原作者:Biteye核心貢獻者Viee

原編輯:Biteye核心貢獻者Crush

Have you started to FOMO TON? These past two days, I have been crazy about posting black and white dog MEMEs and showing off my points. I thought the bull market was back.

Today, Biteye will teach you how to play in the TON ecosystem and seize potential airdrop opportunities.

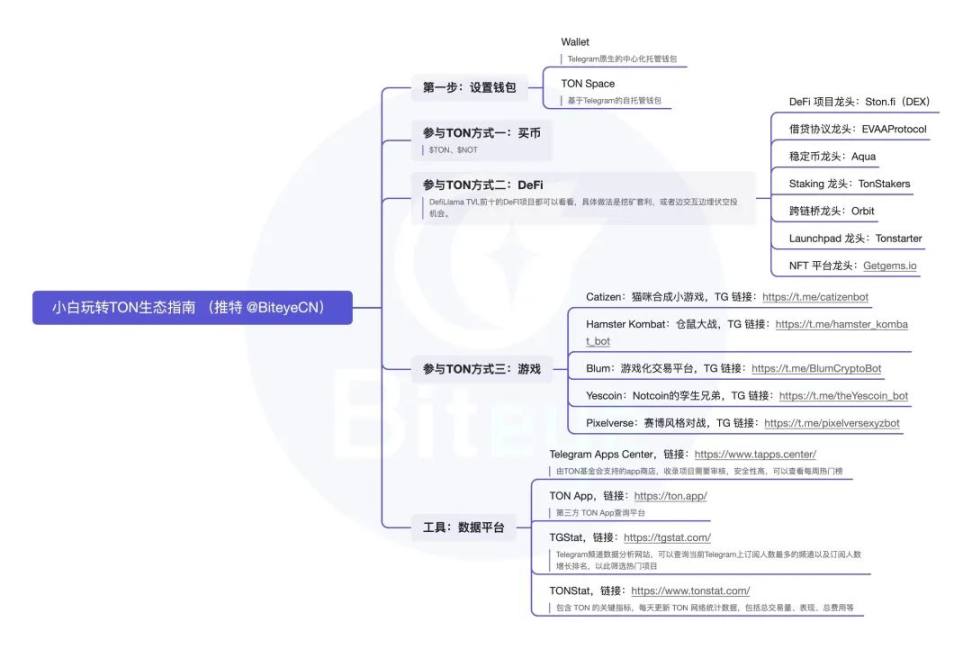

We have organized this thread into a mind map, please take it if you need it.

01 Wallet Introduction

The first step to participate in the TON ecosystem is to use a wallet. Currently, there are 49 wallets that support the TON chain.

Here are two of the most popular ones: Wallet and TON Space

錢包

Wallet is Telegrams native centralized custodian wallet, similar to WeChat Wallet, which is built into WeChats settings. Users can directly use Wallet to exchange tokens. Wallet supports users to deposit funds through P2P or bank cards.

TON Space

TON Space is a self-hosted wallet based on Telegram launched by the TON Foundation. It is embedded in Telegram and can be opened through Ton Space in Wallet. Users can use TON Space to connect directly from TON-based dApps. In addition to the mnemonic private key, the wallet can also be restored through email and Telegram account.

After completing this step, congratulations, you can now have fun in the TON ecosystem!

In addition, you can now interact with 40 TON ecosystem projects such as Catizen, Cat Gold Miner, STON.fi, Tomarket, etc. with 0 gas in the Bitget wallet, and have the opportunity to share a $1 million reward.

Details:

https://web3.bitget.com/zh-CN/tonnect-2024

02 Token related

In terms of market value, $TON is 18 billion US dollars and $SOL is 66 billion US dollars. If $TON can take off like $SOL and become an Ethereum killer, there is still 3.7 times of room for growth.

$NOT has a market value of 1.6 billion and is the second largest coin in the TON chain. It is already in the top 50 in terms of market value and is quite popular. The TON ecosystem is not yet very mature, and few other tokens can compete with it. Wait for a good opportunity.

In short, if you are interested in tokens, only $TON and $NOT are good and are currently listed.

03 DeFi

It has to be said that although public chains are changing, DeFi gameplay remains unchanged, such as DEX, lending, staking, NFT, etc.

Only when a chain has these platforms will it have activity and capital, and can it further create a wealth myth.

Unlike Ethereum Layer 2, the TON chain cannot see large-scale migration of leading projects, and the diversity of the DeFi ecosystem still has a lot of room for improvement.

Here are a few DeFi projects:

-

DeFi project leader: Ston.fi (DEX) @ston_fi

-

Lending protocol leader: EVAAProtocol @evaaprotocol

-

Stablecoin leader: Aqua @aquaprotocolxyz

-

Staking Faucet: TonStakers @tonstakers

-

Cross-chain bridge leader: Orbit @Orbit_Chain

-

Launchpad leader: Tonstarter @ton_starter

-

NFT platform leader: Getgems.io @getgemsdotio

You can take a look at the top ten DeFI projects in DefiLlama TVL. The specific approach is to engage in mining arbitrage, or to ambush airdrop opportunities while interacting.

04 Games

Games are the craze of this round of TON. Simple and easy games plus one-click forwarding on Telegram can spread the games in the most effective way.

A large number of game dealers are pouring into TON, making it easy to obtain a large number of real users. Being listed on a large exchange will bring you huge wealth.

Here are a few ways to play TON chain games:

Catizen: Cat synthesis game

Players run a cat pet shop. Customers will pay gold coins as rewards after petting cats. These gold coins can be used to buy new cats. Two cats of the same level can be combined into a new breed of cat, which will be one level higher than the original one. The players task is to combine higher-level cats and earn more gold coins.

TG link: https://t.me/catizenbot

Hamster Kombat: Hamster Kombat

Tap-to-Earn game, you can get coins by tapping the hamster (CEO role of the simulated exchange) on the mobile phone screen. Players are encouraged to unlock more rewards through community interaction, and they can also increase passive income from mining by purchasing upgrade cards.

TG link: https://t.me/hamster_kombat_bot

Blum: Gamified Trading Platform

Founded by a former Binance executive, players earn points through Farm and Drop games, and can get Drop game tickets and extra points by inviting new users.

TG Link: https://t.me/BlumCryptoBot

Yescoin: Notcoin鈥檚 twin brother

It is very similar to Notcoin, with a mode of collecting coins and completing tasks. You can collect tokens by swiping the screen on your phone.

TG link: https://t.me/theYescoin_bot

Pixelverse: Cyber-style Battle

Users train pet robots, click to fight (PVP and PVE modes), and adventure in different maps in the game center.

TG link: https://t.me/pixelversexyzbot

The above games can be found on the growth rankings on the TGStat website.

05 Tools/Data Platform

Telegram 應用中心

The app store supported by the TON Foundation requires review of included projects, has high security, and you can view the weekly popular list.

TON應用程式

Third-party TON App query platform

關聯: https://ton.app/

TG統計

Telegram channel data analysis website, you can query the channels with the most subscribers on Telegram and the ranking of subscriber growth, so as to filter popular projects.

TONStat

Contains key indicators of TON and updates TON network statistics every day, including total transaction volume, performance, total fees, etc.

06 Development Background and Opportunities of TON Chain

The development of the TON chain has been full of twists and turns.

In 2017, Telegram founders Pavel Durov and Nikolai Durov began developing the Telegram Open Network (TON) project, with the token Gram.

In 2020, Telegram announced its withdrawal from the TON project, renamed the project The Open Network, and changed the name of the token to Toncoin.

In 2023, Telegram officially announced that it would use the TON chain as its preferred choice for Web3 infrastructure and began application integration.

For example, Telegram鈥檚 built-in wallet and the use of TON for payment have greatly accelerated Mass Adoption.

The overall market has been pessimistic recently, but the TVL of the TON chain has increased by more than 20 times in just four months and has now exceeded 700 million.

The TON ecosystem has also gradually developed, covering different tracks such as CEX, DEX, wallets, NFTs and games, as shown in the figure below.

Of course, compared with public chains such as Ethereum and Solana, TON still has a lot of room for improvement, but its value cannot be simply measured by TVL. Relying on the real user base of the Telegram platform is a natural advantage that other public chains cannot match.

Stimulated and promoted by the TON Foundation, the TON ecosystem has shown good development momentum and deserves long-term attention and participation.

This article is sourced from the internet: Must-read guide: Play with the TON ecosystem and seize early dividends

Related: How is the Ethereum ETF different from the Bitcoin ETF?

Original title: Our Thoughts on the ETH ETF Original author: Kairos Research Original translation: Ladyfinger, BlockBeats Editor’s Note: This article deeply analyzes the potential market impact of the ETH ETF, exploring Grayscale’s concerns about premium burden, listing conditions that differ from BTC ETFs, US market demand proxies, and long-term impacts on the DeFi ecosystem, while emphasizing the interaction between price, usage, and narrative. Introduction Regarding the expectations for ETH ETF, our views are briefly summarized as follows: By most measurable data points, BTC ETFs have been a huge success. To date, we have seen approximately $15 billion in net inflows across approximately 260,000 BTC. The volume of these ETFs has also been phenomenal, with 11 ETF products doing cumulative volume of $300 billion since they began trading in early January.…