Bitcoin rises as dovish stance turns to imminent rate cut

At 10 a.m. Eastern Time on Friday, August 23, Federal Reserve Chairman Powell made an important speech at the Jackson Hole Global Central Bank Annual Meeting.

**It is worth noting that Powell stated quite clearly: The time for policy adjustment has come. The policy direction is clear, and the timing and pace of interest rate cuts will depend on subsequent data, changes in the outlook and the balance of risks.

Some analysts said that although Powell confirmed the markets widespread expectation of starting interest rate cuts in September, this speech was also dovish, providing a certain clarity to the financial market in the short term, but did not provide many clues about how the Fed will act after the September meeting.

For example, if there is another negative employment report, whether there will be a sharp 50 basis point rate cut, and whether rate cuts will continue in the coming months. However, Powells speech at least confirmed that the Feds fight against inflation over the past two years is about to reach a critical turning point.

After the annual meeting, Bitcoin rose from US$61,000 to a high of US$65,000, an increase of 6.5%.

There are about 26 days until the next Federal Reserve interest rate meeting (September 19, 2024)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

市場技術與情緒環境分析

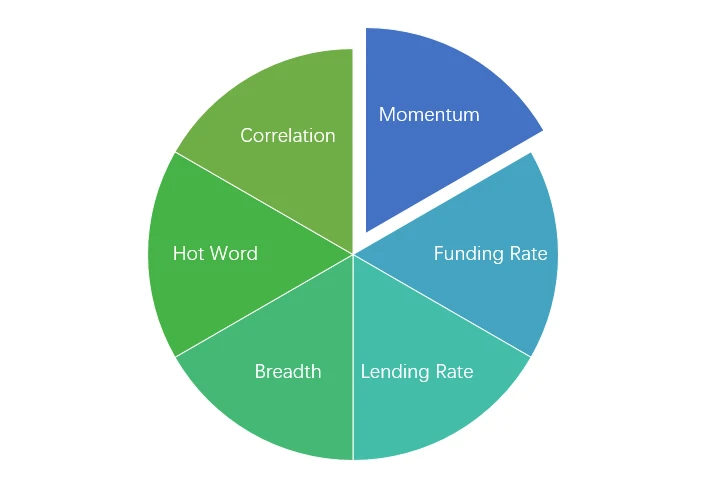

情緒分析組件

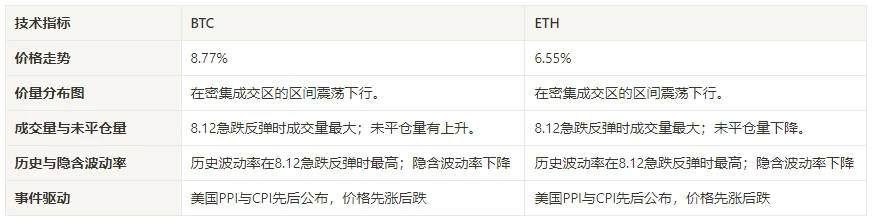

技術指標

價格趨勢

In the past week, BTC prices rose 8.77% and ETH prices rose 6.55%.

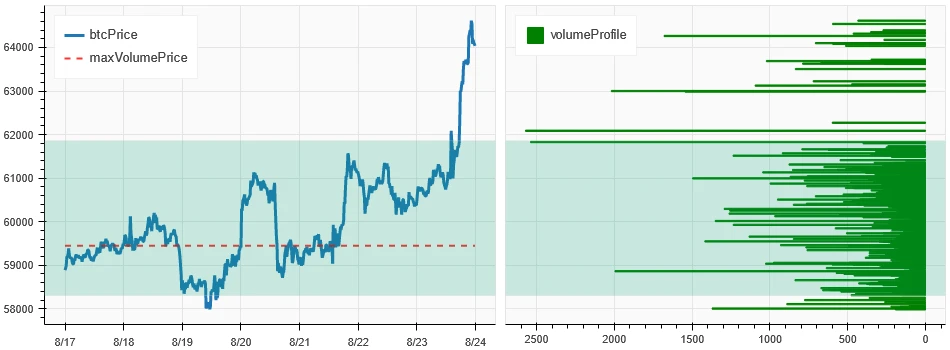

上圖是近一周BTC的價格走勢圖。

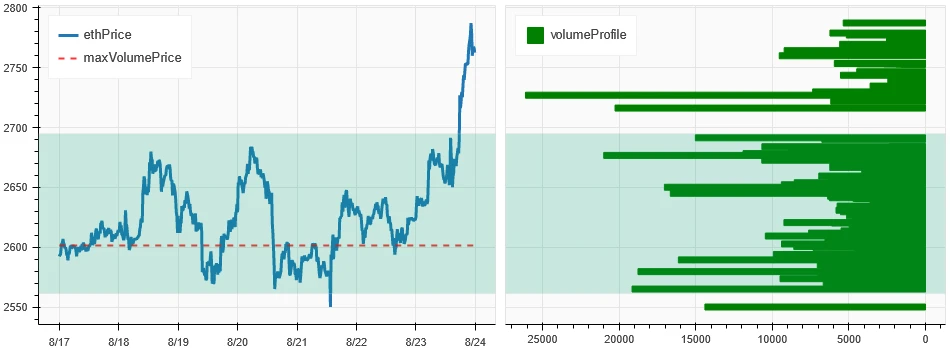

上圖是近一周ETH的價格走勢圖。

表格顯示了過去一週的價格變化率。

價量分佈圖(支撐位和阻力位)

In the past week, both BTC and ETH broke through the concentrated trading area and formed an upward trend.

上圖為近一週BTC密集交易區域分佈。

上圖為近一週ETH密集交易區域分佈。

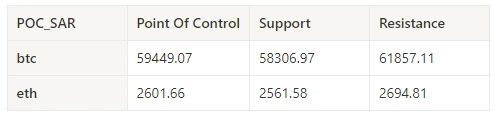

表格顯示了過去一週BTC和ETH的周密集交易區間。

成交量和持倉量

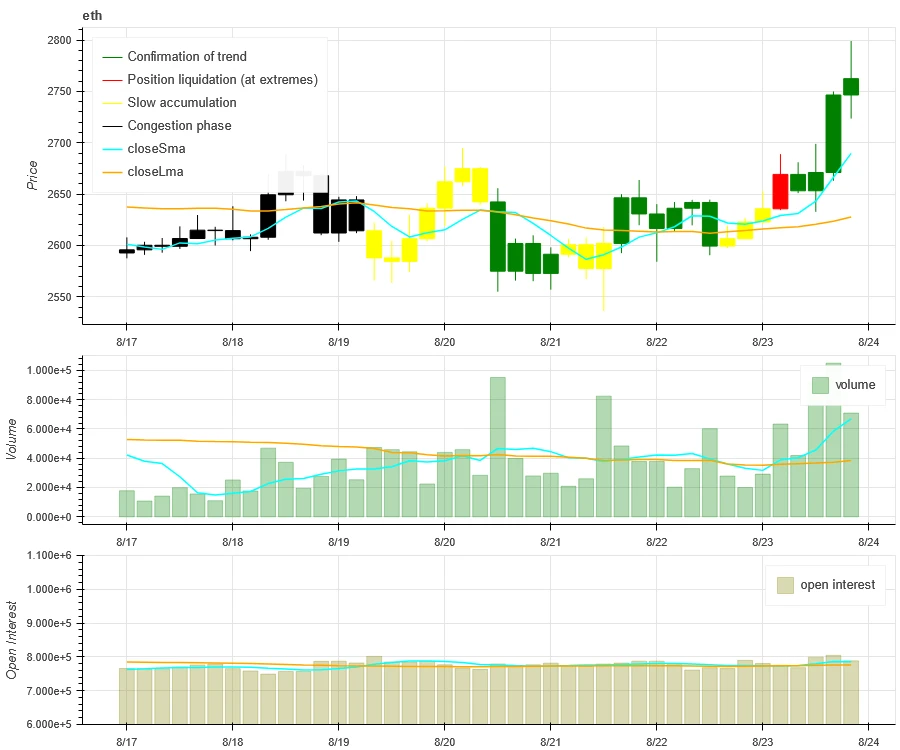

In the past week, the trading volume of BTC and ETH was the largest when they rose to 8.23; the open interest of BTC and ETH both increased slightly.

上圖上方為BTC的價格走勢,中間為交易量,下方為持股量,淺藍色為1日均線,橘色為7日均線。 K線的顏色代表當前狀態,綠色表示價格上漲受到成交量的支撐,紅色表示平倉,黃色表示慢慢累積倉位,黑色表示擁擠狀態。

上圖上方為ETH的價格走勢,中間為交易量,下方為持倉量,淺藍色為1日均線,橘色為7日均線。 K線的顏色代表當前狀態,綠色表示價格上漲受到成交量的支撐,紅色表示平倉,黃色表示慢慢累積倉位,黑色表示擁擠。

歷史波動率與隱含波動率

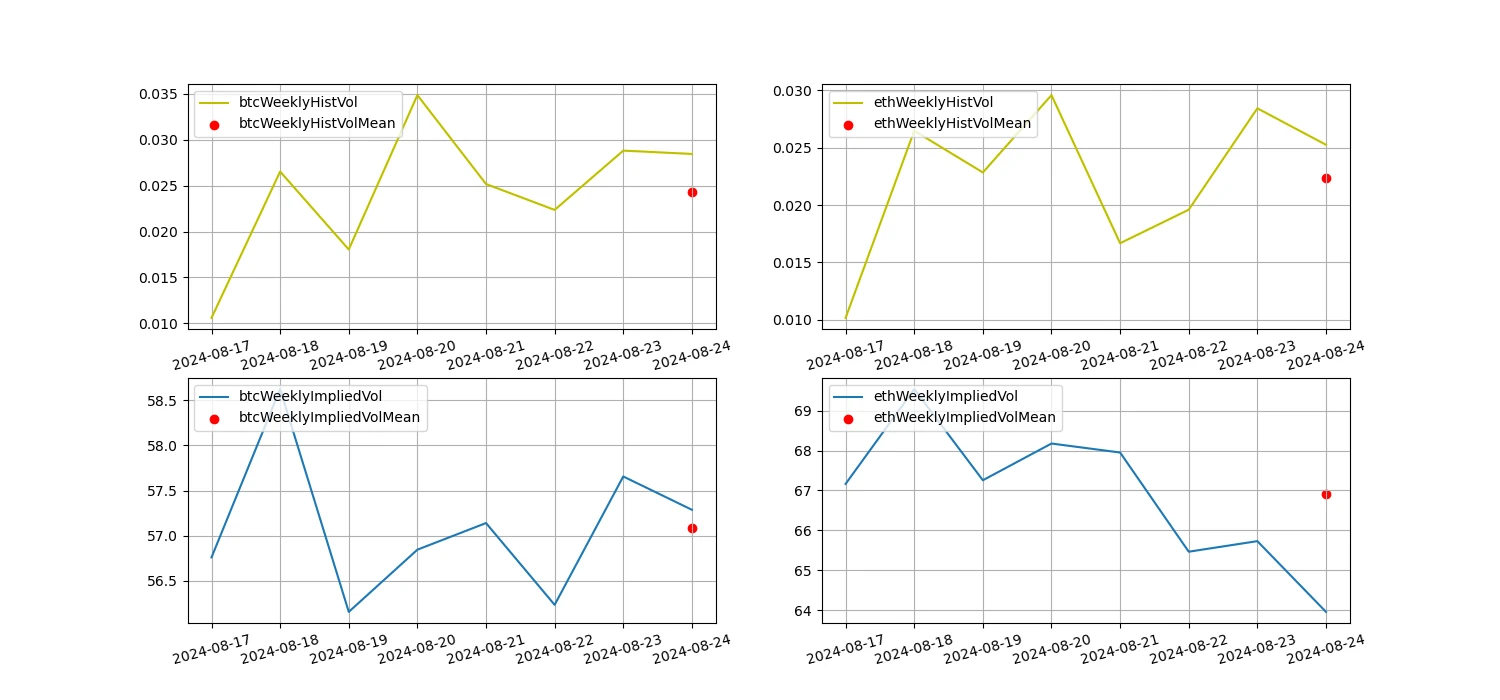

In the past week, the historical volatility of BTC and ETH was highest when they fluctuated in a wide range of 8.20; the implied volatility of BTC increased while that of ETH decreased.

黃線是歷史波動率,藍線是隱含波動率,紅點是其7日平均值。

事件驅動

This past week, the Federal Reserve’s annual meeting hinted at an upcoming rate cut, and Bitcoin rose 6.5% in response.

情緒指標

動量情緒

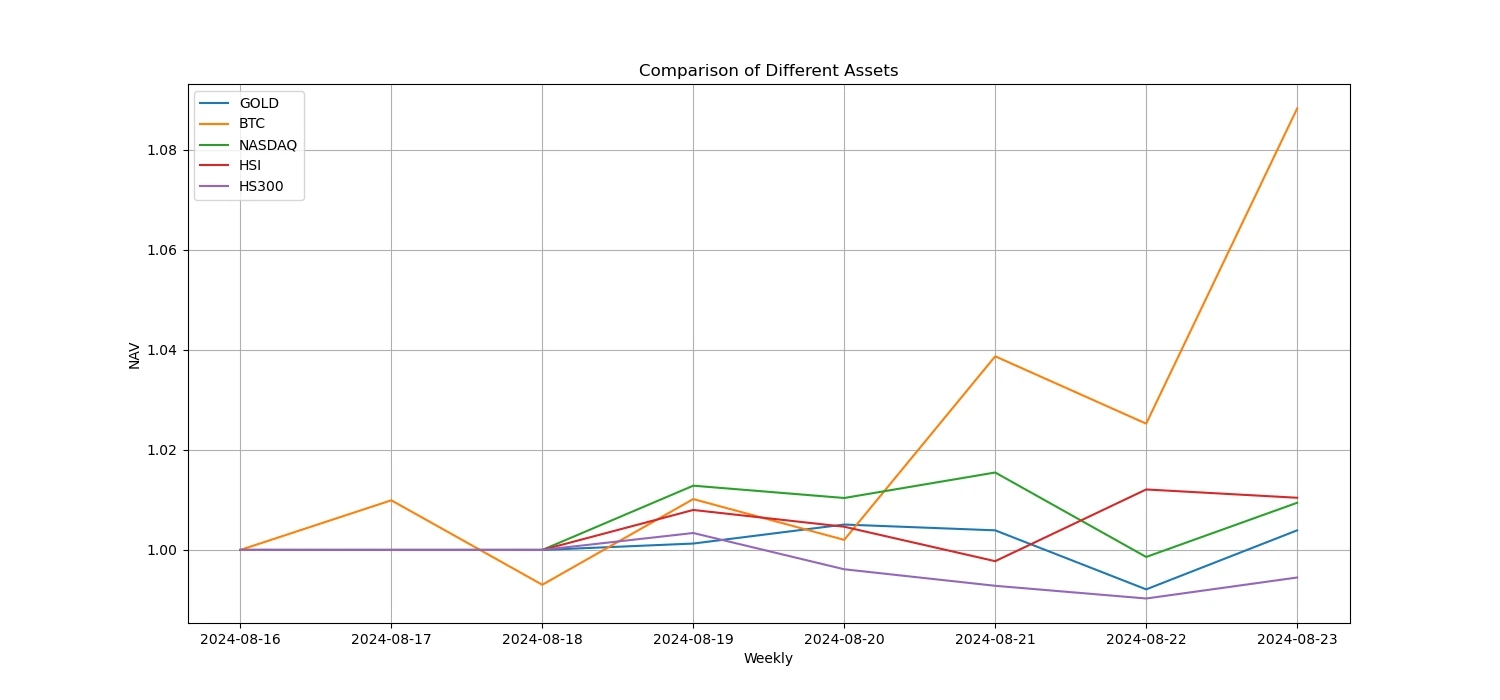

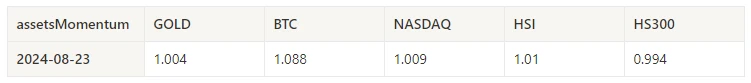

過去一周,比特幣/黃金/納斯達克/恆生指數/滬深300中,比特幣表現最強,滬深300表現最差。

上圖為近一周不同資產的走勢。

貸款利率_貸款情緒

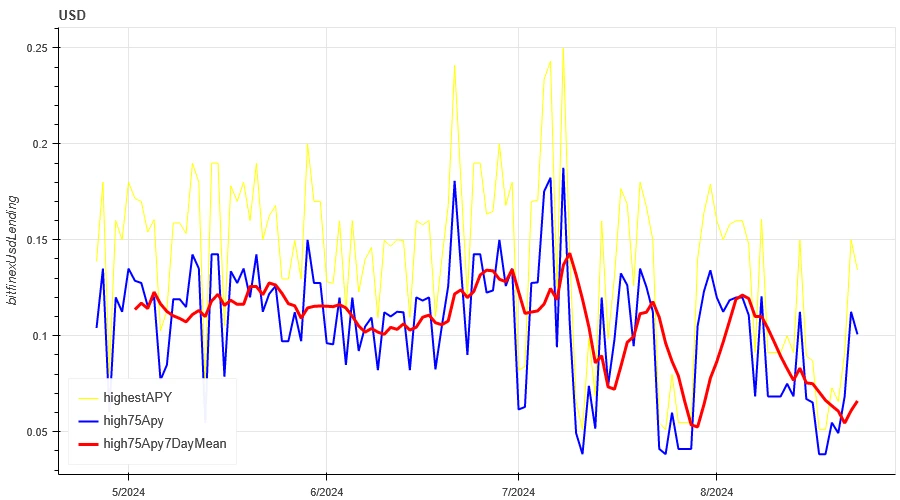

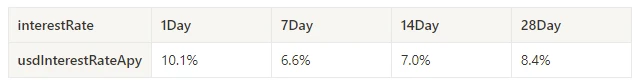

The average annualized return on USD lending over the past week was 6.6%, and short-term interest rates rose to 10.1%.

黃線為美元利率最高價,藍線為最高價75%,紅線為最高價75% 7日均線。

表格顯示過去不同持有日美元利率的平均回報

資金費率_合約槓桿情緒

The average annualized return on BTC fees in the past week was -1.4%, and contract leverage sentiment is turning pessimistic.

藍線是BTC在幣安上的資金費率,紅線是其7日平均值

表格顯示了過去不同持有天數的BTC費用平均報酬。

市場相關性_共識情緒

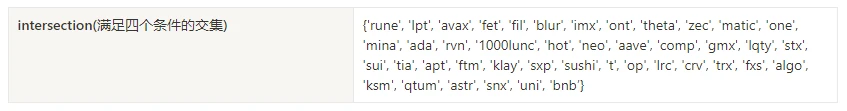

The correlation among the 129 coins selected in the past week was around 0.85, and the consistency between different varieties has increased from a low level.

上圖中,藍線是比特幣的價格,綠線是[1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape、apt、 arb、ar、astr、atom、音訊、avax、axs、bal、樂團、bat、bch、bigtime、模糊、bnb、btc、celo、cfx、chz、ckb、comp、crv、cvx、網路、 dash、doge、 dot、dydx、egld、enj、ens、eos 等、eth、fet、fil、flow、ftm、fxs、gala、gmt、gmx、grt、hbar、hot、icp、icx、imx、inj、 iost、iotx、jasmy 、kava、klay、ksm、ldo、link、loom、lpt、lqty、lrc、ltc、luna 2、magic、mana、matic、meme、mina、mkr、near、neo、ocean、一、ont 、 op、 pendle、 qnt、 qtum、 rndr、 玫瑰、 符文、 rvn、 沙、 sei、 sfp、 skl、 snx、 sol、 ssv、 stg、 storj、 stx、 sui、 sushi、 sxp、 theta、 tia、 trx、 t 、uma、uni 、vet、waves、wld、woo、xem、xlm、xmr、xrp、xtz、yfi、zec、zen、zil、zrx] 整體相關性

市場廣度_整體情緒

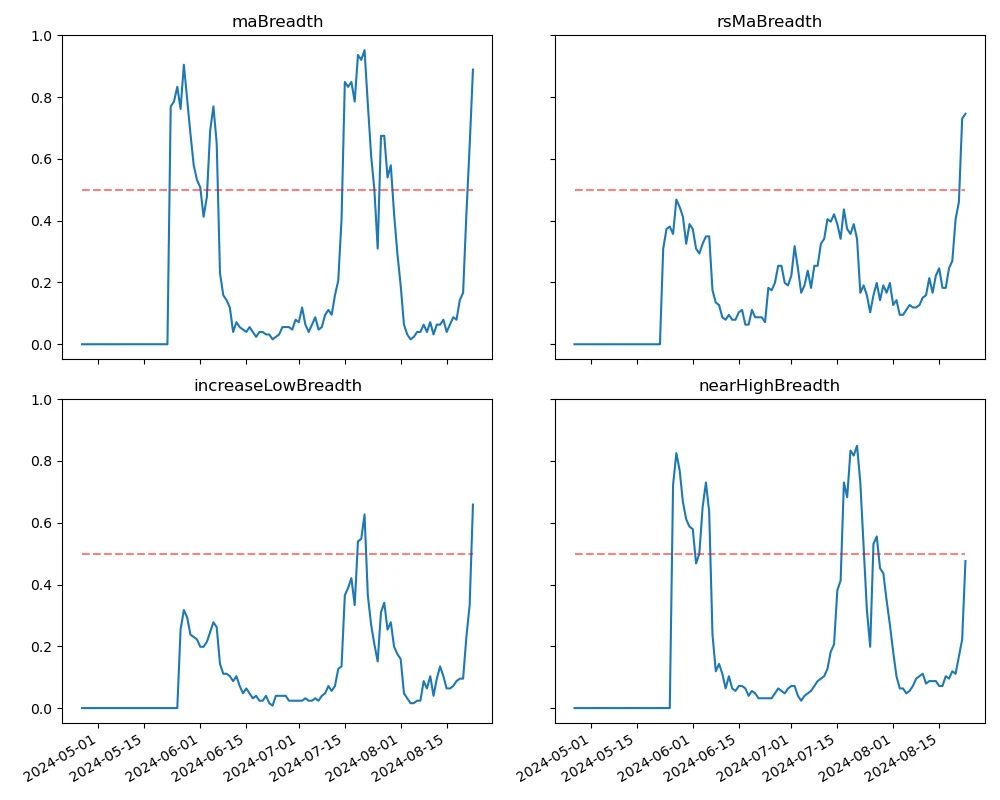

Among the 129 coins selected in the past week, 89% of them were priced above the 30-day moving average, 75% of them were above the 30-day moving average relative to BTC, 66% of them were more than 20% away from the lowest price in the past 30 days, and 48% of them were less than 10% away from the highest price in the past 30 days. The market breadth indicator in the past week showed that most coins in the overall market returned to an upward trend.

上圖是[bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, alt, agix, ai, ape, , 、arb、ar、astr、atom、avax、axs、bal、band、bat、bch、bigtime、blur、cake、celo、cfx、chz、ckb、comp、crv、cvx、cyber、dash、doge、dot、 dydx 、egld、enj、ens、eos 等、fet、fil、flow、ftm、fxs、gala、gmt、gmx、grt、hbar、hot、icp、icx、idu、imx、inj、iot、iotx、jasmy、 jto、 jup、kava、klay、ksm、ldo、link、loom、lpt、lqty、lrc、ltc、luna 2、magic、mana、manta、mask、matic、meme、mina、mkr、near、neo、nfp、海洋、一、ont、op、ordi、pendle、pyth、qnt、qtum、rndr、robin、rose、rune、rvn、sand、sei、sfp、skl、snx、ssv、stg、storj、stx、sui、sushi、sxp 、theta 、tia、trx、t、uma、uni、vet、waves、wif、wld、woo、xai、xem、xlm、xmr、xrp、xtz、yfi、zec、zen、zil、zrx ] 30 天比例每個寬度指示器

總結

In the past week, the price of Bitcoin (BTC) and Ethereum (ETH) fluctuated and then rose. The historical volatility peaked on August 20 when the market fluctuated widely, and the trading volume peaked on August 23 when the market rose. The open interest of both BTC and ETH increased. The implied volatility of BTC increased while that of ETH decreased. Bitcoin performed the best in comparison with gold, Nasdaq, Hang Seng Index and CSI 300, while CSI 300 performed the weakest. Bitcoins funding rate fell to negative, reflecting the pessimistic sentiment of market participants. The correlation between the selected 129 currencies remained at around 0.85, showing that the consistency between different varieties has risen from a low level. The market breadth indicator shows that most cryptocurrencies in the overall market are still back to an upward trend. The Federal Reserves annual meeting hinted at an upcoming rate cut, and Bitcoin rose 6.5% in response.

推特:@ https://x.com/CTA_ChannelCmt

網站: 頻道CMT

This article is sourced from the internet: Crypto Market Sentiment Research Report (2024.08.16–08.23): Bitcoin rises as dovish turn to impending rate cut

相關:加密貨幣對沖基金如何產生超額回報:積極管理風險並投資比特幣

原作者:Crypto, Distilled 原文翻譯:TechFlow Coinbase 剛剛發布了一份關於加密對沖基金如何產生超額收益的報告。以下是最有價值的見解。報告概述 該報告揭示了活躍的加密貨幣對沖基金使用的主要策略。它為任何尋求以下目標的投資者提供了寶貴的見解: 更好地管理風險 獲取超額回報 加深您對加密的理解 提供有價值的見解。被動策略還是主動策略?無論您的經驗水平如何,請始終將您的表現與 $BTC 進行比較。如果您在一年或更長時間內無法跑贏 $BTC,請考慮被動策略。對於大多數投資者來說,定期 DCA $BTC 通常是熊市期間的最佳選擇。比特幣 – 基準 $BTC 是加密貨幣市場測試版的首選基準。自2013年以來,$BTC年化收益…