原作者: 加密,蒸餾

原文翻譯:TechFlow

Everyone dreams of getting rich through altcoins, but only a few can actually do it.

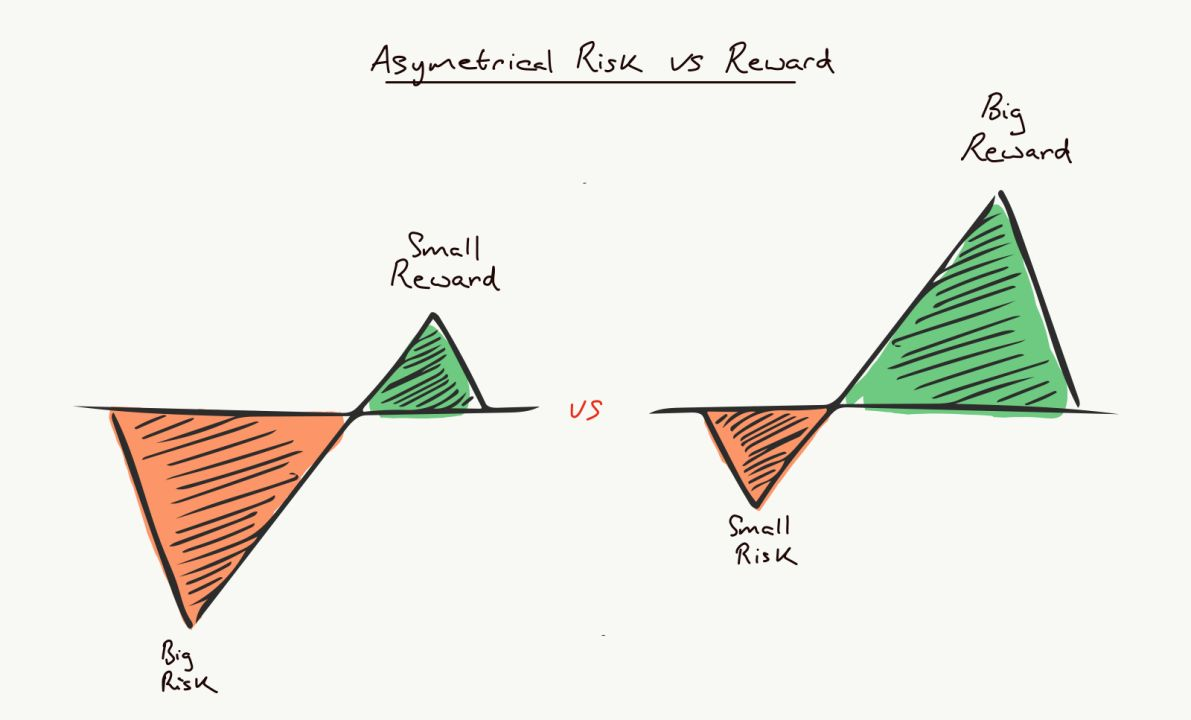

Why? Most people don’t understand the asymmetry of risk and fail to manage it effectively.

After studying hundreds of top investors, I found an investing strategy that works.

Origin of the strategy:

Inspired by @0x_Kun who gained freedom before 30 through crypto investing.

His strategy is simple and works for any skill or capital level. It has 6 steps, bookmark this thread and check back anytime!

Step 1: Manage Risk

The first step is about managing risk.

No matter how smart you are, failing to manage risk means ultimate failure.

What is the most effective way to manage risk? Through smart portfolio construction.

“You can evaluate opportunity by the same standards you use to evaluate risk. They are interrelated.” — Earl Nightingale

Portfolio structure?

Risk isn’t just about individual investments – it’s the interaction between them.

Adjusting asset types/amounts/weights will change your overall odds of success.

The goal? Make sure your gains outweigh your losses over the long term.

Cornerstone: 50%+ invested in $BTC:

Kun’s strategy suggests putting more than 50% of funds in $BTC.

Why? Even if all altcoins fail, $BTC’s long-term growth generally ensures profitability.

It acts as a safety net against investment mistakes.

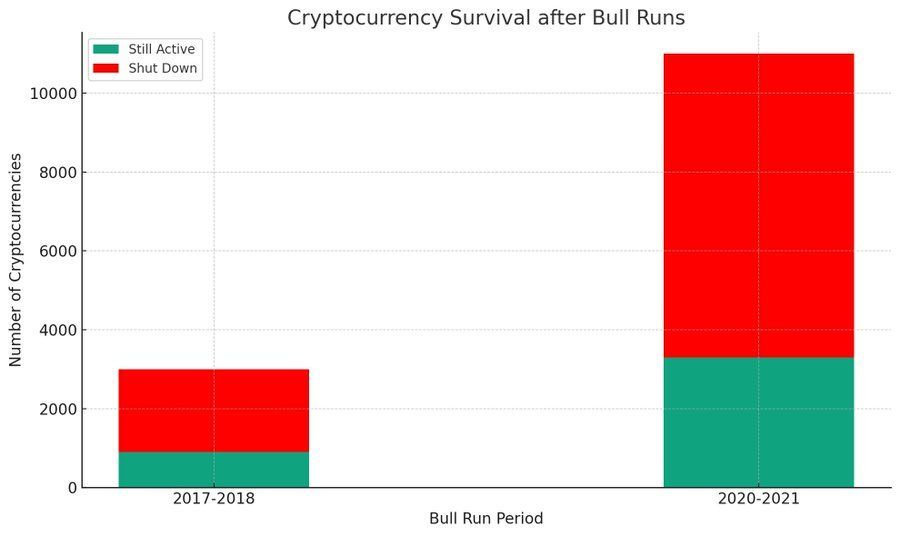

PS: Most altcoins will fail (thanks @coingecko )

Multi-cyclical blue chip stocks: 25%

Kun recommends allocating 25% of funds to blue-chip stocks that can survive multiple cycles.

For most people this is usually $ETH or $SOL.

This increases your likelihood of outperforming $BTC while reducing downside risk.

The remaining 25% is invested in small-cap altcoins:

The final 25% should be diversified across 4-6 equally weighted altcoins.

Think like a venture capitalist: a few big winners can offset losses in other investments.

This approach allows you to pursue 10x to 20x returns while still sleeping soundly.

Why equal weighting is important:

Equal weighting gives each investment a fair chance to balance out the others.

Weighting by conviction is not wise – why include a low conviction asset?

Equal weighting balances potential gains and losses more effectively.

Diversification beyond cryptocurrencies:

Finally, engage in structural diversification.

Your net exposure to cryptocurrencies should take into account your age and other factors.

Kun hedges his crypto holdings with gold. Quality stocks also help with diversification.

Step 2: Assume you might be wrong:

Most people skip this step, but it is crucial.

Always assume that you could be wrong. Focus on probabilities, not outcomes.

Be prepared for different scenarios and adjust your strategy accordingly.

Visualize the worst case scenario:

Imagine the maximum loss you could sustain and still stay afloat.

If losses are too high, consider increasing your investment in $BTC and reducing your investment in altcoins.

Be honest with yourself and reflect on past losses and the emotional impact they have had.

Are You Wrong About Cryptocurrency?

What happens if you’re wrong about crypto?

How do you hedge? Gold can often be used as a hedge for $BTC theory.

Or diversify your income sources to further reduce risk.

Step 3: Look for asymmetry

Patience is key in finding asymmetric investment opportunities.

This means that the potential gains far outweigh the potential losses.

Kun’s goal is to achieve 10x to 20x returns while managing 30% to 50% downside risk.

Don’t go all in:

After identifying an asymmetric opportunity, resist the urge to go all in.

Remember, the goal is to grow wealth through compounding over time.

Step 4: Develop a theory:

Once you identify an asymmetric opportunity, develop a clear investment thesis.

This theory should clearly explain why you are making this investment.

Then, create clear methods to test whether your theory holds up or fails over time.

Theoretical example:

One theory could be that $BTC reaches a market cap comparable to gold.

One failure point could be if Satoshi suddenly dumped all his $BTC.

While this is an extreme example, it illustrates the point.

Multi-factor selling strategy:

Selling is often more difficult than buying.

To solve this problem, Kun suggests setting multiple sell conditions.

This helps protect against market uncertainty and personal biases.

Kuns Three-Factor Selling Method:

Kun suggests breaking down your sell points based on three factors: time, theory, and price.

例如:

-

Sell 25% by the end of 2025

-

Sell 25% when $BTC reaches $100k

-

Sell 50% when $BTC market cap exceeds gold market cap

Step 6: Develop a post-profit strategy:

After making huge gains, many investors make the mistake of giving back their gains.

To avoid this, go back to step one:

-

Reassess your portfolio and look for new asymmetric opportunities.

-

Avoid reinvesting profits in the market too early.

Managing psychological stress:

In addition to financial strategies, manage your mental and emotional health.

Is the crypto market taking its toll on you? Consider taking a break after making some great gains.

Invest your time and money in the things you are passionate about. Balance is the key to long-term success.

Thread review:

-

透過您的投資組合管理風險。

-

Assume you are wrong and plan accordingly.

-

尋找不對稱現象並保持耐心。

-

使用理論驗證和失敗。

-

採用多因素銷售策略。

-

返回第一步,制定盈利計劃。

This is purely educational and does not constitute investment advice.

This article is sourced from the internet: How to get rich in the crypto market: Risk management strategies of top investors

Related: SignalPlus Macro Research Special Edition: Now Hiring

The non-farm payrolls data was slightly weaker than expected, continuing the recent trend of weakening momentum in the US economy. The unemployment rate rose from a cycle low of 3.43% to 4.05%. Of the approximately 200,000 new jobs added in the past month, approximately 150,000 were from the government and healthcare sectors, and the employment data for the past two months was also revised down by 111,000. Wage growth slowed to 3.9% and 3.5% year-on-year and month-on-month, respectively, providing more positive signals to the Federal Reserve that inflation is slowly falling back to its long-term target. In addition, given the recent performance of cryptocurrencies, will we see a small surge in job seekers and lead to lower wage pressures in the coming months? With only a few meetings left before…