原作者: @poopmandefi

原文譯:Alex Liu,前瞻新聞

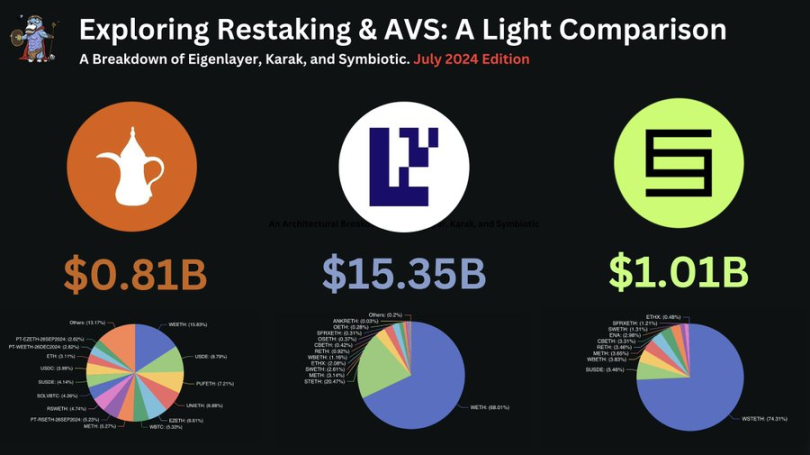

If you are interested in Restaking or AVS (Active Verification Service), this article will briefly compare @eigenlayer , @symbioticfi 和 @Karak_Network and introduce related concepts, which should be helpful to you.

What is AVS and re-staking?

AVS stands for Active Validation Service, a term that basically describes any network that requires its own validation system (e.g., oracles, DAs, cross-chain bridges, etc.).

In this article, AVS can be understood as a project that uses the re-stake service.

Conceptually, re-staking is a way to re-use already staked ETH for additional validation/services to earn more staking rewards without having to unstake it.

Re-staking usually takes two forms:

-

Native Re-staking

-

LST / ERC 20 / LP re-staking

By restaking, restakers and validators can secure thousands of new services by pooling security.

This helps reduce costs and helps new trust networks gain the security assurance they need to get off the ground.

Among these re-staking protocols, @eigenlayer (EL) was the first to be launched.

特徵層

Key Architecture

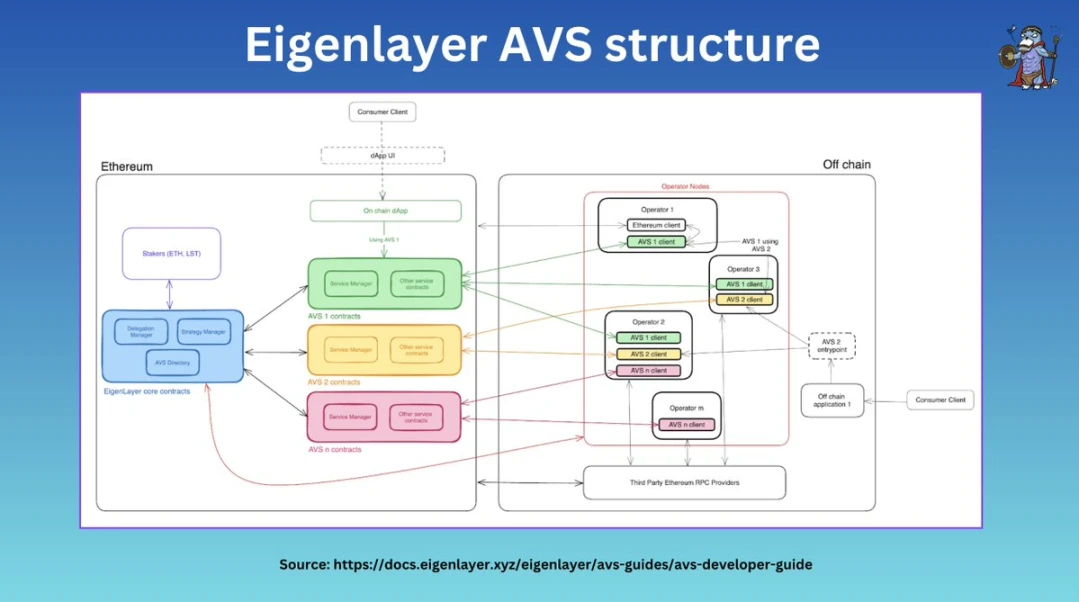

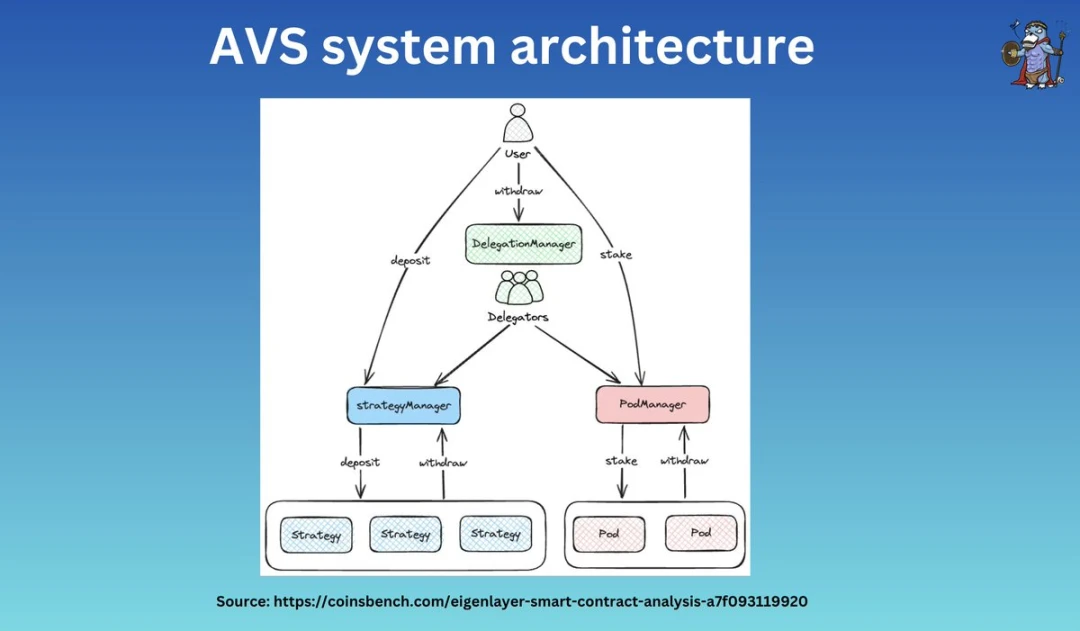

At a high level, @eigenlayer ( EL) consists of 4 main parts:

-

Stakers

-

營運商

-

AVS contracts (e.g. token pools, designated slashers)

-

Core contracts (e.g., delegation managers, slashing managers)

These parties work together to allow stakers to delegate assets and validators to register as operators in EigenLayer.

AVS on EL can also customize the quorum and slashing conditions of its own system.

Re-pledge

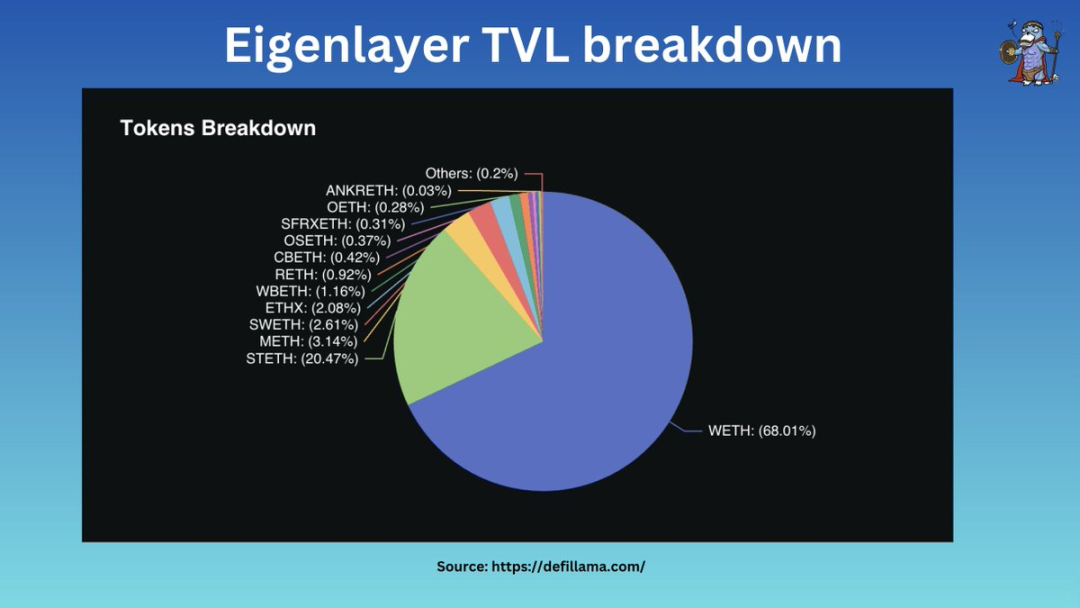

EL supports native re-staking and liquidity re-staking.

Of its approximately $15 billion TVL (total value locked):

-

68% of assets are native ETH

-

32% is LST (Liquid Staking Token).

EL has about 160,000 pledgers but only about 1,500 operators, and 67.6% (about $10.3 billion) of assets are entrusted to operators.

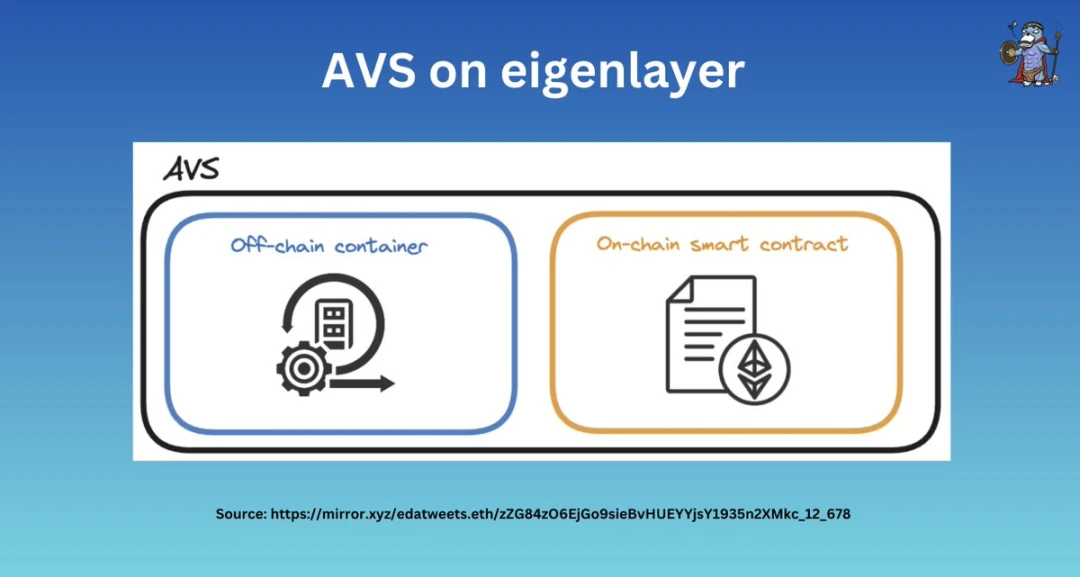

AVS on EigenLayer

EL provides a high degree of flexibility for the self-design of AVS, they can determine:

-

A quorum of stakers (e.g. 70% ETH stakers + 30% AVS token stakers)

-

Forfeiture conditions

-

Fee model (payable in AVS tokens/ETH etc.)

-

Operator requirements

And their own AVS contracts…

What is the role of EigenLayer?

EL controls :

-

Delegated Manager

-

Strategy Manager

-

Confiscator Manager

Validators who wish to become EL operators must register through EL.

The strategy manager is responsible for the balance accounting of the re-staking participants and cooperates with the delegation manager to execute it.

Confiscation

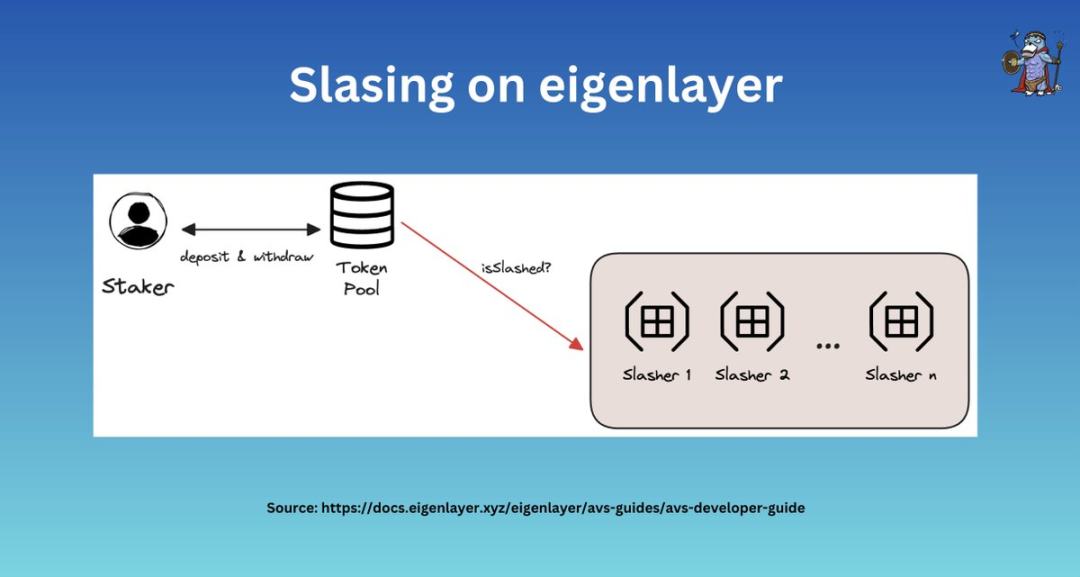

Each AVS has its own slashing conditions.

If the operator behaves maliciously or violates ELs commitment, they will be fined by the slasher, each of which has its own slashing logic.

If operators choose to participate in 2 AVSs, they must agree to the slashing conditions of both AVSs at the same time.

Veto Severance Committee (VSC)

In the case of a wrongful slashing, EL has a VSC that can reverse the slashing result.

The EL does not act as a standards committee itself, but rather allows AVSs and stakeholders to build their own preferred VSCs, thereby creating a market for VSCs tailored for different solutions.

總結

In short, EL provides:

-

Native + LST staking

-

Asset delegation (ETH assets + EIGEN)

-

AVS is highly flexible in designing its own terms

-

Veto Severance Committee (VSC)

-

Operators that have gone online (about 1,500 so far)

Symbiotic

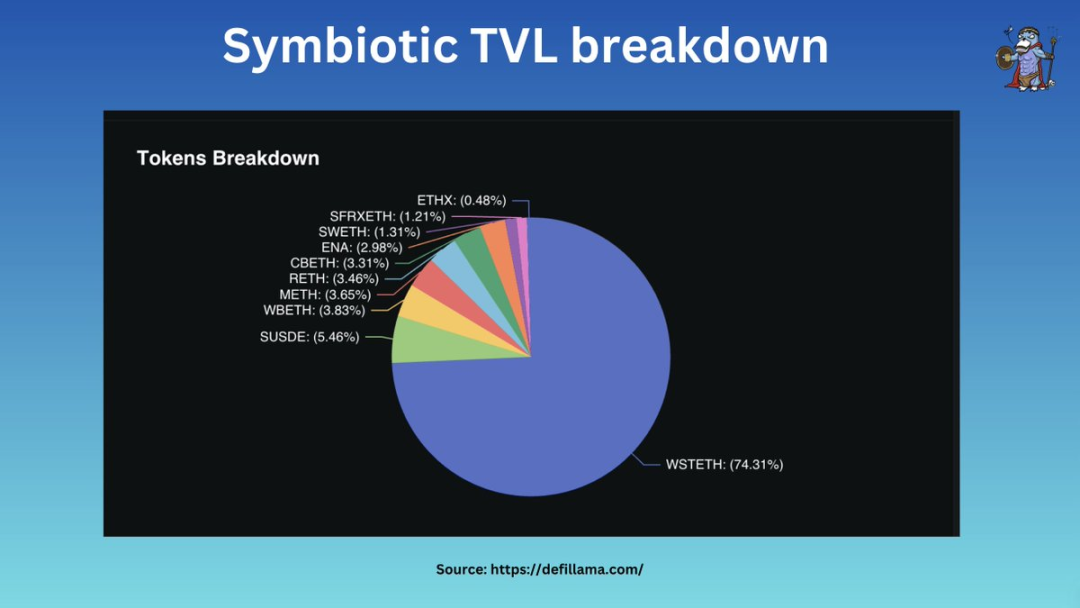

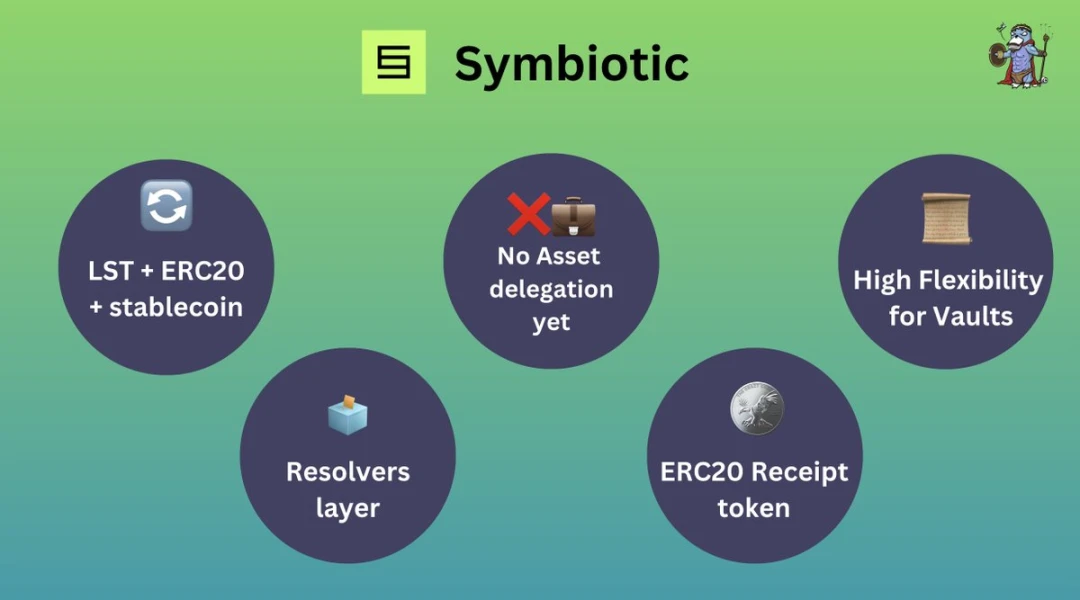

@symbioticfi positions itself as the “DeFi hub” for re-staking by supporting staking of assets like ENA and sUSDe.

Currently, 74.3% of its TVL is wstETH, 5.45% is sUSDe, and the rest is made up of various LSTs.

There is no native re-staking support yet, but it may be supported soon.

Symbiotic ERC 20

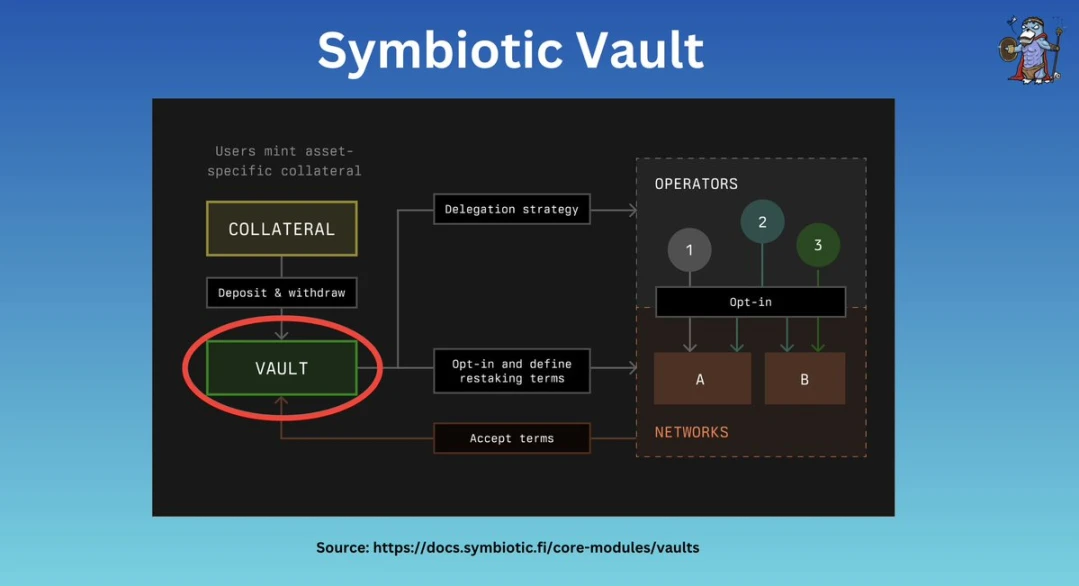

Unlike EL, @symbioticfi mints corresponding ERC 20 tokens to represent deposits.

Once the collateral is deposited, the assets are sent to the “vault” which is then delegated to the corresponding “operator”.

AVS on Symbiotic

In Symbiotic, AVS contracts/token pools are called Vaults.

Vault is a contract established by AVS, which uses Vault for accounting, commissioned design, etc.

AVS can customize the staker and operator reward process by plugging in external contracts.

避難所

Similar to EL, Vault can be customized, for example, there can be Vaults for multiple operators.

A notable difference between Vault and EL is the presence of immutable pre-configured vaults that are deployed with pre-configured rules to “lock in” settings and avoid the risks of upgradeable contracts.

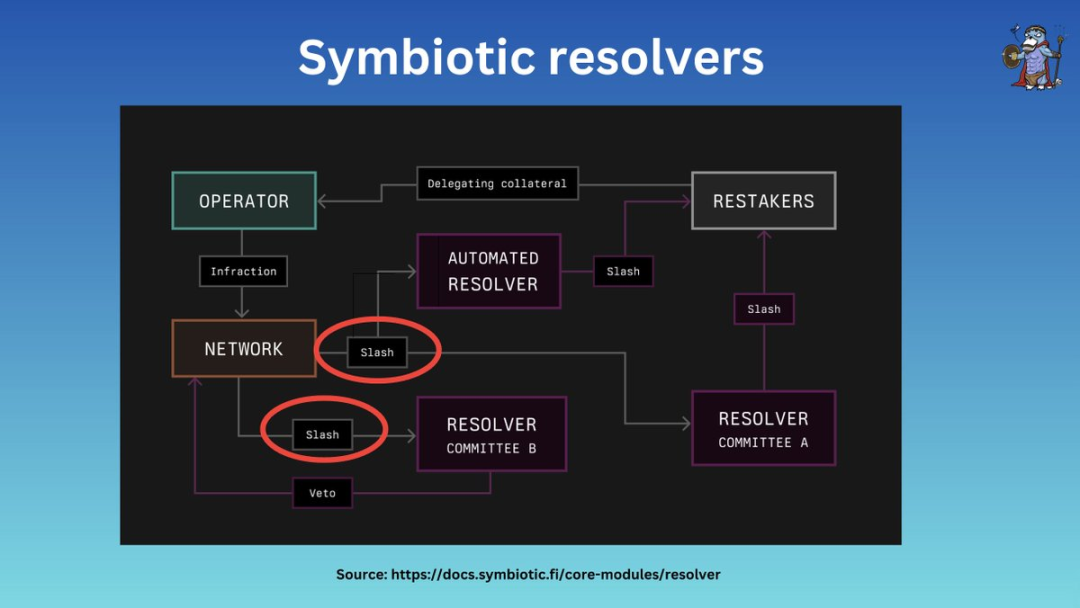

Parser

The parser is roughly equivalent to the ELs veto committee.

When an erroneous slashing occurs, the parser can veto the slashing.

在 @symbioticfi , vaults can request multiple resolvers to cover staked assets or integrate with dispute resolution (such as @UMAprotocol ).

總結

In short, Symbotic offers:

-

Accept LST + ERC 20 + stablecoin collateral

-

ERC 20 Receipt Token Received When Minted

-

There is no native re-staking and no delegation yet

-

Vault with customizable terms

-

Multi-resolver architecture with greater design flexibility

卡拉克

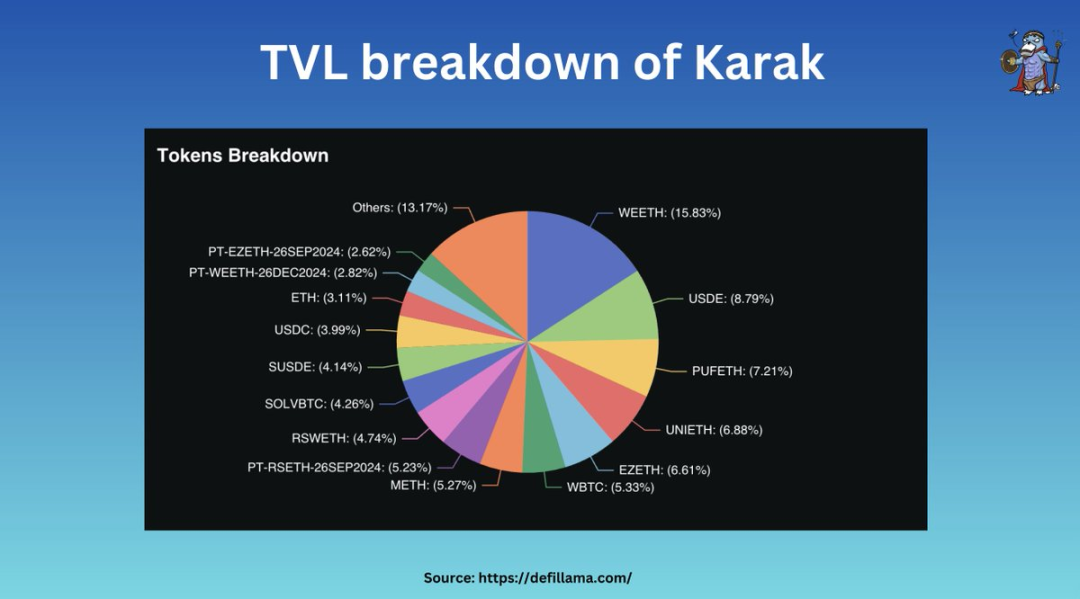

Karak uses a system called DSS, which is similar to AVS.

Among all re-staking protocols, @Karak_Network accepts the most diverse staking assets, including LST, stable, ERC 20 and even LP tokens.

Pledged assets can be deposited through multiple chains such as ARB, Mantle, and BSC.

Pledged assets

Of Karak’s approximately $800 million TVL, most deposits are in LST, and most of them are on the ETH chain.

At the same time, about 7% of assets are deposited through K2, an L2 chain developed by the Karak team and guaranteed by DSS.

DSS on Karak

So far, Karak V1 provides a platform for these participants:

Vault + Supervisor

Asset entrusted supervisor

In terms of architecture, karak provides a Turnkey SDK + K 2 sandbox to make development easier.

More information is needed for further analysis.

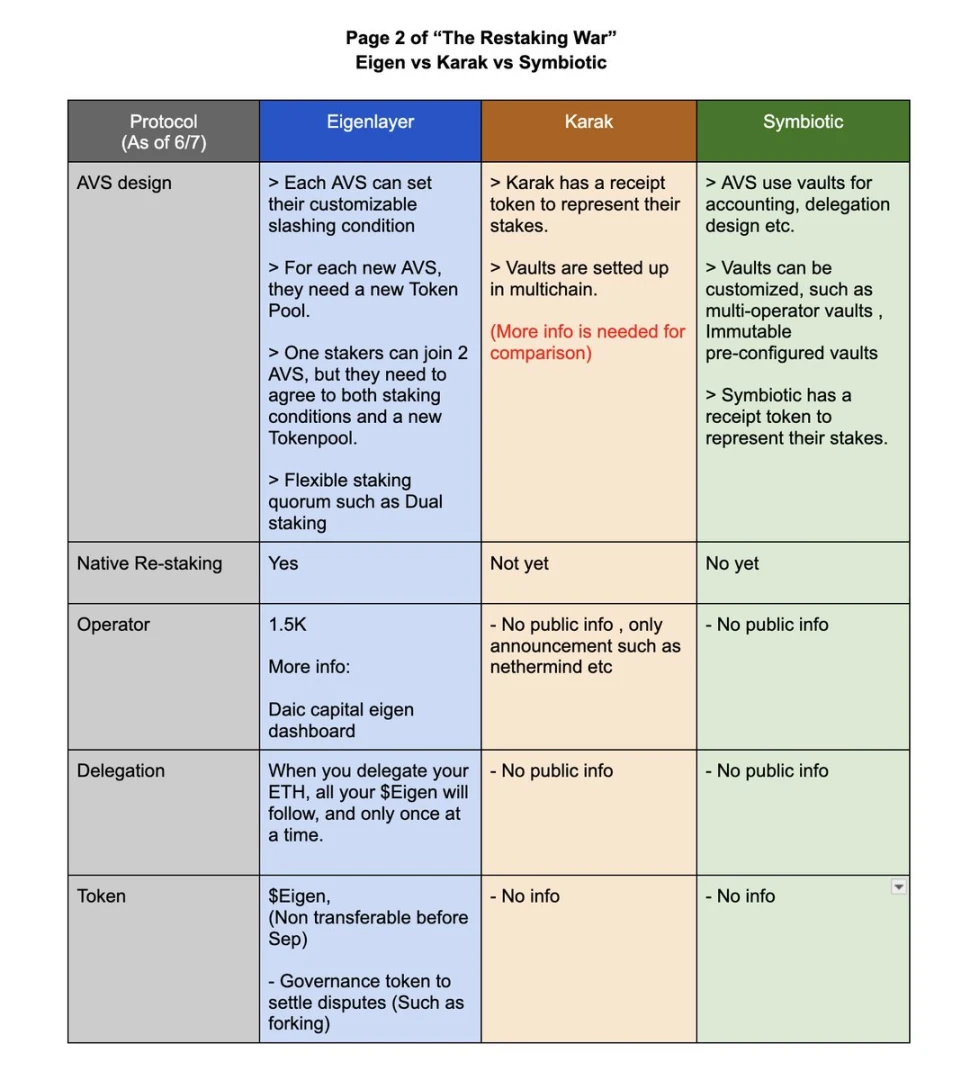

比較的

Intuitively, the pledged assets are the most obvious differentiating factor.

-

特徵層

EL offers native ETH re-staking and EigenPods, which has received ETH accounting for 68% of its TVL and has successfully attracted about 1,500 operators.

They will also soon accept LST and ERC 20 tokens.

-

Symbiotic

Becoming the “DeFi hub” by partnering with @ethena_labs and being the first to accept sUSDe and ENA.

-

卡拉克

It stands out for its multi-chain staking deposits, allowing re-staking across different chains and creating an LRT economy on top of it.

Architecturally, they are also very similar.

The flow is usually from stakeholders -> core contracts -> delegates -> operators, etc.

Its just that Symbiotic allows for multiple arbiter resolvers, while Eigenlayer doesnt specify this, but its possible.

rewards system

In EL, operators who opt in receive a 10% commission from AVS services and the rest goes to delegated assets.

On the other hand, Symbiotic and Karak may offer flexible options that allow AVS to design their own payment structures.

Confiscation

AVS/DSS are very flexible, they can customize slashing conditions, operator requirements, staker quorums, etc.

EL + Sym has a parser + veto committee to support and recover erroneous slashing behavior.

Karak has not yet announced the relevant mechanism.

Finally, tokens

So far, only EL has launched tokens, EIGEN, and requires stakers to delegate their tokens to the same operator as they re-stake (but they are non-transferable).

Speculation on SYM and KARAK is the key motivating factor driving their TVL.

綜上所述

Among these protocols, it is clear that @eigenlayer provides a more mature solution and the most powerful economic security + ecosystem.

AVS that want to gain security in the early stages will build on EL as it has a $15 billion capital pool and 1,500 operators ready to join + a top-notch team.

另一方面, @symbioticfi 和 @Karak_Network are still in very early stages and still have a lot of room to grow. Retail investors or investors seeking income opportunities outside of ETH/multi-chain assets may choose Karak and Symbiotic.

結論

Overall, AVS and re-staking technology removes the burden of building an underlying trust network.

Now, the project can focus on developing new features and better decentralization.

Re-staking is not just an innovation, but also a new era for ETH.

This article is sourced from the internet: Exploring re-staking: Overview of Symbiotic, Karak, and EigenLayer

原文標題:Breakdown Metrics Applied: Identitying Local Bottoms in a Bull Market 原作者:Ukaria OC、CryptoVizArt、Glassnode 原文翻譯:LadyFinger、BlockBeats 編者註:在數位資產市場的快速演變中,準確的數據分析已成為關鍵交易者把握市場脈搏的關鍵。 Glassnodes最新的28個細分指標也標誌著鏈上分析領域的重大飛躍。這些指標不僅可以深入洞察短期持有者的行為,還為交易者提供了識別市場底部和優化交易策略的強大工具。 Glassnode 最近推出了一套包含 28 個新指標的套件,旨在為數位資產市場提供更細緻的視角,這是鏈上分析領域的一項重大發展。您可以在這裡閱讀我們的原始公告…