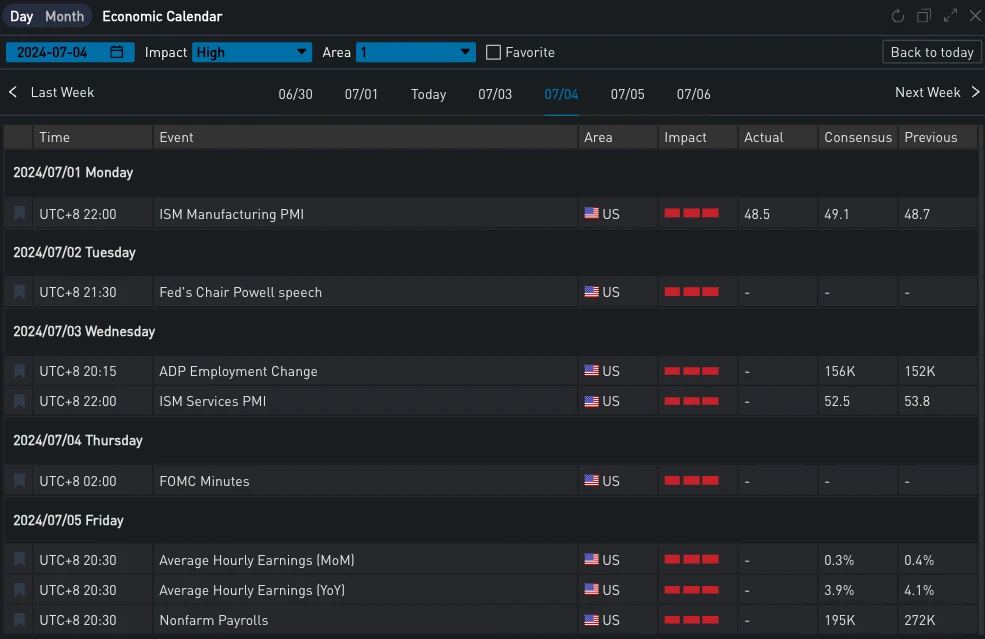

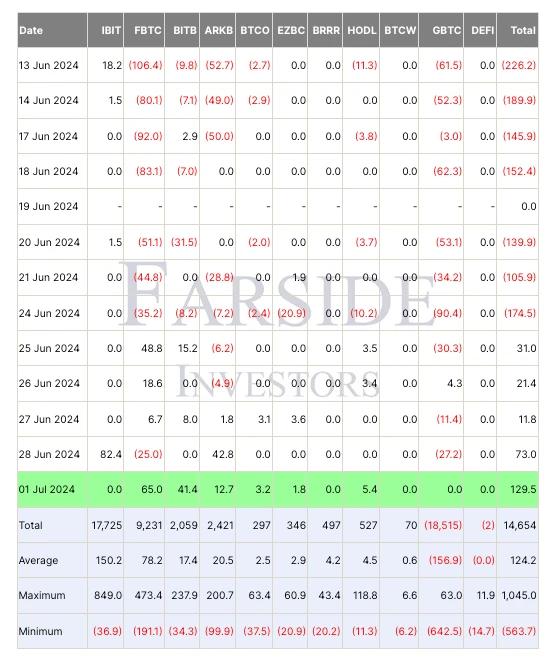

The past month has been a heavy loss for Bitcoin investors. The price of the currency has continued to decline since the high of nearly 72,000 at the beginning of last month, and once fell below the 60,000 mark. As the beginning of July, the funds of ETFs have gradually resumed positive inflows, and the price of BTC has also taken advantage of the trend to get rid of the 60,000-62,000 range at the end of last month, challenging 63,200 US dollars twice. This will be the key to witness whether BTC can continue to recover its lost ground, and investors have high hopes for this. But if the challenge fails, BTC is likely to repeat the tragedy of June and fall below 61,000 again. At the same time, Federal Reserve Chairman Powell will deliver a speech on Tuesday, after which many influential US macro data will also be released to the market, such as ADP on Wednesday, the service industry PMI index, and non-agricultural and hourly wages on Friday, which will all be closely watched by the market.

資料來源:SignalPlus、經濟日曆

Source: Farside Investors; Trading View

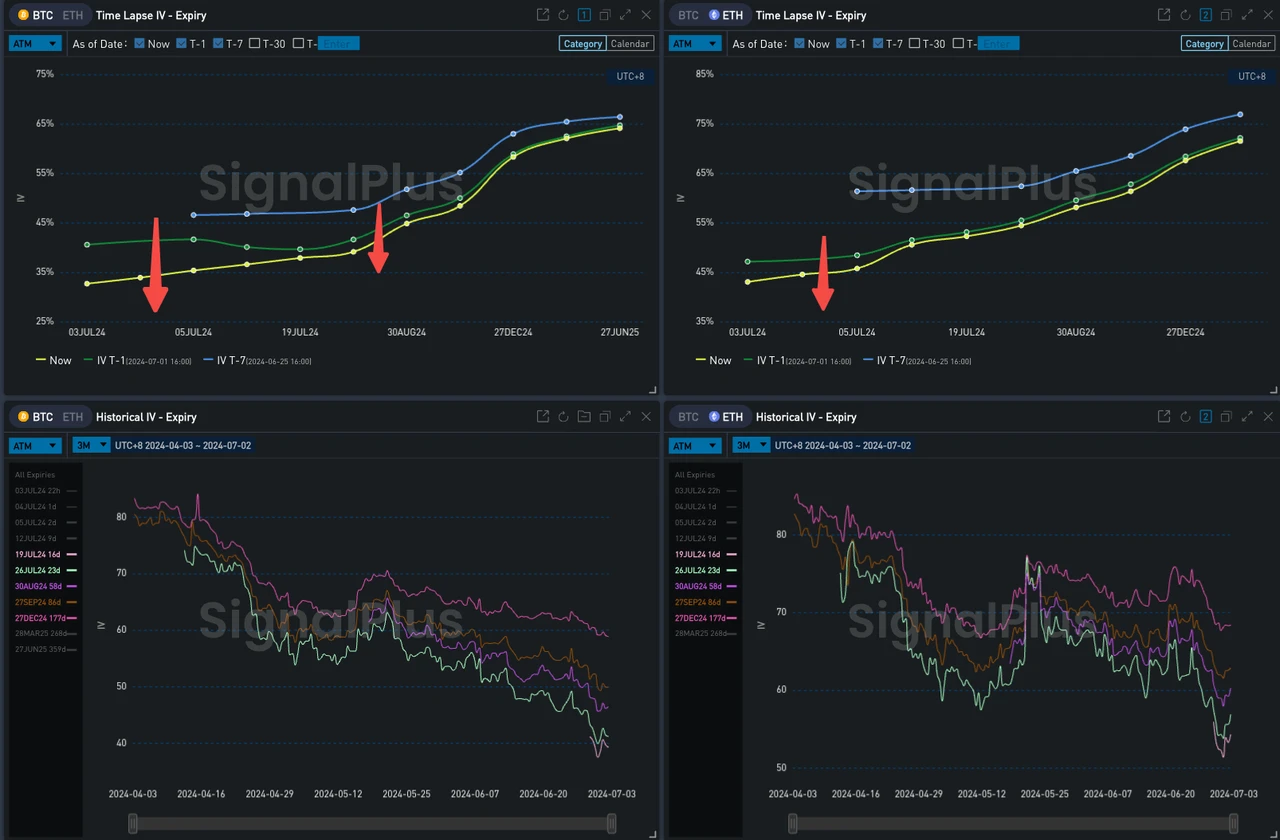

In terms of options, implied volatility is still declining, BTC continues to break the recent historical lows, and ETH IV has experienced several sharp fluctuations after several ETF News shocks, but the overall trend is still downward, currently around 50+%, generally 15% higher than BTC Vol in the same period. Back to the Ethereum ETF, the US SEC returned all the S-1 forms to the issuers, and the market expects that it should be approved within two weeks. In addition, judging from the published rates, in order to seize the market, the Ethereum ETF rate will be lower than that of the Bitcoin ETF, all below 30 basis points.

Source: Deribit (as of 2 JUL 16:00 UTC+8)

來源:SignalPlus

資料來源:Deribit,ETH交易整體分佈

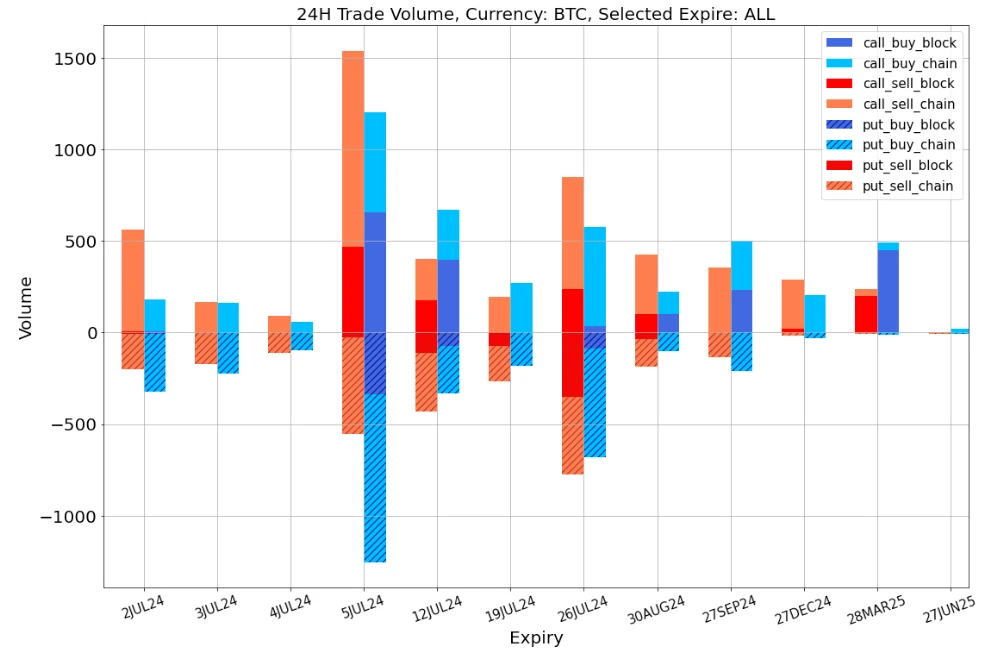

資料來源:Deribit,BTC交易整體分佈

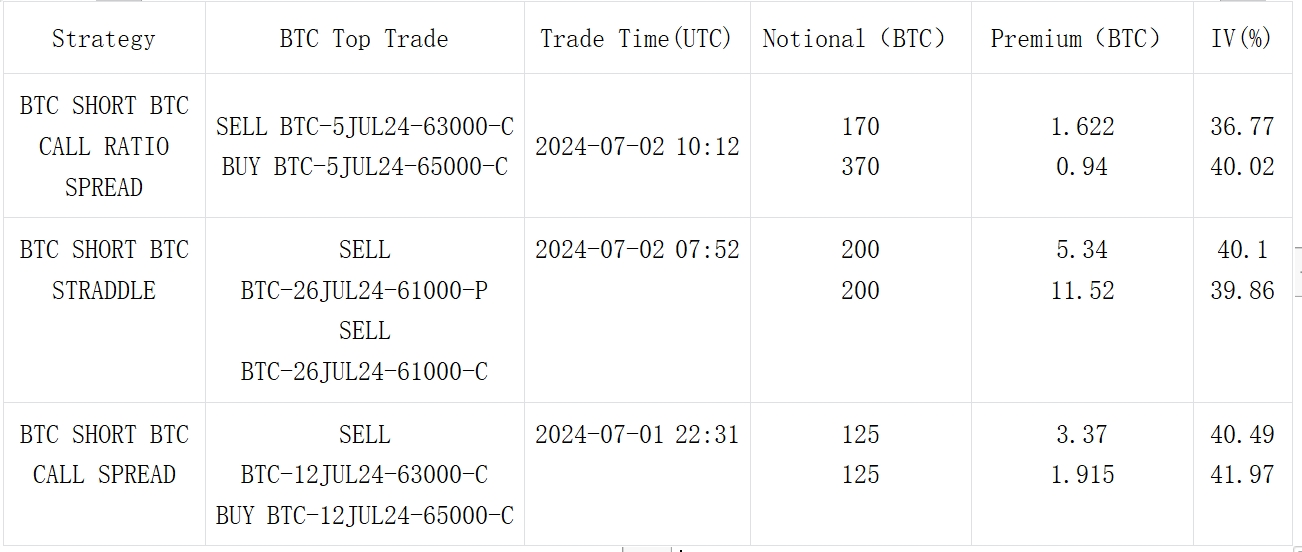

來源:Deribit 大宗交易

來源:Deribit 大宗交易

您可以在ChatGPT 4.0的插件商店中搜尋SignalPlus來取得即時加密資訊。如果您想在第一時間收到我們的更新,請關注我們的 Twitter 帳號@SignalPlus_Web3,或加入我們的微信群(新增助手微信:SignalPlus 123)、Telegram 群和 Discord 社區,與更多朋友交流互動。 SignalPlus 官方網站:https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240702): Can there be a rebound in July?

Related: Towards Mass Adoption, in-depth analysis of the inherent logic of Paypal stablecoin payment

Original title: Analysis of the internal logic of Paypals stablecoin payment and the evolutionary thinking towards Mass Adoption Original author: Will Awang On May 31, 2024, PayPal announced that its stablecoin PayPal USD (PYUSD) was launched on the Solana blockchain. This is another major milestone since PayPal first launched PYUSD on the Ethereum mainnet in August last year. It not only provides its users with a new and efficient payment method, but also provides an important reference for the future trends of the entire payment industry. Previously, when writing a research report on Web3 payments and communicating with industry companies, I have been thinking about a question: Is stablecoin payment really necessary? Coincidentally, PYUSD was launched on Solana. Paypal gave an answer about payment freedom from a very pragmatic perspective:…