Key Metrics (August 19 4pm -> August 26 4pm Hong Kong time):

-

BTC/USD +8.5% ($58,600 -> $63,600), ETH/USD +4.4% ($2,620 -> $2,735)

-

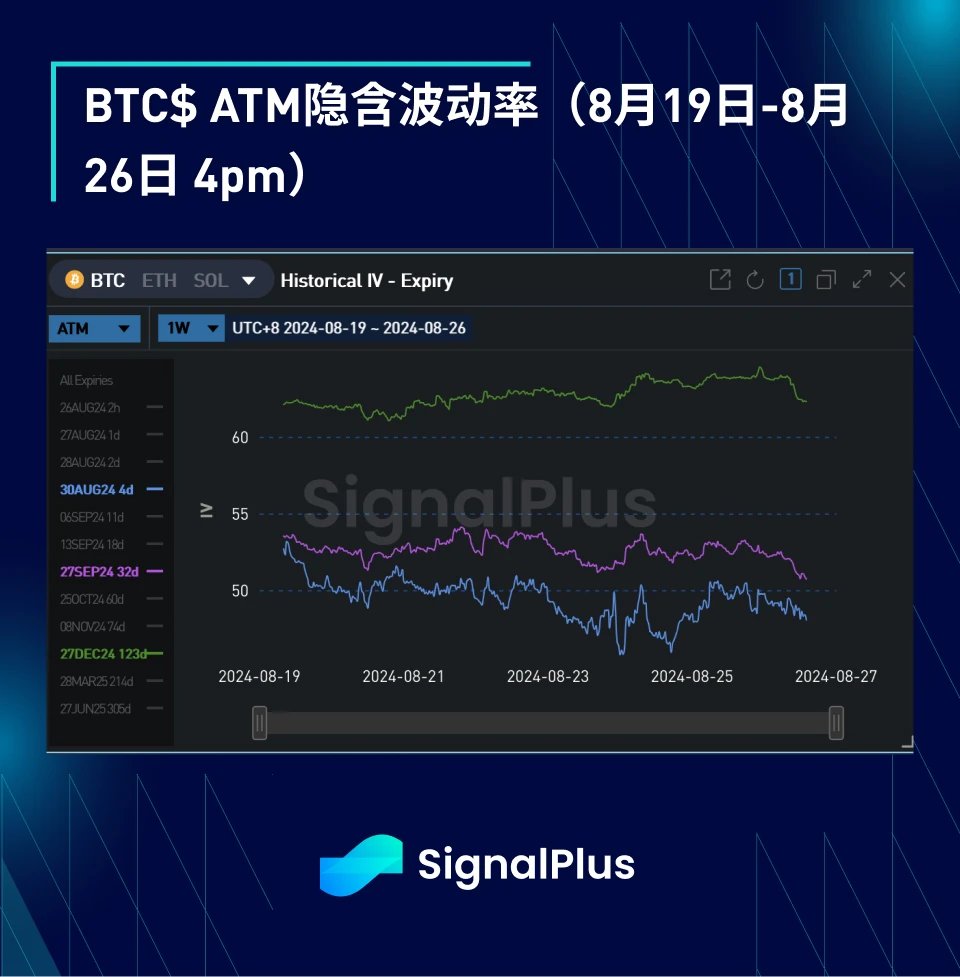

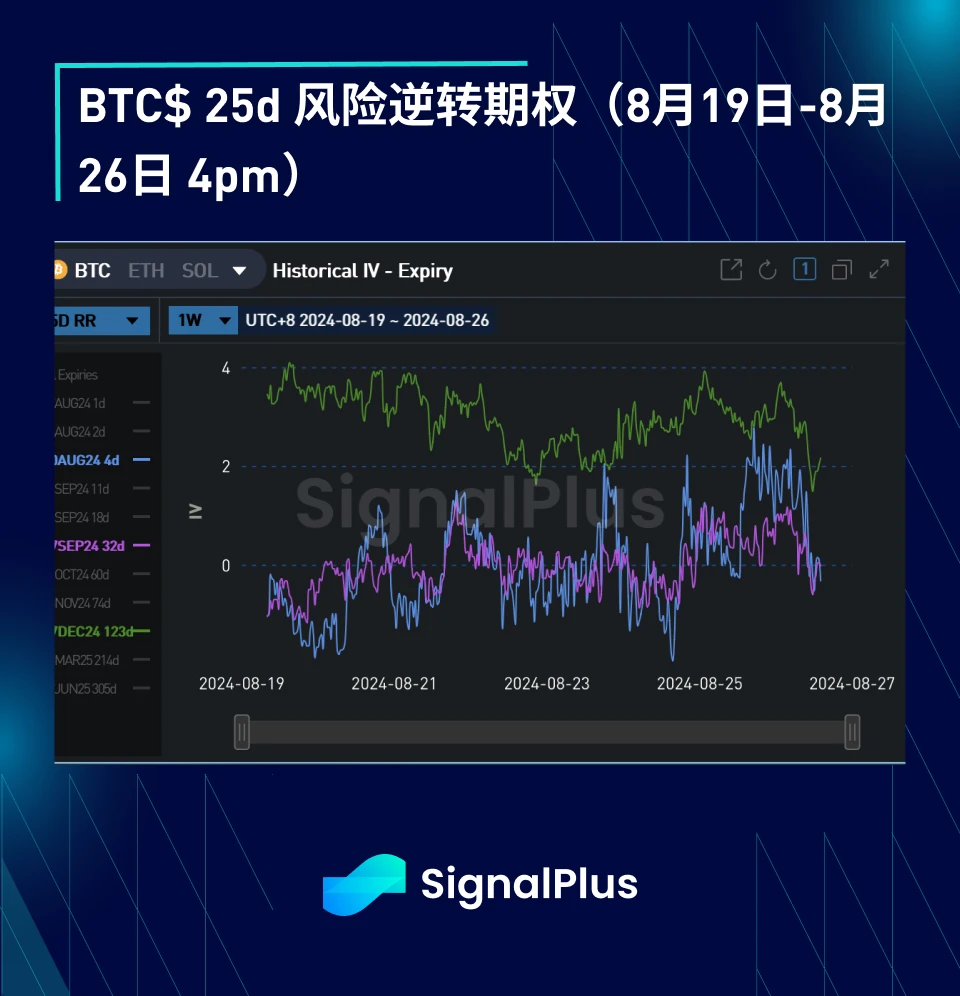

BTC/USD December (end of year) ATM volatility unchanged (62.2 -> 62.2), December 25 day risk reversal volatility -2.0 v (4.1 -> 2.1)

-

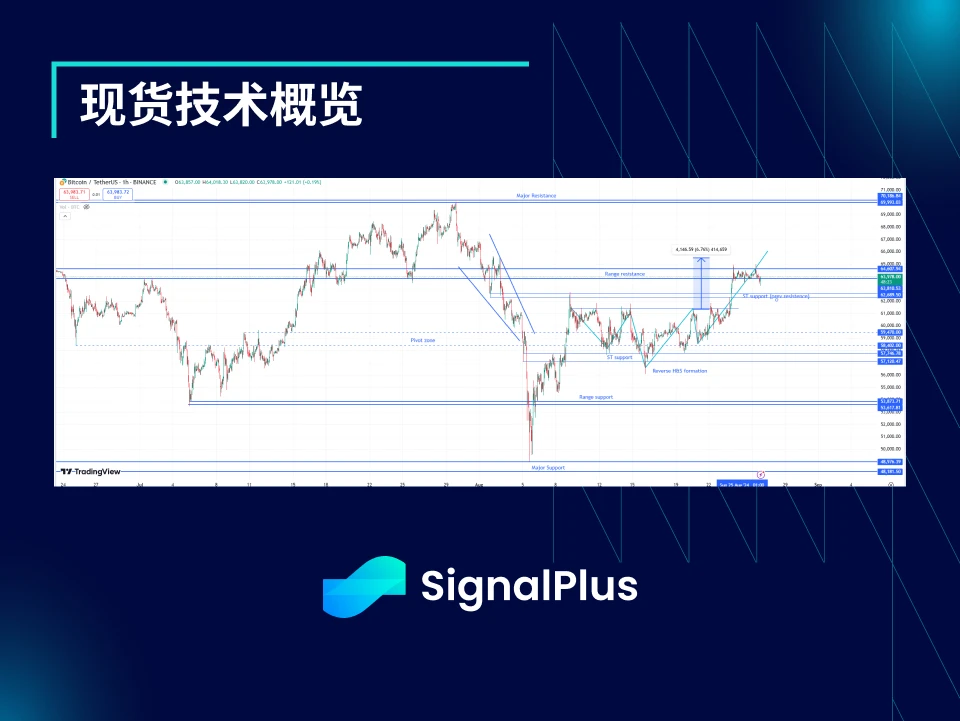

The spot price has finally managed to break through 54-63k and is testing the price range resistance of 64-65k. If it can break through this range, the BTC price may challenge the highs again (initial target is 70k, then above 74k). The initial support level is below 62.5k.

-

Combined with Fridays price breakout, the past few weeks volatile action has formed a (slightly confusing) inverse head and shoulders pattern, suggesting a more intentional move toward range lows could be in the cards if prices pull back again and fail to successfully break through overhead resistance.

市集活動:

-

The market was generally in a quiet consolidation phase at the beginning of this week, but as Powells speech at the Jackson Hole conference approached on Friday night, market expectations gradually heated up. Powell did not respond strongly to the markets expectations of a quick adjustment to faster and earlier rate cuts, but admitted that now is the time to start the Feds rate cut cycle.

-

The cryptocurrency market was relatively slow to react initially (compared to the rapid rise in US stocks/weakening of the USD versus the G10 currencies), but eventually BTCUSD broke through the recent 58-62k price range and stabilized at 64k, driving ETHUSD to the high of the recent range in tandem.

-

Geopolitical noise is now fading into the background, with no signs of an imminent escalation of tensions in the Middle East, while peace talks are struggling to make any substantial progress.

ATM 隱含波動率:

-

Implied volatility has been mostly sideways this week, with spot prices range-bound ahead of the Jackson Hole meeting, which has pushed implied volatility up to the overnight breakeven of 2.5% (with an implied volatility of 60). This level is roughly reasonable based on high-frequency data, but low based on fixed-time data.

-

After the Jackson Hole meeting, the spot price broke out of the 58-62k range and the implied volatility initially rose. But by Monday, the implied volatility quickly fell back, and the spot/realized volatility stagnated around 64k.

-

There was continued demand for US election-related options, mostly through rolling September/October call options to November/December. However, a large supply of long-dated call options after the weekend also caused forward prices to fall, reducing the impact of the US election.

偏度/凸度:

-

The skew pricing has moved significantly lower (less demand for options on the upside), which is interestingly the opposite of the spot price movement. This could indicate that the market is still concerned about an accelerated decline in prices, as the previous two declines in this range were very volatile.

-

In addition, some traders are taking advantage of the rise in spot prices to sell covered calls, especially at longer maturities, which puts downward pressure on the tilt of the term structure.

-

Convexity has weakened this week, with both realized volatility and realized spot risk reversals showing low correlations, which has exerted some downward pressure on convexity.

祝您本週交易順利!

您可以使用t.signalplus.com的SignalPlus交易風向標功能來獲取更多即時加密貨幣資訊。如果您想在第一時間收到我們的更新,請關注我們的推特帳號@SignalPlusCN,或加入我們的微信群(新增助手微信:SignalPlus 123)、Telegram 群和 Discord 社區,與更多朋友交流互動。 SignalPlus 官方網站:https://www.signalplus.com

Welcome to join the Odaily official community

Telegram subscription group: https://t.me/Odaily_News

Telegram chat group: https://t.me/Odaily_CryptoPunk

Official Twitter account: https://twitter.com/OdailyChina

This article is sourced from the internet: BTC Volatility: Week in Review August 19–26, 2024

相關:加密貨幣對沖基金如何產生超額回報:積極管理風險並投資比特幣

原作者:Crypto, Distilled 原文翻譯:TechFlow Coinbase 剛剛發布了一份關於加密對沖基金如何產生超額收益的報告。以下是最有價值的見解。報告概述 該報告揭示了活躍的加密貨幣對沖基金使用的主要策略。它為任何尋求以下目標的投資者提供了寶貴的見解: 更好地管理風險 獲取超額回報 加深您對加密的理解 提供有價值的見解。被動策略還是主動策略?無論您的經驗水平如何,請始終將您的表現與 $BTC 進行比較。如果您在一年或更長時間內無法跑贏 $BTC,請考慮被動策略。對於大多數投資者來說,定期 DCA $BTC 通常是熊市期間的最佳選擇。比特幣 – 基準 $BTC 是加密貨幣市場測試版的首選基準。自2013年以來,$BTC年化收益…