Original author: Terry

In the fiercely competitive L2 track, Arbitrum and Optimism, which were originally sitting on the Diaoyutai, seem to have ushered in unprecedented variables.

According to the L2 BEAT data in the figure below, as of July 23, Bases TVL has climbed to nearly US$7.5 billion, successfully surpassing Optimisms US$6.87 billion, ranking second and becoming the second largest L2 network after Arbitrum.

If we recall that Base itself is a super chain launched based on OP Stack, this disciple surpasses the master drama seems full of a sense of fate.

So why has Base emerged so suddenly? What kind of involvement and secrets does it have with Web3 giants such as Coinbase? What projects in the current Base ecosystem are worth paying attention to?

Base: L2 upstart based on OP Stack

If we use one sentence to summarize Base, it is also very simple: backed by Coinbase, relying on OP Stack, and making a fortune from the Meme wealth-making myth and the traffic of social applications.

Previously, Forbes wrote an article introducing 7 powerful people in Coinbase, among whom Base founder Jesse Pollak was prominently listed (the PUNK avatar in the picture below). He joined Coinbase in 2017 and is an absolute veteran.

According to an exclusive interview with Fortune magazine, he came up with the idea of starting a business in 2021 when he was in charge of Coinbases consumer products. In order to retain Jesse Pollak, Coinbase CEO Brian Armstrong (C position in the picture below) asked him to try to bring Coinbase to the chain, which became the initial opportunity for the birth of Base (this may also be the reason why Base naturally has the consumer application gene).

Source: Forbes

On August 9, 2023, Coinbase officially launched the Base mainnet. In terms of technology, Base relies on Optimisms open source modular toolkit OP Stack – OP Stack allows developers and project parties to customize the Layer 2 network according to their own needs and scenarios, thereby accessing the Ethereum network and sharing security and resources.

For this reason, Base and Optimism jointly launched a governance and revenue sharing framework:

-

The greater of 2.5% of the Base sorter鈥檚 gross revenue or 15% of the Base chain鈥檚 net revenue (L2 transaction revenue minus L1 data submission costs) will go to the governance system Optimism Collective;

-

The Optimism Foundation also offers Base the opportunity to earn up to approximately 118 million OP Tokens over the next six years;

-

Now, in less than a year, Base has not only stood out in the OP super chain ecosystem, but has also surpassed a number of Ethereum L2 networks including Optimism, ranking second, which can be said to be a success.

Therefore, although he currently does not have an executive title in Coinbase, his influence in Coinbase cannot be underestimated because Base, which he is responsible for launching, is almost one of Coinbases most successful products in the field of cryptocurrency in recent years.

Of course, as the only sorter on the Base network, Coinbase has also made a lot of money. For example, in the first quarter of 2024, users paid Base $27.4 million in transaction fees (all fees included), of which Coinbase received $15.5 million.

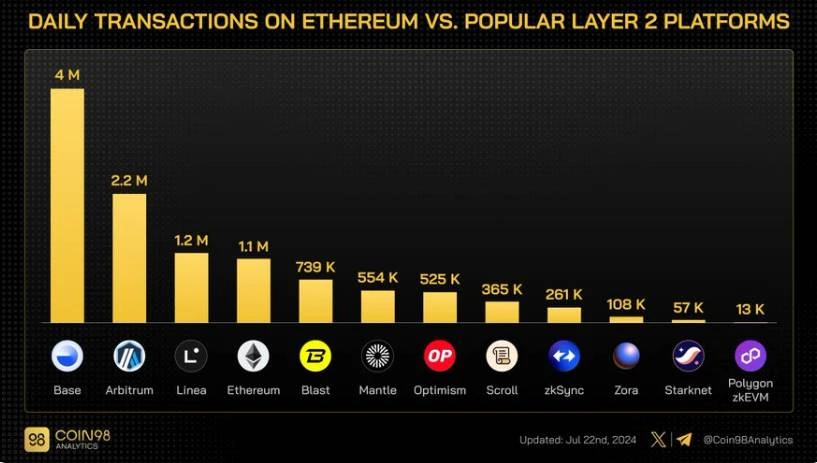

According to Coin 98 statistics, in addition to the skyrocketing TVL of Base, which is second only to Arbitrum, the number of daily transactions has surpassed Arbitrum, leaving the rest far behind – as of July 22, Bases daily transaction volume hit a record high of more than 4 million, almost twice that of the second-ranked Arbitrum!

Source: Coin 98 Analytics

Such active on-chain performance is not just a castle in the air. If we take a closer look at Base, we will find that its consumer genes are very mature, and it has developed difficult-to-replicate competitiveness in the two fields of Meme and SocialFi, making it a highly competitive network in the L2 field even without the expectation of issuing tokens.

Meme and SocialFi are two different things

The first is naturally the layout in the Meme field. If we sort out Bases hot events in the past year, we will find that the Meme wealth-making myths that appear every now and then have become the main driving force for boosting the influx of funds and users into Base. It can almost be regarded as a clever marketing and new user acquisition strategy of Base officials.

To put it bluntly, from TYBG, Degen to Brett and so on, there are magic projects with full wealth effect on Base almost every once in a while, which directly attract a large amount of on-chain traffic to overwhelm Base in the short term, so that many Meme projects on the Ethereum mainnet even migrate their contracts to Base.

And because various memes with strong wealth-creating effects have broken out of the circle one after another, attracting the attention of the community with hundreds or thousands of times of growth, a large part of the funds pouring into Base are being laid out around the slightest movement of MemeCoin, which to some extent further formed a kind of self-proving logic.

Source: OneKey

In addition to Meme becoming one of its constant operation strategies, another label of Base is actually SocialFi.

The well-known friend.tech brought it the first wave of extremely valuable explosive community traffic in September 2023. By strongly binding with X, friend.tech allows users to purchase the shares (Share) of any user on friend.tech through the ETH of the Base chain, obtain the right to communicate with them directly, and also have the possibility of profiting from it, which also makes Bases layout in the social field emerge.

The subsequent Farcaster has further secured Bases position as a social upstart in L2 – not only is it leading in terms of activity among Web3social applications, but it has also completed a large financing of US$150 million, with top venture capital firms such as Paradigm and a16z placing bets.

之前在文章中 A comprehensive inventory of projects and tracks that Ethereum founder V God often likes, we also mentioned Vitaliks optimism about it. In September 2023, Vitaliks X account was hacked. Later, Vitalik stated on Farcaster that his Twitter account was indeed attacked by SIM card hijacking. He also said that he had uninstalled Twitter and joined Farcaster, which can control account recovery through Ethereum address.

And as of the time of writing, Vitalik has indeed regarded Farcaster as his main social media platform. At present, Farcaster has become the favorite social platform of Ethereum OG to some extent.

Inventory of top projects

In addition to technology and hot products, ecological construction is also a necessary condition for L2 to achieve long-term sustainable development.

So how far has the current L2 ecosystem developed? What are the exclusive head projects in each track that are worth paying attention to? (Except for friend.tech and Farcaster, multi-chain head players such as Uniswap and Aave are not mentioned for the time being)

According to DefiLlama data, the current DeFi TVL on Base is US$1.74 billion, among which the TVL of several (semi-)native DeFi projects dominates, including Aerodrome ($650 million), Extra Finance ($106 million), Moonwell ($83.25 million), Morpho Blue ($73.26 million), etc.

機場

The first one is naturally Aerodrome. As a MetaDEX, it is also the DApp with the highest TVL on the Base chain. It is also regarded as the core ecological driver of Base. The total locked volume exceeds 650 million US dollars, which is far ahead of the second-ranked Uniswap (US$282 million), more than double.

Aerodrome combines elements of various DEXs such as Uniswap V2 and V3, Curve, Convex, and Votium. Its unique architecture aligns incentives between different protocol participants, including traders, LPs, and protocols seeking to bring liquidity to tokens, and does this through its Ve governance model.

Participants must lock AERO Tokens in order to collect fees. Locking AERO Tokens enables users to direct the emission of the protocols tokens to specific pools, where they will receive 100% of the fees and emissions. Due to incentives, voters will direct token emissions to pools with the highest trading volume in order to receive the most rewards, which will undoubtedly create a flywheel effect that attracts LPs (liquidity providers), thereby providing traders with a low-slippage trading experience for popular token pairs.

額外財務

Extra Finance is a decentralized lending and automatic compound leveraged income aggregation protocol based on Optimism , which can provide users with a variety of products such as lending, up to 3x leverage farming, long/short, neutral strategies, strategy vaults, etc.

Like Aerodrome, it also adopts ve Token economics. veEXTRA holders can unlock some rights and features, such as annual interest rate rewards, unlocking higher leverage for liquidity mining pools, obtaining high-utilization token pools, and priority enjoyment of more upcoming features and advantages.

Other lending protocols that have been launched, such as Moonwell and Morpho Blue, are also products with a TVL level of tens of millions of dollars.

Outside of the DeFi field, Bases DApps in consumer areas such as social and gaming also deserve special attention.

Warpcast

Warpcast is a client of the decentralized social protocol Farcaster. NFTs on Warpcast already support display on Ethereum, Base and ZORA.

黑鳥

Blackbird is a Web3 platform built specifically for the hospitality industry, focused on creating direct connections between the hospitality industry and its guests through loyalty and membership services.

In October 2022, Blackbird completed a US$11 million seed round of financing, led by Union Square Ventures, Shine Capital and Multicoin Capital, with participation from Variant, Circle Ventures and IAC.

Other social networks that support Base include Friends With Benefits (FWB), Web3 community activity platform Galxe, etc.

In addition, according to official information from Base, Animoca Brands, Game 7 DAO, Web3 game solution provider ChainSafe Gaming, blockchain game company Faraway, NFT sci-fi card game Parallel, adventure and competitive game Pixelmon, word puzzle game Words 3, Yield Guild Games, etc. are also its ecological companies or projects.

概括

In less than a year, it jumped from 0 to the second place in L2, absorbing 7.5 billion US dollars in TVL. This achievement was achieved without issuing a native token.

From this perspective, Base, as a leader in the new L2 network, is nothing short of amazing. It also indirectly illustrates the unique advantages of Web3 consumer applications such as social networking. Does that mean that whoever can seize the future explosive Web3 consumer applications will have the secret to Web3s explosive growth and large-scale adoption?

All that is past is prologue. For those participants who are committed to making a name for themselves in the field of large-scale adoption of Web3, Base may be a rare reference sample.

This article is sourced from the internet: The rising Base: Which ecological projects are worth paying attention to?

Headlines Nomura Securities, Laser Digital and GMO Partner to Explore Issuing Stablecoins in Japan Japanese banking giant Nomura and its digital asset unit Laser Digital have partnered with Japan-based GMO Internet Group to explore issuing stablecoins in Japan. They plan to explore issuing, exchanging and circulating stablecoins denominated in yen and U.S. dollars. The partnership also plans to offer “stablecoin-as-a-service” products to help companies issue stablecoins. According to its announcement, such products may cover regulatory compliance management, blockchain integration, and back-end transaction management. Through the partnership, Nomura Securities and Laser Digital will focus more on crypto trading, asset management and venture capital, while GMO plans to contribute more on the technology side. Previously, GMOs US subsidiary GMO-Z.com Trust has issued stablecoins such as GYEN and ZUSD on multiple chains. (The…