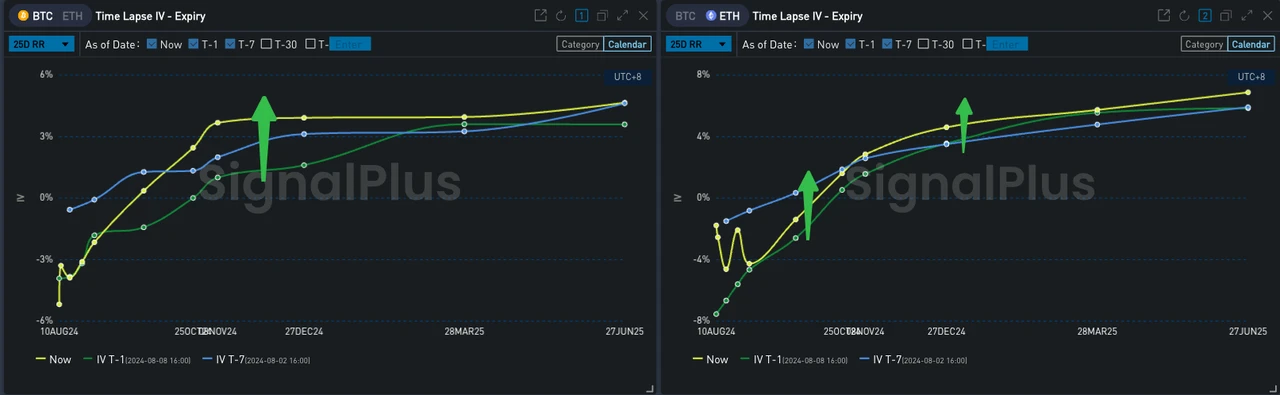

In the past 24 hours, the cryptocurrency market has focused on two focuses: why did IV collapse, and why did it rise? We can find some clues along the timeline.

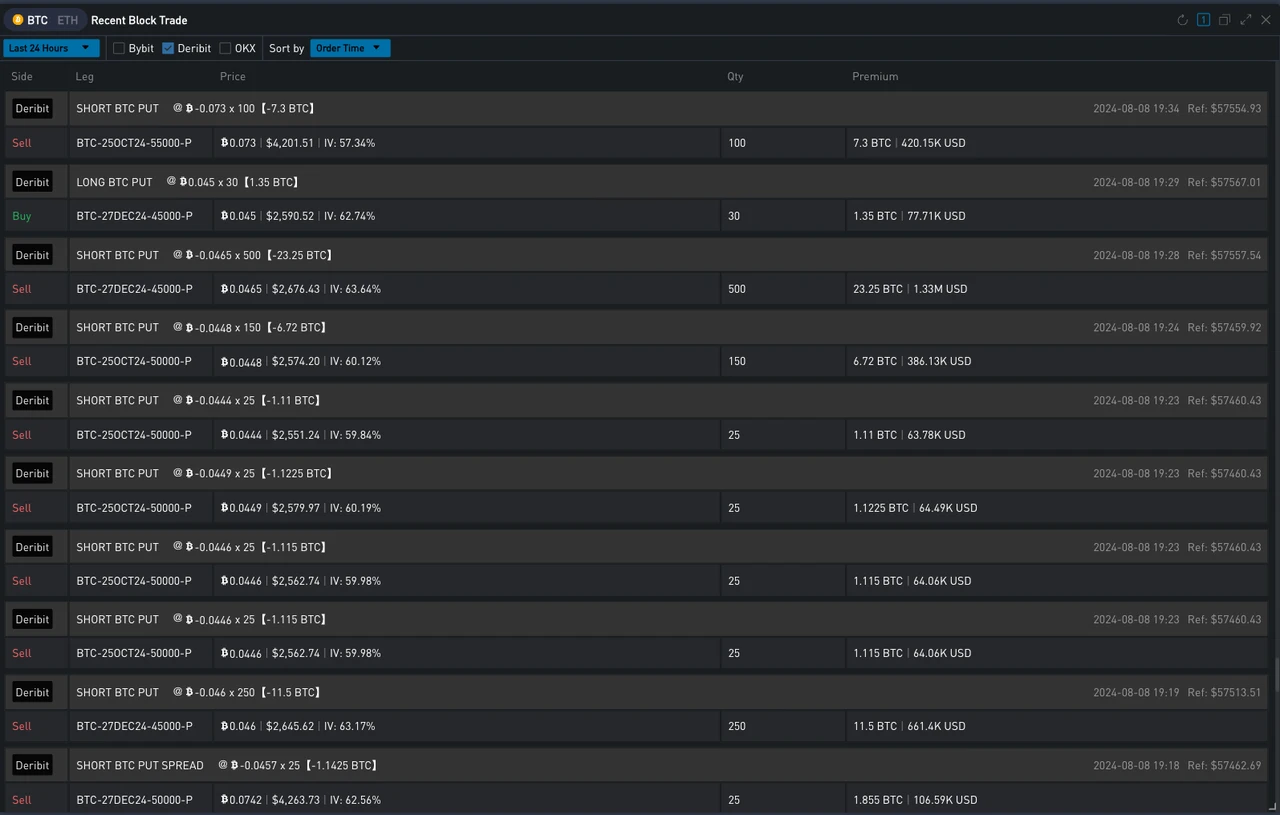

Things started around 7:30 pm on August 8. Prior to this, yesterdays BTC market gradually pushed the overall implied volatility of the market to a high point. Just as the price calmed down and slightly consolidated around 57,500, a large number of Dec and Oct put option transactions suddenly appeared on the Deribit market, and the IV at the end of the year was smashed down by 3% Vol in a short period of time, driving the entire Vol Curve to move downward significantly.

Source: SignalPlus Time Lapse IV / Historical IV

Source: SignalPlus Trade Volume by Expiry; Recent Block Trade

Source: Deribit (as of 9 AUG 16: 00 UTC+ 8)

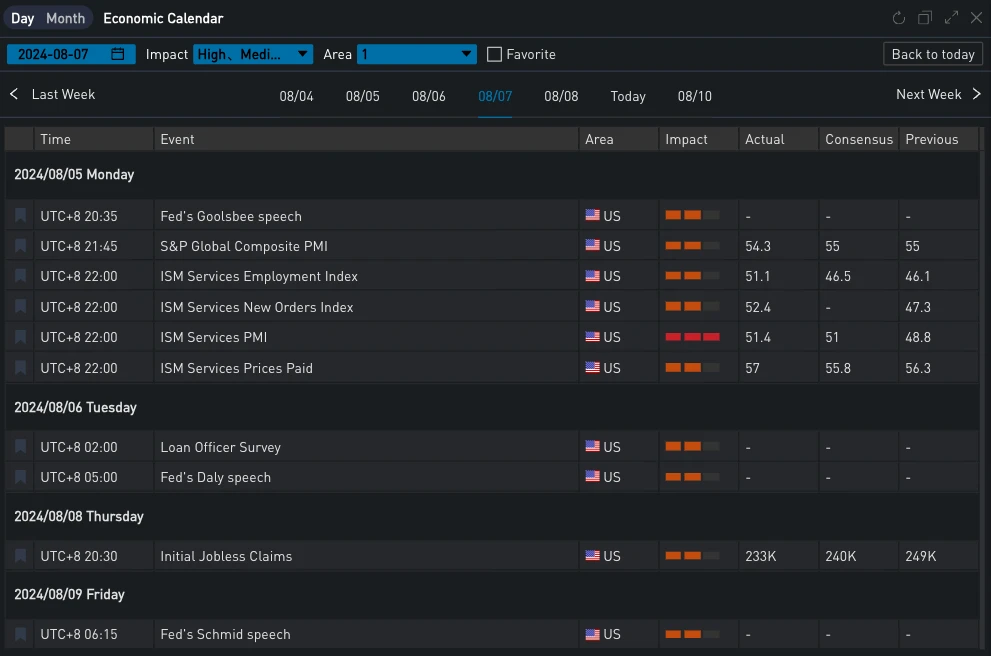

Later at 08:30 pm, the United States announced a new round of initial jobless claims, with the data falling by nearly the largest amount in a year, alleviating peoples concerns about the slowdown of the worlds largest economy. U.S. stocks rebounded strongly (Dow/SP/Nasdaq closed up 1.76%/2.3%/2.87% respectively), and U.S. Treasury yields rose. As a risky asset with a high positive correlation with the U.S. dollar, BTC prices were also boosted, rising from 57,500 all the way to break through 60,000 U.S. dollars, and once challenged the key support level of 62,000.

But back to the macro side, this week was tough for investors around the world, with SoFi’s Liz Young Thomas commenting: “It was up and down, all over the place. We learned how sensitive the market is to U.S. economic data, how widespread the yen carry trade is, and how investors are used to seeing rate cuts as a solution to everything.”

It is precisely in such a volatile market that the markets anxiety and uneasiness gradually accumulated, and investor sentiment has been in a depressed state, which caused such a large fluctuation in this data, which is usually not placed at High-Importance. Perhaps the panic that began at the beginning of this month was a bit exaggerated, but this data does not necessarily calm the panic of recession. Lakos-Bujas of JPMorgan Chase warned the market that the stock market is no longer a one-way upward trade, but is increasingly a two-way debate around the downside risks of economic growth, the timing of the Feds interest rate cuts, excessive positions, overvaluation, and the presidential election and rising geopolitical uncertainties.

Source: TradingView; SignalPlus, Economic Calendar

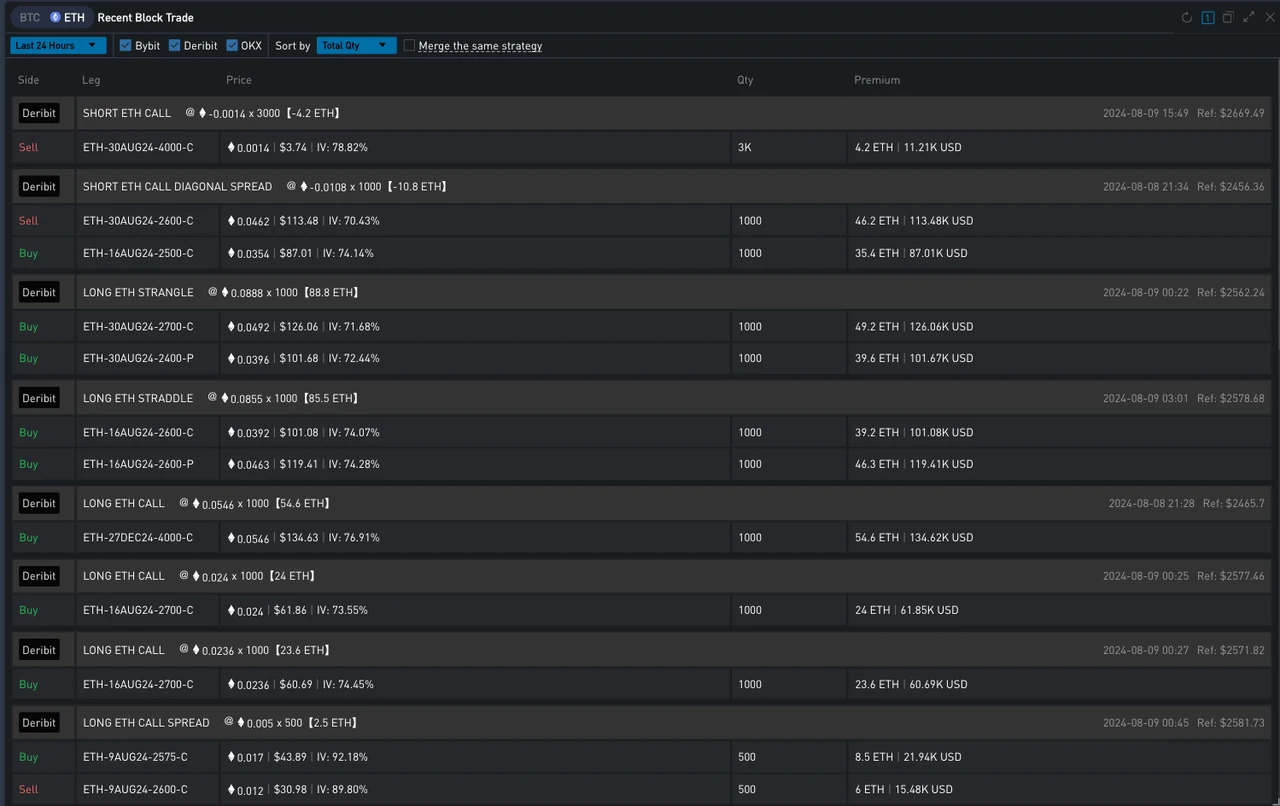

In addition, after these two rounds of events, we observed that the rise in coin prices led to a rebound in Vol Skew. The large-scale sell-off from the bearish side significantly increased the slope of BTC from October to the end of the year, causing the 25 dRR indicator to rise sharply in a local range. The volatility surface underwent a significant shift overnight.

來源:SignalPlus

Data Source: SignalPlus, ETH Top Trade

Data Source: SignalPlus, BTC Top Trade

您可以使用t.signalplus.com的SignalPlus交易風向標功能來獲取更多即時加密貨幣資訊。如果您想在第一時間收到我們的更新,請關注我們的推特帳號@SignalPlusCN,或加入我們的微信群(新增助手微信:SignalPlus 123)、Telegram 群和 Discord 社區,與更多朋友交流互動。 SignalPlus 官方網站:https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240809): Two Questions

Related: Decoding Musks view on cryptocurrency: Not just for fun

Original|Odaily Planet Daily ( @OdailyChina ) Author: Wenser ( @wenser 2010 ) On July 22, Musk changed his profile picture to a laser eye at the request of X platform user @Chriswinig. Due to the existence of the Bitcoin Meme #LaserRayUntil100K (meaning that the laser eye avatar will remain until the Bitcoin price breaks through $100,000), this move is seen as Musks another open support for the cryptocurrency industry (although he has now changed back to his original avatar). For a time, Musk once again became the focus of cryptocurrency, and it has been three years since he last changed his profile picture to Laser Eye Girl. Odaily Planet Daily will sort out and summarize Musks related behaviors and concepts in the cryptocurrency industry in this article, so that readers…