原作者: DeFi 投資者

原文翻譯:TechFlow

Ethereum’s Future Outlook

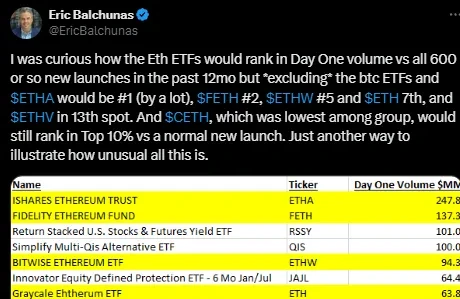

The spot Ethereum ETF is finally available.

Judging from the initial trading volumes, the launch has been quite successful.

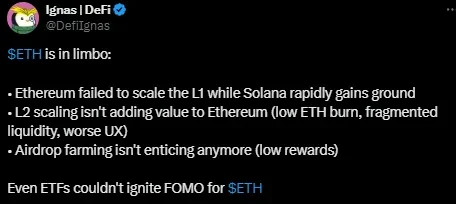

However, as we can see, ETH started to fall after the launch.

In this article, I will discuss the reasons behind this, the future trend of ETH price, and two important catalysts that Ethereum is about to usher in.

My expectations for ETH price movement

I think there are two main reasons why ETH is currently underperforming BTC:

-

The launch of the spot ETH ETF was a “sell the news” event: This phenomenon also occurred in the short term after the launch of the spot BTC ETF.

Since the spot ETH ETF was approved months ago, everyone who wanted to buy ETH had plenty of time to do so. Therefore, catalysts that are known in advance tend to become “sell the news” events.

-

The launch of the ETH ETF unlocks $9 billion in ETH in the Grayscale Ethereum Trust: these ETH have been locked up for years, and now holders can finally sell them, so many people are selling.

So how long will it take for this decline to end?

In the case of BTC, the spot BTC ETF bottomed out about two weeks after its launch. Afterwards, the price moved sideways for a few days before hitting a new all-time high.

If demand for spot Ethereum ETFs is high in the coming weeks, a similar situation could also occur with ETH. But for this to happen, net flows into the ETH ETF would need to turn positive.

For example, yesterday the ETH ETF saw $133 million in outflows due to selling pressure from the Grayscale Ethereum Trust.

There are also some legitimate concerns about ETH in the short term:

Ethereum’s Upcoming Catalyst

I also want to touch upon two important catalysts coming to Ethereum.

The first is the approval of Ethereum ETF staking. This could significantly increase demand for spot Ethereum ETFs. Although the annual ETH staking yield of about 3.2% does not seem like much, due to the low annual inflation rate of ETH and the fact that staking can earn returns, this may make ETH more attractive to some institutions than BTC.

根據 the SEC commissioner , the Ethereum collateralized ETF “can always be reconsidered,” so its approval is only a matter of time.

The second catalyst is the release of Pectra, Ethereum’s next hard fork. This major upgrade is expected to take place in late Q4 of this year or Q1 of 2024. Pectra will introduce several major changes:

-

Making Ethereum account addresses more programmable

-

Increase the maximum stake for ETH validators from 32 to 2048 ETH

By making Ethereum account addresses more programmable, Pectra will bring significant on-chain user experience improvements.

For example, it will support batch sending of transactions, develop social recovery features for wallets, and allow dApps to pay users’ gas fees. Such user experience upgrades are what cryptocurrencies need to achieve mass adoption.

This article is sourced from the internet: After the launch of the ETF, what other long-term catalysts does Ethereum have?

原作者:Sui Foundation 編譯:Odaily Planet Daily Asher Sui Bridge 是專為在 Sui 之間橋接資產和數據而設計的原生橋接協議,今天在測試網上上線。作為原生協議,Sui Bridge 可以輕鬆安全地在以太坊和 Sui 之間傳輸 ETH、wBTC、USDC 和 USDT,使其成為 Sui 基礎設施的重要組成部分。 Sui Bridge 利用 Sui 固有的安全性和速度,由 Sui 網路驗證器提供支持,並提供了進入 Sui 的新路徑。隨著 Sui 生態系統的發展,多樣化、安全、可靠的橋接解決方案成為健康 DeFi 生態系統的基本組成部分。橋接促進了不同區塊鏈之間的互通性,使資產和數據能夠跨網路流動。這不僅增強了流動性,也擴大了數位資產的效用,使得…