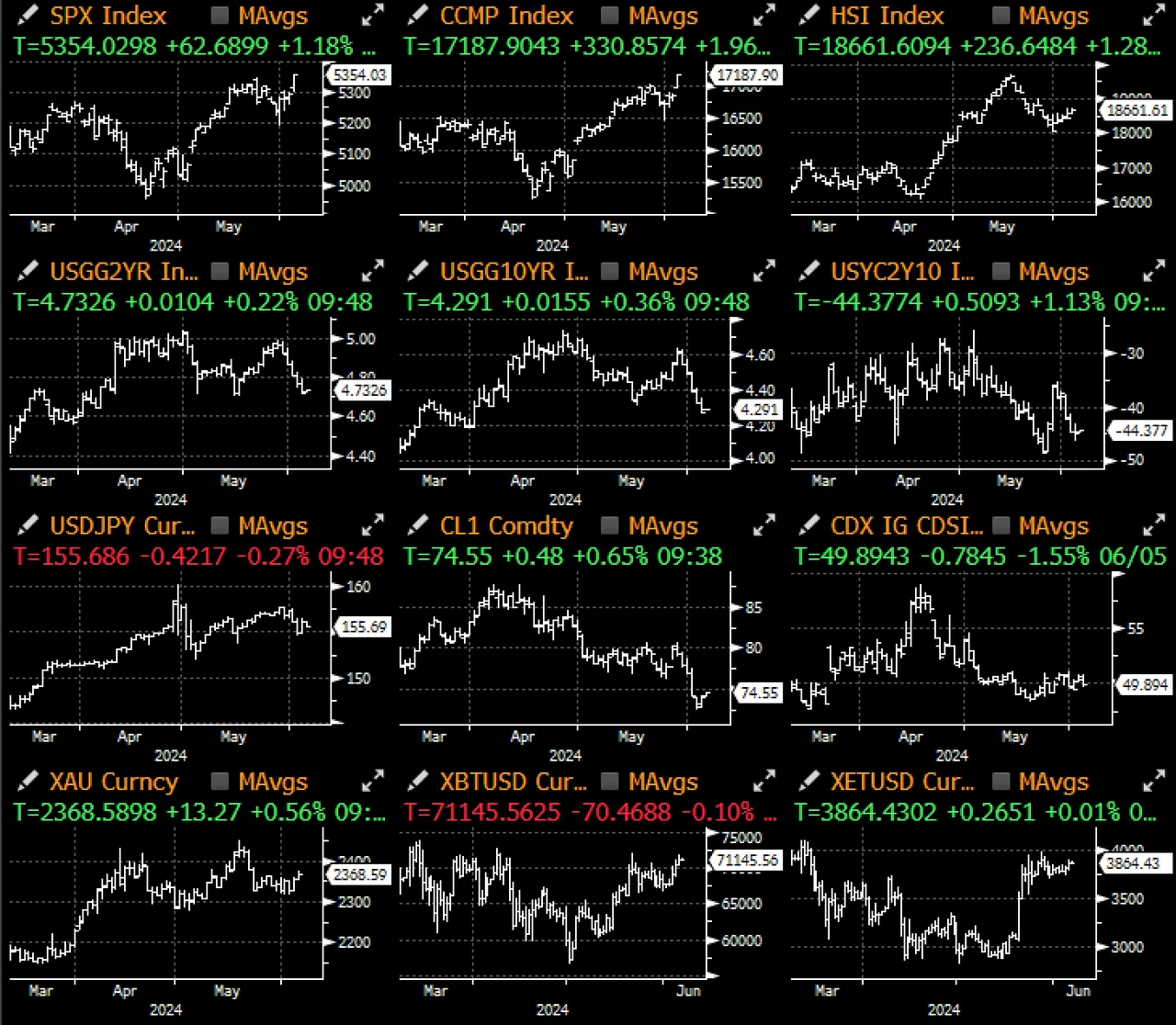

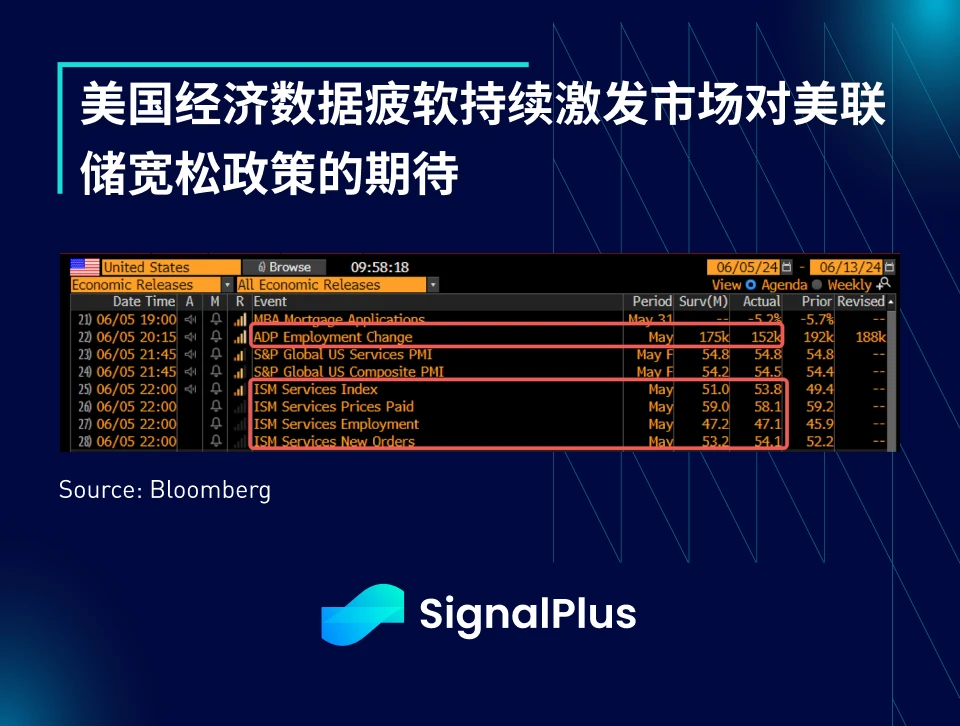

在 ADP 就業數據(15.2 萬對 17.5 萬)和美國服務業 PMI 就業數據疲軟的背景下,風險偏好持續升溫。調查受訪者提到「調整我們的招聘和資本投資策略並管理借貸」、「感受到經濟放緩」、「招聘正在放緩,價格小幅上漲」以及「高利率正在減少資本投資並減緩主要設施升級”,市場忽略了 9 個月來最強勁的非製造業 ISM 指數整體表現(53.8 vs 51)。

加拿大央行降息25個基點被視為即將到來的寬鬆週期的開始,聯邦基金期貨定價顯示年底前將有兩次全面降息,9月降息的可能性也升至60%以上。隨著聯準會降息預期全面回歸,10年期美債殖利率目前低於4.30%,2/10S曲線重新倒掛,利差重回近期低點-45個基點。

隨著殖利率下跌,那斯達克指數昨天再次上漲2%,SPX上漲1.1%,再次逼近歷史高點。由於過去兩週就業指標一系列疲軟,加上市場預期週五非農就業數據疲軟,ETF投資者本月已向美國股市注入1TP10-580億資金,今年迄今流入金額高達1TP10-3150億,傳統的股市格言「五月賣出然後走開」完全沒有實現。

令人難以置信的是,英偉達的市場主導地位繼續擴大,其每日交易量幾乎相當於接下來的九隻股票的總和。

最後,股市也準備進入友好的 7 月上半月,這是股市季節性最積極的兩週時期,數據可以追溯到 1928 年。資金流入後,昨日$333萬。價格會創下更多歷史新高嗎?還有熊嗎?趁你還可以的時候享受它吧,夥計們!

您可以在ChatGPT 4.0的插件商店中搜尋SignalPlus來取得即時加密資訊。如果您想在第一時間收到我們的更新,請關注我們的 Twitter 帳號@SignalPlus_Web3,或加入我們的微信群(新增助手微信:SignalPlus 123)、Telegram 群和 Discord 社區,與更多朋友交流互動。 SignalPlus 官方網站:https://www.signalplus.com

本文源自網路:SignalPlus宏觀分析(20240606):BTC ETF流入兩天突破$12億

簡而言之,WIF 價格正在對稱三角形中移動,突破將使其上漲 44%。 Chaikin 振盪器遠高於 0,顯示自 4 月以來購買壓力一直在增加。 MACD 也接近出現看漲交叉,這將證實上漲的潛力。 Meme 幣的狂熱推動 Dogwifhat (WIF) 的價格在整個 3 月創下新高,而且這種情況似乎可能會再次發生。隨著購買壓力的增加,Solana meme 代幣也可能會上漲,只要它能夠突破這種阻力。為什麼 Dogwifhat 受到投資者的青睞 由於投資者看漲情緒的增加,未來幾天 WIF 價格可能會出現飆升。這在 Chaikin 指標上可見,它是…