原作者: 漢格瑞

原文翻譯:TechFlow

Note: The content of this article only represents the original authors views, please DYOR.

Good morning, fellow furry friends!

Some might say the era of triple-digit annualized returns is over, but they just don’t know where to look.

Here are our Humble Farm recommendations this week.

1. 木星

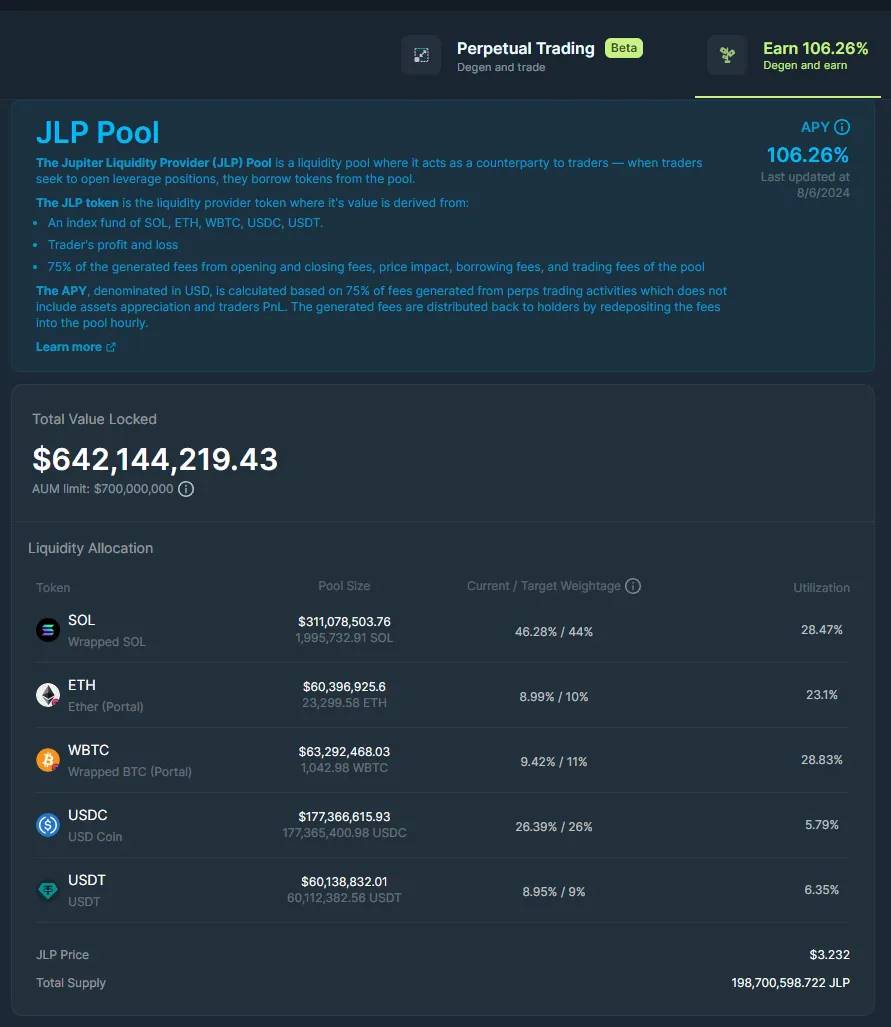

Our first opportunity to staking this week is Jupiter, the leading DEX aggregator and perpetual exchange on Solana.

Over the past year, Jupiter has solidified itself as a blue chip protocol on Solana, with JLP proving to be a safe haven during market volatility.

Currently, liquidity providers (LPs) are earning triple-digit annualized returns while maintaining exposure to major assets such as BTC, ETH, and SOL.

In addition to earnings, providing liquidity may also qualify you for Jupiter’s next airdrop round in January.

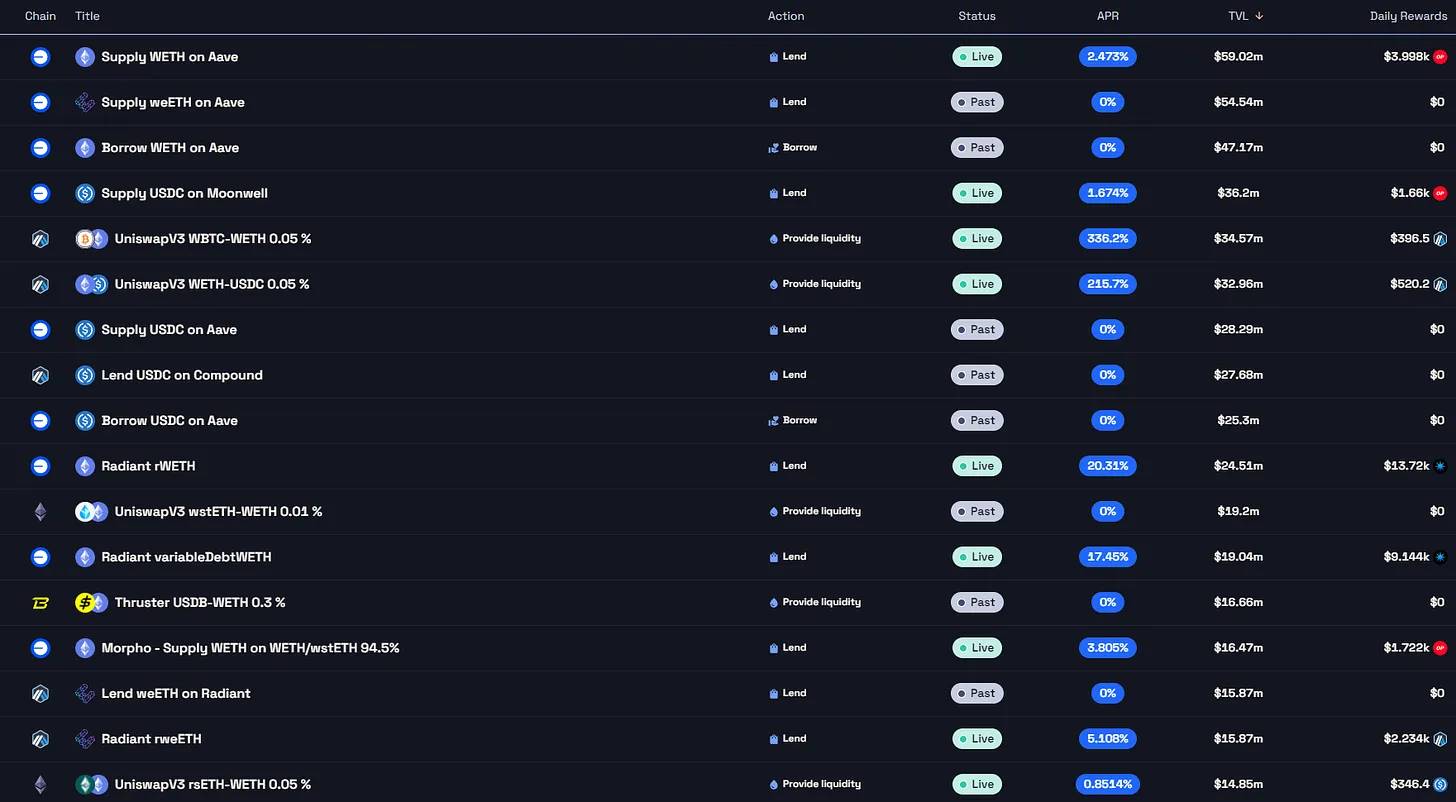

2. Merkl

Next up is Merkl, a rewards hub designed to explore and distribute token rewards for liquidity pools across various chains.

Optimism Superfest rewards are being distributed via Merkl, along with incentives for many other events.

Merkl is one of our favorite places to look when looking for new liquidity pools to provide liquidity.

Some of our favorite liquidity pools currently include:

• tBTC/WETH @ 90% APR

• wBTC/uniBTC @ 31% APR

• wstETH/ezETH @ 25% APR

3. Dolomite

Our next opportunity this week is Dolomite, a multi-chain money market and margin trading protocol.

Dolomite serves as a unified platform to earn additional yield on your tokens while being able to borrow on margin against your portfolio.

With Dolomite, you can deposit various assets on Arbitrum and Mantle to accumulate earnings, points, and Dolomite ore.

Depositing assets such as GLP, DAI, and USDM currently offers annualized yields between 20-40%, while also allowing users to borrow against their portfolios.

4. Brahma

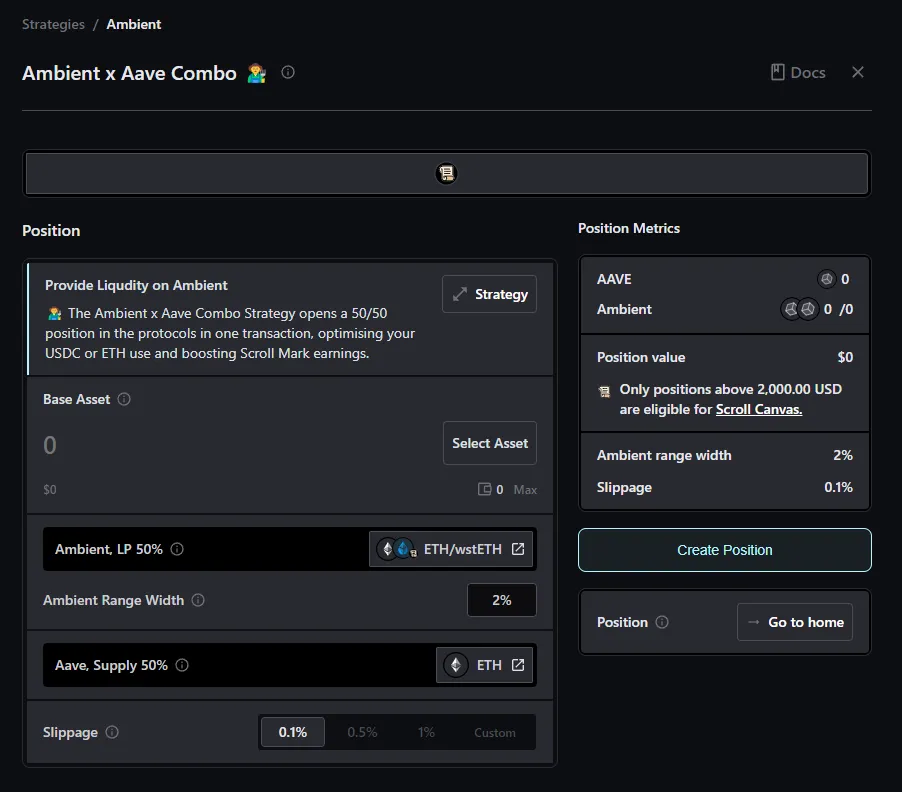

Next up is Brahma, a platform designed to simplify and integrate the decentralized finance experience.

Through the Console, users can securely store and manage their funds while gaining access to a variety of protocols and one-click strategies.

Brahma has just launched a Scroll strategy that improves yield efficiency through Aave and Ambient, which is worth a try if you are doing Scroll farming.

Additionally, users who hold assets in Brahma until the end of this month will receive additional ARB incentives.

5. 卡米諾

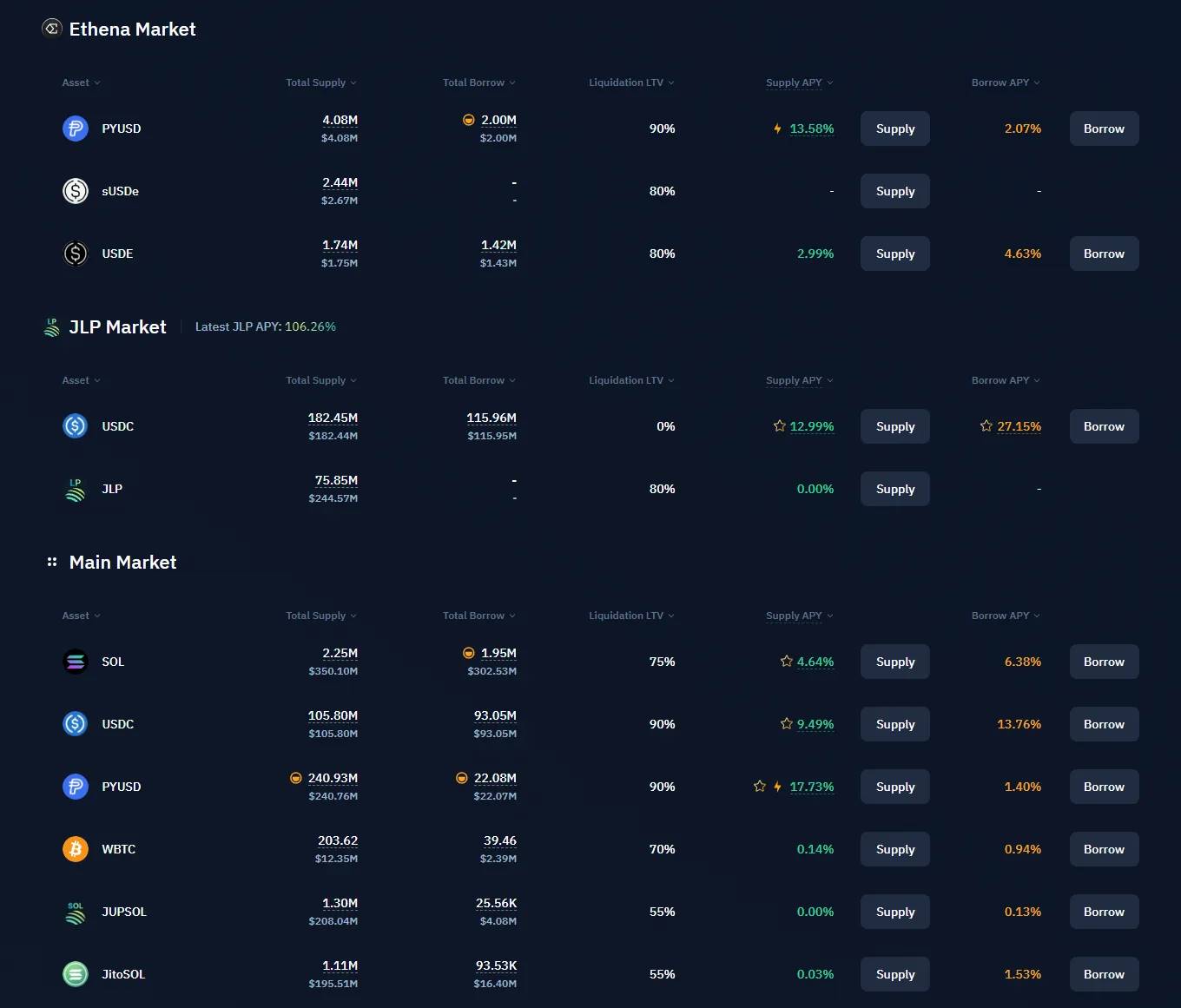

Our final opportunity this week is Kamino, a lending, liquidity, and leverage protocol built on Solana.

Even after the token was launched, TVL (total value locked) continued to grow, thanks to Kamino’s points program and the launch of new products.

Kamino offers a variety of yield opportunities, from lending to liquidity provision and even revolving lending.

Here are some of our favorite opportunities right now:

• JLP @ 285% APY (leveraged)

• pyUSD @ 83.2% APY (leveraged)

• sSOL/SOL @ 27.3% APY

This article is sourced from the internet: List of 5 good places for mining profits this week

相關:SignalPlus 波動率專欄 (20240626):恐慌消退

昨天(6月25日),比特幣現貨ETF終於停止流出,選擇權市場體現的不確定性也基本回落。自6月24日門頭溝賠償受託人宣布將於7月初啟動還款以來,由於市場恐慌,比特幣價格出現短暫下跌。 Galaxy Research 負責人 Alex Thorn 在發文中表示,破產案中最終分配給個人債權人的代幣數量比人們想像的要少,約為 65,000 BTC(遠低於媒體先前公佈的 140,000 個),而且由此產生的比特幣拋售壓力將小於預期。這主要是因為部分債權人選擇了債務承兌(類似於FTX打包出售債務)並收到提前付款,而這筆錢最終流向了…