原作者: hangry

原文翻譯:TechFlow

Hello, humble farmers!

Are you tired of the markets and dont know where to look for those big gains?

To help you out, here are our recommendations for income opportunities this week.

1. 索萊爾

Total locked value (TVL): $161 million

Funding raised: $8 million

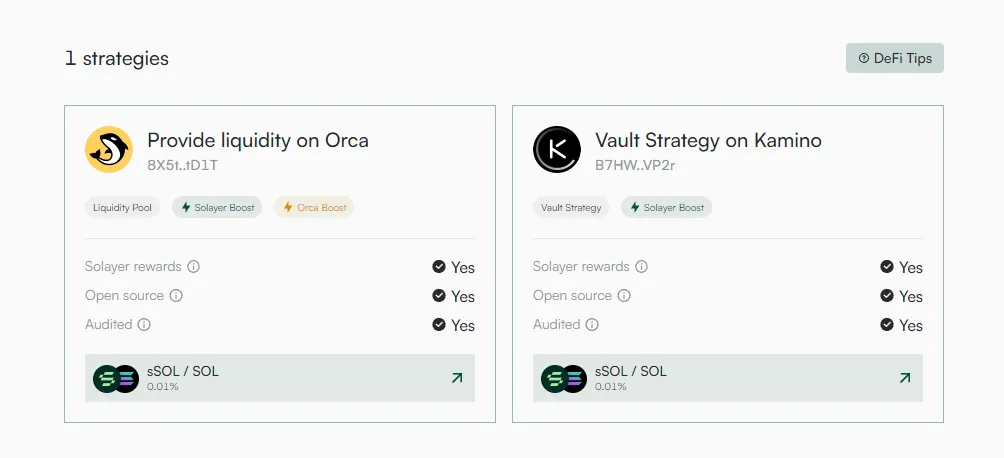

Our first farm this week is Solayer, a Solana-based restaking platform designed to enhance security and decentralization for validators.

Simply put, Solayer allows users to re-stake their existing $SOL and other LST to receive higher rewards and Solayer points.

You can use your sSOL (re-staked SOL) in the Solana ecosystem for lending, providing liquidity, and more.

The simplest and probably most effective farm is the Kamino sSOL/SOL Vault, which provides incentive income and Kamino points.

2. Mantra

Total locked value (TVL): $1.5 million

Audit: ✅

If you’re not familiar with Mantra, it’s a Layer 1 blockchain focused on supporting real-world assets.

Mantra, as a Cosmos L1, aims to be a permissionless blockchain that supports permissioned applications, more information can be read below.

Mantra announced its Chakra pool, where users can deposit USDC to receive USDY, an over-collateralized treasury-backed stablecoin that currently has an annualized yield of 452% with OM and ONDO incentives.

However, it is important to note that your deposit will be locked until the mainnet goes live.

3. Factor

Total locked value (TVL): $7.3 million

Audit: ✅

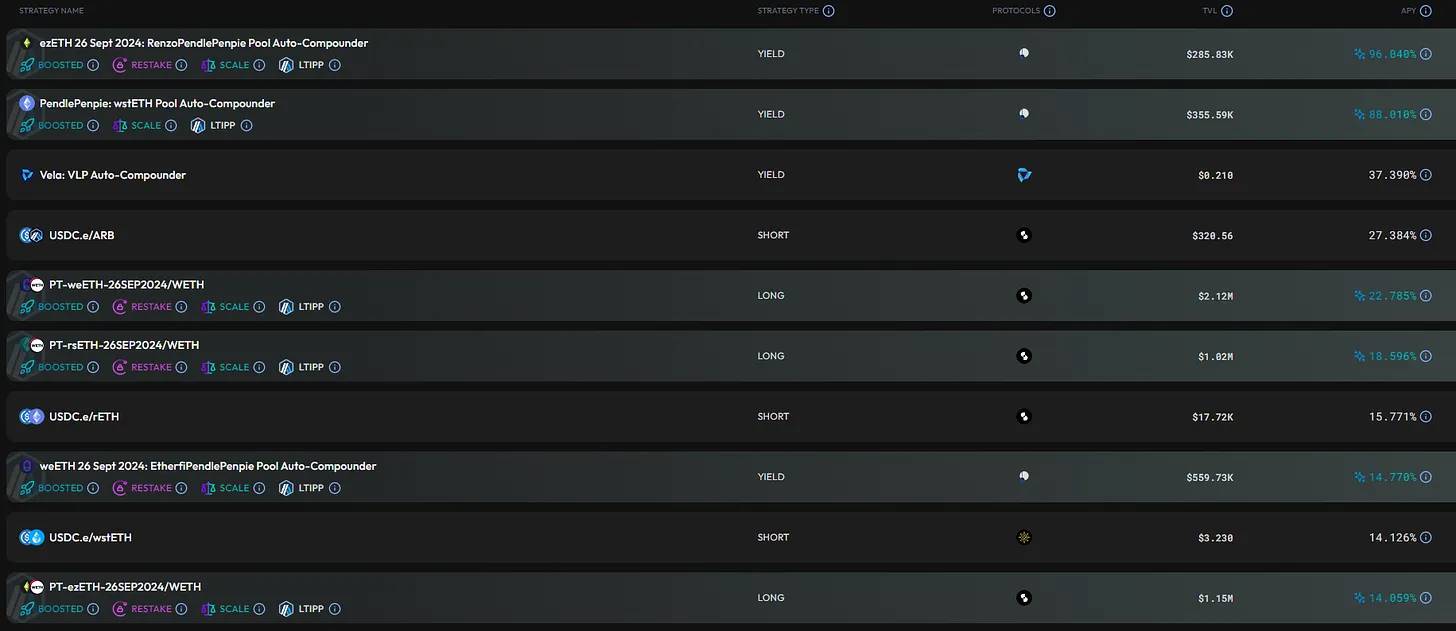

Next up is Factor, a composable DeFi layer designed to enhance and simplify yield farming.

With Factor, users can seamlessly deposit into automatically managed vaults to access a variety of yield strategies and receive additional token incentives.

Factor has been distributing ARB incentives from the LTIPP program, but those will end in a few weeks.

Liquidity providers (LPs) will also receive $FCTR tokens, which are allocated to specific pools based on the staker’s voting weight.

4. Camelot

Total locked value (TVL): $94 million

Audit: ✅

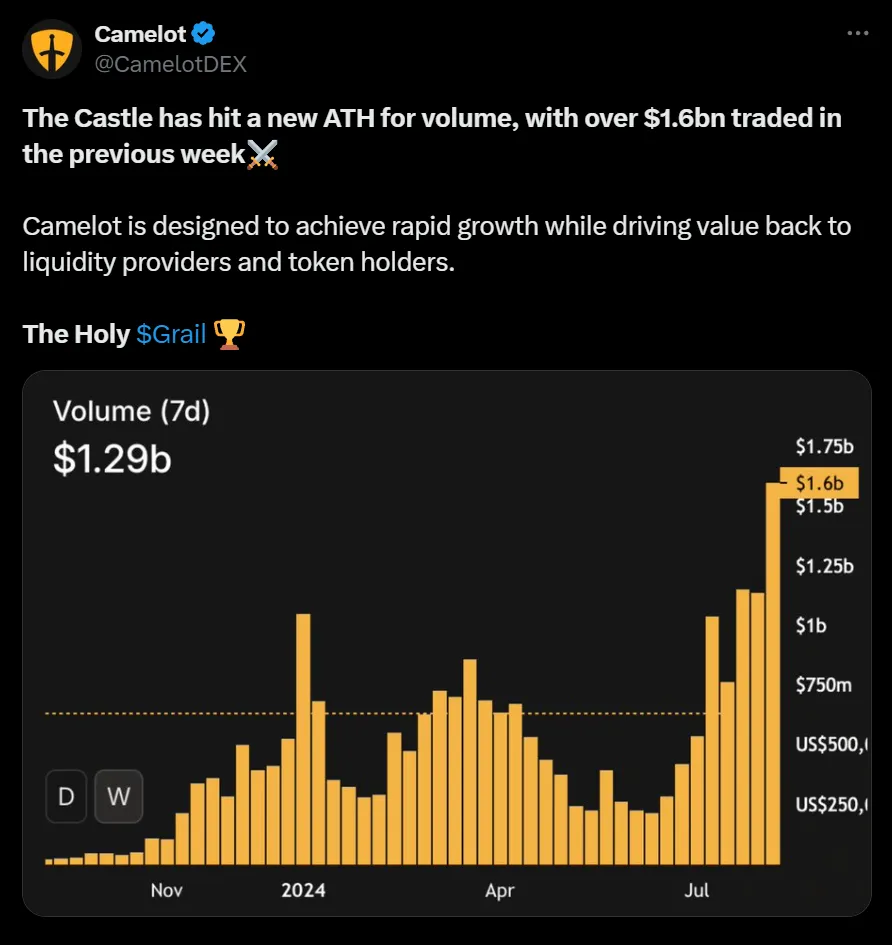

Next up is Camelot, a decentralized exchange focused on supporting Arbitrum and various other Orbit chains.

Camelot has recently been growing rapidly with the launch of Arbitrum Orbit chains such as Sanko, Reya, and Xai.

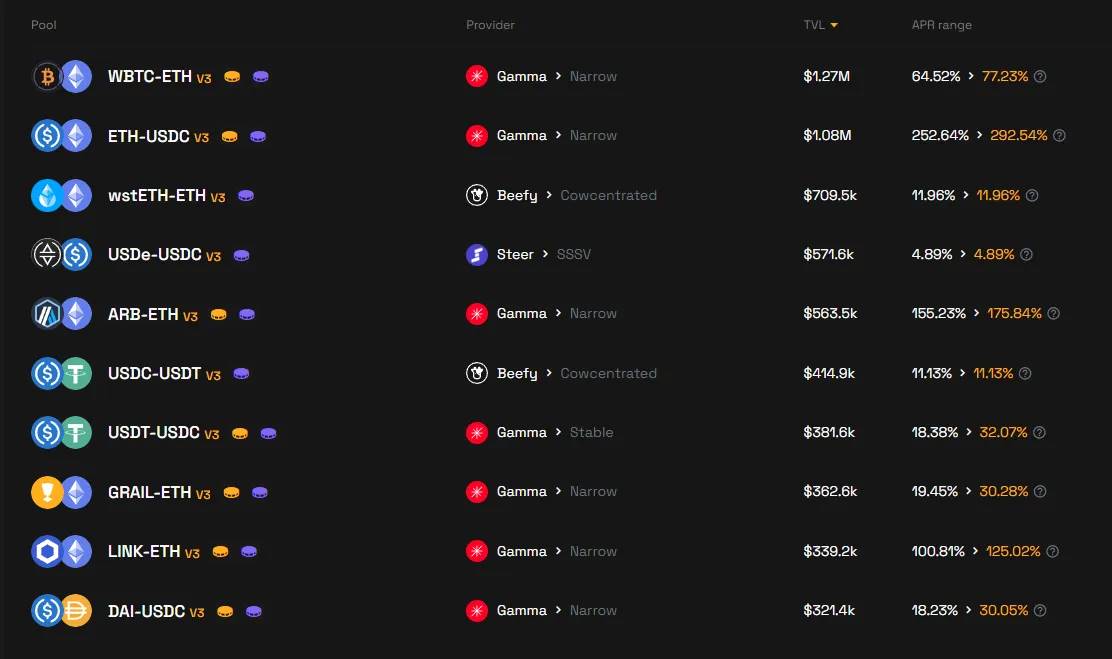

Here are some of our favorite yield pools:

-

ETH/USDC @ 292% APR

-

ARB/USDC @ 151% Annual Percentage Rate (APR)

-

uniETH/ETH @ 30% APR

While these annualized returns are not completely accurate because they are calculated over a smaller liquidity range, they are still quite generous.

5. Beefy

Total locked value (TVL): $262 million

Audit: ✅

Our final farm of the week is 蜜蜂fy, a multi-chain automated yield aggregator and optimizer.

Most experienced farmers are probably familiar with Beefy, and today they also offer a variety of rich vaults.

You can filter the supported trading pairs based on your favorite chain, but some of our favorites include:

-

wstETH/USDC @ 91% APR

-

wBTC/USDT @ 61% Annual Percentage Rate (APR)

-

rsETH/ETHx @ 45% APY

This article is sourced from the internet: Explore new revenue streams and review 5 revenue strategies for this week

Related: Insight Data Issue 03|FMZ Quant OKX: How do ordinary people master quantitative trading?

In the cryptocurrency market, data is always an important basis for trading decisions. How to see through the complex data and discover valuable information to optimize trading strategies has always been a hot topic in the market. To this end, OKX has specially planned the Insight Data column, and cooperated with mainstream data platforms such as AICoin and Coinglass and related institutions to start from common user needs, hoping to dig out a more systematic data methodology for market reference and learning. In this issue of Insight Data, the OKX Strategy Team and the inventor of quantitative trading (FMZ) have an in-depth discussion on the concept of quantitative trading and how ordinary people can get started with quantitative trading. I hope it will be helpful to you. OKX Strategy Team:…