Original author: Ignas, DeFi analyst

原文翻譯:Ismay、BlockBeats

Solana is transitioning from scaling a monolithic blockchain to a modular approach, a narrative currently under discussion.

Which framework will dominate?

Will the name “Network Extensions” gain acceptance in the wider crypto community? Or will Layer 2 frameworks like Ethereum win the market?

This is important because if Solana abandons the monolithic narrative, it will face an embarrassing situation similar to Ethereum in this cycle:

In this bull market, $ETH is caught between $BTC and $SOL.

BTC is a better currency for less conservative investors and institutions, while SOL is a faster, simpler and lower-cost smart contract platform with greater potential growth than ETH.

If Solana’s narrative shifts away from a monolithic model and toward using L2 for scaling (similar to Ethereum), then $SOL could become the new $ETH.

We need to see how these network extensions or L2s actually work in the Solana ecosystem.

If Solana faces liquidity fragmentation, deteriorating user experience due to cross-chain bridges, and other negative impacts similar to Ethereum L2, then SOL will be in real trouble.

In this case, Ethereum is still a safer long-term asset storage option than Solana: ETH is more decentralized and has no downtime issues.

Additionally, if speculators start chasing “network expansion” tokens as a beta test for $SOL rather than buying $SOL directly, this could suppress SOL’s price growth.

$ETH has suffered a similar beta token chase effect this cycle.

I could be wrong, but I believe the situation facing Solana’s “PR team” is not optimistic.

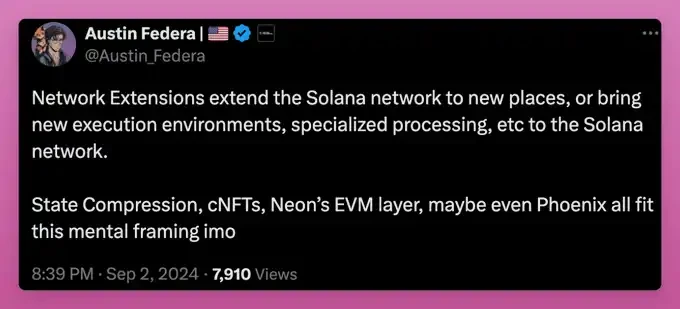

Austin himself mentioned that network expansion brings new execution environments, specialized processing, etc., which sounds more like an L2 to the average retail investor.

But I will continue to wait and see whether this network expansion approach will lead to liquidity fragmentation, deterioration of user experience, and the growth of the SOL beta chasing effect.

Finally, Solana’s shift toward a modular scaling approach gives the crypto community an opportunity for new monolithic scaling champions to emerge.

Is this the perfect time for Monad to launch, or will another Layer 1 blockchain take over Solana and take the monolithic crown?

Exciting! We are witnessing a debate over “truth” in real time. Ultimately, what the community believes to be “truth” may be more important than the facts themselves.

This article is sourced from the internet: Will Solana follow in Ethereum’s footsteps in “network expansion”?

Original author: Chandler, Foresight News In 2024, the crypto asset market experienced extremely violent and wide fluctuations, especially the price of Bitcoin, which fluctuated between $50,000 and $70,000 for a long time and lasted for several months. This fluctuation is not only frequent and unpredictable, but also does not show the trend in traditional markets, nor does it follow the typical cycles of previous bull or bear markets, forcing us to re-examine the internal logic and operating mechanism of the market. A notable feature of the current market is the obvious differentiation of investor strategies. Long-term holders and short-term traders have adopted completely different responses to this sharp fluctuation. Long-term holders usually choose to keep their positions stable during the volatility to cope with market uncertainties; while short-term traders use…