Bitcoin and Ethereum dominated the early days of the cryptocurrency market, but as the industry rapidly iterates and matures, more and more emerging projects are emerging. The new coin market is an important part of the cryptocurrency field and plays a key role in the innovation and development of the industry.

The change in the total market value of the new coin market reflects the progress of innovative technologies and the expansion of application scenarios, which has promoted the evolution of the crypto industry landscape. Its large market penetration potential has increased the global awareness and acceptance of cryptocurrencies. For example, emerging applications such as DeFi and NFT meet users needs for financial innovation and digital art, and in turn promote the further development of the new coin market. As of July 2024, the total market value of the new coin market accounts for about 30%, reflecting its important position in the overall market.

In response to active users enthusiasm for participating in the new coin market, OKX officially launched the pre-market trading function, allowing users to trade delivery contracts for tokens that have not yet been launched, aiming to provide users with a safe and reliable platform to participate in the price discovery of new tokens and lead the innovation of industry trading tools. Users can upgrade the OKX APP to v 6.7* and above to experience it immediately.

About Pre-Market Trading

The delivery contract of OKX pre-market trading is essentially a USDT-based delivery contract, which is usually delivered before the new currency is launched on the currency-to-currency trading market. Through OKX pre-market trading, users can trade before the currency is officially launched, buy and sell digital asset delivery contracts launched on the platform first, and enjoy 2x leverage.

Generally speaking, during the pre-market trading stage, users can gain profits from price fluctuations by going long or short; during the contract delivery stage, OKX pre-market delivery contracts will be delivered at a specific price on the delivery date; but during the coin-to-coin listing stage, OKX pre-market delivery contracts do not guarantee that their currencies will eventually be listed in spot trading.

From the perspective of industry development, delivery contract trading for tokens that have not yet been launched not only provides an effective price discovery and liquidity improvement mechanism, but also provides users and project parties with better risk management tools and market participation opportunities.

It is worth noting that the OKX pre-market trading market has some different product mechanisms from the standard delivery market. The following will select some key mechanisms for interpretation. Among them, the index price uses the latest transaction price of the OKX pre-market delivery contract as the index price, and the index price is also used to determine the delivery price of the contract.

Interpretation of core elements

The question that users are more concerned about is whether OKX pre-market trading will affect the price of subsequent currencies listed on OKX? In fact, the price of OKX pre-market trading market is determined by the market behavior of buyers and sellers, and the price may not accurately reflect the actual issuance price of new currencies. Although pre-market trading can reflect market expectations, the price of the currency itself may be affected by other factors, and the two are not directly correlated.

In addition, the following table summarizes the core elements of the delivery contracts of OKX pre-market trading. Next, we will interpret several of them, such as delivery time, price, etc.

First, the delivery time. 1) If the new currency is issued normally and is confirmed to be listed on the OKX currency market, the delivery contract of the pre-market transaction will be delivered before the currency is listed on the spot market. The specific delivery date will be notified separately in the form of an announcement. After the delivery time is determined, it will be displayed in the delivery date on the trading page.

2) If the project party cancels the issuance of new coins or does not announce the coin issuance plan within half a year, or if the platform decides in advance not to list on the OKX coin-to-coin market due to other risk control issues, OKX may delist the contract in advance. The specific delivery date will be notified separately in the form of an announcement. After the delivery time is determined, it will be displayed in the delivery date on the trading page.

3) For API users: The expTime field of the instrument-related interface returns the settlement date. The settlement date can be modified, and API users should pay attention to the changes of expTime through the push interface or the scheduled query interface.

Second, leverage. The leverage currently supported by OKX pre-market trading is 0.01 to 2 times, with a maximum of 2 times.

Third, the position limit rules for the gradient tiers. The maximum position that a user can open is the maximum position corresponding to the leverage multiple selected by the user in the gradient tier table. The maintenance margin amount of the position is equal to the maintenance margin rate (MMR) of the tier corresponding to the users position size in the gradient tier table multiplied by the users position size.

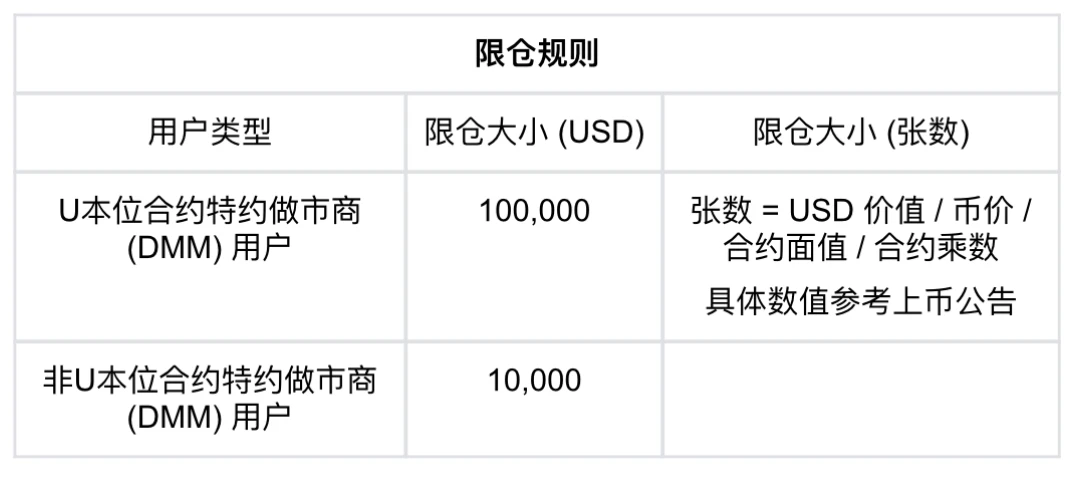

Please note that the maximum position size for the above gradient levels is in USD, which needs to be converted into a specific number of contracts based on the currency price and contract face value:

Number of contracts = USD value / coin price / contract face value / contract multiplier (For the specific number of contracts, please refer to the listing announcement)

Fourth, position limit rules. For pre-market contracts, the position size that users can open must meet the position limit rules of the gradient level while also meeting the position limit size of the user. For users of U-standard contract DMMs, the position limit size is 100,000 USD; for users of non-U-standard contract DMMs, the position limit size is 10,000 USD.

Double-sidedness: highlights and risks

Through OKX pre-market trading, users can meet various needs in different dimensions. For example, they can participate in transactions before the token is officially launched, take the lead in trading, and capture market opportunities. Understanding the expected value of tokens before the official launch, participating in the activity and market reaction of pre-market trading can enhance the communitys confidence in the token project, verify market demand and project potential through actual transaction data, and increase price discovery opportunities and transaction transparency.

例如, you can lock the price before the token is officially launched, and use delivery contract transactions to hedge the risk of price fluctuations, thereby avoiding the uncertainty brought by market fluctuations. You can also choose more trading strategies and flexibly adjust the trading portfolio according to market conditions. In short, through OKX pre-market trading, users can make trading decisions more actively and flexibly in the cryptocurrency market, and enjoy more market opportunities and higher trading efficiency.

Although OKX continues to work hard to provide you with a better trading experience, trading pre-market contracts carries high risks because the pre-market market is more prone to lower liquidity, higher price volatility, and users face a greater risk of forced liquidation. Not all currencies traded in pre-market contracts will eventually be listed on OKX.

Currently, OKX reserves the right to adjust listings, extend or terminate contracts, and contract settlement dates at its sole discretion.

It is important to note that pre-market contracts have a fixed expiration date that is linked to the listing of the relevant underlying tokens and are settled only in USDT upon expiration, so users are not trading the underlying tokens and should not expect to receive the underlying tokens upon contract expiration. In addition, since the transaction is conducted before the listing of the relevant currency, there is no clearly identifiable price source for the underlying tokens, so the price of the contract may be different from the price of the underlying tokens at and after listing. OKX may suspend or terminate such pre-market contract transactions at any time at its sole discretion.

教學

How to use OKX pre-market trading?

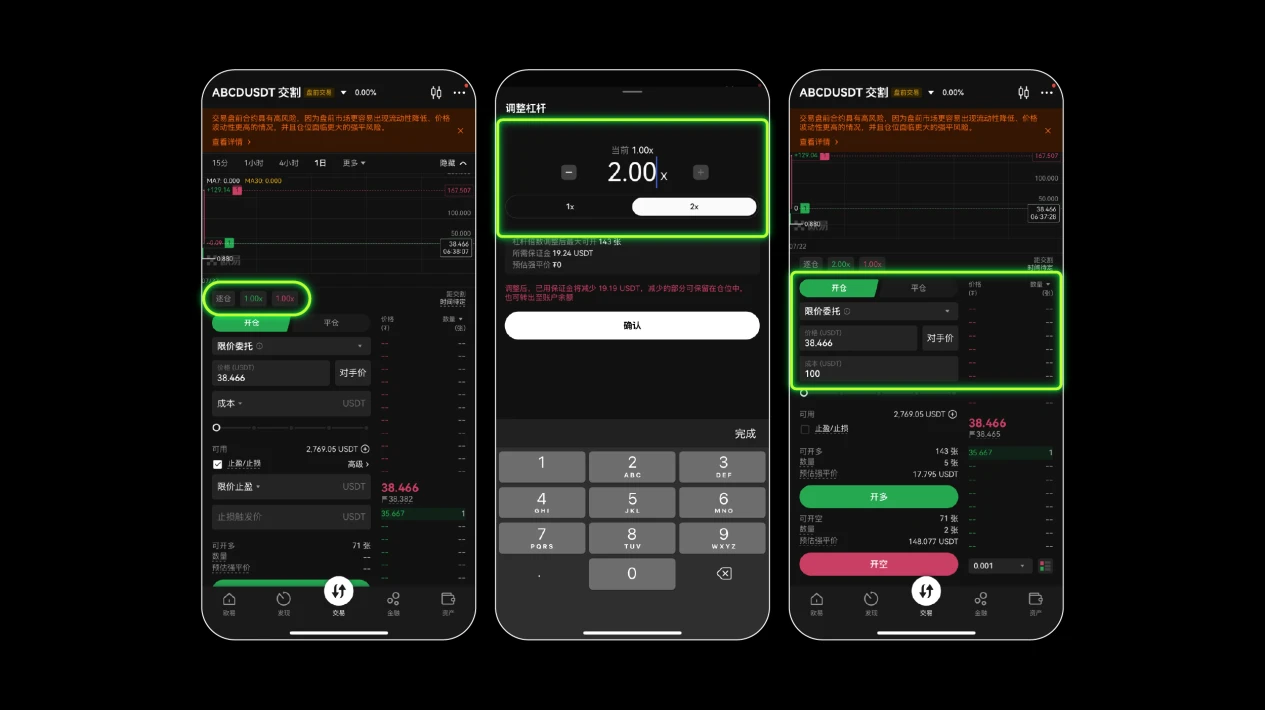

1) Open the OKX App, click Trade, and select Pre-Market Trading. Or click More in the upper left corner and select Pre-Market Trading.

2) Here we take ABCD as an example. After clicking Go to Trading, Start Pre-Market Trading enters the currency trading interface

3) Pre-market trading is limited to position-by-position mode. You can click on the leverage multiple to modify it freely, and the maximum is 2X. The other operation procedures are the same as most trading procedures. You can set the order mode, price, cost and other parameters according to your personal preferences to open long or short positions.

Tool Innovation

From an industry perspective, OKX pre-market trading demonstrates its strong technological innovation and ability to respond to user needs, bringing more trading models and tools to the cryptocurrency market, attracting more users and liquidity, and helping the market discover and determine the price of tokens in advance. This price discovery mechanism helps to form a market consensus before the token is officially launched, making market prices more transparent and stable, and promoting the progress of the industry.

From the users perspective, you can hedge the risk of price fluctuations before the token is officially released, and avoid the possible price fluctuation risks after the launch, thereby achieving more effective risk management. Or you can have the opportunity to participate in new projects in advance, so you can plan and participate in new projects earlier, breaking the restrictions.

From a project perspective, OKX pre-market trading provides an additional liquidity channel for new tokens. Through delivery contracts, traders can buy and sell tokens before they are launched, increasing market activity and liquidity. For new projects, this can gain market attention and financial support before formal trading. In addition, new token projects can demonstrate their market demand and user interest before they are officially launched, which not only enhances the confidence of the project party, but also enhances the trust of potential users and the community, which helps the project succeed after it is launched.

But any tool has two sides, and OKX pre-market trading is no exception. While providing opportunities, it also brings risks. Users need to conduct a comprehensive assessment before participating and cannot be blind. The new coin market is like a bright star in the world of cryptocurrency, shining with infinite possibilities. OKX launched the pre-market trading function to better convey this possibility.

免責聲明

本文僅供參考。本文僅代表作者觀點,不代表OKX立場。本文無意提供 (i) 投資建議或投資推薦; (ii) 購買、出售或持有數位資產的要約或招攬; (iii) 財務、會計、法律或稅務建議。我們不保證此類資訊的準確性、完整性或有用性。持有數位資產(包括穩定幣和NFT)涉及高風險,並且可能會大幅波動。您應該根據您的財務狀況仔細考慮交易或持有數位資產是否適合您。請諮詢您的法律/稅務/投資專業人士以了解您的具體情況。請負責了解並遵守當地適用的法律法規。

This article is sourced from the internet: OKX pre-market trading: the first choice for SGX contract trading tools, leading cutting-edge innovation

According to incomplete statistics from Odaily Planet Daily, there were 23 blockchain financing events announced at home and abroad from June 3 to June 9, which was a decrease from last weeks data (32). The total amount of financing disclosed was approximately US$234 million, which was an increase from last weeks data (US$178 million). Last week, the project that received the most investment was blockchain expansion service provider Avail ($43 million); followed by DePIN project io.net ($40 million). The following are specific financing events (Note: 1. Sort by the amount of money announced; 2. Excludes fund raising and MA events; 3. * indicates a traditional company whose business involves blockchain): Blockchain expansion service provider Avail completes $43 million Series A financing, led by Founders Fund and others On June 4,…