過去24小時,市場上出現了許多新的熱門幣種和話題,這可能是下一個賺錢的機會, 包括:

-

The sectors with relatively strong wealth creation effects are: MEME sector and TON ecological project

-

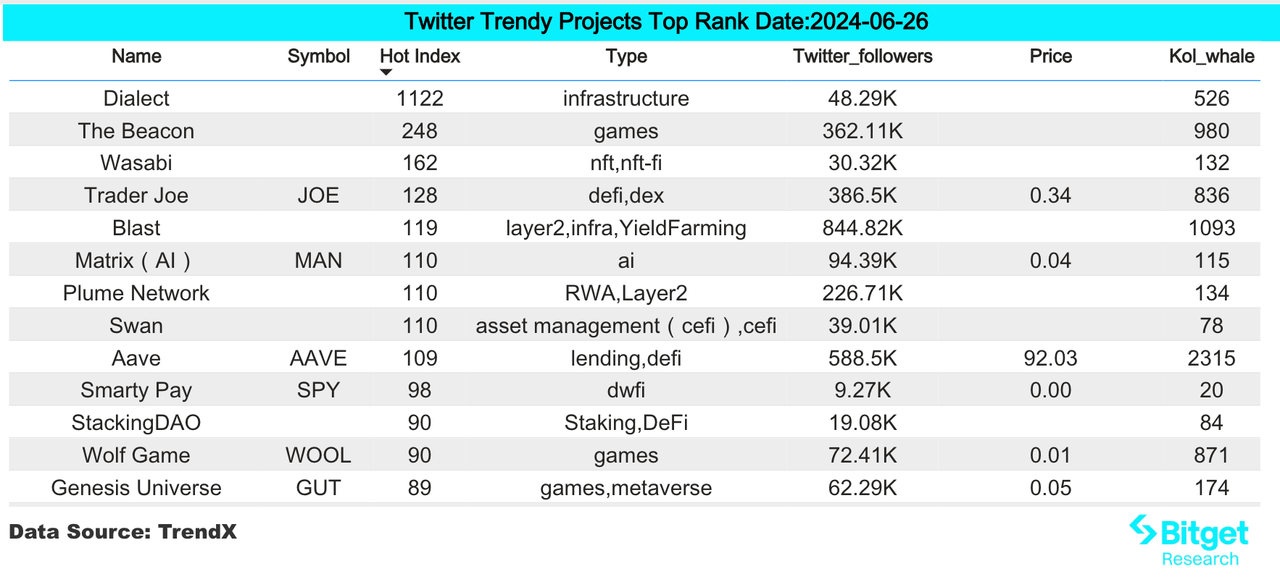

Hot searched tokens and topics: The Beacon, Blast, FET

-

Potential airdrop opportunities include: Bemo, Bedrock

Data statistics time: June 26, 2024 4: 00 (UTC + 0)

1、市場環境

In the past 24 hours, Bitcoin rebounded and broke through 62,000 USDT, with a daily increase of 2.83%. Ethereum rose above 3,400 USDT, with a daily increase of 1.43%. MEME tokens generally rose, and WIF, PEPE, BONK, etc. all rose by more than 10% in 24 hours. At the same time, yesterday, the Blast Foundation announced that it would airdrop BLAST to the community at 22:00 on June 26, Beijing time. Blast announced the token economic model. The total supply of BLAST is 100 billion, 50% of which will be airdropped to the community, and the initial airdrop amount is 17 billion. Blast is currently the sixth largest on-chain economy. Bitget launched a limited-time airdrop of BLAST, and investors can keep an eye on it.

In the market, Bitcoin spot ETF had a total net inflow of 31.0131 million US dollars yesterday, the first net inflow after the net outflow in the past 7 days, and the price of Bitcoin is expected to strengthen. At the same time, there are certain positives in the Ethereum spot ETF. Gary Gensler, chairman of the U.S. Securities and Exchange Commission (SEC), said that the process of launching the Ethereum spot ETF is progressing smoothly. According to the timeline of the 8-A form submitted for the Ethereum spot ETF, it is currently highly likely that the ETH ETF will be approved in July.

2. 致富領域

1) Sector changes: MEME sector (PEPE, WIF, BONK)

Main reasons: Affected by the sentiment of the crypto market, Bitcoin rebounded slightly yesterday, BTC ETF had a certain net inflow, and the market wealth effect spilled over to the Meme sector; if the market maintains an upward trend, you can continue to pay attention to Meme assets. Often in the process of BTC recovery, MEME track assets will be the first to have a certain wealth effect.

Increase: Pepe (PEPE) 24 hours increase of 15.96%, dogwifhat (WIF) 24 hours increase of 17%, Bonk (BONK) 24 hours increase of 12.8%

影響後市的因素:

-

ETH是否持續上漲:ETH生態Dex具有良好的流動性,DEX上許多代幣都是以ETH計價的。 ETH的上漲可以直接疊加ETH生態資產的上漲。如果ETH的價格持續上漲,以太幣上的核心資產往往能維持人氣;

-

Community hype enthusiasm: PEPE is the most suitable hype group for American retail investors in terms of imagery. The group is easy to be sentimental. At the same time, PEPE is relatively active in trading, and its price is prone to surges and plunges. The main feature of PEOPLE is that the project owner has almost given up the project, but it still has a high hype popularity. The core reason for the recent surge in PEOPLE is the long squeeze. As an old MEME, FLOKI has also been active recently and is worth paying attention to.

2)未來需要重點關注的板塊:TON生態系統

The main reason: Notcoins popularity has boosted the activity of the entire TON ecosystem, and a large number of similar projects and improved GameFi projects have emerged. TON ecosystem currently has several high-traffic projects that have not issued tokens: TON ecosystem game Hamster Kombat claims that its user base has exceeded 100 million, and Catizens user base has exceeded 15 million, making the market full of expectations for the mass adoption of future TON ecosystem projects. These projects will bring more users and funds to TON.

Increase: Notcoin 24 hours increase of 8%;

特定幣種列表:TON、NOT、STON、GRAM、FISH

影響因素:

-

隨著大盤持續下跌和山寨幣暴跌,TON 代幣和 Ton 生態系統代幣表現相對較好。

-

Ton生態中領先的兩個DEX也是TVL最高的兩個協議:DeDust和STON.fi,其TVL在過去7天內逆勢增長,分別增加了12%和3%。

-

Ton生態系統高流量Telegram Mini App Catizen和Hamster Kombat的用戶數量持續飆升,吸引了市場關注。 Catizen鏈上用戶總數已超過125萬,Hamster Kombat用戶數已超過1.5億,成為近期加密貨幣市場少數的熱點之一。

-

Pantera Capital 正在為一支專門投資 TON 代幣的新基金籌集資金。該基金名為 Pantera TON Investment Opportunities,旨在籌集資金購買更多 TON 代幣,每個支持者的最低投資額為 $250,000。

3.用戶熱搜

1) 流行的Dapp

Blast: Blast released its token economics today. Blast is a Layer 2 network based on Optimistic Rollup. It was launched by Pacman, the founder of NFT market Blur. Investment institutions such as Paradigm and Standard Crypto participated in the investment. The total financing was 20 million US dollars. The main network was launched in March this year. The total locked-in amount of the Blast network exceeds 3 billion US dollars, the total locked-in amount of Dapp exceeds 2 billion US dollars, the number of user addresses exceeds 1.5 million, and more than 200 Dapps have been launched. The total supply of Blast tokens is 100 billion, 50% of which will be airdropped to the community. The first phase of Blast airdrop accounts for 17% of the total supply, of which Blast Gold and Blast Point each account for 7% of the total tokens. Due to the recent poor market conditions, many top-level projects have been launched and broken. Users are advised to handle airdropped tokens with caution, and the bullish foundation is weak.

2)推特

The Beacon: The Beacon is a pixel-style Free 2 Play action role-playing game released by TreasureDAO on the Arbitrum chain. The gameplay includes single-player level-breaking, team adventure, casual dress-up, etc. The Beacon recently launched three large-scale events, and participants can receive token airdrops. The TGE is planned to be held shortly after the global game release, which is expected to take place in December.

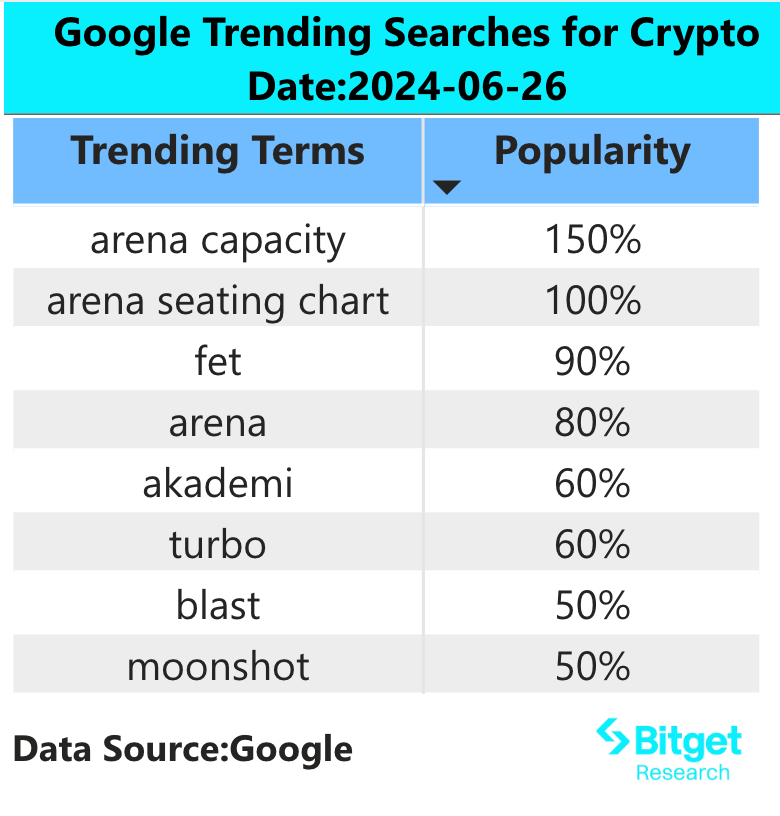

3) 谷歌搜尋區域

從全球角度來看:

FET: According to official news, the Artificial Superintelligence Alliance announced major progress and updates on the merger of ASI tokens. The first phase is scheduled to start on July 1, 2024, and the migration platform from AGIX and OCEAN to FET will be opened on the SingularityDAO dApp, allowing holders to convert their tokens to FET. The conversion rate is 1 AGIX for 0.433350 FET and 1 OCEAN for 0.433226 FET.

The second phase is the cross-chain deployment of ASI tokens. The FET network is upgraded to the ASI network. The migration contract from FET, AGIX, and OCEAN to ASI is open. EVM and other bridges are open. Trading platforms begin to migrate from FET to ASIs spot market. Currently, AI tokens are rising with the rebound of the market.

從各地區熱搜來看:

(1) Asian countries: There is no obvious preference for searches in Asian countries, and AI projects appear relatively more frequently. The main reason is that in the past 24 hours, AI track projects such as FET, AGIX, and OCEAN have performed well.

(2) European and American countries: There are no obvious hot spots. The tokens and terms on the top search lists of different countries are different. The focus of British and American users has returned to conservative thinking. For example, public chain projects such as ICP and SUI appear on the hot search list. The same trend exists in European countries, but the tokens they pay attention to are slightly different. Solana, ada and starknet are more popular.

4. 潛力 空投 機會

Bemo

Bemo is the second largest liquidity staking service provider in the TON ecosystem. Users can stake TON in the protocol to earn an annualized return of 3.9%. The current project TVL is 76 million US dollars. It is an early project in the TON ecosystem and has a large space.

The project鈥檚 official website has launched an airdrop operation, where Bemo鈥檚 application stakers can receive xtXP rewards, which can be exchanged for $BMO tokens in the future.

具體參與方式: 1)造訪專案官網,點選立即質押; 2) 將 Ton 錢包連結到質押。

基岩

Bedrock is a multi-asset liquidity re-pledge protocol that started with the institutional-grade liquidity re-pledge token uniETH on EigenLayer, and later expanded to the first and largest liquidity re-pledge protocol on the IoTeX network. It will also be introduced before the launch of the Babylon mainnet, supporting liquidity pledged Bitcoin uniBTC.

Bedrocks current TVL has exceeded US$200 million, with a strong lineup of investors: OKX Ventures, LongHash Ventures, and Comma 3 Ventures led the investment, and Waterdrop Capital, Lbank Labs, Amber Group, ArcheFund, Whale Ground, and angel investors such as Babylon co-founder Fisher Yu followed suit.

How to do it specifically: If you hold ETH or IOTX, you can go to Bedrock to stake it into uniETH or uniIOTX to get staking income and future Bedrock airdrops; if you hold wBTC, you can go to Bedrock to stake it into uniBTC, and you will get staking income, Babylon airdrops, and Bedrock airdrops in the future.

原文連結: https://www.bitget.com/zh-CN/research/articles/12560603811741

【免責聲明】市場有風險,投資需謹慎。本文不構成投資建議,使用者應考慮本文中的任何意見、觀點或結論是否適合自己的具體情況。根據此資訊進行投資的風險由您自行承擔。

This article is sourced from the internet: Bitget Research Institute: ETH ETF is expected to be approved as early as July, Blast coin airdrop

相關:誕生於邊緣:去中心化算力網路如何賦能加密貨幣和人工智慧?

原作者:Jane Doe、陳力 原來源:優幣資本 1 AI 與加密貨幣的交集 5 月 23 日,晶片巨頭英偉達發布 2025 財年第一季財報。其中,數據中心收入比去年增加了4,27%,達到驚人的US$226億。英偉達能夠憑藉一己之力拯救美國股市的財務表現背後,是全球科技公司為了在AI賽道上競爭而爆發的算力需求。越是頂尖科技公司在AI賽道上雄心勃勃的佈局,其對算力的需求就越是指數級增長。根據TrendForces預測,2024年需求...