過去24小時,市場上出現了許多新的熱門幣種和話題,這可能是下一個賺錢的機會, 包括:

-

The sectors with strong wealth creation effects are: blue chip public chain sector, RWA sector, Bitget platform currency

-

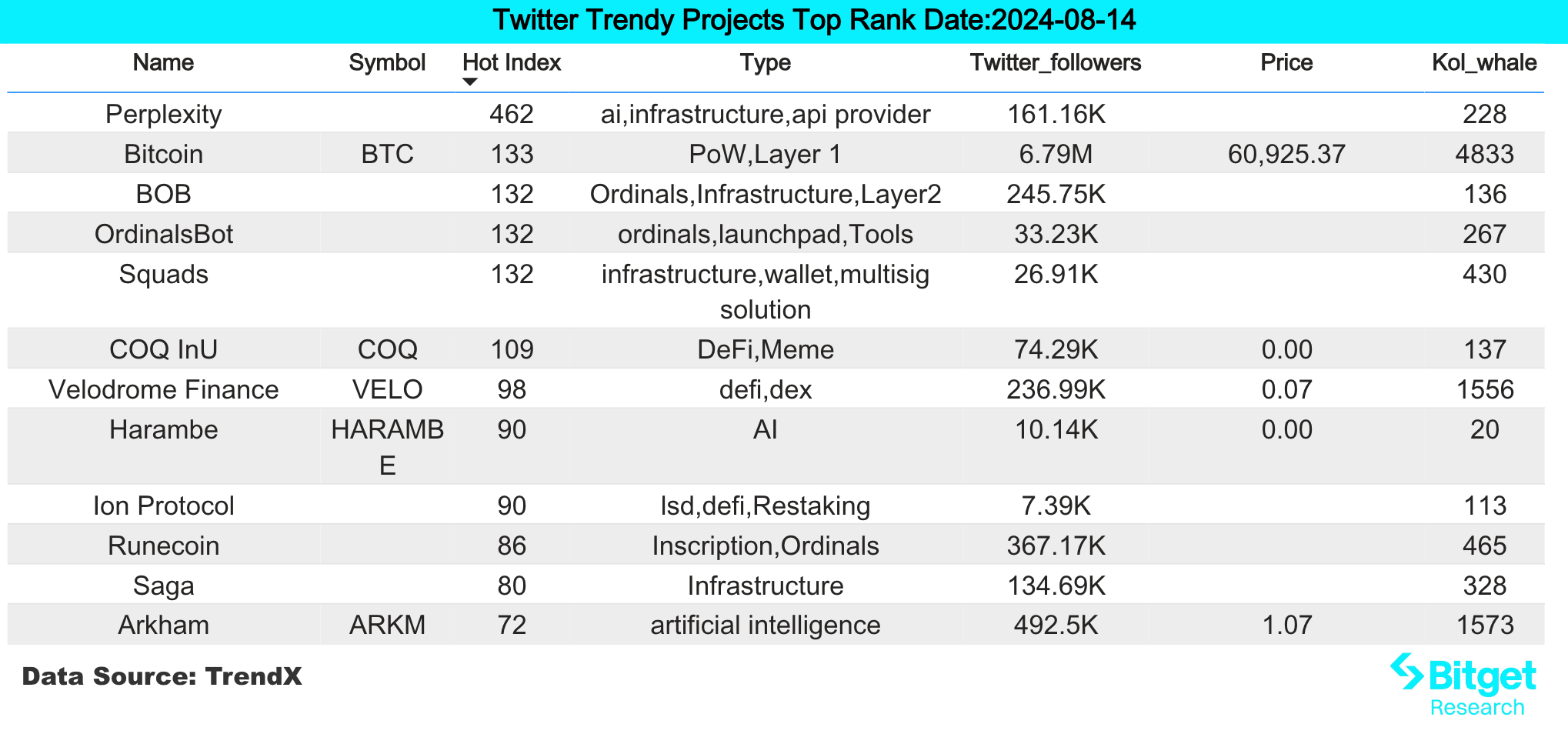

Hot search tokens and topics by users: Pump.fun, Perplexity

-

Potential airdrop opportunities include: Tonstakers, Kelp DAO

Data statistics time: August 14, 2024 4: 00 (UTC + 0)

1、市場環境

In the past 24 hours, BTC briefly broke through $61,000, and the current box fluctuates between $59,000 and $61,000. The intraday amplitude has narrowed significantly, indicating that the staged rebound may encounter pressure. ETH briefly broke through $2,700, and the weekly capital flow of Ethereum spot ETF achieved positive growth for the first time, with a net inflow of 31,500 ETH last week, equivalent to $75.07 million. This round of capital inflow was mainly driven by Blackrock, which has purchased a total of $168.55 million worth of ETH. In terms of the market, the top blue-chip public chain sector has risen steadily in the past 7 days. At the same time, the number of Bitget Wallet users has exceeded 30 million, and the number of downloads in July has exceeded Metamask. Investors can continue to pay attention to BWBs performance in the future.

Macroeconomically, the increase in U.S. producer prices in July was lower than expected, with the PPI in July unchanged from the previous month. The more closely watched CPI data will be released on Wednesday, and the index is expected to show a slight increase. Against the backdrop of fading inflationary pressures, weak employment data in July prompted economists to expect the Federal Reserve to make a series of interest rate cuts starting next month. According to CMEs Fed Watch data, the probability of the Federal Reserve cutting interest rates by 25 basis points in September is 50.5%, and the probability of cutting interest rates by 50 basis points is 49.5%.

2. 創造財富的部門

1) Sector changes: blue chip public chain sector (FTM, APT, TON)

主要原因:

-

The new public chain sector has been falling and consolidating for a long time. In the environment of oversold market rebound, it has been the first to attract the attention of funds; ETH has been too weak recently, and institutions have frequently sold ETH in the secondary market. Funds have a consensus on the layout of new public chains; at the same time, Aptos has launched the second Tapos game, which can be used on browsers and TG, and has received a lot of attention recently;

Rising situation: FTM, APT, and TON rose by 5%, 9%, and 6% respectively in the past 24 hours;

影響後市的因素:

-

TVL continues to rise: According to DefiLlama data, Aptos TVL exceeded $400 million, a record high. At the same time, the total locked-in amount of TON ecosystem exceeded $80 million, also a record high, which is 4 times the TVL value in early March. In the future, we can continue to pay attention to the changes in TVL of each ecosystem, and maintain capital inflow to continue investing in the top public chains.

-

Ecosystem construction continues to gain momentum: Recently, OKX Ventures and Aptos Foundation, a global blockchain leader, announced that they will jointly launch a new fund of US$10 million to support the growth of the Aptos ecosystem and the widespread adoption of Web3.

2) Sector changes: RWA sector (ONDO, Pendle)

主要原因:

-

The RWA sector is still the most popular sector in the current cryptocurrency industry, and is considered to have a large market size. ONDO and Pendle occupy the RWA treasury tokenization track and the crypto asset interest rate swap market track respectively. The asset volume ceiling of these two tracks is extremely high, and the protocol income that the protocol can generate increases with the growth of asset volume. Investors should pay special attention to each round of market rebound.

Rising situation: ONDO and Pendle rose by 3.4% and 6% respectively in the past 24 hours;

影響後市的因素:

-

協議總資產規模:該類協議的現金流產主要取決於協議的資產規模。隨著協議容納的資產規模逐漸增大,協議所能產生的收入也會逐漸增加,相應的幣價也會有強勁的表現。

-

Policy impact: As the cryptocurrency industry gradually passes various legislations and social recognition gradually increases, policies that are favorable to this track will also be one of the main factors for the rise of tokens in this track. As more asset management giants enter this field, I believe that the subsequent development of this field will steadily improve.

3) The sectors that need to be focused on in the future: Bitget platform coins (BGB, BWB)

主要原因:

-

Bitget近日宣布,為了協助Bitget Token(BGB)的長期發展,提升BGB持有者權益,Bitget將升級代幣智能合約,擴大BGB在DeFi、DEX等去中心化應用中的使用和 GameFi。 Bitget錢包用戶數突破3000萬,7月下載量超過Metamask,讓市場看好幣價上漲。

具體幣種列表:

-

BGB: Bitget platform currency, the smart contract of the token will be upgraded recently. In the future, BGB will be deeply integrated into the development of DeFi, DEX, Gamefi and other applications. The potential demand for BGB may surge in the future, so it is recommended to pay close attention.

-

BWB:Bitget錢包代幣,總市值僅US$5億。皮夾賽道未來具有良好的成長潛力,適合長期持有。

3.用戶熱搜

1) 流行的Dapp

Pump.fun:

According to DefiLlama data, Solana meme coin platform Pump.funs protocol revenue in July reached 28.73 million US dollars, a record high. The platforms cumulative protocol revenue has reached 89.03 million US dollars. In the past three months, the Solana meme coin platform pump.funs fee account has converted a total of 222,073 SOLs into 35.54 million USDCs, with an average price of 160 US dollars. As pump.funs popularity also means that the meme token transactions on the Solana chain have entered a white-hot state, the marginal income and wealth effect of the god disk are decreasing.

2)推特

Perplexity:

Prediction market Polymarket is partnering with AI-driven search engine Perplexity to display news summaries of events. When users click on an event on Polymarket, they can now see relevant news summaries based on Perplexity search results, as well as a search box that users can use to ask more questions.

Perplexity completed a $73.6 million Series B financing in January this year at a valuation of $520 million, led by IVP. Perplexitys total financing has reached $100 million. With Perplexitys search tools, users can instantly get reliable answers to any question, with complete sources and citations. There is no need to click on different links, compare answers, or dig for information endlessly. Since the project adopts equity financing, it is unlikely to issue cryptocurrency.

3) 谷歌搜尋區域

從全球角度來看:

爆破:

According to official news, Blast announced that the second round of distribution of the second phase of Gold (gold points) has been launched, with a total of 11 million Gold distributed to DApps. This distribution officially reserves 10 million Gold for existing DApps on the Blast mainnet and 1 million Gold for newly launched DApps. According to defillama data, the TVL of the Blast mainnet has fallen by more than 60% from its peak and is now reported at US$883 million. At the same time, the price of Blast tokens has fallen by more than 46%, which is a serious decline, and the current market situation is unclear. Users are advised to participate with caution.

從各地區熱搜來看:

(1) From the perspective of Asia: The projects and sectors that each region pays attention to are very scattered, without much in common, but there are some sporadic hot spots in a small range. For example, Vietnam, the Philippines and Singapore are more concerned about RWA-related projects, and Indonesian layer 1 projects frequently appear in hot searches. Malaysia is more concerned about mainstream currencies such as Bitcoin.

(2) In European and American countries, the hot search words are relatively scattered and have no universal characteristics. At the same time, the enthusiasm for memes in European and American countries has declined, and the hot searches are mainly concentrated on pepe and floki.

(3) In addition to the TON ecological hot words in the CIS region, hot words such as solana ecological lst project sanctum and ai type also appeared in the hot searches.

潛在的 空投 機會

噸斯塔克斯

Tonstakers 是 TON 生態系統中最大的流動性質押服務提供者。使用者可以在協議中質押 TON,以獲得 3.8% 的年化回報。目前專案TVL為2.56億美元,潛在估值較高。

該計畫受到了Ton基金會的關注,目前該協議有68,000名質押者。計畫與Ton核心開發商、Tonkeeper、OKX等機構合作,未來發幣將獲得支持。

具體參與方式: 1)造訪專案官網,點選立即質押; 2) 將 Ton 錢包連結到質押。

海帶DAO

Kelp DAO is currently building an LRT solution on EigenLayer. Its re-staking token is rsETH. Currently supported LSTs include ETHx (Stader), sfrxETH (Frax) and stETH (Lido). According to DefiLlama data, Kelp DAO TVL is currently $617 million.

Kelp DAO has launched Kelp Miles incentives. Kelp Miles is used to track users contributions to Kelp and to determine future reward distribution ratios. Kelp Miles depends on the users LST re-staking amount and staking days. This project is also known as the top unsold project in Restaking, and it is estimated that the coin will be issued in Q2.

How to participate: (1) Link your wallet to Kelp DAO; (2) Prepare ETHx (Stader), sfrxETH (Frax) and stETH (Lido) or ETH for investment; (3) Hold the converted rsETH and accumulate points.

原文連結: https://www.bitget.fit/zh-CN/research/articles/12560603814350

【免責聲明】市場有風險,投資需謹慎。本文不構成投資建議,使用者應考慮本文中的任何意見、觀點或結論是否適合自己的具體情況。根據此資訊進行投資的風險由您自行承擔。

This article is sourced from the internet: Bitget Research Institute: The market remains in a narrow range of fluctuations, and BWB rises against the trend

Original author: Richard Yuen Original translation: TechFlow The downstream front-end application layer will become one of the largest components of the on-chain economy Many are calling for more applications, but for the wrong reasons — this is not about VCs trying to drive up their infrastructure assets, or looking for the next 100x speculative story. Here are some ideas. 1. Value chain – upstream, midstream and downstream To understand how the crypto/blockchain space might evolve, we can draw on the evolution of mature industries such as the internet. In a mature Internet industry, its value chain can be divided into upstream, midstream and downstream. Upstream: The underlying technologies and infrastructure that make the Internet possible; including hardware, connectivity, networks, core software and protocols, etc. Midstream: Platforms built on underlying infrastructure;…