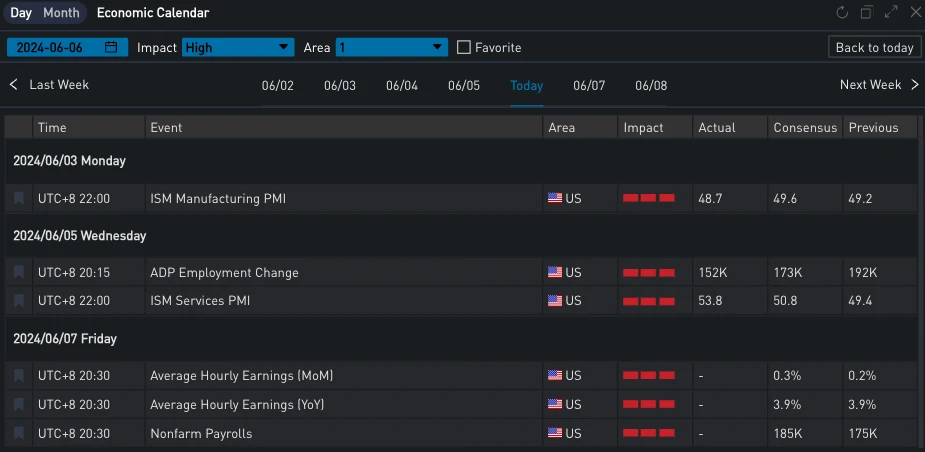

Before the release of non-farm data, yesterday (5 JUN), the US ADP index, known as the small non-farm, was lower than expected, recording 152,000 people, the smallest increase since January this year. U.S. Treasury yields continued to fall, with the 10-year yield falling below the 4.3% mark. The three major U.S. stock indices all closed higher, with the SP and Nasdaq up 1.18% and 1.96% respectively, and the Dow up 0.25%. Nvidia surged 5.16%, with its total market value exceeding Apple, ranking second in the world.

Source: SignalPlus, Economic Calendar; Investing

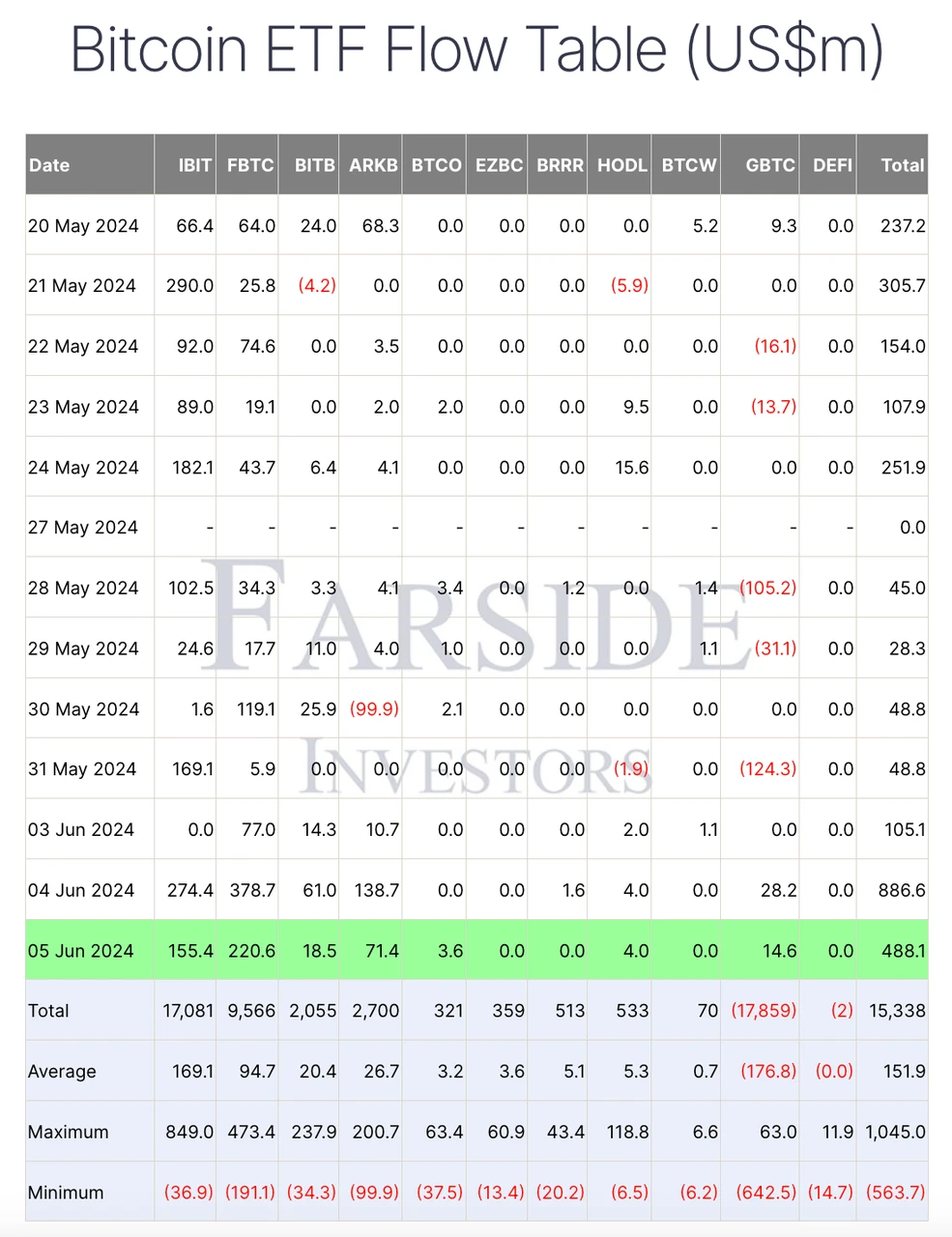

In terms of digital currency, under the favorable macro environment in recent days, the price of BTC continued to rise, challenging the resistance level of 71,600 again. The force that helped it rise must be inseparable from the accelerated inflow of ETFs in the past two days. The purchase volume on June 4 alone was as high as US$886 million, and it continued to increase by US$488 million yesterday.

來源:TradingView

資料來源:Farside 投資者

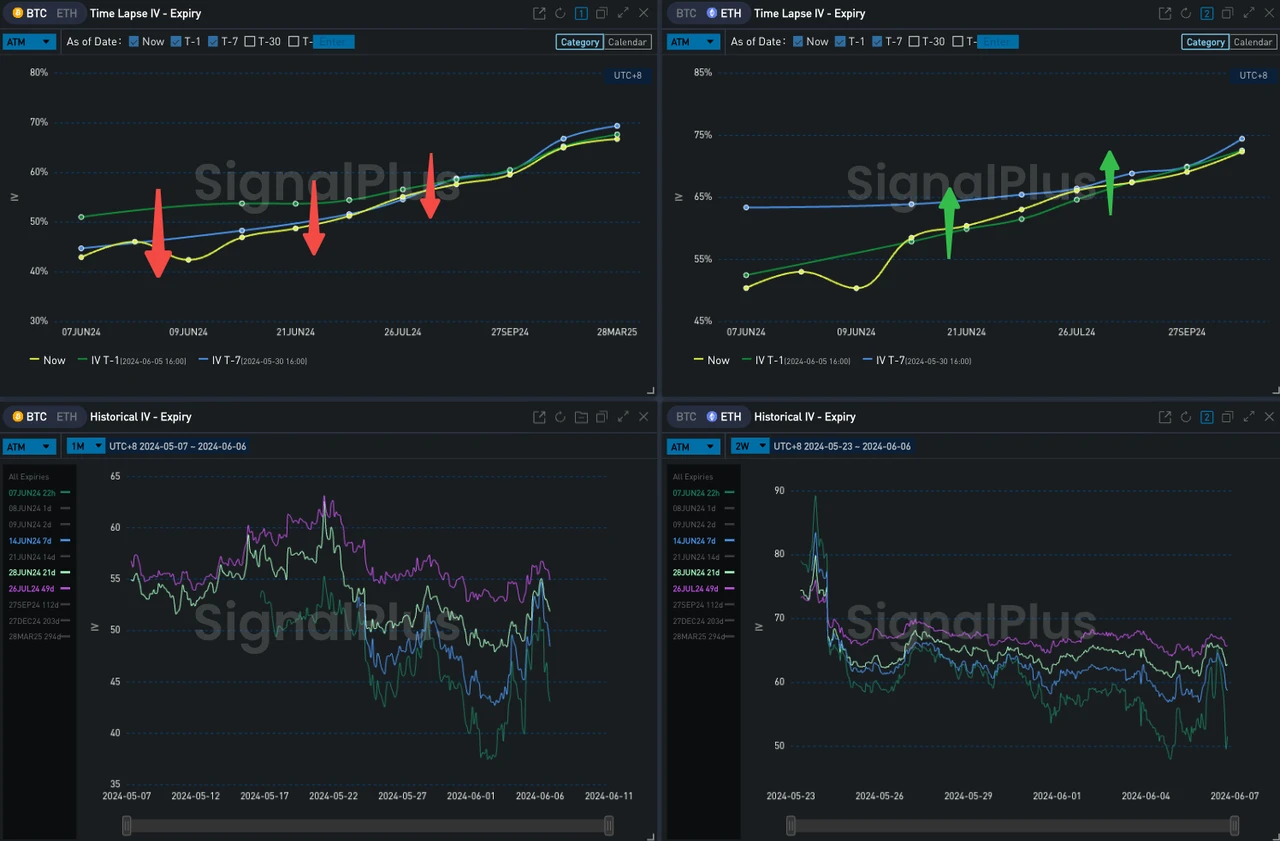

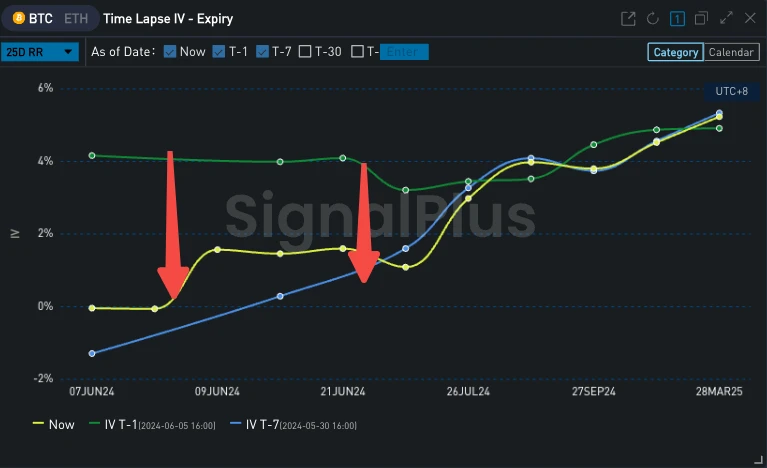

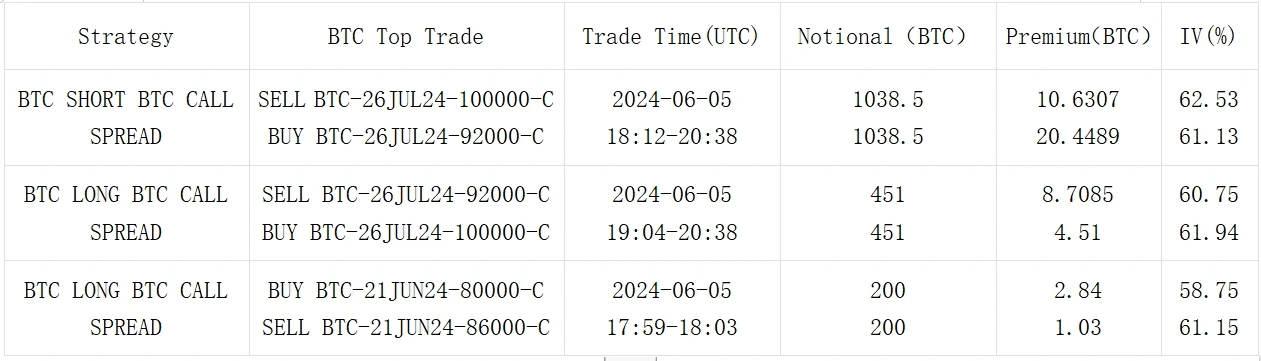

In terms of options, BTC front-end IV and Vol Skew fell at the same time. From the perspective of trading, the continuous rise in prices attracted traders to sell short-term call options, and there were also call spreads sold at the end of June. In addition, the last single-leg 92000 vs 100000 buy call strategy with more than 1000 BTC at the end of July became the focus of the market, but then almost half of the position was closed at the cost price within an hour.

Source: Deribit (as of 6 JUN 16: 00 UTC+ 8)

來源:SignalPlus

來源:SignalPlus

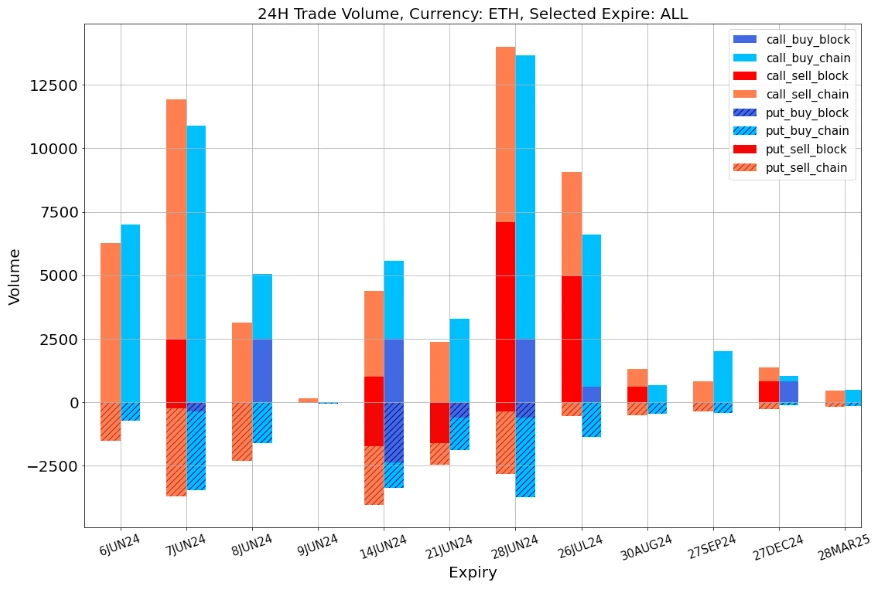

資料來源:Deribit,ETH交易整體分佈

資料來源:Deribit,BTC交易整體分佈

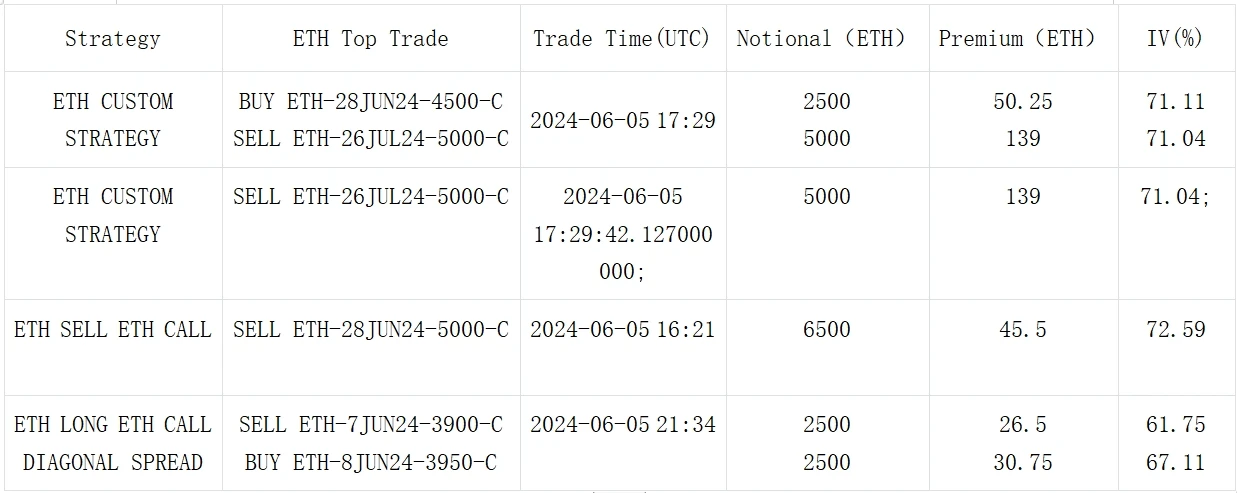

來源:Deribit 大宗交易

來源:Deribit 大宗交易

您可以在ChatGPT 4.0的插件商店中搜尋SignalPlus來取得即時加密資訊。如果您想在第一時間收到我們的更新,請關注我們的 Twitter 帳號@SignalPlus_Web3,或加入我們的微信群(新增助手微信:SignalPlus 123)、Telegram 群和 Discord 社區,與更多朋友交流互動。 SignalPlus 官方網站:https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240606): ETF flows pour into the market

Related: 3 Hidden Gem Altcoins That May Increase and Surprise Investors Next Month

In Brief The recent rally and the lack of one have brought many altcoins on the verge of a potential rally. The likes of Ravencoin (RVN) and Akash Network (AKT) are witnessing a shift in winds, potentially towards a rise. Theta Fuel (THETA) is also set to explode despite being present in a bearish pattern on the daily chart. The crypto market’s volatility in April resulted in Bitcoin and many altcoins witnessing considerable growth. However, some altcoins missed this opportunity but are preparing to do so in May. BeInCrypto has prepared this analysis to put the spotlight on lesser-known coins that are poised for gains in the coming month. Eyes on Theta Network (THETA) Theta Fuel (THETA) price has witnessed nothing but a drawdown throughout April and the second half of March. The altcoin…