Original author: Evan Haozhe, Waterdrip Capital; Peter Boris, BitTap

介紹

The essence of blockchain is an extension of payment scenarios. In terms of payment scenarios, stablecoins not only occupy an important position in the cryptocurrency market, but also play an increasingly important role in global payments, cross-border settlements, etc. The centralized stablecoin market still accounts for more than 90% of the market share. Among them, USDT issued by Tether occupies an absolute dominant position in stablecoins. In addition, although more than $150 billion of stablecoins have been issued, according to 2024, The Federal Reserve reports that M1 is $20 trillion (including all cash in circulation, travelers checks, funds in current accounts, etc.), and the market value of stablecoins is only 0.75% of M1. There is still a long way to go. The launch of the Taproot Assets protocol indicates that stablecoins have broad potential in high-frequency, small-amount payment scenarios, and also indicates that the large-scale adoption of stablecoins as a regular means of payment is possible.

1. Stablecoin is the next trillion-dollar track in the future

The booming stablecoin market indicates that it has the potential to become a trillion-dollar market in the future financial sector. Currently, the market value of stablecoins has exceeded 160 billion US dollars, and the daily trading volume is as high as more than 100 billion US dollars. Policies and regulations related to stablecoins; at the same time, many institutions predict that stablecoins will bring in a new trillion-dollar market, and the new incremental market will mainly come from the widespread use of stablecoins in global payments.

Stablecoins can be divided into two categories: centralized stablecoins and decentralized stablecoins. Decentralized stablecoins can be further divided into algorithmic stablecoins, stablecoins issued by pledging crypto assets, and a combination of both. Currently, centralized stablecoins dominate the market. The two giants USDT and USDC, Tether and Circle, have issued USD stablecoins worth $114.46 billion and $34.15 billion respectively. Tether is a company with 125 employees. The scale of the company is 4.5 billion US dollars in gross profit per year. Such an attractive opportunity naturally attracted many large institutions to enter the market:

-

BlackRock has launched a tokenized fund, BUIDL, on Ethereum that aims to provide stable value and earn income, becoming a large tokenized fund with a market value of $384 million.

-

On July 24, according to Cailianshe, JD.com CoinChain Technology (Hong Kong) will issue a cryptocurrency stablecoin in Hong Kong that is anchored 1:1 to the Hong Kong dollar.

Centralized stablecoins have been widely adopted in the crypto ecosystem. Our daily transactions and settlements in DEX or CEX are all settled and traded through centralized stablecoins. It is a crypto asset, usually used for lending.

Although stablecoins play an important role in cryptocurrency transactions and DeFi, the exploration of their integration with physical businesses is still in its early stages. In the long run, the most promising application scenario for stablecoins is in the payment field, especially in cross-border Cross-border payments. Currently, cross-border payments involve multiple intermediaries, including card issuers, payment gateways, payment processors and other complex processes, which are not only expensive but also take a long time to settle. Stablecoins are not only another better choice, It is also an important channel for economic participation. As stablecoin regulation gradually develops towards compliance, its position in global payment scenarios will become increasingly important. Not only that, with the large-scale adoption of stablecoins in payment scenarios in the future, It can be integrated with DeFi to give birth to Pay Fi, realize interoperability, programmability and composability in payment scenarios, and form a new financial paradigm and product experience that traditional finance cannot achieve.

2. Taproot Assets Protocol + Lightning Network is expected to become the infrastructure of the global payment network

Currently, stablecoins are mainly circulated in ETH and TRON blockchain networks, but their handling fees are generally more than 1 U, and the on-chain transfer time is more than 1 minute. In contrast, the Lightning Network has faster, lower cost and The advantage of high scalability.

2.1 What is the Lightning Network?

The Lightning Network is the first relatively mature second-layer expansion solution for the Bitcoin network. After the Lightning Network white paper was released, multiple teams began to independently develop the Lightning Network, including Lightning Labs, Blockstream, and ACINQ. Taproot Assets is the first Lightning Network to be developed. An asset issuance protocol developed by Labs.

How is it implemented? The two parties first establish a two-way state channel. The two parties A and B who initiate the payment create a 2-2 multi-signature address on the chain, so that A and B can both use this address to send money. The new address can transfer bitcoins within the limit. Before the transfer, both parties send some locking data and record it to form a transaction payment, which can be paid back and forth multiple times. Until the transaction is recorded and both parties settle, the bitcoins of the new address will be transferred to the new address. Coins are transferred to both parties in the settlement amount. Therefore, only the latest version is valid, which is implemented and enforced by the hash time lock contract (HTLC). Either party can broadcast the latest version to the blockchain. Feel free to close this entry without any trust or escrow.

Therefore, both parties can conduct off-chain transactions without restrictions and use the Bitcoin chain as an arbitrator, but the smart contract will only be activated when the transaction is completed or an error occurs on one side of the transaction (for example, one party does not have enough balance in the wallet). The court will intervene and execute on the blockchain. This is similar to A and B signing many legal contracts, but they will not go to court every time they sign a contract. The court will only go to court after the final contract is confirmed or when non-cooperation occurs. intervention.

2.2 Lightning Network becomes the best infrastructure for global stablecoin payments

That is to say, users can send unlimited transactions to each other off-chain without causing congestion on the Bitcoin network itself; at the same time, they can rely on the security of the Bitcoin network. There is no upper limit (to scalability).

So far, the Lightning Network has been running for 9 years and is built on the most secure network in the current crypto ecosystem – the Bitcoin network (with more than 57,000+ nodes and Pow proof-of-work mechanism), which can maximize the security of Lightning. The security of the network.

As of now, the Lightning Network has a capacity of more than 5,000 bitcoins, 18,000+ nodes and 50,000+ channels worldwide. By establishing a two-way payment channel, it has achieved instant and low-cost transactions. The Lightning Network is being used by a large number of payment providers around the world. , merchant integration and use, is gradually becoming the most widely recognized decentralized solution for global payments.

Data source: https://mempool.space/zh/lightning

Bitcoin assets account for half of the crypto market value, and the Bitcoin ecosystem is returning to the upsurge with this cycle; Lightning Network, as the first second-layer expansion solution for Bitcoin, truly solves the idea of peer-to-peer global payment built by Satoshi Nakamoto The Lightning Network has become the most legitimate and consensus-based Bitcoin community, and is the best solution for ideal global payments.

2.3 Taproot Assets Protocol Completes the Last Mile of Lightning Network

The only drawback is that before the emergence of the Taproot Assets protocol, the Lightning Network only supported Bitcoin as a payment currency, and its application scenarios were very limited. Today, when Bitcoin has become digital gold, most people are unwilling to spend their Bitcoin. .

Although there have been some Bitcoin layer issuance protocols before, such as Atomical and BRC 20 based on Odinals, none of them support direct access to the Lightning Network. The launch of the Taproot Assets protocol can just solve this problem. It is led by Lightning Labs. Research and development, asset issuance protocol based on the Bitcoin network. Like the Odrinals protocol, anyone or organization can use the Taproot Assets protocol to issue their own tokens. It also supports the issuance of stablecoins corresponding to fiat currencies, such as USD, AUD, CAD, HKD Corresponding stablecoins, etc.

Compared with other asset protocols, the assets of the Taproot Assets protocol will be fully compatible with the Lightning Network, making it possible to use stablecoins for payments on the Lightning Network. This means that there will be a large number of new assets issued based on the Bitcoin network in the future. (especially stablecoins) will circulate to the Lightning Network, which in turn empowers the Lightning Networks payment layout and influence around the world.

Relying on the security and decentralization of Bitcoin, Lightning Labss goal of making the US dollar and world financial assets Bitcoin-based is becoming a reality. The launch of the Taproot Assets mainnet protocol means that the trillion-dollar payment scenario of stablecoins has been realized. Officially kicked off.

3. Taproot Assets Agreement (hereinafter referred to as TA)

The operating principle of the TA protocol is deeply rooted in Bitcoins UTXO model, and its implementation relies on the Taproot upgrade of the Bitcoin network. As the core elements of the TA protocol, the two drive the effective operation of the protocol.

Account

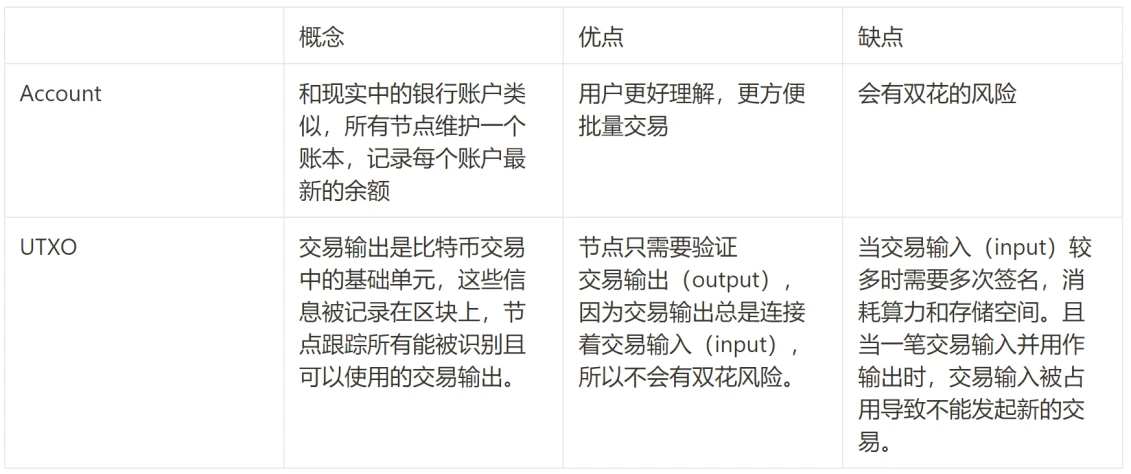

UTXO (Unspent Transaction Output) is a very important concept. It is the basis for all Bitcoin Layer 2 and Ordi, Runes protocol implementations. In fact, almost all public chains such as Ethereum and Solana use Account ( The following is an explanation and comparison of the two concepts:

Comparison between Account Model and UTXO Model

The account model is easy to understand, just like our Alipay account; for each income and expenditure, the corresponding personal intuitive feeling is the change of numbers in the account interface.

The UTXO model can be understood as a wallet of a person A. It contains checks authorized by B, C, and D to be redeemed by A, as well as checks authorized by A to be redeemed by E, F, and G. The balance = (the face value of the check from B, C, D to A) – (the face value of the check from A to E, F, G). The Bitcoin network is equivalent to a bank that can accept these checks, and it can trade these checks between users. The latest situation is used to calculate the latest balance in each users address.

Due to the unique nature of the UTXO model, it naturally eliminates the double-spending problem and provides higher security than the account-based model. In addition, the TA protocol fully inherits the security features of the Bitcoin network layer, avoiding erroneous transfers. or risk of leakage.

In addition, the TA protocol adopts the concept of one-time sealing, that is, each UTXO cannot be used again after it is confirmed to be spent; ensuring that assets move with UTXO. Under this mechanism, the miner who mines the longest chain has the right to the UTXO. The TA protocol has the final right of interpretation and can control its use. Unlike BRC 20, which relies on off-chain indexes to identify assets, the TA protocol enhances the security of transactions, avoids double-spending attacks, and eliminates errors or omissions that may be caused by centralized institutions. The risk of malicious behavior. These characteristics make TA protocol + lightning network a reliable payment scenario infrastructure.

3.2 Taproot upgrade to achieve more complex functions

The Taproot protocol upgrade in 2021 brought simple smart contract functions to the Bitcoin network. For example, wallet addresses in P2TR format can implement some more complex logic through Bitscript, making new and complex transaction types possible on the chain. The Taproot upgrade is shown in the following figure:

Taproot Mechanism, River: https://river.com/learn/what-is-taproot/

The most critical improvement is the implementation of multi-signature (multi-signature). This feature makes transactions for institutional users safer. In terms of public key addresses, the length of multi-signature addresses is the same as that of private wallet addresses, and the outside world cannot distinguish them, thus enhancing This technological advancement also provides a solid foundation for institutional and B2B (business-to-business) transactions, promoting wider commercial applications.

The most intuitive feeling presented to users is the change in the format of the wallet address. The wallet address starting with bc 1 p… is the wallet address that supports the Taproot upgrade.

3.3 TA Technology Principle

Initially, Ordinal, which ignited the Bitcoin ecosystem, and the derived BRC 20 protocol were both based on the account model, with balances tied to addresses. Asset issuance was done by adding specific identifiers or data to “mark” the smallest unit of Bitcoin, Satoshi. ), mapping Satoshi to a certain asset, and the data corresponding to the asset status is stored in the isolated witness part of the block (where the transaction signature or witness data is stored) in JSON format. Once an asset transaction occurs between the two parties, The script that records the asset changes will be inscribed into the block and interpreted by the off-chain indexer.

However, this approach will cause every transaction of Ordinals or BRC 20 assets to be recorded in the block, which will increase the block size, cause invalid data to accumulate and be permanently stored on the Bitcoin chain, and ultimately cause The data storage of full nodes is causing increasing pressure. In contrast, the TA protocol adopts a more efficient method. Assets are marked on each UTXO, and only the root hash of the script tree is stored on the chain. It is stored off-chain.

In addition, TA assets can be deposited in the payment channel of the Lightning Network and transferred through the existing Lightning Network, which means that TA assets are a new type of asset that can circulate on the Bitcoin mainnet and the Lightning Network.

As the name suggests, Taproot Assets is a protocol developed using Bitcoins Taproot upgrade (BIP 341). The Taproot upgrade allows spending a UTXO using either the original private key or a script on the Merkle tree.

In short, the Taproot Assets protocol expands on the Taproot upgrade and records the transition of asset status on the Taproot Merkle tree. At the same time, it uses the “one-time seal” feature of Bitcoin UTXO to Obtaining consensus on asset state transitions also means that the Taproot Assets protocol does not need to run off-chain indexers of other protocols.

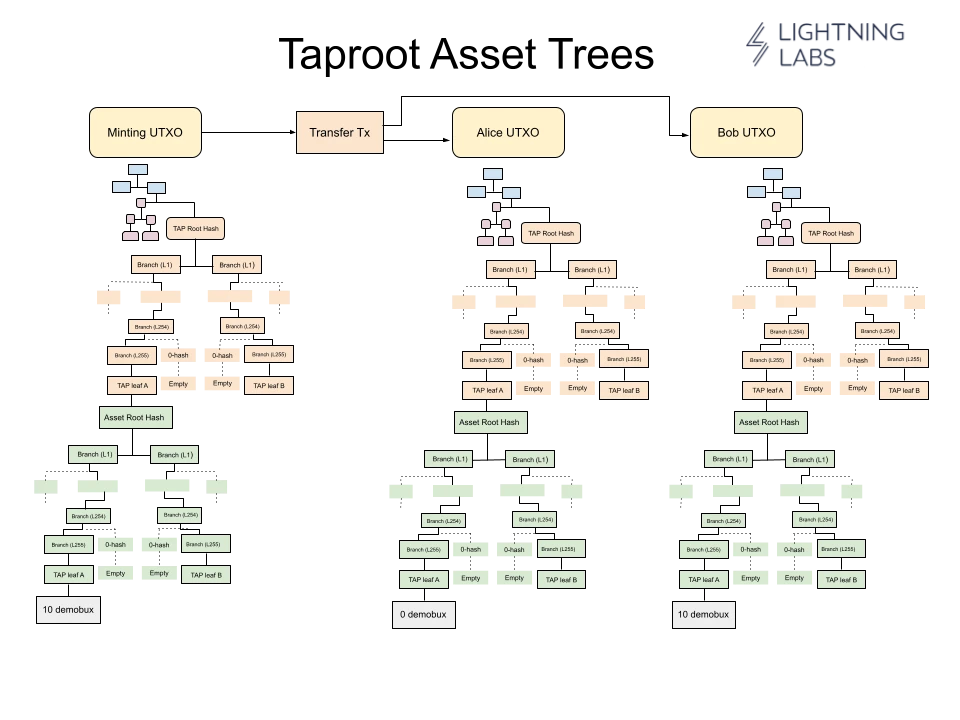

The Taproot Assets protocol uses the asset management structure shown below, and adopts the Merkle-Sum Sparse Merkle Tree (MS-SMT) to manage asset status. The Taproot Assets protocol defines the standards to be followed for asset status conversion. .

Taproot Assets Trees, Lightning Labs: https://docs.lightning.engineering/the-lightning-network/taproot-assets/taproot-assets-protocol

It should be noted that not all data in the Merkle tree is written to the Bitcoin chain. Only the root hash of the Merkle tree is written to the chain. In other words, no matter how large the asset data is, The transaction length on the Bitcoin chain remains unchanged. From this point of view, Taproot Assets is a protocol that does not pollute the Bitcoin chain.

3.4 Relationship between TA Protocol and Lightning Network

In the latest product release of Lightning Labs, Taproot Assets protocol assets can now be seamlessly integrated into the Bitcoin Layer 2 Lightning Network through the TA channel (Taproot Assets Channel). The Taproot Assets protocol has changed this situation, allowing assets, especially stablecoins, to be issued on the Bitcoin main chain through the Taproot Assets protocol. Enter the Lightning Network for circulation.

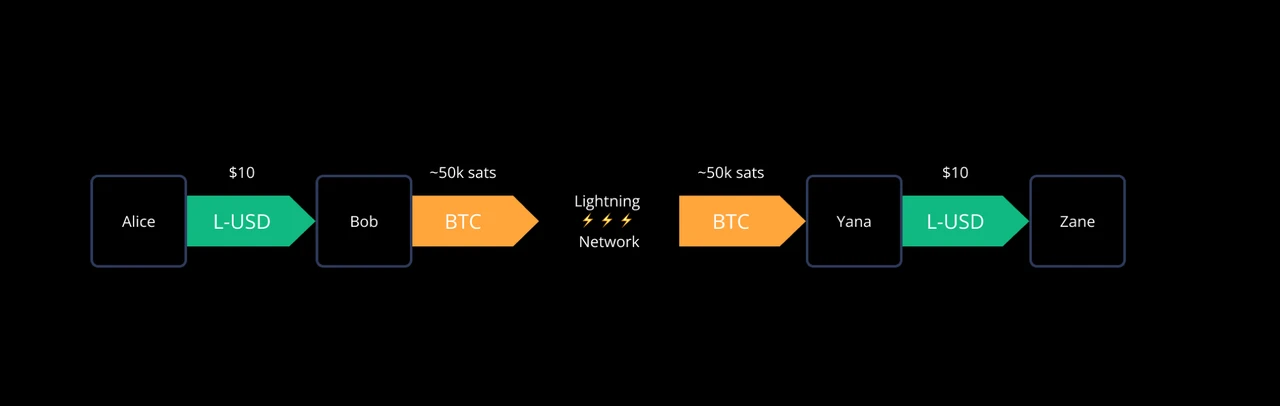

As shown in the figure below, the stablecoin asset L-USD was issued through the Taproot Assets protocol, and Alice transferred $10 worth of L-USD to Zane through the Lightning Network.

An example of a Taproot Assets payment made to the wider Lightning Network, Lightning Labs:

https://docs.lightning.engineering/the-lightning-network/taproot-assets/taproot-assets-on-lightning

The implementation principle of the TA channel is the same as that of the state channel, which is also based on the hash time lock contract. Because the Taproot Assets assets themselves are in a UTXO, the implementation mechanism of the TA channel has not changed, but the Channel can only circulate bits before. Coin, and the current Channel also supports the circulation of TA assets.

The TA protocol makes it possible to circulate assets other than Bitcoin through the Lightning Network, enabling seamless transfer of assets such as stablecoins on the Lightning Network.

3.5 User usage costs are too high, and the centralized hosting problem still needs to be solved

Although the TA protocol only records the root hash of each transaction on the chain to ensure the simplicity of the Bitcoin chain, the cost of doing so is that the asset data needs to be stored on each client off the chain. If a user wants to use Taproot Assets like Bitcoin, first, they need to have the private key of the UTXO (Virtual UTXO) corresponding to the asset, and second, they need to have the Merkle The relevant data of this asset in the tree.

At the same time, the official implementation of the Taproot Assets protocol (Tapd) is deeply dependent on the wallet service of the Lightning Node (LND) and has no account management mechanism. The unique architecture of the Lightning Network determines that its decentralized method is that users build their own nodes, while ordinary It is difficult for users to participate in setting up nodes, which is one of the important reasons why the Lightning Network has not yet been widely popularized.

Therefore, the current wallet services on the Lightning Network are basically custodial wallet solutions, which means that new assets issued by TA will also be stored in the custodial wallet. In the future, when a large number of stablecoins are circulated on TA assets, large amounts of Assets will be stored on TA first, that is, on the Bitcoin mainnet, because the mainnet is more secure and has the strongest consensus; only small assets and change will be recharged to the Lightning Network to meet payment needs. The storage and safe management of large assets in a more decentralized way so that users can fully own stablecoins is particularly important.

4. Self-custodial solution – the last piece of the puzzle for the Lightning Payment Network

At present, there are many teams in the market that have developed decentralized solutions for the circulation of TA assets on the Lightning Network. For example, LnFi has proposed a cloud hosting solution that allows users to easily deploy their own Lightning Network nodes, effectively reducing the user participation threshold.

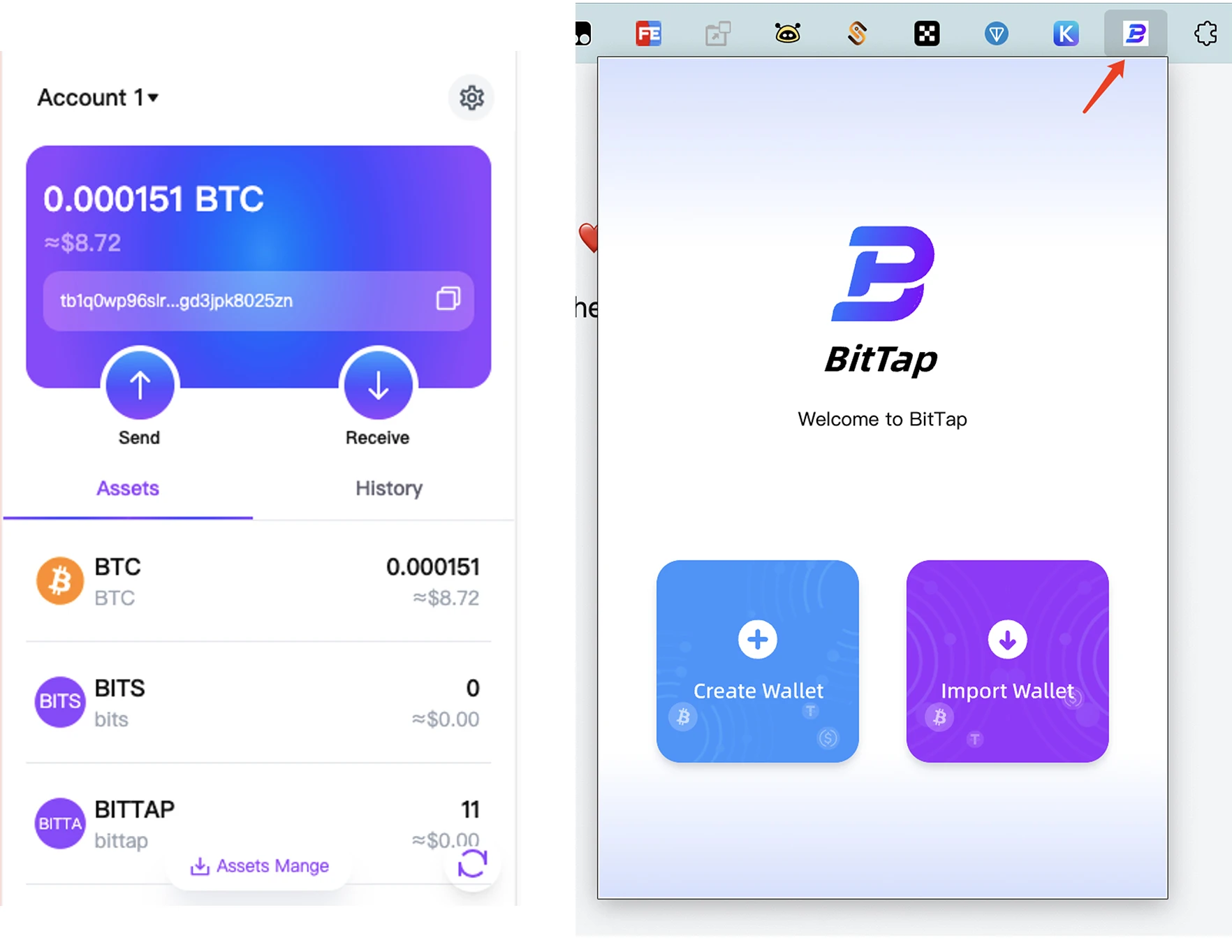

The BitTap team, which focuses on building the decentralized infrastructure of the TA protocol ecosystem, has developed TAs decentralized browser plug-in wallet, providing users on TA with the right to self-host their wallets.

BitTap wallet page display, source: BitTap team

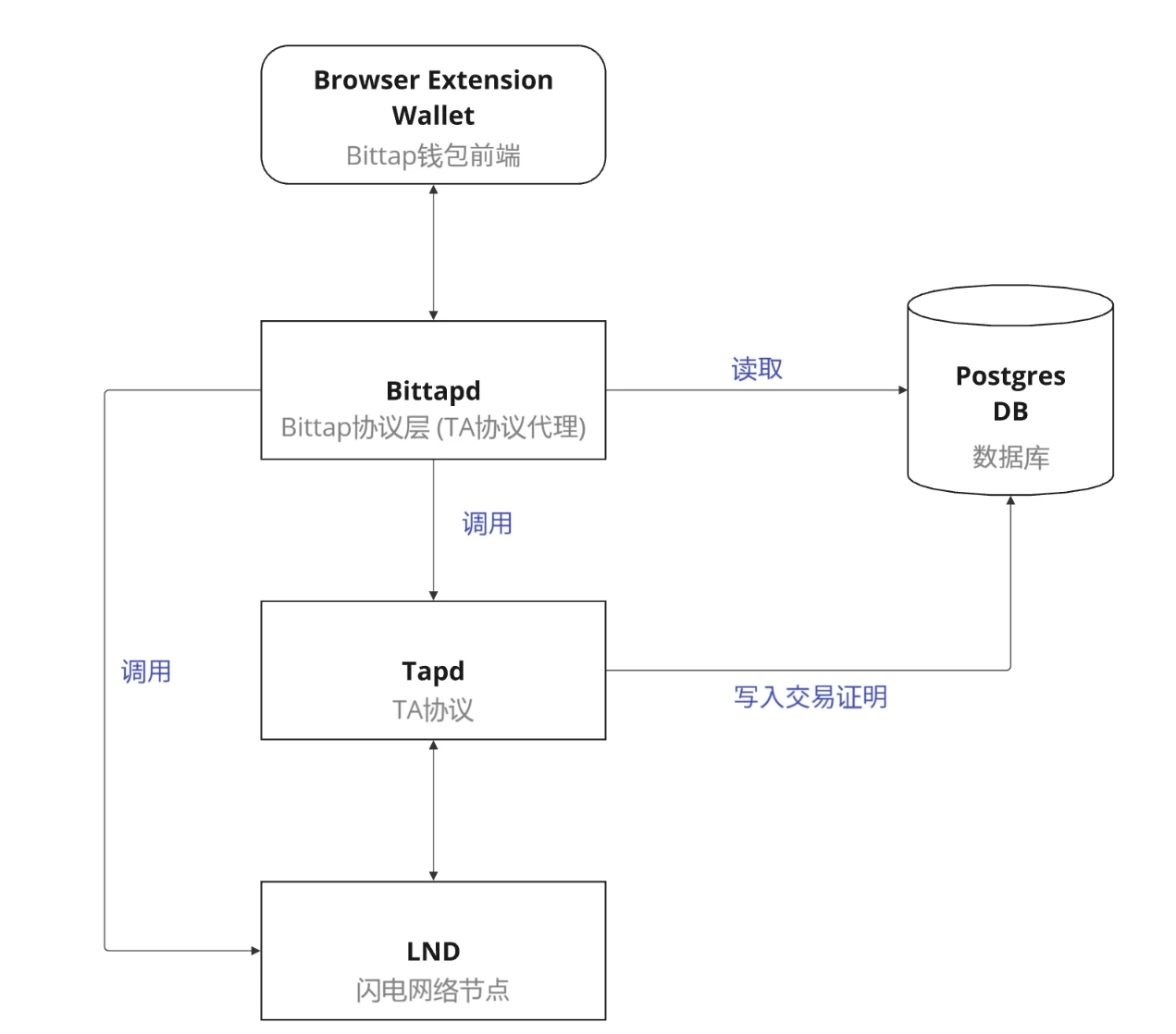

BitTaps innovative wallet protocol (Bittapd) keeps the users private key completely in the hands of the wallet user. When a transaction needs to be signed, Bittapd interacts with Tapd on behalf of the user, so that users can enjoy a completely decentralized wallet like Metamask. When stablecoins are issued and circulated on TA, users can use the BitTap wallet to store and transfer stablecoin assets on the Bitcoin mainnet, and can freely transfer change to the Lightning Network. The technical principle is as follows:

BitTap wallet architecture, BitTap Docs: https://doc.bittap.org/developer-guides/overview

The Bittapd protocol is equivalent to a decentralized proxy for the TA protocol. It transforms Tapds native centralized escrow account system into a decentralized solution. It also serves as a network communication and forwarding task for plug-in wallet users when requesting transactions. Role.

5. 結論

Stablecoins have gained widespread attention and application around the world, gradually expanding from the narrow scenario of cryptocurrency transactions to an important choice for global payments. The Lightning Network has become a global payment method with its low fees and fast transactions. At the same time, the launch of the Taproot Assets protocol further enhances the functionality of the Lightning Network, making it possible to issue and circulate stablecoins on the Bitcoin network. This protocol solves the problem of Bitcoins high volatility. Significantly improved its applicability in the payment field.

In addition, in response to the centralization problem of the Lightning Network and its wallet services, decentralized wallet solutions such as those developed by the BitTap team have emerged on the market, providing users with a more secure and decentralized way to manage assets. Assets+Lightning Network becomes the last piece of the puzzle for global payment facilities.

Although traditional payment infrastructures such as Alipay, PayPal and Stripe use their transaction volume, large number of users, cooperation and supervision by the government, and brand recognition as endorsement, their hosted nature and reliance on complex Internet and bank The system will still lead to inefficiency, malicious behavior or the possibility of government sanctions. In addition, in the field of cross-border payments, due to strict regulatory policies and restrictions of the institutions themselves, payment accounts are often subject to the location and transfer amount. These factors together affect the security and flexibility of traditional payment methods.

The payment infrastructure composed of TA protocol + Lightning Network is not only comparable to traditional payment institutions in terms of immediacy, but also achieves the de-trust of payment through sophisticated code design. At the same time, the self-custody solution in the ecosystem guarantees the users autonomy over assets. , which can support the free transfer of TA protocol tokens anytime, anywhere and without restrictions; it has brought the freedom of payment to an unprecedented level.

參考

Web3 Payment Research Report: From Electronic Cash, Tokenized Currency, to the Future of PayFi: https://www.theblockbeats.info/news/54626

OKX Ventures Research Report: Understanding the Development Pattern and Future Direction of Stablecoins in One Article: https://www.theblockbeats.info/news/48341

What Is Taproot and How Does It Benefit Bitcoin? https://river.com/learn/what-is-taproot/

About BitTap: https://doc.bittap.org/

Taproot Assets Protocol: https://docs.lightning.engineering/the-lightning-network/taproot-assets/taproot-assets-protocol

Ten years of stablecoins: What impact have they had on global development trajectory, economic impact, and monetary system? https://foresightnews.pro/article/detail/65637

This article is sourced from the internet: Taproot Assets: The next growth point for the stablecoin track to exceed a trillion-dollar market value

Related: 2024RWA Industry Development Report

1. RWA Development History The initial rise of tokenization in 2017 was primarily centered around creating digital assets on the blockchain that represented illiquid physical assets such as real estate, commodities, art, or other collectibles. However, with the emergence of a high-yield environment, the digitization of financial assets such as treasuries, money market funds, and repurchase agreements has become particularly important in terms of tokenization. We believe that the potential for traditional financial institutions to use this space is huge and could become a core part of the next crypto market cycle. Although full implementation may take 1-2 years, compared to 2017, when the opportunity cost was about 1.0-1.5%, the current nominal interest rate is over 5.0%, making the capital efficiency of instant settlement even more important for financial institutions.…