原作者: 李進

原文翻譯:白話區塊鏈

地球上最大的公司都是 市場建立在網路效應之上。像亞馬遜($1.9兆)、Meta($1.2兆)、騰訊($4.59兆)這樣的公司都聚合了市場供需,他們控制的供需越多,他們的網路就變得越有價值。

加密貨幣領域也是如此。像比特幣($1.4兆市值)、Solana($790億市值)和以太坊($4600億市值)這樣的高價值網絡都是由開發者、用戶和網絡運營商組成的多邊網絡,它們變得更有價值隨著規模的擴大。

但當我審視 Web2 和 Web3 市場的格局時,我不僅看到了已經存在的市場,還看到了尚未存在的市場。

在我對市場新創公司的多年投資中,我了解到應該存在一些市場來幫助供需找到彼此,並為雙方提供重要的利益。 我還親眼目睹了新技術如何為新市場的出現和繁榮提供機會。

市場是加密貨幣領域最令人興奮的機會。透過利用加密貨幣的殺手級功能,即基於代幣的可擴展性和鏈上可組合性,企業家可以創建新的市場,為迄今為止尚未滿足的需求的群體提供服務。這是跨越式創新的機會,而不僅僅是漸進式創新。

1. Web2市場創新的系統性障礙

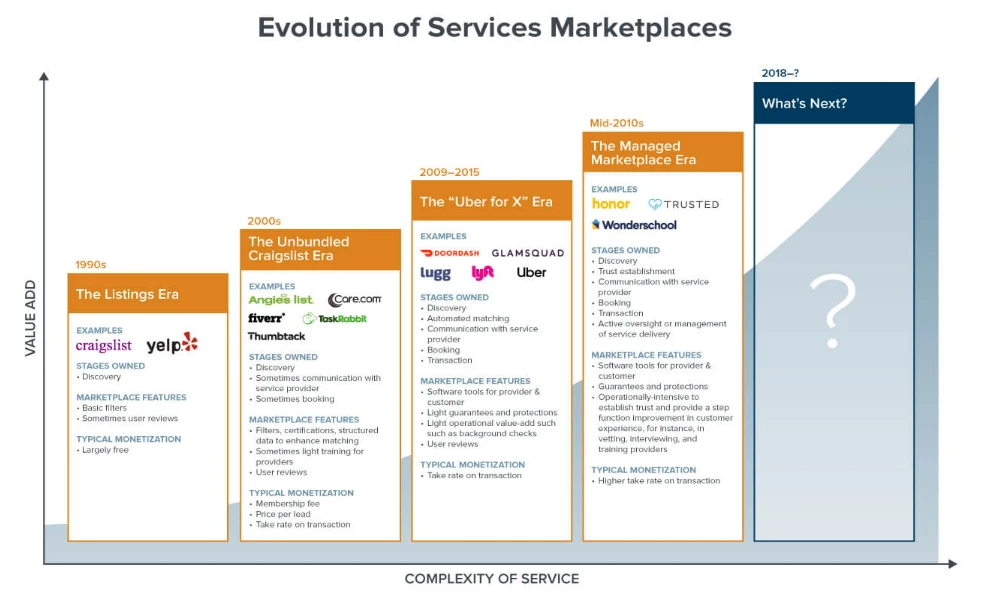

我之前寫過關於服務市場時代的文章,特別是互聯網市場從 20 世紀 90 年代的列表時代(以 Craigslist 為代表)到“Uber for X”時代(2009-2015)的按需應用程序的演變。市場時代(2010 年代中期)。

資料來源:a16z、李進和安德魯陳

每個時代的發展都是為了回應新技術或新興市場需求。在清單時代,互聯網使個人能夠在線上發布和找到清單。與智慧型手機同時出現的Uber for X時代,提供了對各種服務的即時訪問,並利用了用戶的即時位置資訊。在市場機會逐漸減少後,管理市場的出現是為了因應複雜市場中更高的信任需求。

然而,每個時代也帶來了限制創新的挑戰。在上市時代,缺乏信任和標準化限制了成長。在按需時代,擴展市場以提供近乎即時的服務需要巨額資本投資。託管市場面臨著與建立交易信任相關的高昂營運成本,影響了這些市場的生存能力。

其中許多挑戰在 Web2 市場中仍然存在,阻礙了創新的進步。特別是擴展和信任這兩個問題正在阻礙進展,而加密貨幣在解決這些問題方面具有獨特的優勢。

2. 擴展問題

傳統的 Web2 市場可能需要大量資金來建構和擴展,尤其是在市場實現實用性之前需要大量的規模。這種對資本的需求為新參與者設定了進入障礙。這也意味著整個類別的市場可能無法建成,因此由於達到所需規模的成本過高而無法提供效用。

例如,考慮約會應用程式。在交友網路中,只有雙方都有大量的用戶,才能促成良好的配對。傳統上,這意味著平台必須花費大量資金來吸引大量用戶,然後該應用程式才能對任何個人用戶有用。約會應用程式還存在用戶保留率低的問題,因為如果應用程式成功,用戶就會離開,從而進一步阻礙可擴展性。因此,約會類別中很少有突破性的獲勝者。

3.信任問題

Web2 市場中的第二個持續挑戰是信任。某些垂直產業需要市場參與者之間建立非常高的信任度才能進行交易。例如,在某些類別中,與正確的提供者/服務相符的風險很高(例如兒童保育或老年人保育)。其他行業的訂單價值非常高(例如奢侈品、藝術品、房地產)。

為了建立所需的信任,託管市場建立了額外的服務和營運層。例如,兒童保育市場在提供者在市場上進行交易之前會對其進行廣泛的審查,包括現實生活中的訪談、背景調查以及構建用於實時可見性和位置的軟體工具。在房地產領域,一些託管市場承擔了整個端到端流程的責任,從維修到充當房屋的市場交易者(“iBuyers”)。這些額外的操作會帶來巨大的開銷。此外,希望在市場上列出供應品/提供者的其他市場必須重複這項工作,從而導致市場效率低下。

4. 解決問題:加密貨幣的殺手鐧

從這些挑戰的角度來看,加密貨幣具有三個殺手級功能,為市場創新開闢了新的潛在方向:規模、鏈上聲譽和支付。

1)規模

如果加密貨幣擅長一件事,那就是規模。加密貨幣激勵措施(以代幣的形式)已被證明是推動成長的非常強大的工具。

與Web2市場相比,加密貨幣透過代幣提供的財務誘因使市場能夠順序成長,從供給面開始,然後擴大需求。例如,去中心化實體基礎設施網路(DePINs)Helium和Hivemapper透過向參與者提供代幣激勵來啟動其供給側,而底層網路的收入隨後趕上。

您可以將代幣激勵應用於許多不存在的市場類型,因為啟動成本太高。想像一個需要大量用戶密集使用的超本地化社交網路(類似於 Citizen,但更廣泛地適用於資訊或即時事件),或一個新的約會應用程式。在人工智慧領域,我們看到開發者應用代幣激勵措施來創造Web2世界中沒有先例的新市場。例如,Vana 和 Rainfall 等網路使用戶能夠為人工智慧訓練貢獻數據並獲得代幣獎勵。如果沒有明智的激勵措施來動員大規模用戶貢獻,那麼聚合長尾、私有和難以存取的資料集幾乎是不可能的。

2) 鏈上聲譽和歷史

上述的 Web2 市場中的一項挑戰是,孤立的市場在建立信任方面會重複運作。例如,Uber 對所有新司機進行背景調查,但當同一司機下載 Lyft 應用程式時,該應用程式也會進行背景調查,因為平台是孤立的。

加密貨幣的一種應用是作為便攜式信譽系統。如果這些資訊儲存在鏈上並隨著加入任何市場的任何司機一起移動,而不是要求對每個應用程式進行單獨的背景調查,會怎麼樣?此外,有關提供者歷史的其他資訊(例如可靠性和品質)可以在鏈上表示,從而使市場能夠結合和利用全球信任儲存庫。這樣的系統可以消除不同管理市場實施自己的資本密集流程的需求。在 Web2 中,許多託管市場提供了出色的使用者體驗,但由於營運成本高昂,最終無法作為商業模式可行。全球鏈上聲譽可以從根本上改變他們的成本結構。

您可以在 Farcaster 生態系統中找到這個想法的縮影。這項社群媒體協議將貼文、按讚、追蹤和個人資料儲存在去中心化的中心網路中。當用戶安裝基於該協議構建的不同應用程式時,他們的社交數據也會隨之移動。您已經可以看到 Farcaster 上出現的無介面市場。 Bountycaster 就是一個例子,用戶可以利用 Farcaster 網路上豐富的聲譽數據,在任何 Farcaster 用戶端上發布和發現賞金。由於這種可移植的社交數據,您可以想像 Farcaster 生態系統中出現的各種新市場,從智慧合約審計市場到利用 Farcaster 連接圖和聲譽的專家市場。

3)付款

便利支付是現代市場的核心組成部分,但在 Web2 中,支援跨國支付需要跨本地系統的國際化。這對於數位市場尤其重要,因為數位市場的客戶和供應商往往相距甚遠。例如,超過 80% 的 YouTube 用戶來自美國境外。為了支援每個地理區域的本地貨幣支付,平台必須與國際支付網關整合。通常,這會使一些邊緣地區無法獲得服務,特別是對於資源有限的早期市場或無法國際化的平台。

加密貨幣從一開始就可以在國際範圍內運作,使任何擁有加密錢包的人都可以進行交易。這使得資源有限的市場從一開始就具有全球影響力。例如,我最近在一個名為 bytexplorers 的鏈上資料社群購買了 NFT,這使我能夠向分析師社群提出與資料相關的問題。回答正確的分析師將獲得代幣獎勵,從而實現無縫支付和全球參與。

5. 下一代市場機會

如果說我多年來對市場新創公司的投資學到了什麼的話,那就是當建構者利用新技術為最終用戶帶來重大改進時,最好的機會就會出現。每一代的市場建立者都利用新技術來解鎖以前不可能存在的新市場。

加密貨幣代表了這一演變的下一個階段。透過利用代幣激勵措施進行擴張,新市場可以以更資本有效的方式成長。鏈上聲譽和歷史可以減少任何特定市場運營商的管理費用。基於加密貨幣的支付方式使市場從一開始就能跨國無縫運作。所有這些不僅將改善現有市場,還將催生只有在新的成本結構和擴張策略下才能存在的新市場。

本文源自網路:加密貨幣的殺手鐧:規模、鏈上信譽與支付

相關:星球日報 | Curve創辦人貸款部位已清算; MicroStrategy 將繼續購買比特幣(6 月 14 日)

頭條新聞 Curve 創辦人的借貸倉位已被清算約 1 億 CRV,剩餘倉位若健康率達到 1 以上則暫時不會被清算 據 Embers 檢測,Curve 創始人 Michael Egorov 的借貸倉位已被清算約 1 億枚 CRV 1億輛CRV,價值約$27萬。主地址剩餘持倉量為3,935萬枚CRV,借貸量為$540萬枚。目前健康率在1以上,暫時不會被清算。 MicroStrategy:將使用收益購買更多比特幣 MicroStrategy 表示將使用收益購買更多比特幣。美國SEC主席:以太坊ETF S 1預計今年夏天獲得批准 根據市場消息,美國SEC主席Gary Gensler...