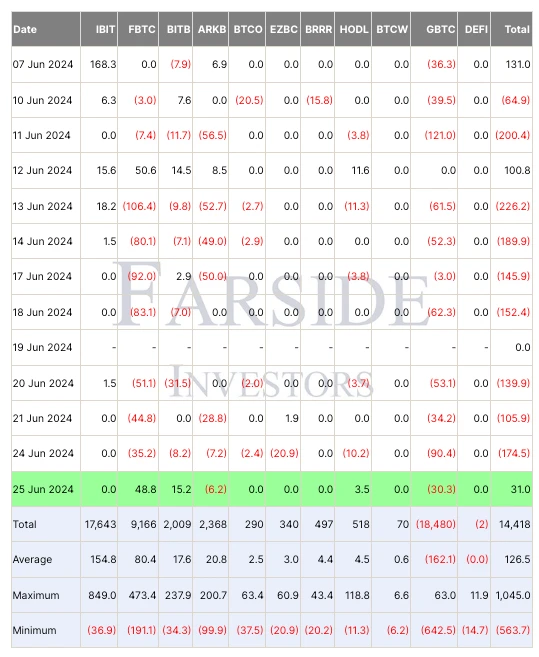

Yesterday (JUN 25), Bitcoin spot ETFs finally stopped outflows, and the uncertainty reflected in the options market also basically fell. Since the Mentougou Compensation Trustee announced on June 24 that repayments would be initiated in early July, the price of Bitcoin has fallen for a short time due to market panic. Alex Thorn, head of Galaxy Research, said in a post that the number of tokens ultimately allocated to individual creditors in the bankruptcy case was less than people thought, about 65,000 BTC (far lower than the 140,000 previously announced by the media), and the resulting Bitcoin selling pressure will be less than expected. This is mainly because some creditors chose debt acceptance (similar to FTXs packaged sale of debt) and received early payment, and the money eventually flowed to large institutions. In addition, the letter did not mention the specific repayment period, but it should not be too short, and these Mentougou creditors themselves are all early digital currency users who are proficient in technology. There is reason to believe that creditors clearly prefer long-term Bitcoin holders, so the maximum daily selling pressure is not exaggerated.

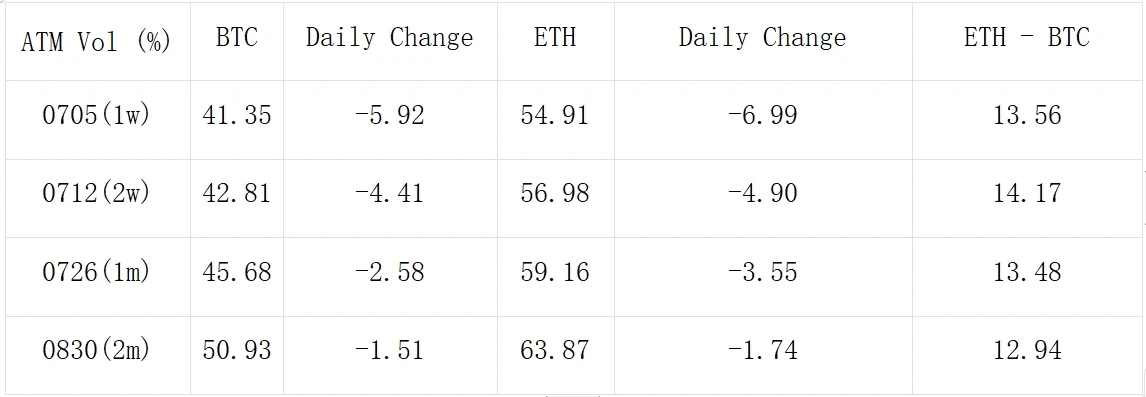

Source: Farside Investors; SignalPlus, ATM Vol.

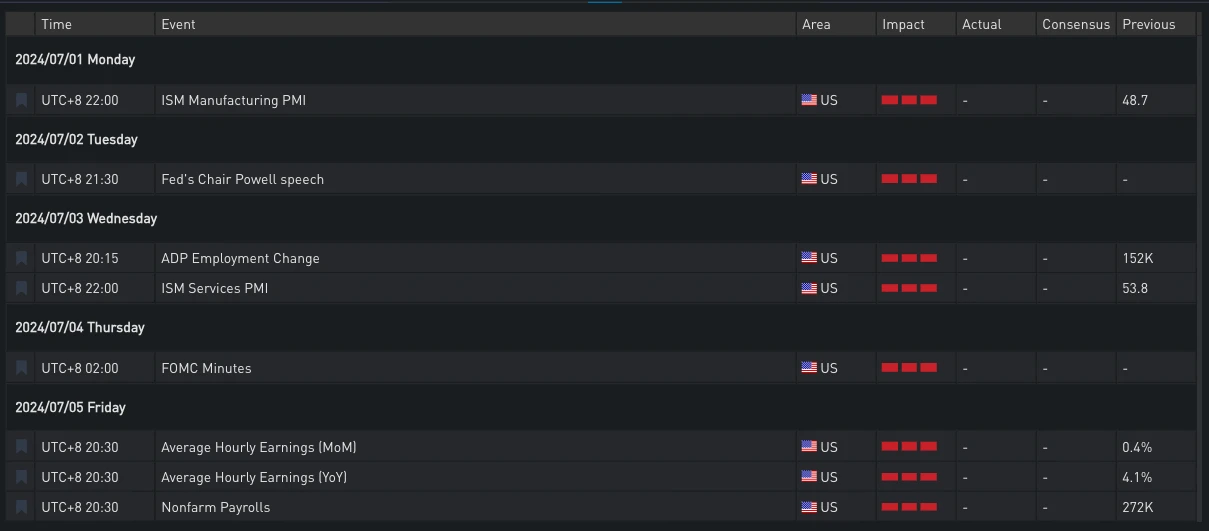

Judging from the price trend of the currency yesterday, although the price rebounded to around 62,000 and the ETF temporarily ended the outflow of funds, it still cannot change the current negative sentiment and poor liquidity. Therefore, the next macro trend should be paid attention to, such as PCE this Friday, the speech of Fed Chairman Powell next Tuesday, and the hourly wage and non-agricultural data next Friday, which will affect the market repricing and capital flow.

Source: SignalPlus Economic Calendar, Important US economic events this week

Source: SignalPlus Economic Calendar, important US economic events next week

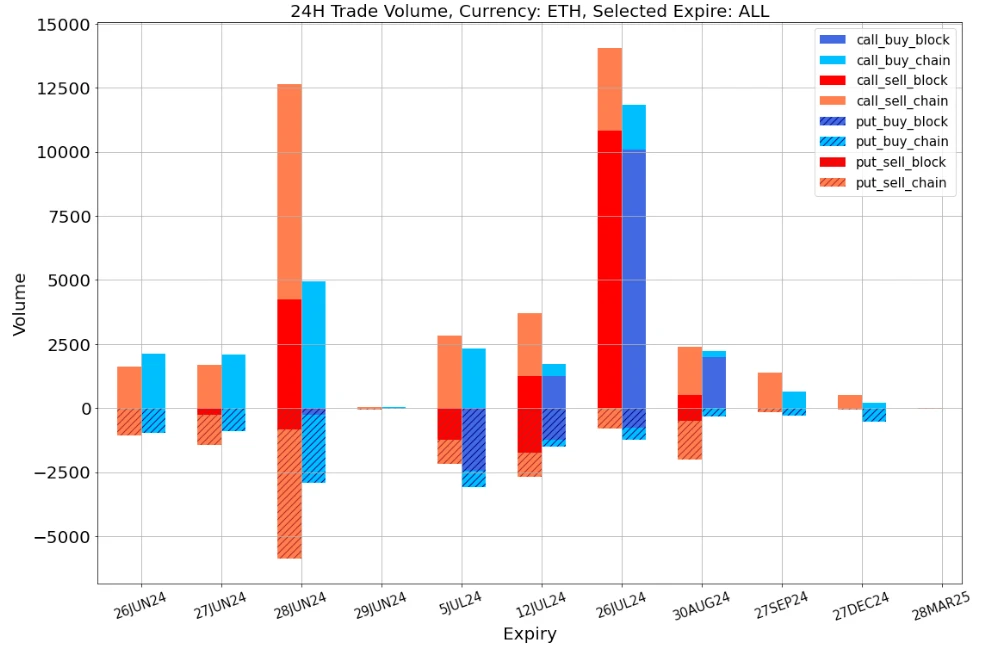

Source: Deribit (as of 26 JUN 16: 00 UTC+ 8)

In terms of trading, after the panic subsided, BTC saw bargain-hunting of call options in late June and July. In addition, a large transaction at the end of September was also particularly eye-catching. This strategy protected the remote positions by selling 190 ATM Calls worth 62,000 in exchange for 1,140 Puts worth 48,000 at almost zero cost.

資料來源:Deribit,BTC交易整體分佈

資料來源:Deribit,ETH交易整體分佈

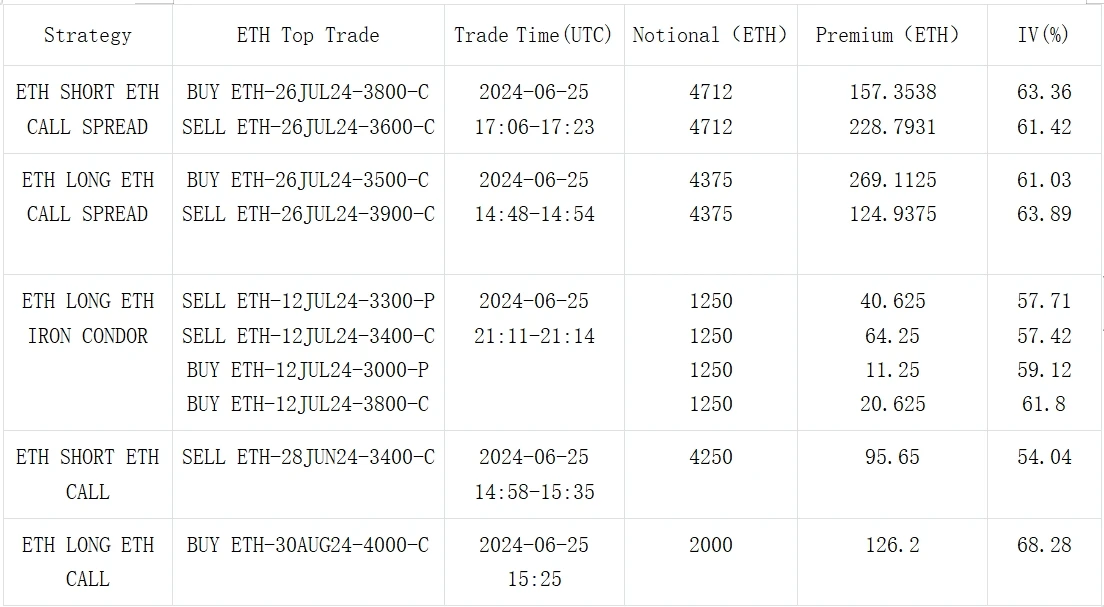

來源:Deribit 大宗交易

來源:Deribit 大宗交易

您可以在ChatGPT 4.0的插件商店中搜尋SignalPlus來取得即時加密資訊。如果您想在第一時間收到我們的更新,請關注我們的 Twitter 帳號@SignalPlus_Web3,或加入我們的微信群(新增助手微信:SignalPlus 123)、Telegram 群和 Discord 社區,與更多朋友交流互動。 SignalPlus 官方網站:https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240626): Panic subsides

相關:快速瀏覽 a16z、BlackRock 和 Coinbase 持有的 10 個有前景的代幣

原作者:Atlas、Crypto KOL 原文翻譯:Felix、PANews 創投家每天向各種山寨幣投資數百萬美元,推高這些山寨幣的價格。追蹤頂級創投機構和鯨魚的錢包並追蹤他們的持股可能會帶來超額利潤。 Crypto KOL Atlas 掃描了 100 多個基金錢包和盈利鯨魚,分析了他們的錢包並審查了所有項目,並選出了 Web3 中表現最好的基金,包括 a16z、BlackRock 和 Coinbase。以下是它持有的 10 個最有前途的代幣。 PANews 註:本文旨在提供市場信息,不構成投資建議,DYOR。複合實驗室 (COMP) 一種用於借貸的 DeFi 協議,允許用戶透過存入其池中的加密貨幣賺取利息。市值:$386…