原作者: 果阿後

原文翻譯:TechFlow

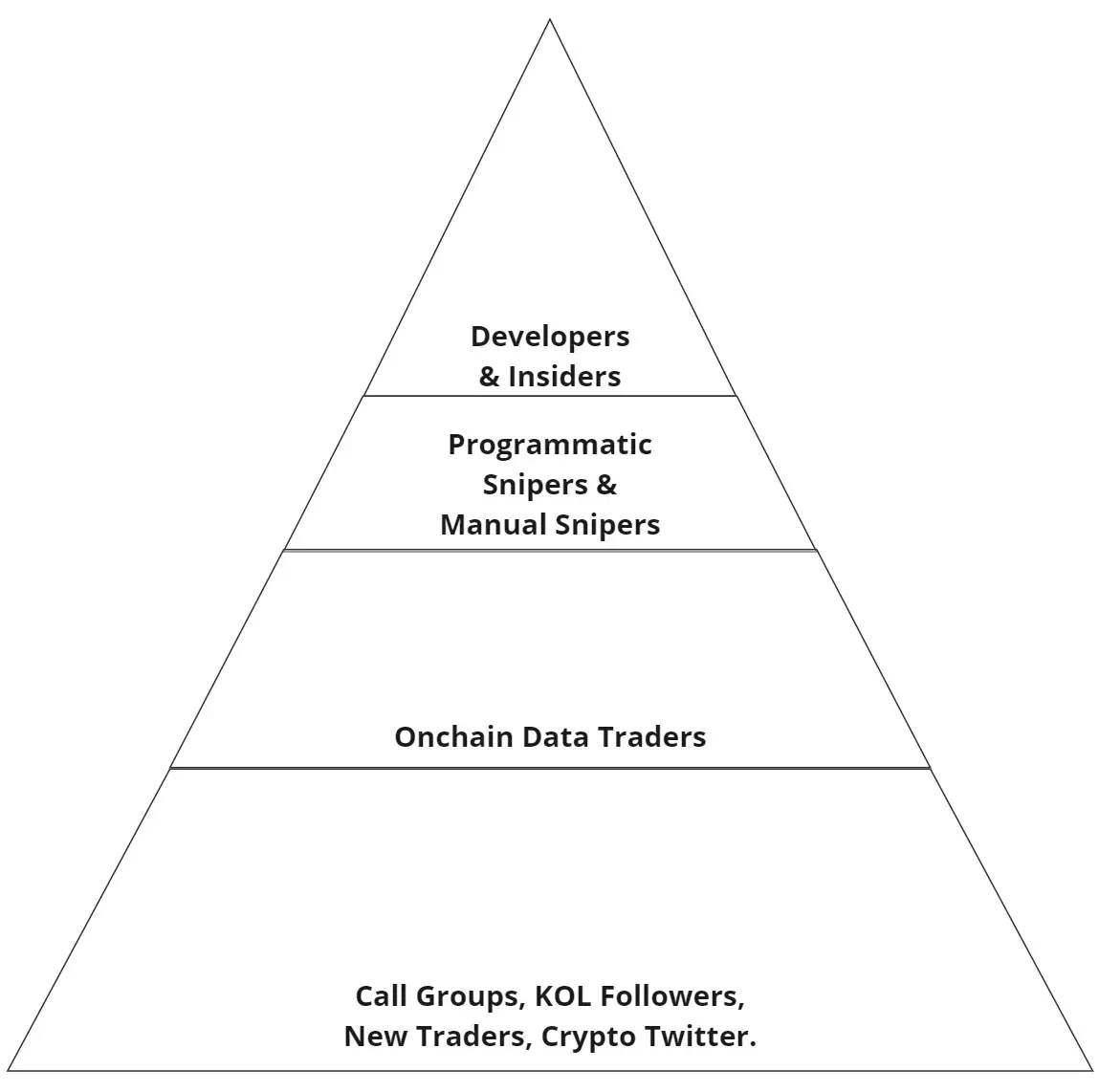

根據我的研究,以下是對鏈上流動性遊戲中扮演的角色的簡要總結。

開發者和內部人士

虛假效用慢慢拉升或被「利用」:

-

這些在早期的人工智慧熱潮中非常流行,因為當時沒有人真正理解人工智慧,但每個人都希望儘早接觸到。

-

他們從來沒有完成超過 1% 的路線圖,通常是由意見領袖 (KOL) 炒作的。

-

團隊經常在合約啟動時分配大量供應給自己,然後先於其他人分配。然後這些代幣被隱藏在多個錢包中然後被出售。

-

在最初的反彈後緩慢拉升或在幾週的拉動後陷入困境,並在積累大市值(20-1億)後迅速跑走。

-

涉及反覆發布遵循當前流行敘事的虛假項目的團體。這些項目通常是更成功的大型創投項目的衍生項目。

程式化狙擊手

客製化機器人:

-

有系統地針對多個 ETH 專案的客製化機器人。

-

該機器人遵循基於智能合約和交易量的特定參數。

-

我們的目標是從許多失敗或逃跑的少數項目中獲得 10-100 倍的回報,幾乎就像是一種收入形式。

手動狙擊手 (ETH)

最賺錢的鏈上交易者之一:

-

搜尋發現新的合約地址,或透過內部消息取得合約地址。

-

模擬合約以檢查其安全性和其他潛力指標,或了解團隊的背景。

-

當承諾合約啟動時,出價高於其他狙擊手。

-

當承諾在沒有反狙擊防禦的情況下啟動鏈上或隱形專案或使用 Fjord 等預啟動平台時,搶佔大量供應。

-

使用多個錢包狙擊可持有大量供應,超過1%。

-

很多時候,專案都會受到狙擊手的攻擊,他們可以在早期將物品粉碎為零。

-

很多狙擊手進入項目,互相博弈,希望當市值達到500k-1m的時候,有傻錢進來賣掉,然後項目就死掉了。這種情況在 ETH 主網上每天都會發生。

-

結合一些基本面分析和機器學習,那些能夠識別哪些合約可能帶來市值超過 1TP10-500 萬以上利潤的狙擊手在過去一年中的表現明顯優於其他人。

-

大多數狙擊手持硬幣的時間不到幾個小時。

鏈上數據交易者

追蹤狙擊手和內部人員的行動:

-

追蹤獲利(最高盈虧)錢包的動向。

-

追蹤交易量和持有者警報。

-

經常在狙擊手拋售後買入強勢項目;或者,即使他們知道狙擊手擁有大量供應,如果發射非常有希望,他們也會購買。

-

通常對新啟動的項目進行一些基本或敘述性分析。

-

長期持有者。

-

隨著鏈上交易成為該領域不斷增長的一部分,並且越來越多的鏈上服務可供零售使用,它們的受歡迎程度已經減弱和增加。

-

它是上述參與者的退出流動性。

-

這些交易者經常在新推出的項目上相互對賭,而這些項目最終將歸零。這只是誰先進入的問題。

-

依靠愚蠢的加密推特(CT)、意見領袖(KOL)或其他後來的鏈上交易者作為退出流動性。

其他貿易商

尚未學習如何使用 Etherscan 或檢查令牌的基本指標:

-

從電話群組、意見領袖 (KOL) 和加密推特 (CT) 獲取資訊。

-

交易速度較慢的交易者往往會相信炒作。

-

相信加密貨幣的實用性超越投機。

-

敘事上落後了一步。

-

可能剛進入這個領域不到一年。

-

這些交易者很可能已經放棄購買新的公用事業項目或迷因幣。或者他們正在慢慢開始了解鏈上交易並逐漸升級到上述類別。

總結

鏈上交易是開發者、狙擊手、鏈上資料交易者等人的流動性遊戲。隨著進入鏈上空間的流動性減少,參與者之間的競爭變得更加激烈,結果是金字塔頂端的人獲得了大部分回報。

本文源自於網路:鏈上流動性博弈:開發者、狙擊手與交易者的追捕

原作者:Distilled 原文翻譯:TechFlow 簡介 這兩年,我全心關注山寨幣市場。不過,市場上一直有個疑問:期待已久的類似2021年的山寨季還沒有出現。在這裡,我將解釋原因並提供優化山寨幣策略的建議。讓我們先定義「另類季節」。定義:當山寨幣表現優於比特幣($BTC)且價格全面飆升時。這是山寨幣蓬勃發展的時期,市場上正在興起欣喜若狂的時期。可以把它想像成水漲船高。這就是強勁的山寨幣季節所能發揮的作用,提振幾乎所有行業。動力是什麼?大量流動性湧入市場。追蹤流動性流動性歷史上曾有過…