Original author: DaPengDun (X: @DaPangDunCrypto)

On July 9, Justin Bons posted a long article on Twitter, stating that “BTC’s security model has been destroyed” and arguing according to his logic.

I was very interested in this view, so I tried to analyze this view and the arguments.

1. Justin Bons’ Logic

First, I sorted out Justin Bons’ logic in this tweet:

-

Hash rate does not equal BTC network security. The cost of producing hashes (and the cost of miners) is the guarantee of BTC network security. The current network security is lower than it was three years ago.

-

As block rewards decrease due to halving, the extreme situation of high fees on the superimposed chain is unsustainable, and miners’ income will and is decreasing;

-

Therefore, maintaining the current level of security would require a continued increase in the price of BTC, which is unsustainable;

-

At that time, the dilemma can only be solved by canceling the 21 million hard cap or forking;

Ultimately, he concluded:

BTC’s security model has collapsed, and in order to maintain the current level of security, its price must double every 4 years, a process that needs to continue for a century, otherwise extremely high fees will be maintained! This is impossible because it would need to exceed the global GDP market value within a few decades!

Let us analyze each key point and argument in its logic one by one.

2. Security indicators of the BTC network

1. Hashrate Evolution

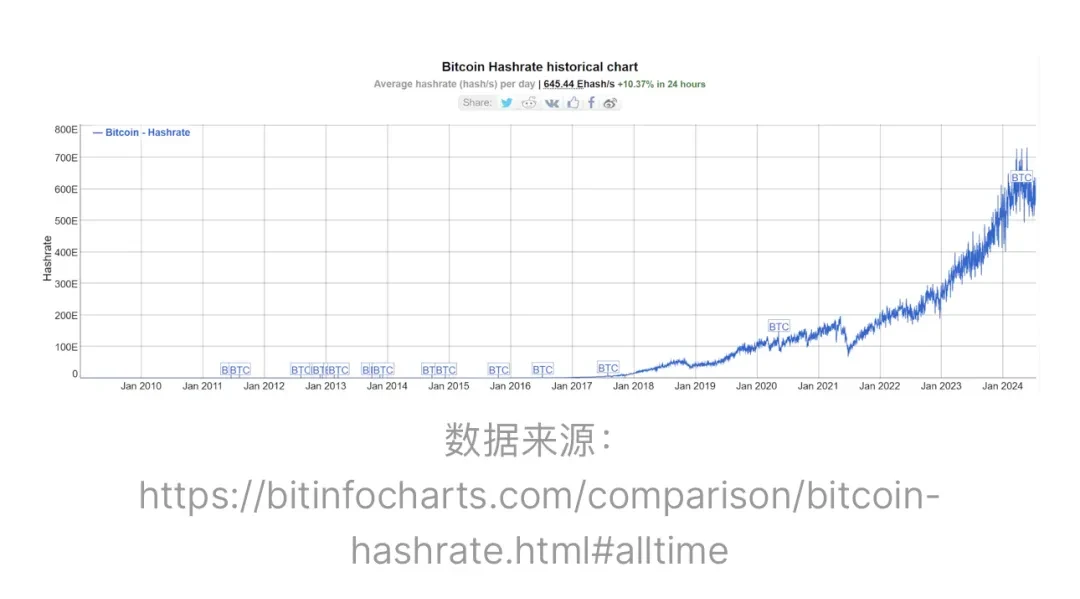

We often use hashrate to measure the security of the POW network. As can be seen from the figure below, the current hashrate is on an upward trend, so this is considered to be evidence that BTCs network security is constantly increasing.

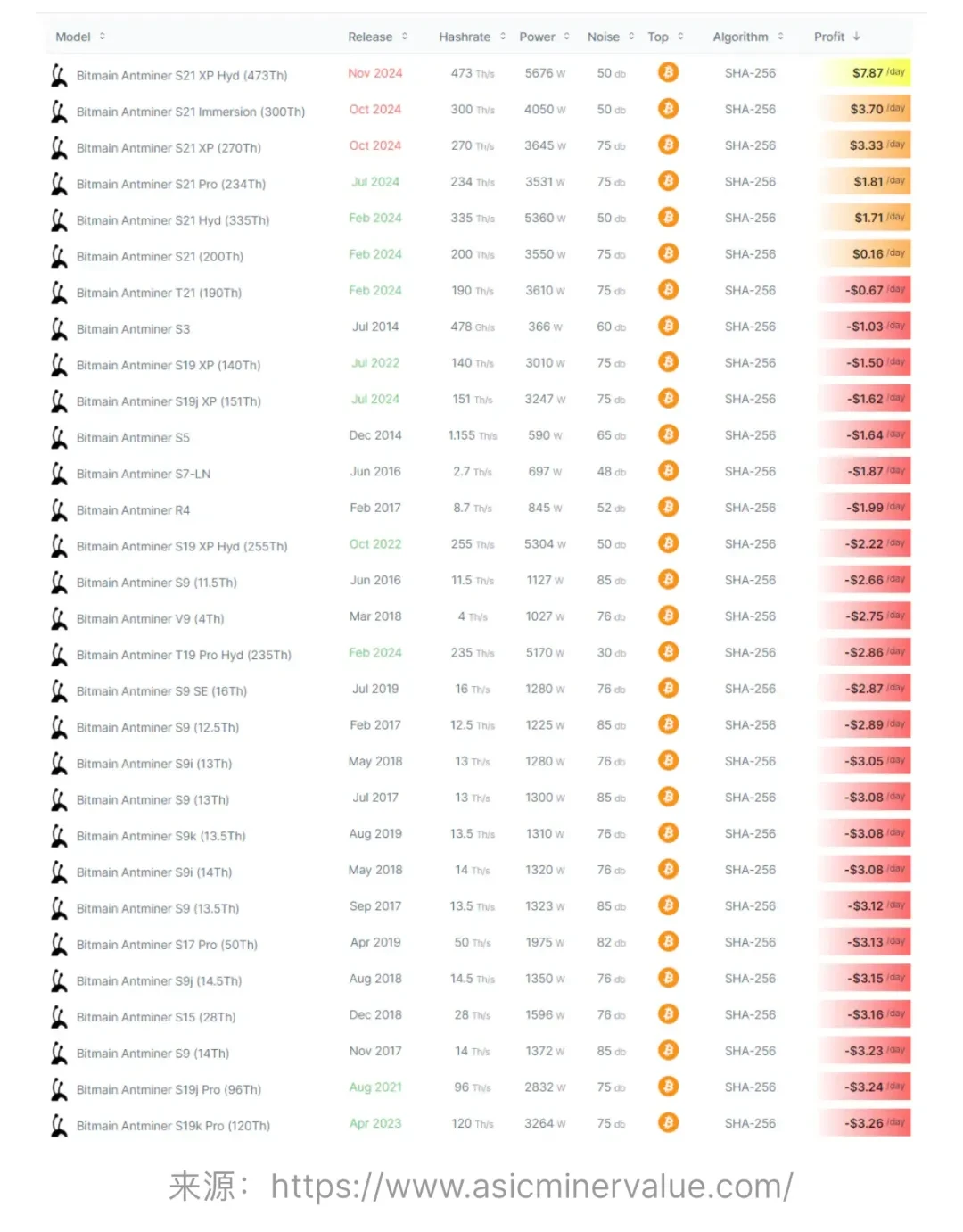

However, we also need to realize that changes in mining hardware have indeed reduced the cost of obtaining unit computing power. The following figure shows the models and functions of Bitmains BTC mining machines over the years:

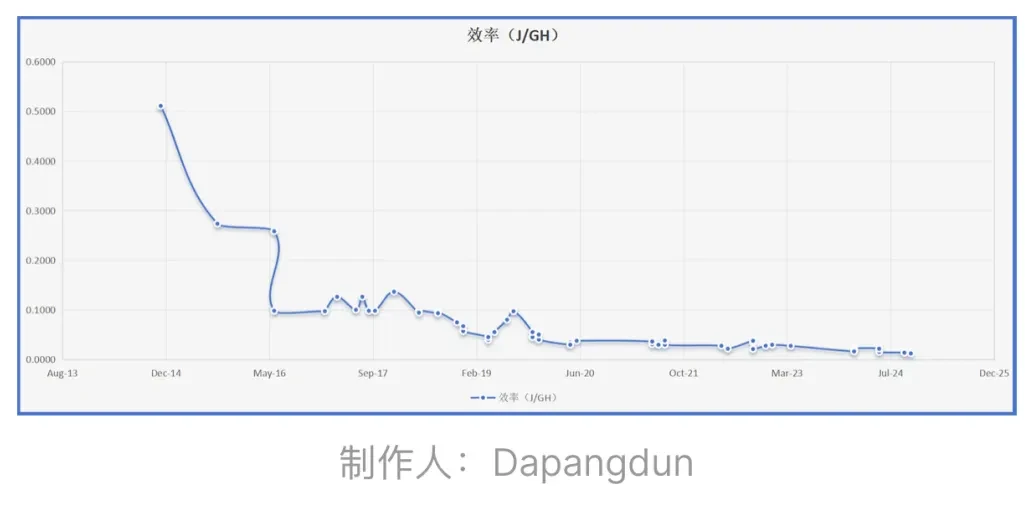

Based on the above figure, I drew a graph of the evolution of machine efficiency as follows:

As you can see, the efficiency of machines is getting higher and higher, and today’s equipment is 30-40 times more efficient than it was 10 years ago;

We also need to note that with the development of energy mining technology and the diversification of energy forms (green energy, etc.), the cost of energy is also decreasing, which will further reduce the mining costs of miners.

Therefore, the overall system security cannot be measured entirely by hashrate. So is the cost of miners a good indicator of system security?

2. Miner costs

Miners are the most important players in the “BTC distribution”, so the total cost that miners actually and continuously invest can indeed be regarded as the “safety valve” of the network. If you want to attack the network, you need to spend enough cost to achieve the effect, and this attack cost is directly related to the miners’ investment cost.

The calculation of miner costs is difficult because it includes mining machine fees, maintenance fees, electricity costs, etc., so we make some assumptions in advance to simplify the process:

Mining machine fees and maintenance fees are not considered for the time being, because the former also involves depreciation, discounts, insurance, etc., and the latter is related to the automation level and management level of the mine, so only electricity costs are considered (electricity costs are likely to be the largest part)

The mining machines in each period are calculated based on the best mining machines of Bitmain at that time.

Electricity costs fluctuate, so here we simply calculate it based on $0.12/kw.

The calculation results are as follows:

It can be seen that the estimated cost consumed by miners is still showing an upward trend overall. Therefore, if the cost of miners is considered to be an important indicator affecting network security, the current network security is still showing an upward trend.

Why did Justin Bons say that security has been reduced? Because he used miners’ income as a measure of security, but income is only a judgment about the future, while miners’ expenditure should be the guarantee of current security.

3. Cost as a percentage of market value

Of course, there is a problem here, lets consider a situation:

Is it better to use 1M cost to protect 1B of assets or 10M cost to protect 100B of assets?

Some people would say that the ratio of 1 M/1 B is higher than that of 10 M/100 B, so it is more secure; others would say that the total amount of funds of 10 M is large, so it is more secure.

Both have their merits, my personal opinion is:

When costs have not reached a sufficient level, cost will be a better measure, which is a threshold issue; if costs are already high enough, then the proportion of cost to market value will be a better measure.

3. Miners’ Benefits

If the cost of miners is the most important factor affecting network security, then the miners income is the most important factor affecting the overall miners ability to maintain such security .

The miners’ income mainly consists of two parts: [Block Rewards] [Transaction Fee Subsidy]

1. Block Rewards

The block reward is relatively simple. We all know that it follows the halving rule. Four halvings have occurred so far, corresponding to the following:

1. In November 2012, the first halving occurred, with rewards from 50 BTC to 25 BTC

2. In July 2016, the second halving occurred, with rewards from 25 BTC to 12.5 BTC

3. In May 2020, the third halving will occur, with rewards increasing from 12.5 BTC to 6.25 BTC

4. In April 2024, the fourth halving will occur, with rewards from 6.25 BTC to 3.125 BTC

Because the cost is calculated in $, we also convert the revenue into the corresponding $. In order to simplify the calculation (reduce the amount of data), I made an assumption:

-

Take the average price of BTC for a month (the average of the opening and closing prices) as the daily BTC price data for this month

-

The average block interval is calculated based on 10 minutes.

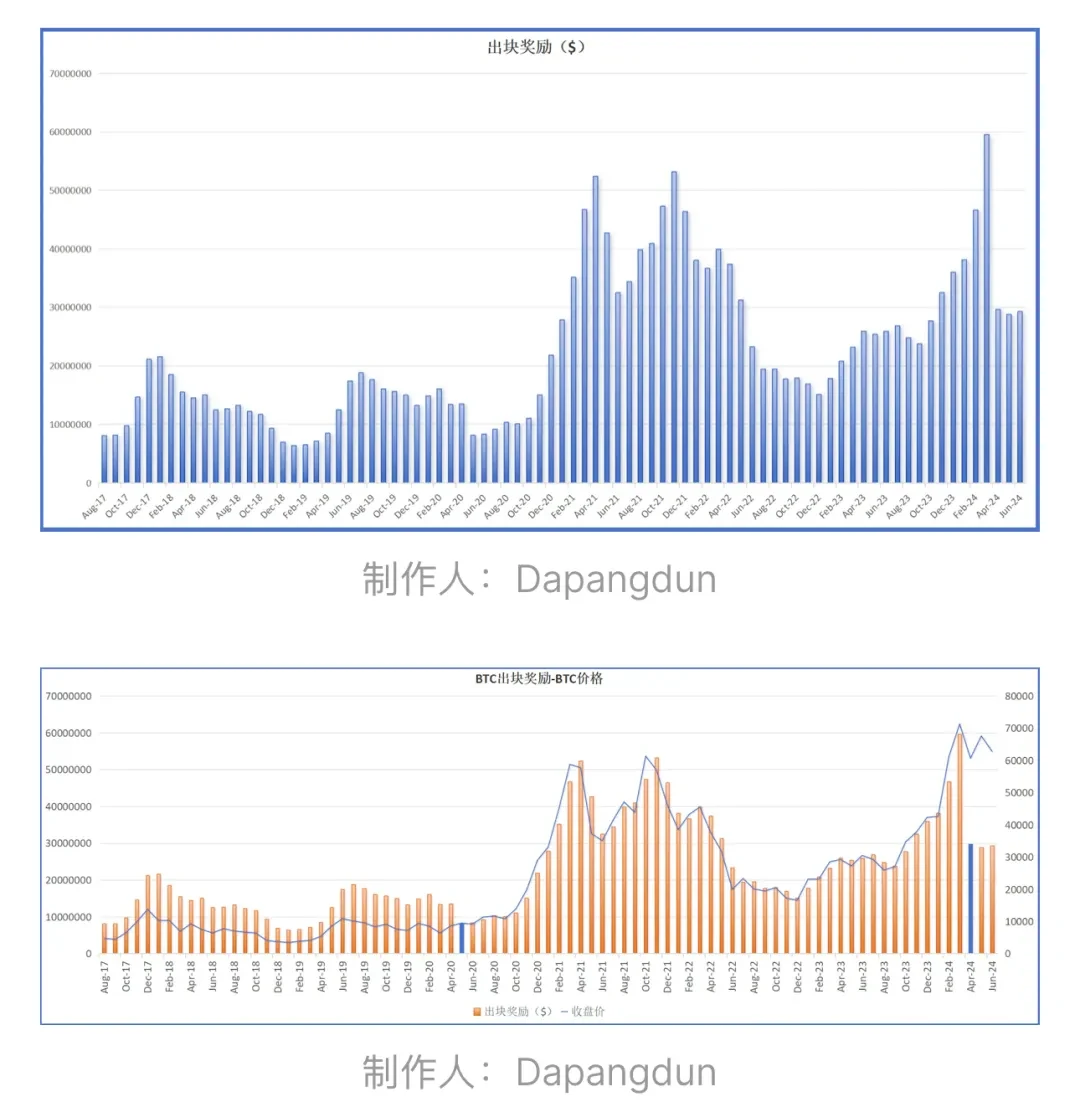

Get the following picture:

Combining these two graphs and comparing them with the graph of electricity expenditure, we can see:

-

Most of the time, the rewards for miners’ blocks can cover the costs and make a profit.

-

The early profits were very high, even if they were sold at the price at that time. This was also the bonus period for the development of the industry.

-

In the bull market, miners also make huge profits, and price is the key factor.

-

In the last round, the price of BTC started its main uptrend about 4 months after the halving.

-

At the current stage, judging from the block rewards alone, the profit level has been reduced

2. Transaction Fee Subsidy

Another very important fee for miners is the transaction fee subsidy, which is also considered to be a compensation for the reduction in block rewards caused by halving in the future. This is easy to understand. If the block reward is reduced, then as long as the transactions on the chain are more active, the miners income can still be guaranteed.

Of course, we also need to consider another factor, which is the gas corresponding to the transaction. If there are too many transactions, the gas will naturally be high and the transaction fee will naturally be pushed up.

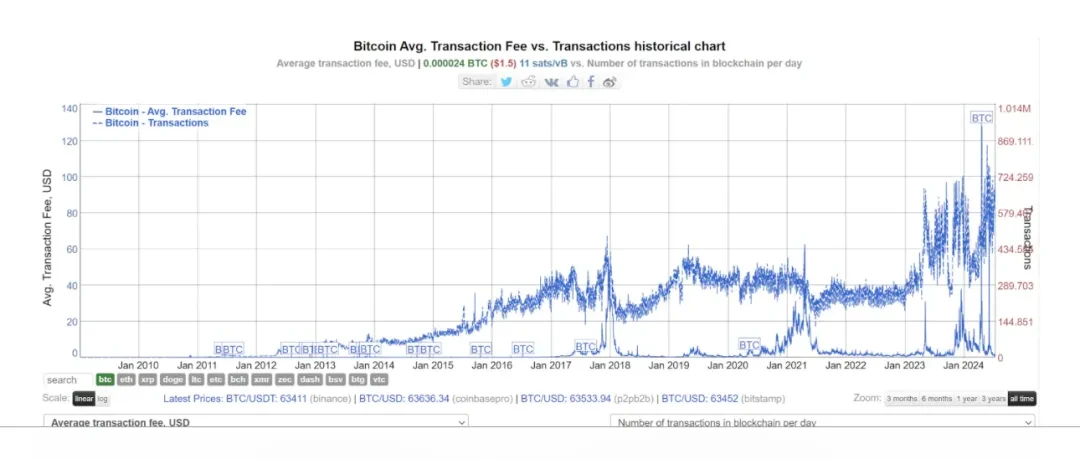

Lets look at the actual situation with data:

From the comparison curve we can see that:

The activity on the chain is generally on the rise, but whether this trend can be sustained is still unknown, as the activity on the chain from 2016 to 2023 is similar;

Transaction fees can be high at certain times, but overall, the fees for most transactions are

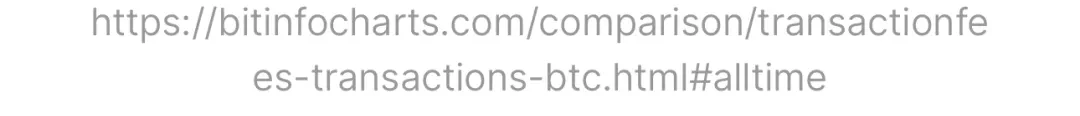

If we want to calculate the specific transaction fee subsidy, we need to multiply these two data and process them. Because the amount of data is large, I will use another indicator to observe: [The proportion of transaction fee subsidy in block rewards)

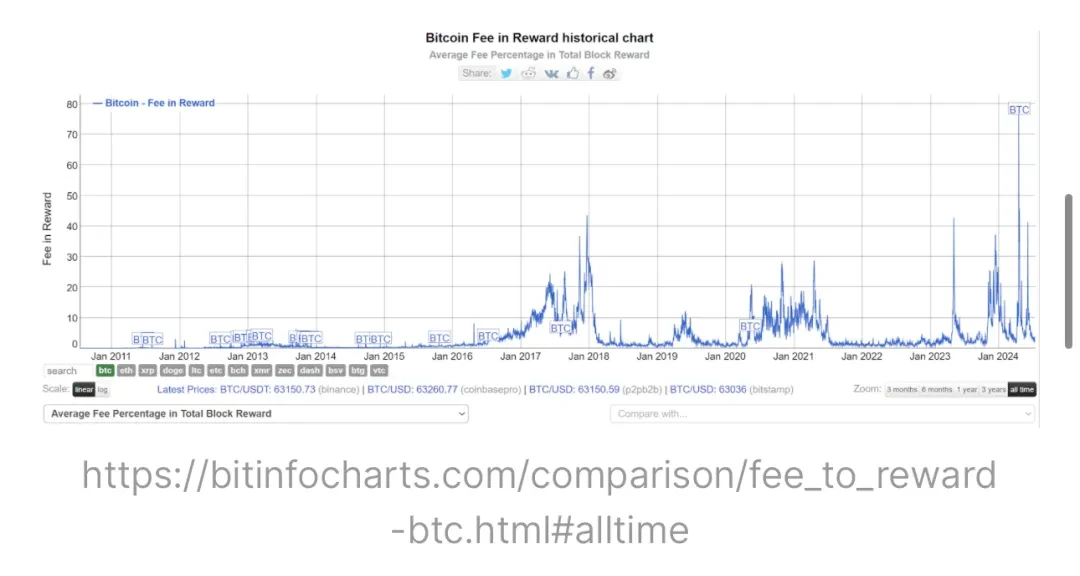

I roughly sampled the data and calculated it, and got the following chart:

Combined with the block reward, we get the following picture:

Combined with the miners’ expenditure, we can know that:

-

According to the current BTC price level, transaction fee rewards have not yet shown a higher level than the previous round.

-

Because miners’ expenditure levels are rising, miners’ profits are indeed decreasing.

3. BTC Price

I think this should not need to be discussed, because rational people should easily judge that the assertion that BTC prices have been rising is impossible. It is impossible for the market value to exceed the worlds GDP, right?!

Although we hope that BTC can continue to perform well in terms of price, it is also subject to the constraints of objective laws. It is an obvious fact that the increase in BTC prices is decreasing in each round.

Since there is a limit to price increases and miners’ earnings will indeed gradually decrease, expectations for maintaining current security levels may change, ultimately affecting the security of the network.

所以, the problem mentioned by Justin Bons is real , but whether the solution is to lift the hard cap or fork the big block as he said, I think this requires another discussion.

4. Discussion of solutions

Miners profits are affected by two aspects: cost and income, and we have some solutions in both directions.

1. Cost

Things that can be done to reduce costs include:

-

Further improve mining efficiency, develop hardware, optimize algorithms, and further reduce the cost per unit of computing power;

-

Striving for lower-priced energy, of course, also requires taking stability into account;

-

We look forward to changes in the worlds energy technology. For example, if commercial controlled nuclear fusion is developed, the price of energy will be greatly reduced, which can reduce costs.

Of course, we also need to realize that miners will inevitably move from the previous era of making money by mining to the era of mining game, and investors need to fully consider the risks and input-output results before deciding whether to participate.

This is very similar to our current situation. Everyone feels that it is difficult to make money because the industry has passed its early bonus period and competition has become very fierce. It is no longer an era where you can make money by just buying anything. Gambling will be the main theme.

2. Income

Block Rewards

This part is temporarily unchangeable. According to the halving rule, the miners block revenue will gradually decrease to 0. This is an indisputable fact. One solution is to eliminate the 2100W hard cap and then set up long-tail rewards. But for the current cognition, it is extremely difficult. BTCs 2100W consensus is extremely powerful. If it is changed, it will have a huge impact on the consensus.

Transaction fee subsidy

Therefore, the natural idea is to work on the transaction fee subsidy and increase this part to make up for the loss of block rewards, and add a certain increase in BTC prices to allow this system to operate for as long as possible.

However, the performance of the current BTC mainnet cannot support large-scale transactions. Gas and block time are both problems. Possible solutions include:

-

BTC block expansion : Make the block bigger and improve efficiency, this is another plan of Justin Bons; but after the big and small block dispute that year, the right to speak was basically controlled by small block supporters, so it is difficult to start such a plan at present. Of course, it is difficult for me to evaluate other impacts brought by this plan, such as the impact on the degree of decentralization, etc., which requires a deeper understanding of the underlying industry.

-

Lightning Network : Make the Lightning Network more popular, so that it can replace part of the worlds financial payment, and then add technological innovation to make the transaction fees on the chain shared by many people. The current number of main network transactions per day is about 300,000 to 500,000, and the number of transactions on Alipay alone on Double Eleven can reach 9.7 billion. The order of magnitude difference is too large, and there is still a lot of room for development.

-

Expansion of the BTC native network: The current functionality of the BTC network is still very weak. Based on its expansion innovations, whether on-chain or off-chain, as long as the main body increases the number of transactions on BTC, there will be contributions to transaction fees.

Of course, there are some other ideas, such as: for some joint mining projects, the computing power can be operated in parallel to obtain additional rewards while mining BTC…

Overall, my take on Justin Bonss point is:

Hash rate cannot be used as the only indicator to measure the security of BTC. The cost of miners can better reflect the security of the network. The current security has not decreased. With the reduction of block rewards caused by halving, the high fee rate on the chain is unsustainable, and the price of BTC cannot rise indefinitely. The network security problem is real and needs to be discussed. However, it is not only canceling the hard cap and forking again that can solve it. At least for now, there is a certain time and way for us to try to solve this problem through other innovations. Therefore, it is too early to assert that the security model of BTC has been destroyed.

This article is sourced from the internet: In-depth analysis: Is BTC’s security model really broken?

最近一段時間,在宏觀數據和政府機構拋幣的影響下,加密市場似乎非常動盪,但越是在這樣的時期,我們越需要冷靜下來,找到好的標的並持續關注。雖然本輪週期中 meme 佔據主導地位,但 DeFi、遊戲等賽道也不乏優秀項目。 Base生態中最大的DEX Aerodrome Finance和Ton生態中的Notcoin都是優秀案例。 Notcoin上線流行後,許多生態係都有Tap-to-Earn模仿,但取得顯著效果的卻很少。 Aptos 生態系統遊戲 Tapos 是最好的遊戲之一。根據鏈上分析機構 Artemis 的數據,5 月 25 日,Aptoss 日交易量達到 1.154 億筆,超過 Solanas…