Last week, MakerDAO officially changed its name to Sky Protocol, and will upgrade its tokens and stablecoins to SKY and Sky Dollar (USDS). This move has attracted many old users to diss. In addition to complaining about the unprofessional team and the improper handling of the original X (Twitter) account, more people think that the new name has no characteristics and even lost the characteristics of Web3. It is more like a Web2 technology company and is not as impressive as MakerDAO; some KOLs bluntly stated that the team has violated the vision of decentralization.

Throughout the crypto cycle, it is common to see project name changes, mergers, or token name changes. According to incomplete statistics from BlockBeats, there have been more than 40 projects involving protocol, project, or token name changes or mergers this year alone. In addition to MakerDAO, other well-known protocols and platforms such as Galxe (now renamed Gravity), Helio Protocol (now Lista DAO), and Polygon (token name changed to POL) have also changed their names (or tokens).

Why is everyone obsessed with changing their names?

Expanding the vision to the entire industry, from the table analysis compiled by Lvdong above, we can see that the main reasons for changing the name of an agreement or project include: reintegration of resources and funds, brand positioning update, and major technology upgrades. In addition, the name change may also be affected by factors such as simplified structure, major personnel changes, easing regulatory pressure, and differentiated competition . When the market environment is not good or the project is not well received, changing the name may also become a strategy to attract market attention .

Taking MakerDAO as an example, crypto researcher Haotian pointed out that for such old DeFi projects, there are unavoidable regulatory compliance issues. Unless they stay in a corner, they must cater to regulation if they want to expand the market scale. This name change is also the first step in its change. MakerDAOs ambition is not limited to making a more decentralized stablecoin on the chain, but rather to expand its business scope and market user share.

Projects such as Solend (now Save), Mirror L2 (now Mirror Staking Protocol), and Qredo (Open Custody Protocol) changed their names to better reflect their core business directions and technical expertise, allowing users to more intuitively understand the areas that these protocols are currently focusing on.

Amber Japan (now S.BLOX) and Fantom (now Sonic Labs) involve changes in team ownership or technology and brand upgrades.

Take Fantom as an example. On August 2 this year, Fantom was officially renamed Sonic Labs. Sonic is a brand new L1 that can cross-chain to Ethereum through native L2. At the same time, Sonic has added a new Sonic Foundation, Sonic Labs and a new visual image. Andre Cronje, the founder of Fantom, is a leader in the DeFi field and was previously a member of the Fantom Foundation. But in 2022, he suddenly announced his temporary withdrawal from the DeFi industry, causing the markets confidence in Fantom to drop sharply, and the price of FTM tokens plummeted. The name change also involves personnel changes, and Andre Cronje became the Chief Technology Officer (CTO) of Sonic Labs. At present, Fantom is trying to take this opportunity to restart the market and get rid of the impact of the Multichain incident by changing its name and adjusting its organizational structure. However, whether it can lead DeFi to glory again remains to be tested by time.

Some projects have changed their names to change and expand their tracks, improving the imagination of project development. Take Galxe (now Gravity) as an example. It has transformed from the largest task platform of Web3 to a Layer 1 blockchain with a full-chain abstract design. Previously, Galxe had more than 25 million user addresses, cooperated with more than 6,000 project parties/communities, and has been launched on mainstream trading platforms such as Binance and OKX. After changing to a public chain, the original users will be retained and followed to a large extent. At present, the number of monthly active addresses of Gravity has also returned to the previous peak level. In the ecological construction of the new public chain, Gavity can rely on many years of project experience and personal connections, which will save a lot of effort in the basic DeFi project convening and seeking cooperation.

Another high-profile renaming practice this year is the token merger case of Fetch.ai (FET), SingularityNET (AGIX) and Ocean Protocol (OCEAN). The three AI-focused projects announced in June that they would establish a decentralized artificial intelligence alliance and merge their tokens FET, AGIX, and OCEAN into ASI in order to form an artificial intelligence super alliance to promote the development and application of artificial intelligence technology. With the continued support of the AI narrative craze, the three projects chose to integrate their own resources and funds to promote new projects, which is also a way to stand out.

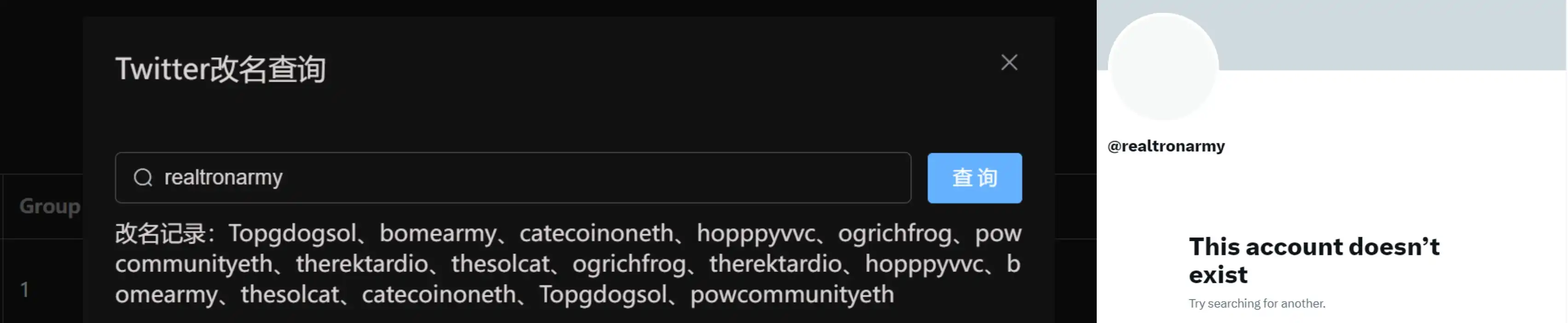

The above projects mainly initiated name changes under the premise of pursuing positive feedback such as self-construction and improving brand image . However, there are also some fraudulent projects in the crypto market that have repeatedly defrauded users funds by constantly changing their names. For example, the project @realtronarmy. Due to the recent popularity of the meme platform sun.fun, the project tried to defraud users funds by riding on the hot spots to release new coins. However, sharp-eyed netizens immediately discovered that the project had changed its name several times before and cut leeks by issuing new coins. After being exposed, the Twitter account of the project is currently shown to have been cancelled.

What is the “effect” of the name change?

By changing the brand name or creating a new token symbol, the token can start over with a new price curve.

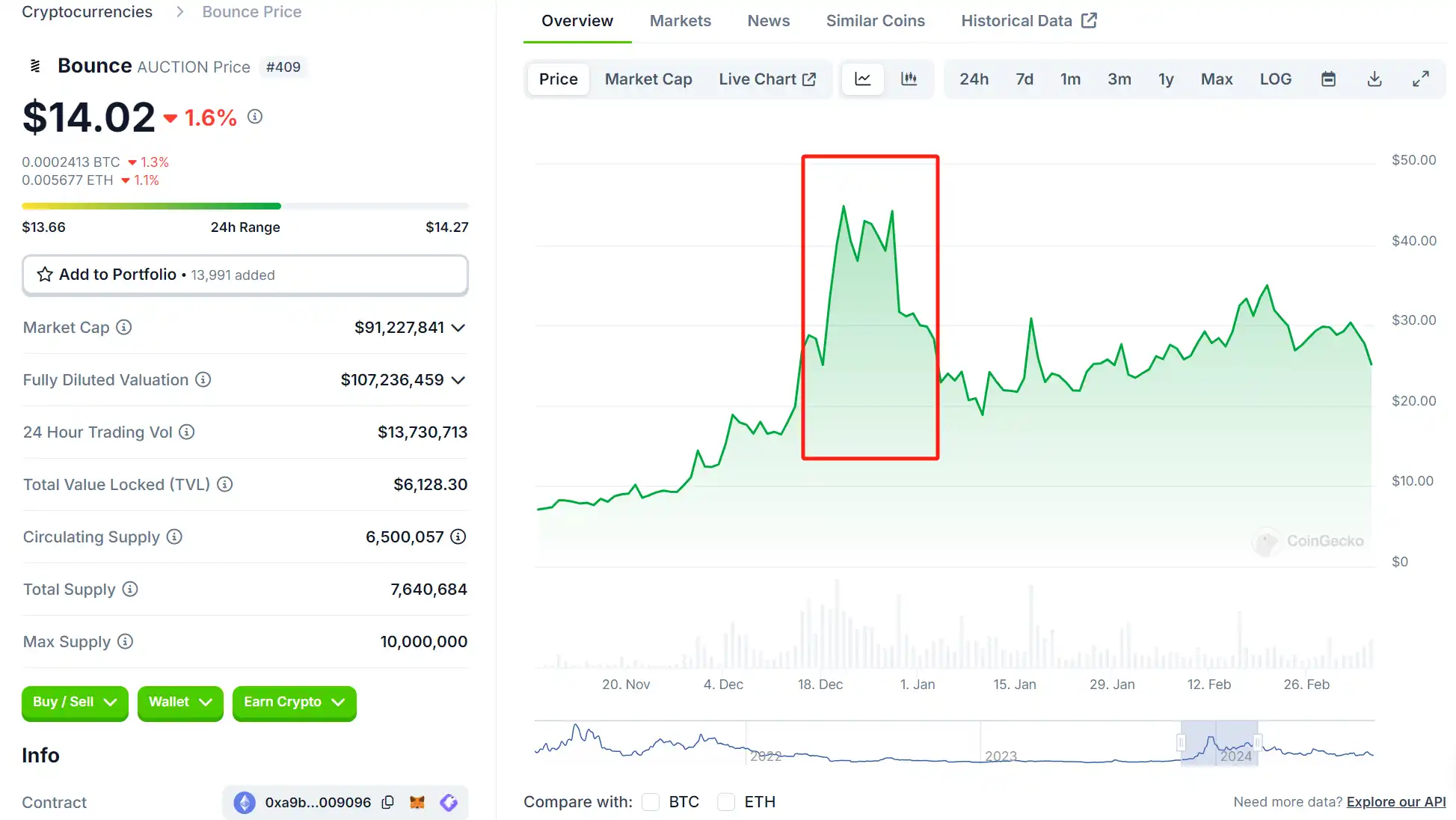

In March of this year, the media reviewed the price trends of 15 tokens after their rebranding in the past year, and found that the token prices showed a strong trend after the rebranding, with an average maximum increase of nearly 243.5%. For example, in December 2023, the decentralized auction platform Bounce Finance announced that its brand would be upgraded to Bounce Brand while the Bitcoin ecosystem was in full swing. The product line was tilted towards the Bitcoin ecosystem, and the effect was very significant. Two weeks after the name change, AUCTIONs highest increase reached 223%. However, the negative effects of the hotspot effect name change also emerged as the heat of the Bitcoin market faded. The pull effect brought about by the name change lasted only more than two weeks, and the price of the currency fell back to the level before the name change.

AUCTION chart source: CoinGecko

It can be seen that changing the name does not mean changing luck. After a short period of market heat, how the team strikes while the iron is hot, seizes opportunities to develop or gives full play to its own advantages is the key to sustainability. OKX is one of the more successful cases. In January 2022, OKEx officially changed its name to OKX and designed a new Logo. After the brand upgrade, OKX followed suit with a combination of punches: continuous social media publicity, domestic and overseas advertising, sponsorship of well-known events, etc.; in the product business line, the launch of the OKX Web3 wallet quickly grasped the market pain points, becoming one of the important turning points of this brand upgrade, and also enabled it to successfully embed the new brand into the hearts of users in a very short time.

最後的想法

In the current market environment, aside from objective factors such as organizational structure changes and supervision, the behavior of small and medium-sized projects actively changing their names has evolved more into a promotional strategy. Due to the lack of new narratives, it is difficult for project parties to form an effective brand promotion strategy.

Since the DeFi Summer of 2020 and the NFT Summer of 2021, the market has not seen a main theme narrative that can reach a broad consensus for a long time. The Bitcoin ecosystem boom lasted less than half a year, and the rise of memes on Solana does not conform to the practical spirit of crypto fundamentalists and true builders. There is even a view in the market that the narratives of new ecosystems such as Bitcoin and Solana are also repeating Ethereums old path to a certain extent.

In this cycle, multi-party games are more open. Compared with the brainless all-in situation of retail investors in previous cycles, retail investors are now more cautious and firmly grasp the chips. Faced with such a market environment, project parties have come up with surprising tricks to grab attention, among which brand reshaping with a name change as a gimmick has become one of their killer weapons. However, changing the name does not mean changing fate. In order to become an evergreen tree in the cryptocurrency circle in the alternation of bull and bear markets, it is also necessary to have a large user base, easy-to-use and just-needed products, real innovative discoveries, and firm beliefs and unremitting persistence.

Finally, if you want to give your project a good name, you can also take a look at this article as a reference: The Art of Naming Crypto Projects: Is the First Step to Success a Good Name? Attached is a metaphysical naming 網站 , I hope it will be helpful to you:)

參考:

https://www.panewslab.com/zh/articledetails/87ijlftv.html

https://www.theblockbeats.info/news/54801

https://www.ignasdefi.com/p/seven-emerging-trends-in-crypto

This article is sourced from the internet: Web3 name change trend: Can rebranding bring new life?

Since 2018, Web3 games have been stirred up every time a cryptocurrency cycle comes, but they have never really taken off. Most Web3 games are short-lived and have not achieved mass adoption. Recently, due to the rise of the TON ecosystem, the gaming track has once again attracted attention. According to the TON Foundation market, compared with Axie Infinitys 2 million DAU at its peak, Notcoin quickly accumulated 6 million DAU during the mining stage. On May 16, just one hour after NOT went online on various exchanges, its market value quickly exceeded US$820 million. But opportunities often appear when the old is replaced by the new. As the main entertainment and social life for 4 billion users worldwide, games cannot be absent in Web3, and the undervalued game track…