原作者:Mary Liu,BitpushNews

Financial markets were volatile on Wednesday as the U.S. core CPI fell for the fourth consecutive month in July and recorded the slowest growth rate since early 2021, which may further guide the Federal Reserves 25 basis point interest rate cut in September.

At the close of U.S. stocks, the SP and Dow Jones indexes rose 0.38% and 0.61% respectively, while the Nasdaq index was flat.

Despite the rise in U.S. stocks, crypto markets are struggling. On-chain data showed that the U.S. government transferred 10,000 Silk Road-related bitcoins to Coinbase Prime during the midday trading session on Wednesday, which seemed to trigger market concerns about another large-scale sell-off. At press time, Bitcoin fell below $59,100, a 24-hour drop of nearly 3%.

Altcoins fell more than they rose. Among the top 200 tokens by market capitalization, Toncoin (TON) led the gains, up 8.5%, followed by Aave (AAVE) and Notcoin (NOT), up 8.3% and 5.3% respectively. Safe (SAFE) fell 8.1%, Celestia (TIA) fell 7.9%, and ConstitutionDAO (PEOPLE) fell 7.4%.

The current overall market value of cryptocurrencies is $2.09 trillion, and Bitcoin’s market share is 55.8%.

“As Bitcoin remains below the 20-day, 50-day, and 200-day moving averages, bears are eyeing further declines with a target of $57,500. If this level is breached, we could see pressure below at $55,000,” said analysts at Secure Digital Markets.

More than $1 billion USDT flowed out of crypto exchanges yesterday, and downward pressure increased further

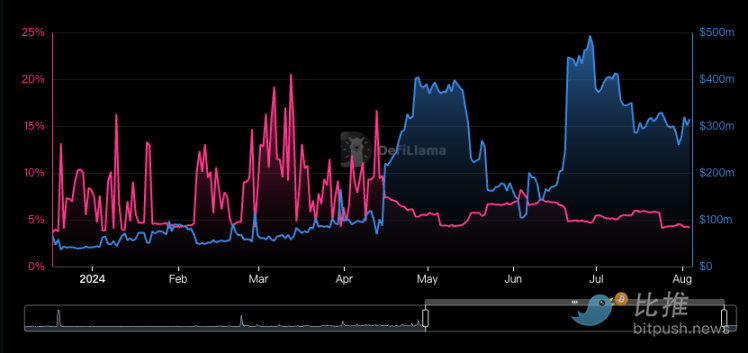

Crypto analysis firm IntoTheBlock noted that on Tuesday, more than $1 billion in Tether stablecoin USDT was withdrawn from cryptocurrency exchanges, marking the largest Tether outflow since May.

Analysts noted: While deposits are generally seen as positive (indicating that users are preparing to buy assets), withdrawals may have more subtle explanations. For example, users may move funds to DeFi, seeking returns outside of centralized exchanges. However, in recent cases where withdrawals exceeded $1 billion, Bitcoin began to trend downward shortly afterwards, suggesting that investors may be taking a risk-averse stance and moving funds to safer environments such as cold wallets to cope with market volatility.

However, it is worth noting that DefiLlama data shows that the yield for providing USDT liquidity in DeFi pools has been on a downward trend.

Additionally, data compiled by CoinGlass shows that August and most of September have been negative monthly returns in Bitcoin’s history.

Cryptocurrency analyst Miles Deutscher noted that Bitcoin’s current price action is similar to last year’s, when BTC fell from the top of the $30,000 range to $24,000 during a massive leveraged run in August and traded mostly sideways for two months before starting to rise in October.

“Retail interest is fading fast, there is apathy from existing market participants, and a lack of a clear narrative, which feels eerily similar to August-October last year,” Deutscher said.

The bull market will continue until 2025

Although Bitcoin is facing upward resistance in the short term, analysts at ByBit believe that the bull run that began in early 2023 will continue until 2025.

“Our analysis suggests that the current bull run has lasted approximately 624 days, with a trough-to-all-time high ratio of 3.5x,” ByBit analysts said in a report published Wednesday. “This is significantly lower than the 20x trough-to-peak ratio observed in the previous cycle (2019-2022). However, based on limited historical data from the three previous cycles, averages suggest that the current cycle may take another 350 days to surpass the previous peak.”

“These observations suggest that the current market rally may not have reached its true peak yet, which is different from the typical pattern of previous Bitcoin bull and bear cycles,” the analysts said. “The lack of vitality in altcoins and Bitcoin’s consolidation (rather than a sustained record rise) mean that the current market dynamics are different from past cycles.”

They also found that several macroeconomic factors that have historically influenced Bitcoin prices had limited impact during this cycle.

“For example, historically, loose monetary policy and a weak dollar have been bullish for Bitcoin, yet Bitcoin is still experiencing strong gains despite the lack of these conditions in the current environment,” they wrote.

“Furthermore, personal savings rates have previously been positively correlated with Bitcoin bull runs, but this relationship is not evident this time around,” they noted. “These observations suggest that current Bitcoin market dynamics are different from the patterns observed in previous boom and bust cycles.”

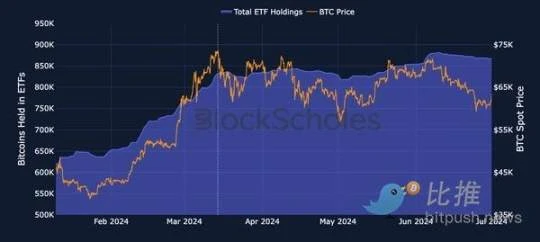

The analyst highlighted that Bitcoin’s price peak in March coincided with the end of massive inflows into Bitcoin spot ETFs, saying, “Following this price peak (and continuing to this day), the velocity of inflows into BTC spot ETFs abruptly moderated. This suggests that the pool of new institutional demand was temporarily saturated. Crucially, the decline in new demand subsequently impacted Bitcoin spot price response to the halving event on April 20, 2024 (one month later).”

But history shows that Bitcoin’s biggest gains usually occur after the halving, and ByBit analysts said: “The current low market sentiment does not necessarily mean the end of the Bitcoin bull market. A clear conclusion can be drawn from the behavior of the derivatives market in the last round of Bitcoin cycles, that is, a decline in sentiment, even to a relatively low level, does not always mean the end of the bull market. In fact, the final peak of the 2021 cycle was achieved after the Bitcoin hash rate suffered a near-systematic blow, when market sentiment fell to a historic low, before the market recovered and continued to rise.”

“This historical precedent suggests that the current depressed market sentiment may not accurately predict the end of the Bitcoin bull run, and derivatives data tracked by Block Sholes suggest that the current pessimism may be temporary,” they concluded.

This article is sourced from the internet: More than $1 billion USDT flows out of exchanges, BTC faces upward resistance

Related: Why have altcoins performed poorly in this cycle?

Original author: Miles Deutscher, Crypto Analyst Original translation: Mia, ChainCatcher In the cryptocurrency space, the over-fragmentation of altcoins has become a core factor in their weak performance in this cycle. After further research, I found that this fragmentation poses a serious threat to the overall health of the cryptocurrency market. Unfortunately, it seems that we have not yet found a clear solution to this challenge. I wrote this post to hopefully provide more insight into this critical issue that will impact the future of cryptocurrency. It will explain how we got here, why prices behave the way they do, and the path forward. Cryptocurrency market flooding: token inflation concerns behind the surge in new projects In the cryptocurrency market in 2021, there is a frenzy of enthusiasm. New liquidity is…