executable steps are needed

• Opportunistic pickers/traders: follow narratives and buzz

• Infrastructure users (technology first): very rare, as Koreans trust third-party solutions more

Using a one-size-fits-all approach is doomed to fail, and customizing marketing campaigns to the target audience is crucial. Building trust through transparent and open communication, while using the Korean language, is key to success in the Korean market.

其他

a) Large consumer applications in South Korea

• Naver

• Coupang (e-commerce)

• Kakao (KakaoTalk, Kakao Taxi)

• Samsung Pay (Apple Pay doesn’t work in Korea for obvious reasons)

b) Korean developers are mainly from SKY or KAIST

SKY is an informal abbreviation for three of South Koreas most prestigious universities:

• Seoul National University

• Korea University

• Yonsei University

KAIST (Korea Advanced Institute of Science and Technology) is a national research university.

c) Other interesting things I learned

• Aptos and Sui are very popular in Korea.

• Many ecosystems have already started recruiting Korean heads, including Monad, Chromia, etc.

• Haven’t met anyone from Upbit or BitThumb, listings on these exchanges are very difficult and random.

• There are many e-cigarette shops on the street.

• On your next trip to South Korea: use Naver Map and KakaoMap for navigation; Uber and Kakao Taxi for travel; Catch Table for finding restaurants; Coupang Eats for food delivery, and Papago for translation.

Okay, enough of the rambling.

Summary: Map out the local ecosystem and market → Work with local consultancies → Develop localized marketing campaigns → Understand Korean retail investors → Don’t capitalize on Korea just because it has high trading volume.

This article is not written by a Korean. If there are any omissions or errors, please point them out in the comments section!

This article is sourced from the internet: The most comprehensive guide: How can crypto projects enter the Korean market?

Related: Will all applications develop towards Appchain?

Original author: Pavel Paramonov Original translation: Alex Liu, Foresight News Is everything really moving towards AppChains? Yes and no. The main reason dApps turn to building their own sovereign chains is that they think they are being exploited. This is not far from the truth, as most dApps do not make money. You can consider the recent example of @zkxprotocol ceasing operations, and many other applications in the past like @utopialabs_, @yield , @FujiFinance , and many more. But is this because their business model is bad, or are the protocols truly exploitative? The main (and often only) source of revenue for a dApp is fees. Users pay the fees because they directly benefit from them. However, users are not the only beneficiaries of the rise in dApp usage. There…