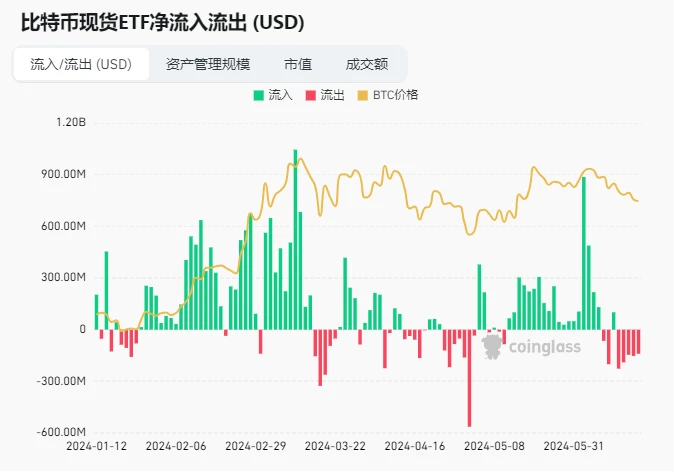

過去5天比特幣ETF持續遭到拋售

資料來源: https://www.coinglass.com/en/bitcoin-etf

最新數據顯示,美國現貨比特幣ETF於6月17日掀起拋售風暴!總共售出了 3,169 個比特幣,價值超過 $2 億!

其中,知名機構富達減持1,224枚比特幣,價值高達$8034萬,目前仍持有大量比特幣。另一巨頭Grayscale也減持了936個比特幣,價值超過$61.4百萬。這兩大巨頭的減持無疑為市場帶來了不小的震動。

這次拋售風暴為比特幣市場的未來趨勢帶來了更多的不確定性,需要更多的風險管理。

距離聯準會下一次利率會議還有大約38天(2024.08.01)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

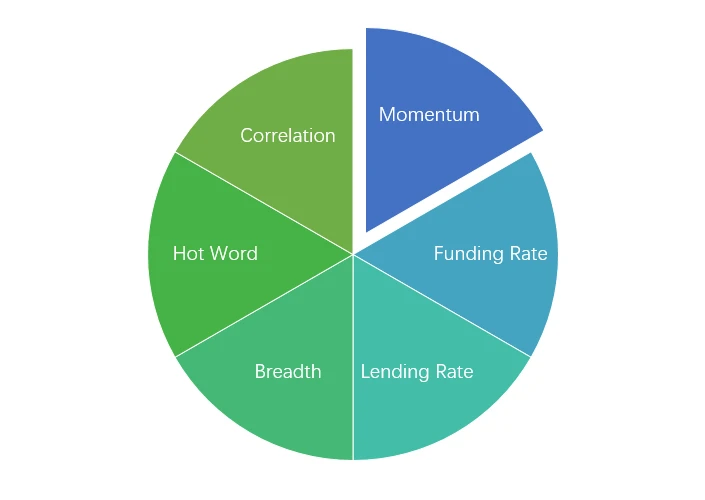

市場技術與情緒環境分析

情緒分析組件

技術指標

價格走勢

過去一周,BTC價格下跌-2.85%,ETH價格上漲1.26%。

上圖是近一周BTC的價格走勢圖。

上圖是近一周ETH的價格走勢圖。

表格顯示了過去一週的價格變化率。

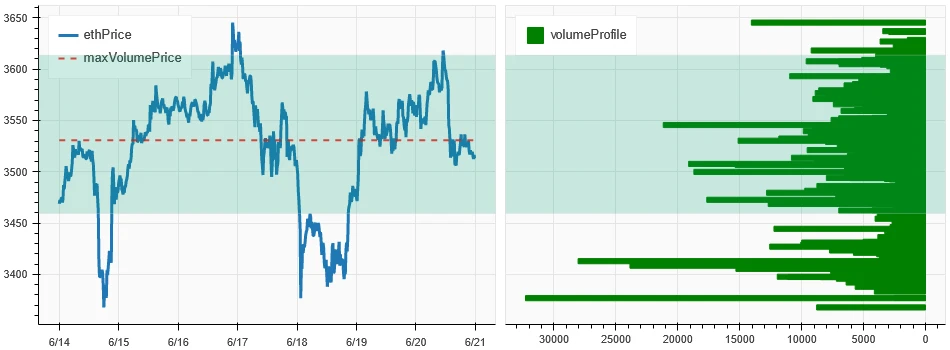

價量分佈圖(支撐位和阻力位)

過去一周,BTC、ETH在交易密集區大幅波動。

上圖為近一週BTC密集交易區域分佈。

上圖為近一週ETH密集交易區域分佈。

表格顯示了過去一週BTC和ETH的周密集交易區間。

成交量和持倉量

BTC和ETH上周成交量最大,6月18日出現下跌; BTC持倉量下降,ETH持倉量小幅上升。

上圖上方為BTC的價格走勢,中間為交易量,下方為持股量,淺藍色為1日均線,橘色為7日均線。 K線的顏色代表當前狀態,綠色表示價格上漲受到成交量的支撐,紅色表示平倉,黃色表示慢慢累積倉位,黑色表示擁擠狀態。

上圖上方為ETH的價格走勢,中間為交易量,下方為持倉量,淺藍色為1日均線,橘色為7日均線。 K線的顏色代表當前狀態,綠色表示價格上漲受到成交量的支撐,紅色表示平倉,黃色表示慢慢累積倉位,黑色表示擁擠。

歷史波動率與隱含波動率

過去一周,BTC和ETH歷史波動最高時跌至6.14; BTC、ETH隱含波動率較周初均上升。

黃線是歷史波動率,藍線是隱含波動率,紅點是其7日平均值。

事件驅動

過去一周沒有發布任何數據。

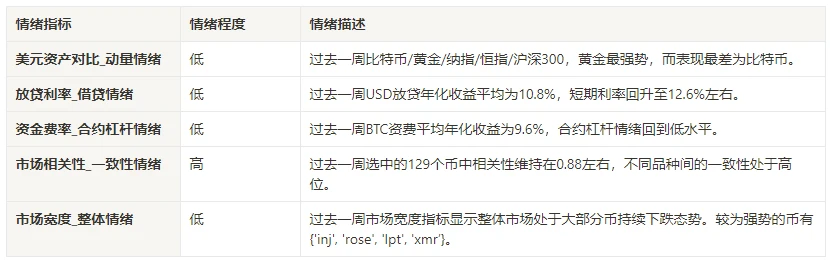

情緒指標

動量情緒

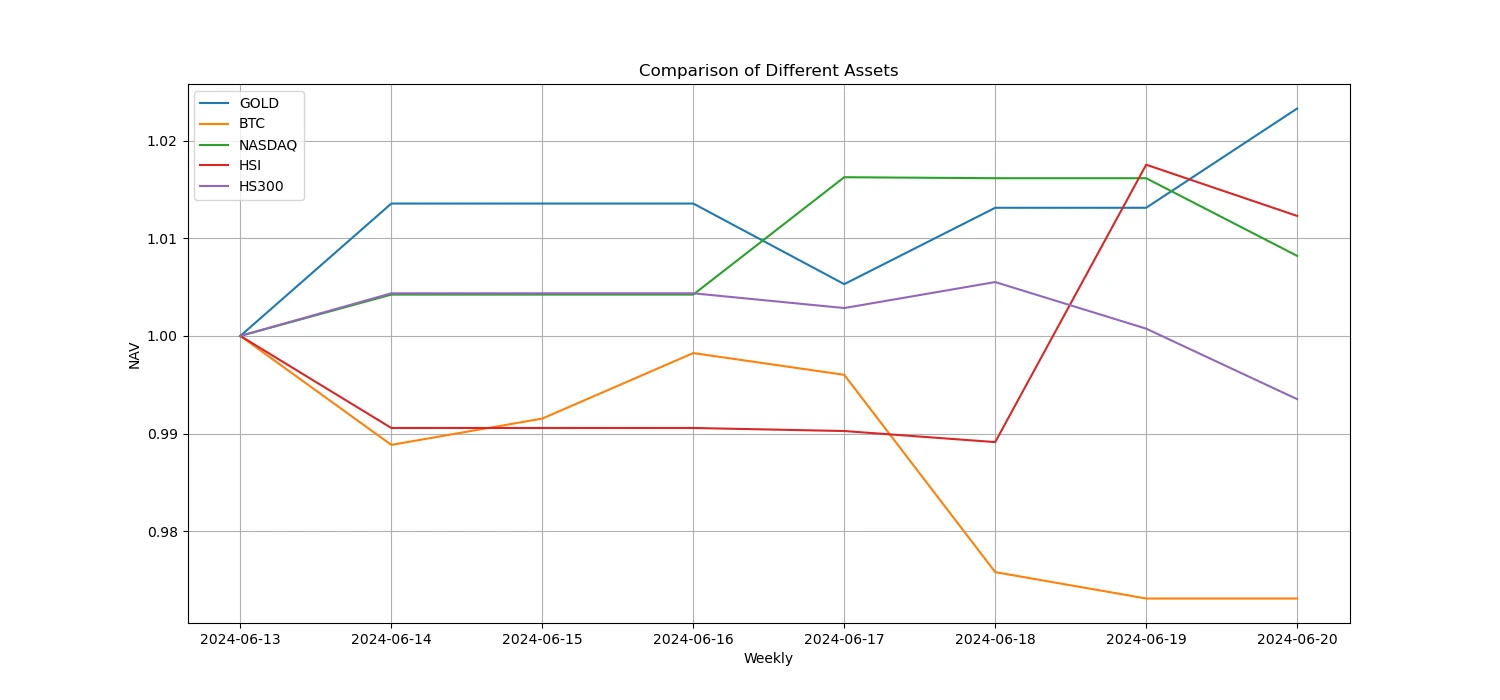

過去一周,比特幣/黃金/納斯達克/恆生指數/上證300中,黃金表現最強,比特幣表現最差。

上圖為近一周不同資產的走勢。

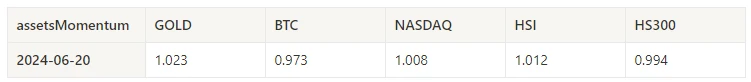

貸款利率_貸款情緒

近一週美元貸款平均年化報酬率為10.8%,短期利率反彈至12.6%附近。

黃線為美元利率最高價,藍線為最高價75%,紅線為最高價75% 7日均線。

表格顯示過去不同持有天數美元利率的平均報酬

資金費率_合約槓桿情緒

近一週BTC手續費平均年化報酬為9.6%,合約槓桿情緒重回低點。

藍線是BTC在幣安上的資金費率,紅線是其7日平均值

表格顯示了過去不同持有天數的BTC費用平均報酬。

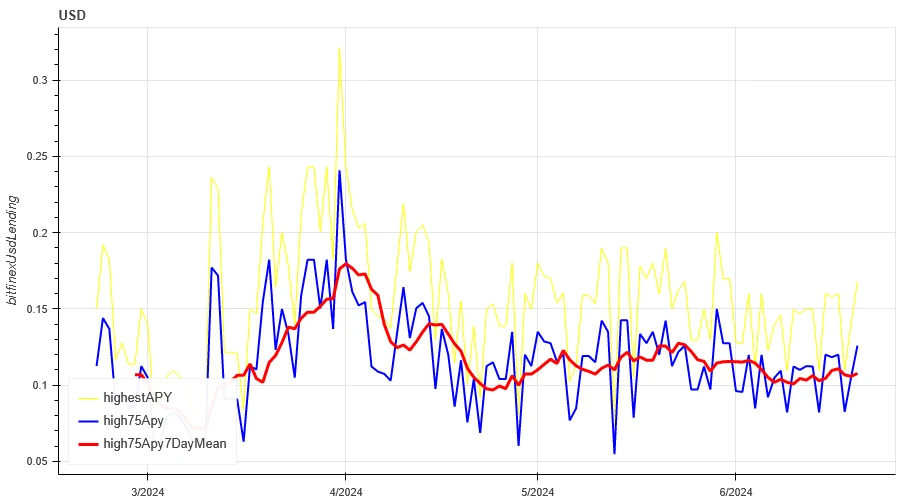

市場相關性_共識情緒

近一週入選的129枚幣之間相關性維持在0.88左右,不同品種之間的一致性處於較高水準。

上圖中,藍線是比特幣的價格,綠線是[1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape、apt、 arb、ar、astr、atom、音訊、avax、axs、bal、樂團、bat、bch、bigtime、模糊、bnb、btc、celo、cfx、chz、ckb、comp、crv、cvx、網路、 dash、doge、 dot、dydx、egld、enj、ens、eos 等、eth、fet、fil、flow、ftm、fxs、gala、gmt、gmx、grt、hbar、hot、icp、icx、imx、inj、 iost、iotx、jasmy 、kava、klay、ksm、ldo、link、loom、lpt、lqty、lrc、ltc、luna 2、magic、mana、matic、meme、mina、mkr、near、neo、ocean、一、ont 、 op、 pendle、 qnt、 qtum、 rndr、 玫瑰、 符文、 rvn、 沙、 sei、 sfp、 skl、 snx、 sol、 ssv、 stg、 storj、 stx、 sui、 sushi、 sxp、 theta、 tia、 trx、 t 、uma、uni 、vet、waves、wld、woo、xem、xlm、xmr、xrp、xtz、yfi、zec、zen、zil、zrx] 整體相關性

市場廣度_整體情緒

過去一週入選的129個幣種中,有4%價格位於30日均線上方,其中8.6%相對於BTC位於30日均線上方,其中2.4%距離BTC較20%還多。距離近30天最高價不到10%。過去一週的市場廣度指標顯示,大部分幣種整體市場處於持續下跌狀態。

上圖為[bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, alt, agix, ai, ape, , 、arb、ar、astr、atom、avax、axs、bal、band、bat、bch、bigtime、blur、cake、celo、cfx、chz、ckb、comp、crv、cvx、cyber、dash、doge、dot、 dydx 、egld、enj、ens、eos 等、fet、fil、flow、ftm、fxs、gala、gmt、gmx、grt、hbar、hot、icp、icx、idu、imx、inj、iot、iotx、jasmy、 jto、 jup、kava、klay、ksm、ldo、link、loom、lpt、lqty、lrc、ltc、luna 2、magic、mana、manta、mask、matic、meme、mina、mkr、near、neo、nfp、海洋、一、ont、op、ordi、pendle、pyth、qnt、qtum、rndr、robin、rose、rune、rvn、sand、sei、sfp、skl、snx、ssv、stg、storj、stx、sui、sushi、sxp 、theta 、tia、trx、t、uma、uni、vet、waves、wif、wld、woo、xai、xem、xlm、xmr、xrp、xtz、yfi、zec、zen、zil、zrx ] 30 天比例每個寬度指示器

總結

過去一周,比特幣(BTC)和以太坊(ETH)價格出現寬幅下跌,並於6月18日達到波動頂峰。日下跌。此外,兩者的隱含波動率均略有上升。此外,比特幣資金費率已降至較低水平,這可能反映出市場參與者對比特幣槓桿情緒的下降。另外,市場廣度指標顯示大部分貨幣持續下跌,顯示過去一週整個市場整體呈現弱勢趨勢。

推特:@ https://x.com/CTA_ChannelCmt

網站: 頻道CMT

本文源自網路:加密貨幣市場情緒研究報告(2024.06.14-2024.06.21):比特幣ETF近5天持續被拋售

相關:今晚8:00開放申請,快速了解Kamino(KMNO)的估值預期

原創| Odaily 星球日報 作者 | Azuma 北京時間 4 月 30 日 20:00,Solana 生態中領先的 DeFi 協議 Kamino 將正式開放治理代幣 KMNO 的代幣申請。此前4月5日,Kamino在其官網添加了代幣創建頁面。用戶先前可以透過該頁面查詢具體的KMNO代幣空投份額。今晚的公開認領意味著用戶將可以透過該介面認領已建立的KMNO份額,並在DEX或一些支援KMNO的CEX上進行交易。卡米諾商業模式分解 卡米諾的商業模式並不複雜,其基礎產品是大家都熟悉的借貸協議。根據 DeFi Llama 數據,Kamino 目前是排名第三的 DeFi 協議和排名第一的借貸協議…