原作者: The Open Platform

原文翻譯:TechFlow

In the first quarter of 2024, the memecoin craze became a central theme in the TON DeFi space and the cryptocurrency market as a whole, which is at least partly responsible for the surge in on-chain activity and DeFi metrics:

Source: TonStat, DeFillama, CoinMarketCap

A major highlight of the quarter was a sevenfold increase in TVL (total value locked), driven primarily by increased activity on DEXs (decentralized exchanges) and the market dominance of liquidity staking protocol 噸斯塔克斯 .

Source: DefiLlama. Note that the chart includes the values of “Staking” and “Liquid Staking” in TVL.

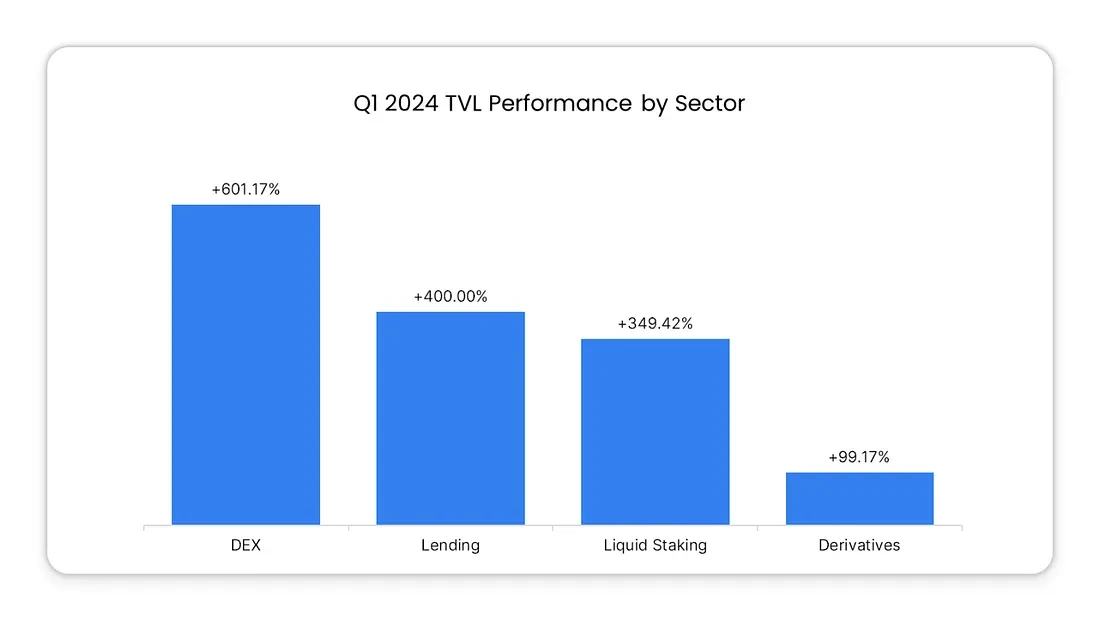

Another key topic was the launch of The Open League . The project rewards users for interacting with the TON project and sets up a Toncoin prize pool to reward the strongest TON project in each season. The key element of the project is the mining pool with increased APY (annual yield) . The introduction of the mining pool and the surge in memecoin trading volume made DEXs the best performing DeFI sector on TON by TVL:

Source: DefiLlama. Note that “Lending” includes Evaa Protocol, which will only be listed on DefiLlama on February 29, 2024.

In the following sections, we will explore the patterns behind TON’s surge in performance based on DEXs in more detail.

DEXs: The Open League Meets the Memecoin Craze

Tokens on the TON blockchain, also known as jettons, surged in popularity in the last quarter of 2023 and continue to do so today. The increase in trading activity has been driven in large part by memecoins.

This rally chronologically predates the launch of Notcoin, a previously untradable memecoin that anyone can “mine” by clicking a button in the Notcoin mini-app on Telegram . Within a few months of its launch, Notcoin attracted 35 million active users . Notcoin is now listed on multiple DEXs and CEXs and has inspired the creation of many meme jettons with similar mechanisms. The popularity of these jettons is one of the main drivers of the surge in trading volume on TON based DEXs.

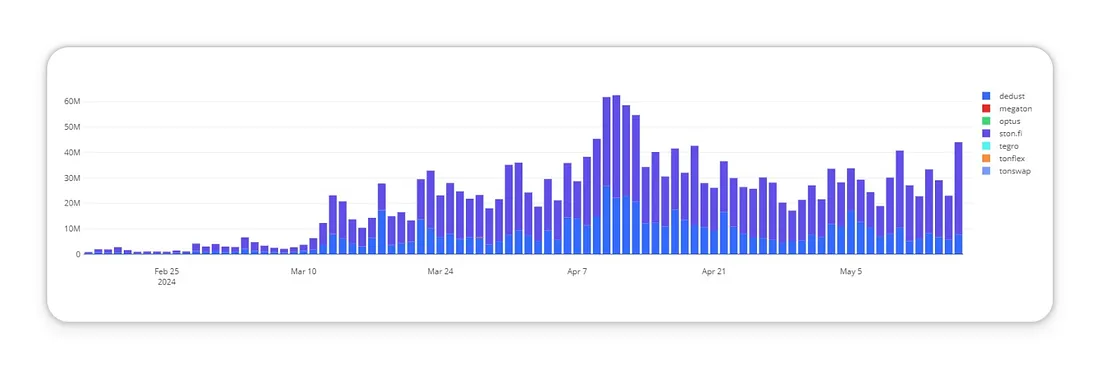

The memecoin craze attracted a lot of attention to DeDust 和 STON.fi , two DEXs that listed a large number of these tokens. According to Tonalytica, the total trading volume of DEXs on TON hit an all-time high of $4.2 million in 90 days. The all-time high was refreshed in the second quarter and now exceeds $60 million:

Source: Tonalytica.redoubt.online. Accessed: May 17, 2024

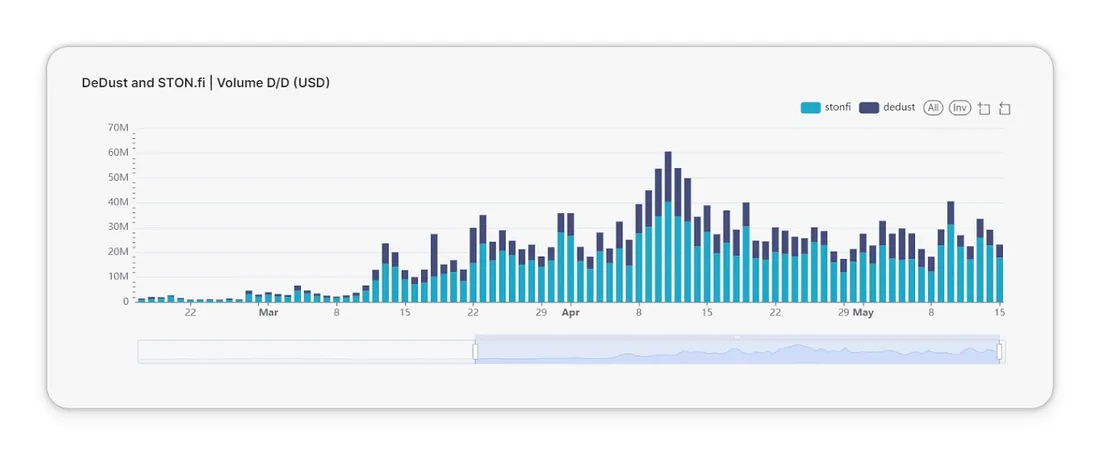

Below is a screenshot from our internal analytics tool showing the trading volume of the two DEXs. The pattern closely matches the Tonalytica chart:

Source: The Open Platform. Accessed: May 17, 2024

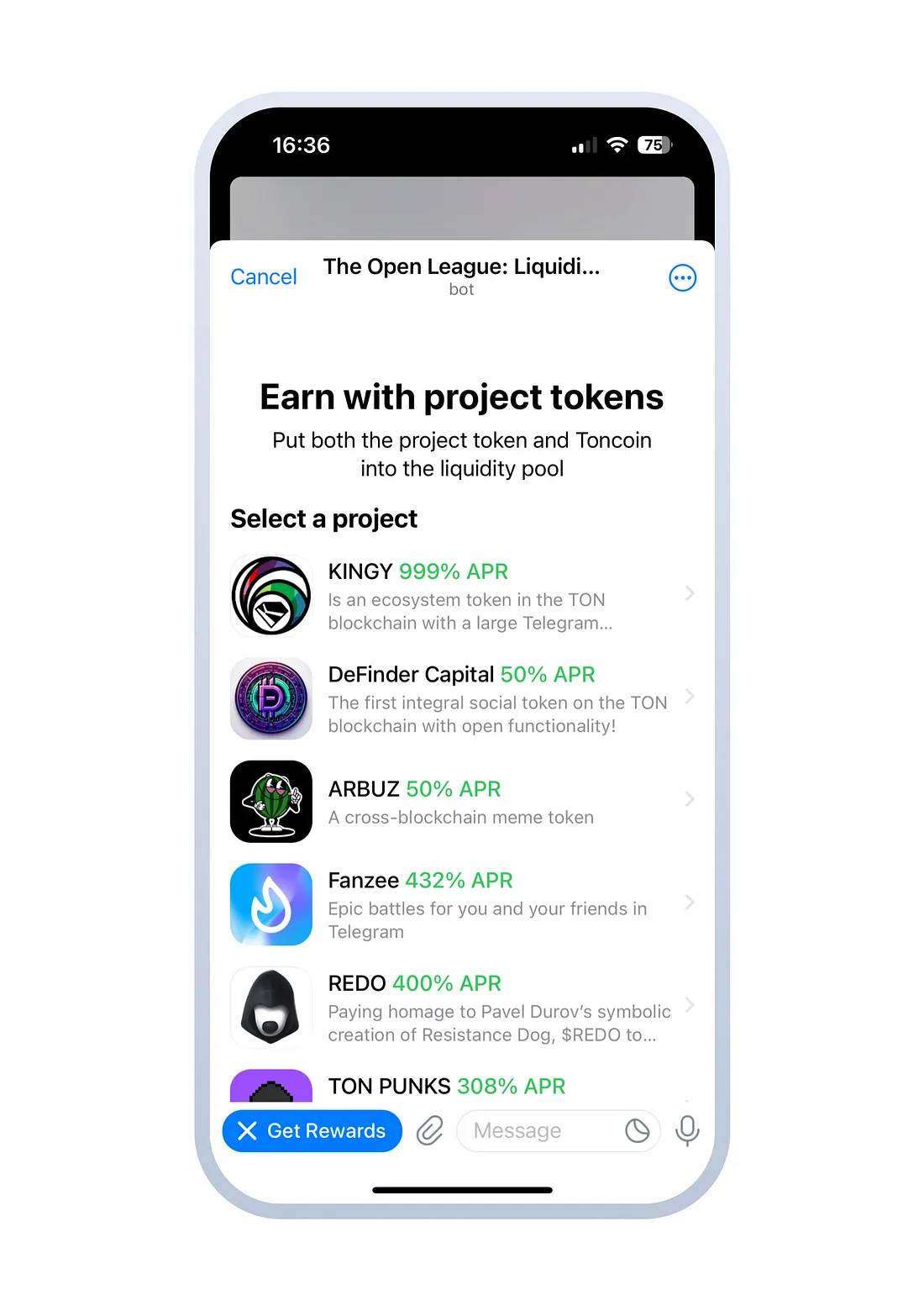

STON.fi 和 DeDust serve as the main liquidity pool venues as part of The Open Leagues incentives. As a result, TVL on TON has grown more than nine times in the first three seasons of the project, with both making significant contributions . Season 3 is already underway, and readers can check out the available enhanced pools at STON.fi 和 DeDust and access The Open League Pools bot .

( The Open League Robot . Accessed May 17, 2024)

STON.fi ranked first in the DeFi competition of The Open Leagues pilot season, followed by DeDust . The ranking is based on the change in TVL and protocol fees earned during the pilot season. The final ranking can be viewed here .

One of the themes of the first quarter of 2024 is the launch of Telegram 迷你應用程式 by two major DEXs. Both DeDust 和 STON.fi now have their own mini apps, which will make the trading experience more diverse and allow users to execute trades directly in Telegram. This may be particularly convenient for traders who use Telegram-based token research tools and news channels.

此外, Storm Trade , currently the main derivatives exchange on TON, now allows traders to use Toncoin as collateral for futures trading. This update eliminates the need to convert TON to jUSDT for collateral, simplifies the onboarding process for users, and gives Toncoin additional utility in the ecosystem. Additionally, Storm Trade completed its largest ever bounty program as part of The Open League, with a prize pool of approximately $130,000. The bounties were allocated to top performers in terms of trading volume, PnL ranking, and providing liquidity in designated pairs.

Liquidity staking pushes TON into the top 20 chains by TVL

Liquidity staking remains the sector with the highest TVL in TON. According to 德菲拉瑪 , as of this report, TON ranks 17th in TVL when calculating staking and liquidity staking value.

來源:DefiLlama

噸斯塔克斯 won the liquidity staking competition in the pilot season of The Open League , followed by bemo and the new liquidity staking protocol Stakee , and continued to lead in TVL market share. Similar to the DeFi competition, the ranking is based on the change in TVL; another metric used is the number of new users who joined the protocol during the corresponding period.

Stakee ( Stakee Bot ) is a new liquidity staking protocol on TON. Stakee combines simplicity, reliability, and high APY to attract Toncoin holders seeking enhanced returns and low fees. The platform ensures the security and transparency of transactions by using official smart contracts developed by the TON Foundation .

此外, TON Whales 推出 Whale Liquid , a new liquidity staking pool. The protocol allows Toncoin holders to earn wsTON, which can be exchanged in DeDust and lending protocols on TON. The project is currently in beta with a total stake of 848K Toncoin (over $5 million).

Lending: EVAA protocol launched on TON

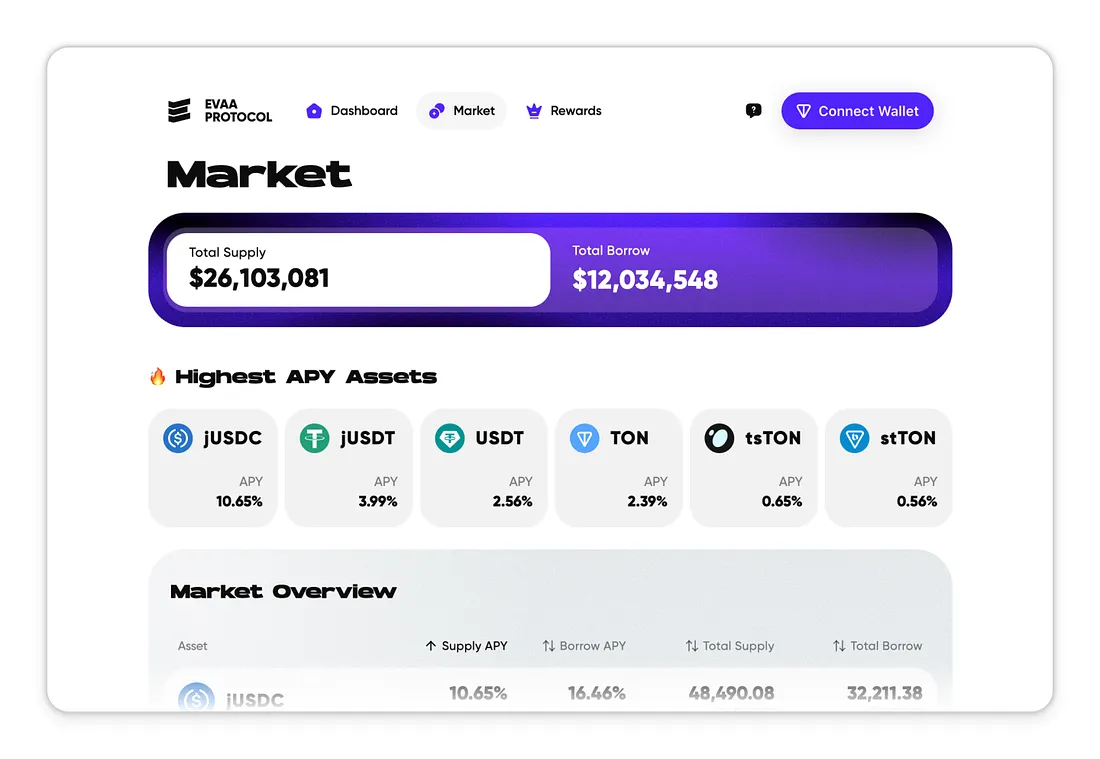

Evaa Protocol is launched on the TON mainnet. As of this report, the total supply of Evaa is $26.1 million and the total borrowing volume is $12.03 million.

EVAA Protocol held a supply and lending event as part of The Open League. The event provided users with a unique opportunity to borrow TON, stTON, tsTON, jUSDC and jUSDT tokens through the EvaaAppBot or on app.evaa.finance . Participants received interest rewards from weekly airdrops, supply and lending events, and EVAA XP points, which will be redeemable for EVAA DAO tokens in the future.

While the campaign has officially ended, the rewards pool in the app still offers an attractive APY:

Source: https://app.evaa.finance/market. Accessed: May 17, 2024

Likewise, DAOLama held a farming season and introduced Reward Points (RP), an internal token designed to incentivize users through in-app activity. Each loan earned RP, which can be redeemed for $LLAMA. The promotional period ended on March 30, and users can now trade the token on STON.fi and DeDust.

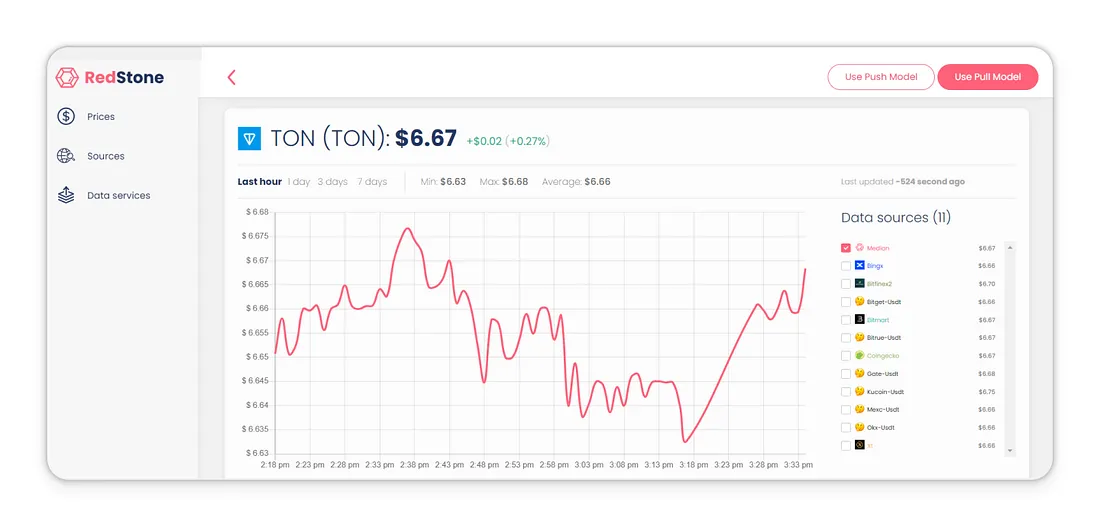

RedStone is the first oracle solution on TON

Oracles are a key component in blockchain technology because they act as a bridge that connects the blockchain to the outside world. They provide a reliable way to deliver external data to the blockchain, such as tokens or stock prices. This ability is essential to enabling smart contracts – clauses written directly into the code – to interact and respond to external events.

紅石 becomes the first available oracle on TON, marking an important milestone in TON’s DeFi-based data integrity.

RedStones Toncoin price feed, combining data from 11 external sources

RedStone stressed that TON, due to its asynchronous and fully decentralized nature, requires a significant shift from the usual integration approach, involving more complex inter-contract messaging rather than the simple contract interactions typical in other blockchains. Looking ahead, RedStone aims to enhance TONs DeFi ecosystem with a new relay system, smart contract templates, and advanced data feeds to meet the growing needs of TONs DeFi-based ecosystem. Learn more about the integration 這裡 .

未來展望

Jettons on the TON blockchain are carving out a unique niche, representing a range of digital assets that go beyond traditional utility. While some of these jettons may not yet have clearly defined real-world applications, they still occupy an important position in the broader ecosystem.

The surge in interest in these diverse assets could be the start of a larger process: increased demand for DeFi infrastructure to meet the capital efficiency requirements of token holders. We can already see this reflected in the success of The Open League’s incentive campaign.

Honestly, I never believed in TON since I discovered it in 2022. Absolutely not. I thought, “It’s just another ghost chain.” But as you can see, it wasn’t. My first interaction with TON was in late 2022 when I had only a mid-2-digit stake in crypto (yes, 2-digits) and won a giveaway.

The admin of this Telegram channel PMed me, Hey, can I send your prize to TON via Telegram wallet? I was like, What? Telegram wallet? He kindly explained everything and sent the prize. It was $10, by the way. Thankfully, TON fees are low, so I sent it to CEX.

When I started writing posts and leveraging content creation by learning 24/7, I got deeply involved in the marketing strategy. For some reason, I didn’t like TON’s marketing strategy at the time. Six months later, I still don’t completely like their marketing strategy. But as we can see, the numbers for TVL and TON’s price show that despite my opinion, it is working.

I started hearing TON mentioned by regular people who are not involved in cryptocurrencies. TON is cheap, accessible, and easy to understand. That’s why regular people like to mine Notcoin. Currently, TON is ranked 9th in CoinMarketCap’s “Today’s Cryptocurrency Prices by Market Cap”.

Although there are still many areas for improvement, such as marketing, TON will receive more and more attention in the future. The numbers for the number of active users, TVL, and TON market cap are astonishing and totally unexpected to me.

As the DeFi ecosystem on TON grows in complexity, the demand for reliable and secure oracle services will increase. RedStone’s efforts in this regard indicate a high level of trend towards data integrity on TON. We can expect oracle solutions to further penetrate the ecosystem in the near future.

What is being built on TON now?

We expect to see:

-

Solutions to bring EVM capabilities to TON

-

DEXs with non-standard order execution models, including limit order book-based exchanges

-

Automatic Compounder/Yield Optimizer

This article is sourced from the internet: TON DeFi report for Q1 2024: TVL increased 7 times, DEX became active due to the Meme craze

相關:DFG對比特幣亞洲的回顧與洞察:基礎設施是比特幣生態首先要解決的痛點

原作者:James Wo,數位金融集團創辦人兼CEO 2024年5月9日,香港迎來了首屆比特幣亞洲大會。歷屆比特幣會議基本上都是在歐洲和美國舉行。此舉也將亞洲的Web3產業推向了一個新的高度。比特幣生態目前的繁榮離不開亞洲市場,其中包括亞洲的開發者和專案方。或許正是因為這個原因,比特幣大會選擇了香港作為今年的第一站。會上,人們談論最多的是宏觀比特幣生態系統和Layer 2技術的現狀和未來發展。當然,這些都是圍繞著比特幣的金融屬性和交易進行的。會議現場雲集了專案方、礦業…等參展商。