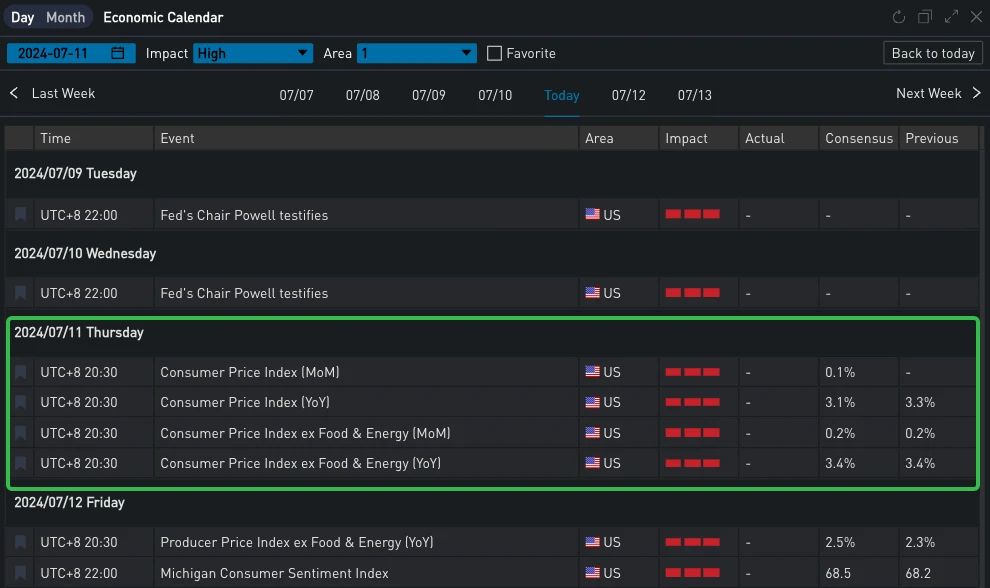

On Tuesday, Federal Reserve Chairman Powell gave a speech in which he affirmed the Feds past efforts and achievements in reducing inflation by cooling the labor market, and said that the labor market is no longer the cause of inflation. But on the other hand, the audience could feel that his overall wording was more rigorous this time, and he did not give clear guidance on the policy direction. Judging from the markets reaction, the SP and Nasdaq have been eager to set new highs in the past two days. U.S. Treasury yields fluctuated slightly, perhaps waiting for instructions from tonights CPI data. If the data meets expectations (3.1%), it can confirm to a certain extent that inflation is indeed moving towards the Feds target of 2%, and it can also provide support for its interest rate cut in September.

資料來源:SignalPlus、經濟日曆

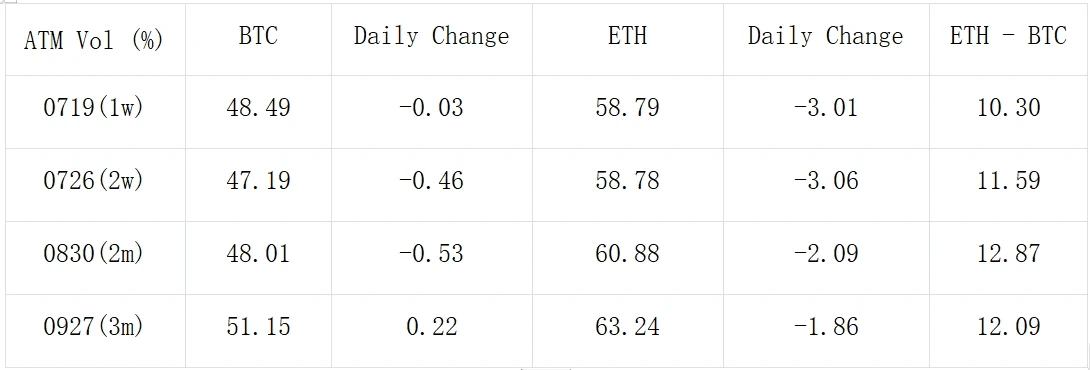

Risk markets, including cryptocurrencies, are paying close attention to the data releases today and tomorrow. Judging from the options data, the overall IV level represented by the middle and back ends is gradually declining, especially for ETH, which is 2-3% lower than the previous day; but the end-of-day options are still at a high level, which fully reflects the traders game on this macro data.

來源:SignalPlus

Source: Deribit (as of 11 JUL 16: 00 UTC+ 8)

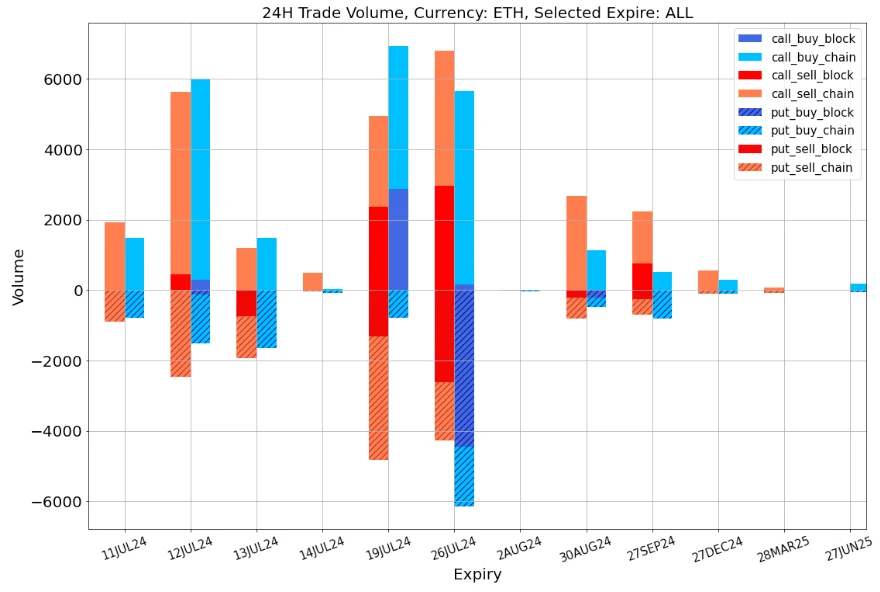

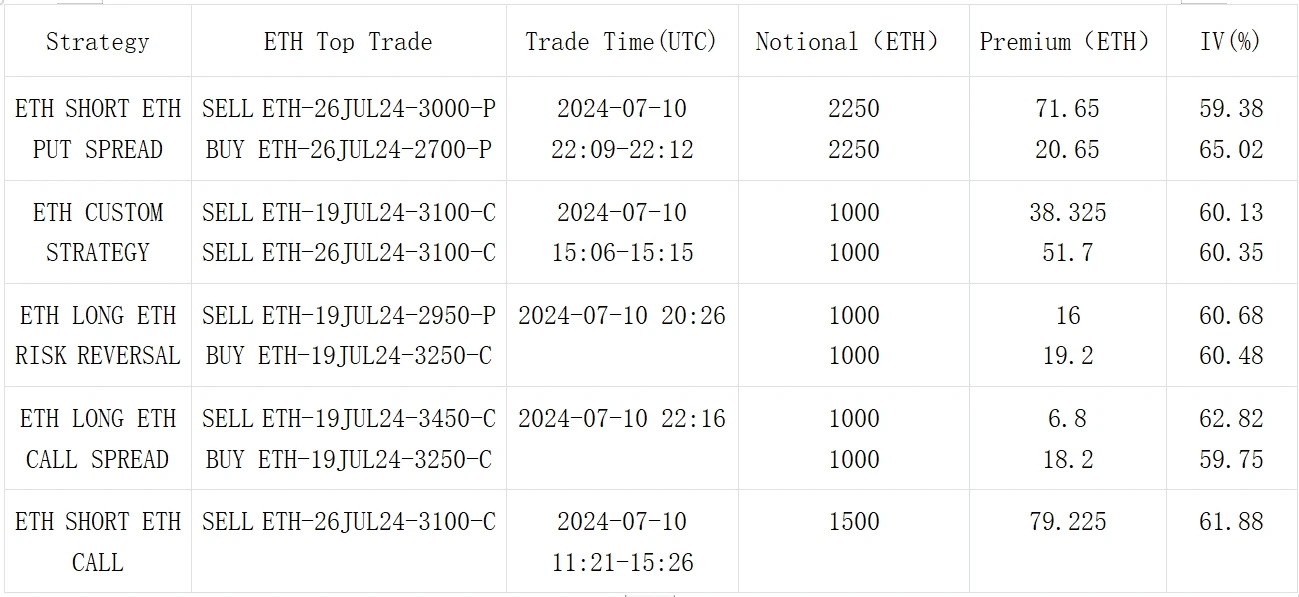

From the perspective of transactions, a feature of recent transactions is that the P/C Ratio has increased significantly, basically maintaining at around 1: 1, just like today, a large number of Puts were sold on ETH 19 JU L2 4, and the Sell Put Spread on 26 JU L2 4 also became the focus of market attention, explaining the return of the Vol Skew on the front end of ETH. BTC has both Sell Call Spread and Sell Put Spread, which is relatively cautious about short-term fluctuations.

Data Source: Deribit, ETH overall transaction distribution; SignalPlus, ETH 25 dRR

資料來源:Deribit,BTC交易整體分佈

來源:Deribit 大宗交易

來源:Deribit 大宗交易

您可以在ChatGPT 4.0的插件商店中搜尋SignalPlus來取得即時加密資訊。如果您想在第一時間收到我們的更新,請關注我們的 Twitter 帳號@SignalPlus_Web3,或加入我們的微信群(新增助手微信:SignalPlus 123)、Telegram 群和 Discord 社區,與更多朋友交流互動。 SignalPlus 官方網站:https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240711): Be careful with macro data

Original锝淥daily Planet Daily Author: Wenser As the competition in the Ethereum L2 network enters a white-hot stage and the Bitcoin network ecosystem becomes increasingly rich, the Bitcoin L2 network has become the next crypto highland. As a Bitcoin L2 network rookie that adopts a two-layer architecture and has recently successfully developed and implemented ZKP verification, Zulu Network is expected to be the first to connect the Bitcoin L1 network, Bitcoin L2 network and L3 network. Odaily Planet Daily recently conducted an in-depth interview with Zulu Network CTO Cyimon to share the behind-the-scenes story of the Bitcoin L2 network. Q: Could you please give us a brief self-introduction, such as your past work experience, and what your responsibilities are after joining the Zulu Network (hereinafter referred to as Zulu) team? Cyimon:…