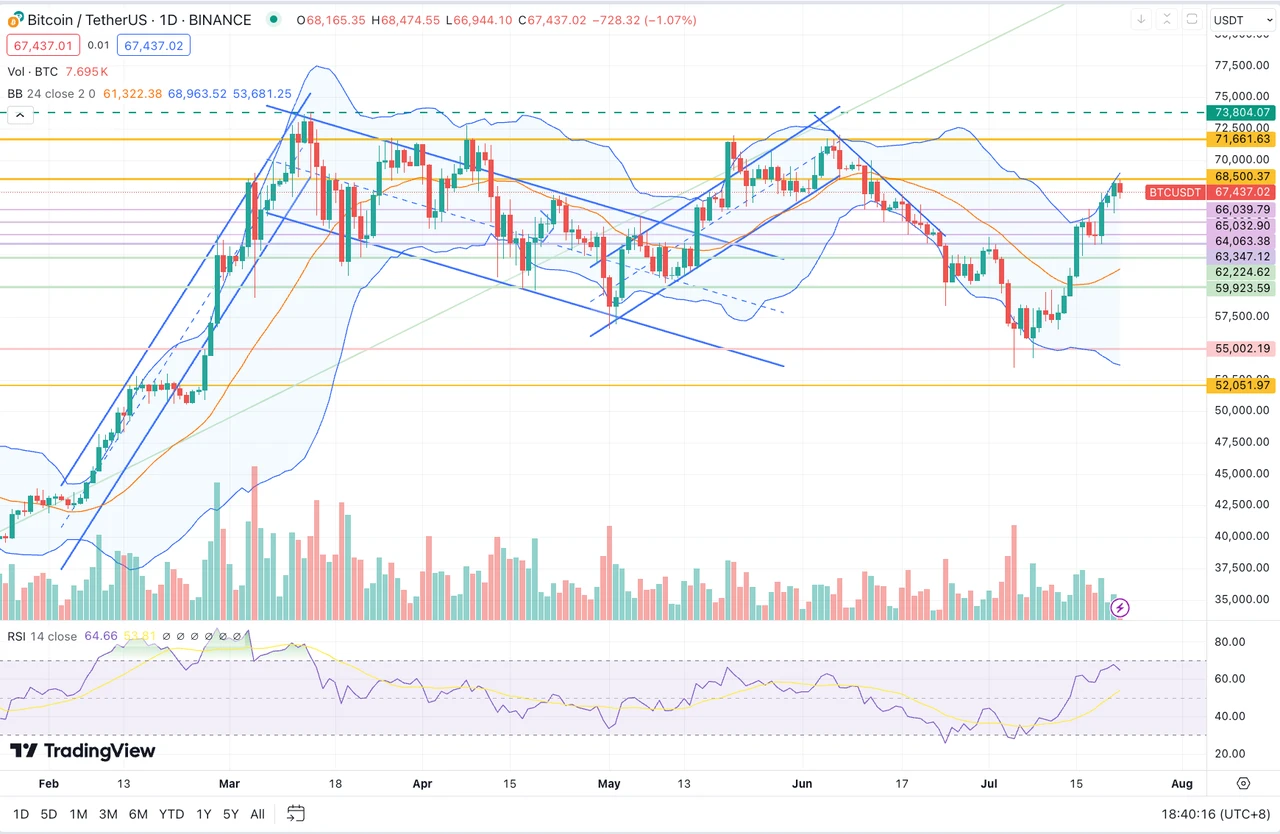

Yesterday morning, the Democratic presidential candidate Biden suddenly announced his withdrawal from the election on Twitter, triggering a shock in the crypto market. BTC first fell below 66,000 in a short period of time, and then quickly recovered all the lost ground and climbed below the resistance level of 68,500 US dollars before the opening of the Asian market, showing a V-shaped reversal trend. Analysts have different views on the incident. Some believe that Bidens withdrawal from the election has increased Trumps chances of winning. Considering that Trump has said that he may use Bitcoin as a strategic reserve resource and other remarks in favor of cryptocurrency, this news is good for the price of the currency; others pointed out that since the riots on January 6 this year, the American peoples trust in Trump has also weakened. Trumps current competitor has changed to Kamala Harris. Although his chances of winning are still high, the new candidate is not less threatening than the overwhelming gap with Biden. As the passion of surviving the shooting fades, Trumps prospects for victory seem to have become a little vague again. But in any case, we have seen that the impact of the trend of the US political situation this year on the price of the currency is gradually increasing, and any further actions of the two parties may have an impact on the price trend in the short term.

來源:TradingView

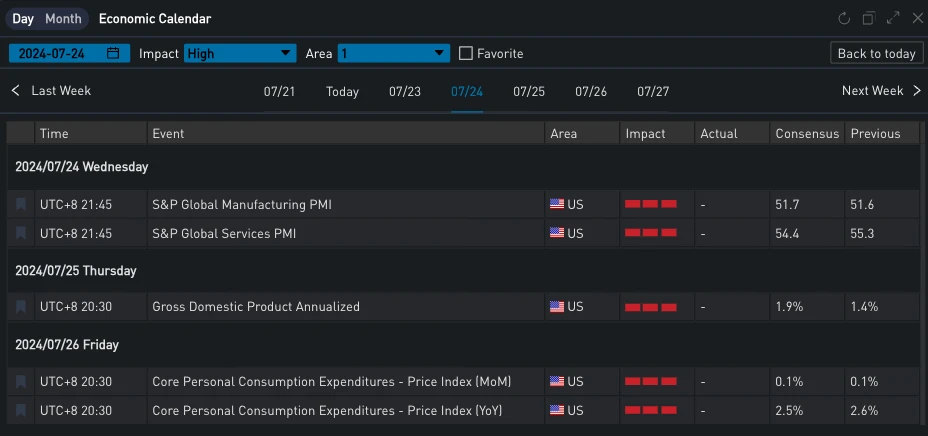

On the macro level, this week there are important indicators such as manufacturing/service index/GDP/PCE released. Considering the upcoming FOMC meeting next week, this weeks data is crucial.

資料來源:SignalPlus、經濟日曆

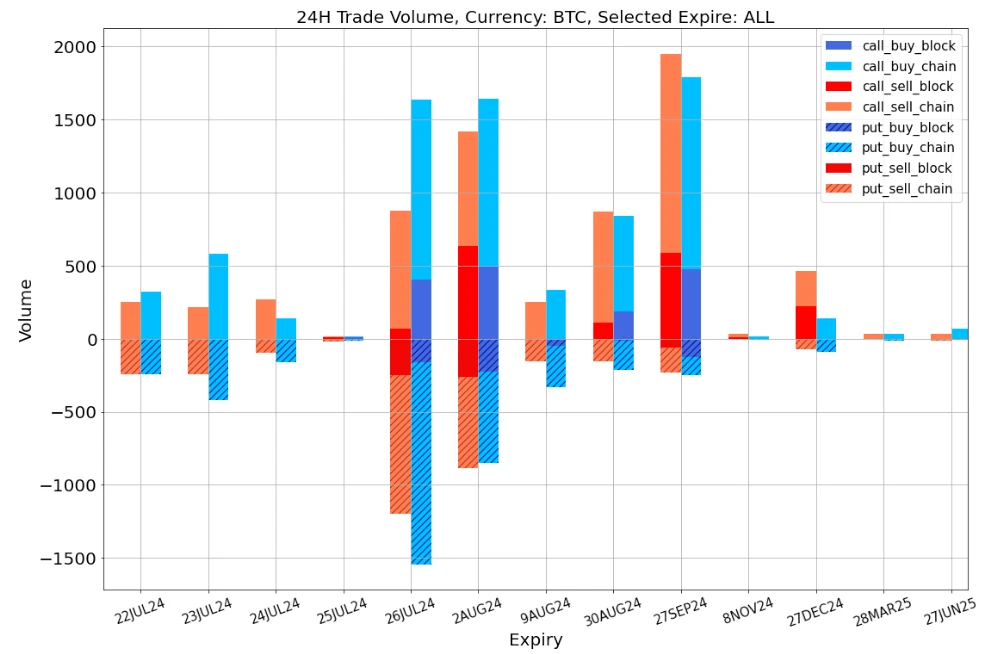

In terms of options, implied volatility has recently shown a general trend of fluctuating upwards. Due to poor liquidity on weekends, the IV fluctuations caused by the latest news event appear to be more severe. The IV Curve of the term can interpret the views of some markets. In terms of BTC, the Bitcoin 2024 conference scheduled to be held on the 25th-27th of this month has become the focus of attention. At that time, presidential candidate Trump will give a speech as the number one guest. The market has priced it with a high degree of uncertainty, which makes the expiration date 2 AUG 24 after the meeting obtain a higher Vol Premium; in terms of ETH, the spot ETF originally scheduled to start trading on July 23rd has been enthusiastically anticipated by the community, and the IV at the front end has leveled off and risen to a high of 70% Vol.

資料來源:Deribit(截至 5 月 2 日 16:00 UTC+ 8)

來源:SignalPlus

Data Source: Deribit, ETH overall transaction distribution/26 JU L2 4 transaction distribution

資料來源:Deribit,BTC交易整體分佈

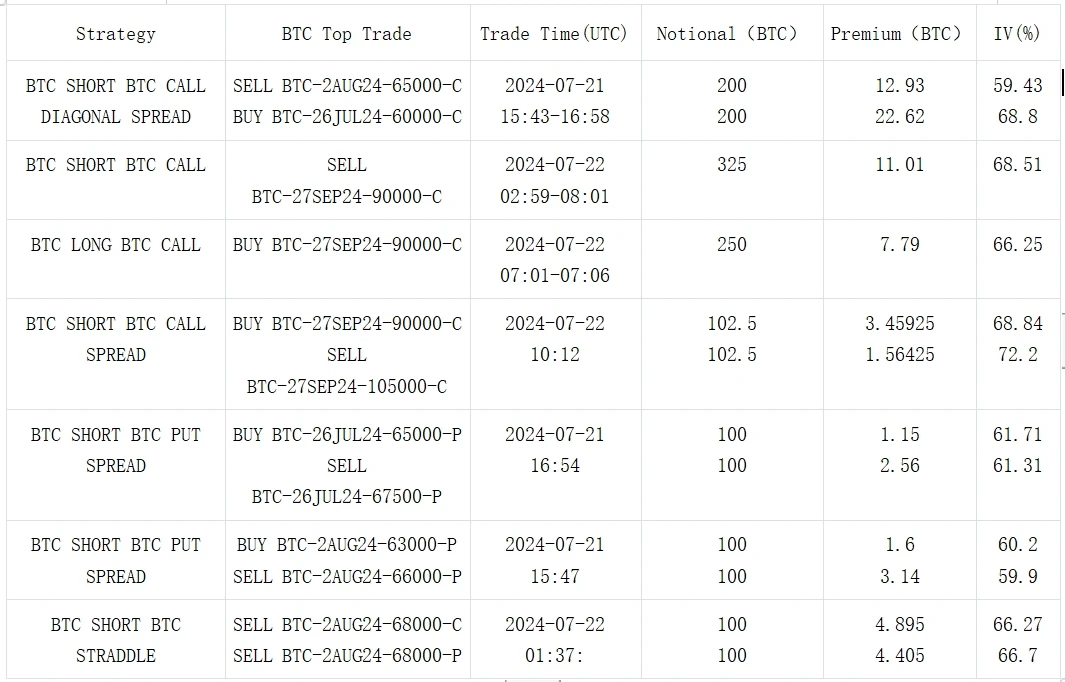

來源:Deribit 大宗交易

來源:Deribit 大宗交易

您可以在ChatGPT 4.0的插件商店中搜尋SignalPlus來取得即時加密資訊。如果您想在第一時間收到我們的更新,請關注我們的 Twitter 帳號@SignalPlus_Web3,或加入我們的微信群(新增助手微信:SignalPlus 123)、Telegram 群和 Discord 社區,與更多朋友交流互動。 SignalPlus 官方網站:https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240722): Biden withdraws from the election

Related: Biden withdraws from the election, is the crypto industry saved?

Original|Odaily Planet Daily ( @OdailyChina ) Author: Wenser ( @wenser2010 ) At 2 a.m. today, Biden announced his withdrawal from the 2024 U.S. presidential election. Perhaps affected by this, the crypto market plugged in, with Bitcoin falling to around $65,700 and Ethereum falling to around $3,400, but then rebounded quickly. For details, see the market analysis 3-minute quick view of the market outlook: the bottom is over, and the rise has become inevitable? . After that, Biden supported Vice President Harris as the Democratic presidential candidate. Odaily Planet Daily will interpret and analyze the impact of this incident on the crypto industry in this article. Cryptocurrency impact: Tokens mixed In addition to Bitcoin and Ethereum being affected by news related to the US election, many related tokens, especially Meme coins,…