Syrupal, a decentralized options and structured financial products exchange, recently announced the successful completion of a $3.75 million seed round of financing. This financing has brought Syrupals valuation to $25 million. Investors include several top crypto traders.

Syrupal is an innovative CeDeFi platform that is committed to integrating the advantages of centralized and decentralized systems to provide users with a friendly trading experience and sufficient market liquidity. Syrupal focuses on compliance and innovation, with an efficient order book model, gas-saving on-chain settlement, and comprehensive risk management tools.

Syrupal provides options for mainstream cryptocurrencies including BTC and ETH, supports a variety of option strategies, and helps users hedge risks under different market conditions. The main product has been supported on the Arbitrum chain and will be expanded to other multi-chain environments. Apiary is an important extension on the TON Network.

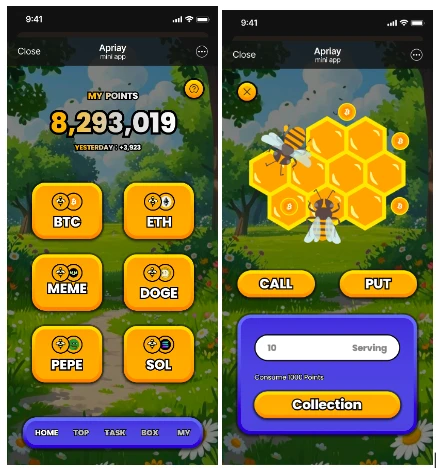

The Apiary Bot launched this time provides a new option trading method for TON ecosystem users. Users can participate in transactions through points. The platform integrates a variety of mainstream and emerging Altcoin option transactions, and innovatively introduces a dynamic option listing model. This model allows high-volatility and high-liquidity projects to be launched quickly. Users can trade through points, which enhances the flexibility of transactions and helps users seize more opportunities in market fluctuations.

The left picture is the Apiary homepage, and the right picture is the transaction page

Apiary has various ways to earn points with very low thresholds. Users can earn points by signing in daily, inviting friends, and completing transactions. Users who log in to Apiary for the first time can also get 1,000 points for free and easily start exploring options trading. This allows users to experience options trading in a zero-cost way without any financial risk, and gradually become familiar with the relevant knowledge.

Apiary aims to create a simple and easy-to-understand options trading environment for TON ecosystem users. Considering the complexity of options trading, especially the unlimited loss risk of selling options, Apiary only allows users to buy call options (CALL) and buy put options (PUT), and Syrupal plays the role of the seller. This design not only meets the risk control requirements of the options market, but also greatly simplifies the trading process, reduces the learning difficulty and psychological burden of users, and allows novice users to participate in transactions with peace of mind.

In addition, Syrupa also announced that it has reached a strategic cooperation with Werich. This cooperation will promote the seamless integration of TON and Base ecosystems, and achieve wider asset liquidity and user coverage with the help of Werichs technical strength and market resources. It is worth mentioning that Werich has also received strategic investment from Animoca Brands and Folius Ventures, which has laid a solid foundation for the interconnection of future ecosystems.

In the future, Syrupal plans to introduce more blockchain technologies, support multi-chain interoperability, and expand the types of tradable assets. By continuously enriching Apiarys functions, Syrupal is committed to creating a more diversified, convenient and efficient options trading platform, further consolidating its position in the field of decentralized finance.

This article is sourced from the internet: Options platform Syrupal completes $3.75 million seed round and launches Apiary Bot for TON ecosystem

Related: How are Rollups doing in the post-Cancun upgrade era?

Original author: NingNing (X: @0x Ning 0x ) The core upgrade of the Cancun upgrade, EIP 4844, stores the state data of L2 batch to the Ethereum mainnet in the newly added Blob space. We know that the design architecture of Rollup is actually reselling Ethereum mainnet block space to developers and consumers. There are two core business models for Rollup: Build a truly prosperous Rollup ecosystem, and then make money from the interaction between developers and consumers, L1L2 Gas price difference and sequencer MEV income. Companies that adopt this business model include: Arbitrum, Optimism (via Super Chain Ecosystem), Base, etc. Using the expectation of airdrops to continuously engage in Odyssey PUA users, and then earn money from the interaction between developers and consumers, L1L2 Gas price difference and sequencer…