Original author: Biconomy

原文翻譯:TechFlow

When we hear about the convergence of AI and crypto markets, the projects that are mainly in the spotlight are those networks that solve data collection, GPU computing, or data reasoning problems in the field of AI. These protocols include Akash Network, Ritual net, etc. They stand out in the large AI industry by leveraging the advantages of decentralization, incentives, censorship resistance, and privacy provided by 网页3.

While these projects have created fascinating applications, their impact on the average web3 user remains limited and they have not been effective in bringing new users into the web3 space.

The rise of AI agents

As Web3 rapidly evolves, new crypto protocols, tokens, and applications emerge in an endless stream. Even the most experienced users find it difficult to cope with this complexity. As a result, there is a growing need to create AI agents, smart assistants designed to simplify the use of crypto applications. AI agents are at the crossroads of cryptocurrency and artificial intelligence, designed to solve complex user experience problems in cryptocurrency. Imagine a future where you can simply tell an AI agent what task you want to complete on-chain, and it will automatically write and execute the necessary transactions for you.

AI agents will help us build an intelligent layer on top of the existing DeFi infrastructure, which will be equivalent to bankers, investors, traders, and fund managers in traditional finance in web3. They will use the underlying technology to conduct transactions on the chain.

The integration of DeFi and AI is expected to bring advanced applications such as AI-driven lending, smart liquidity mining strategies, automated market making, and AI-assisted portfolio management. The application of AI agents is not limited to this, they can also be used in the gaming industry, allowing users to have assistants and pets to help them experience the game better.

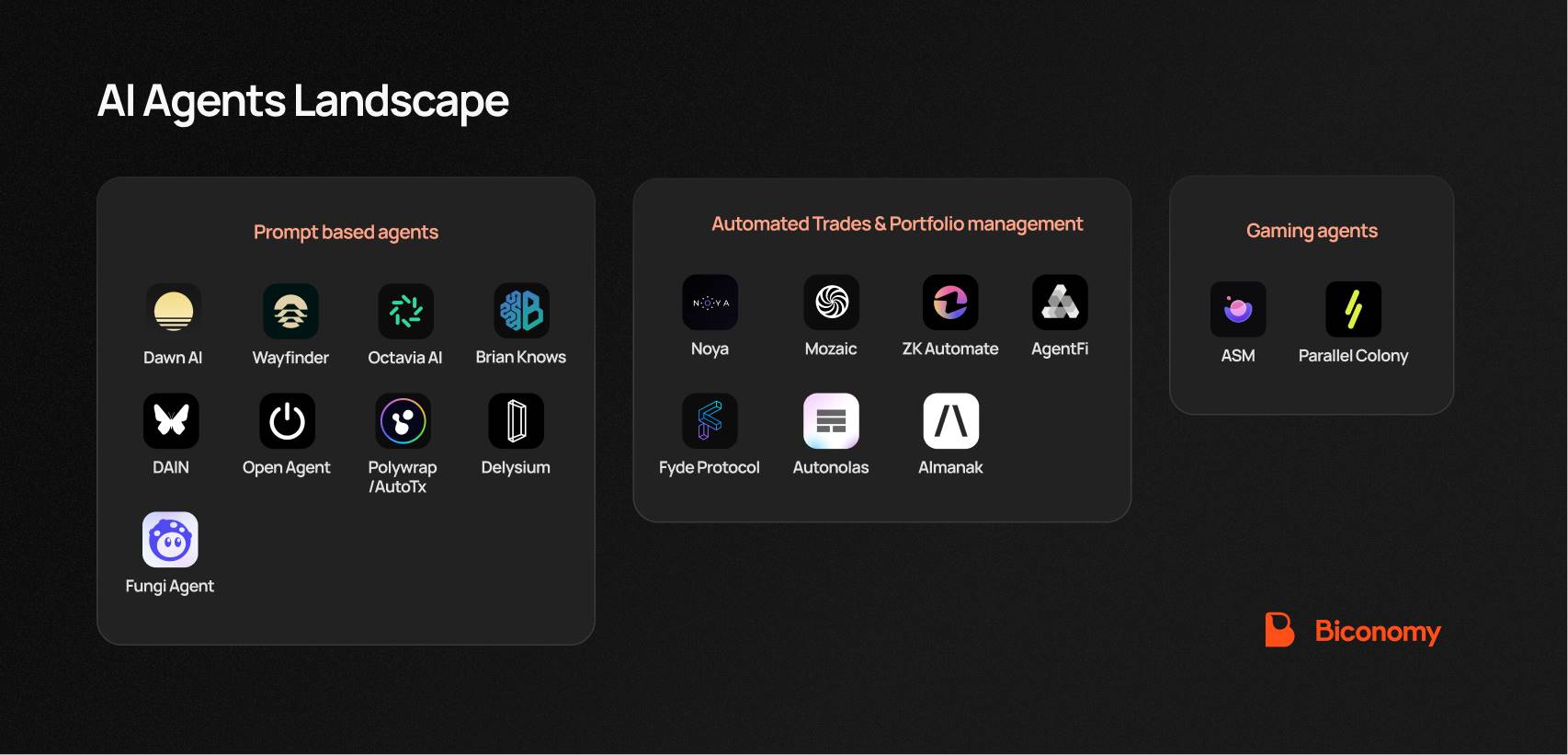

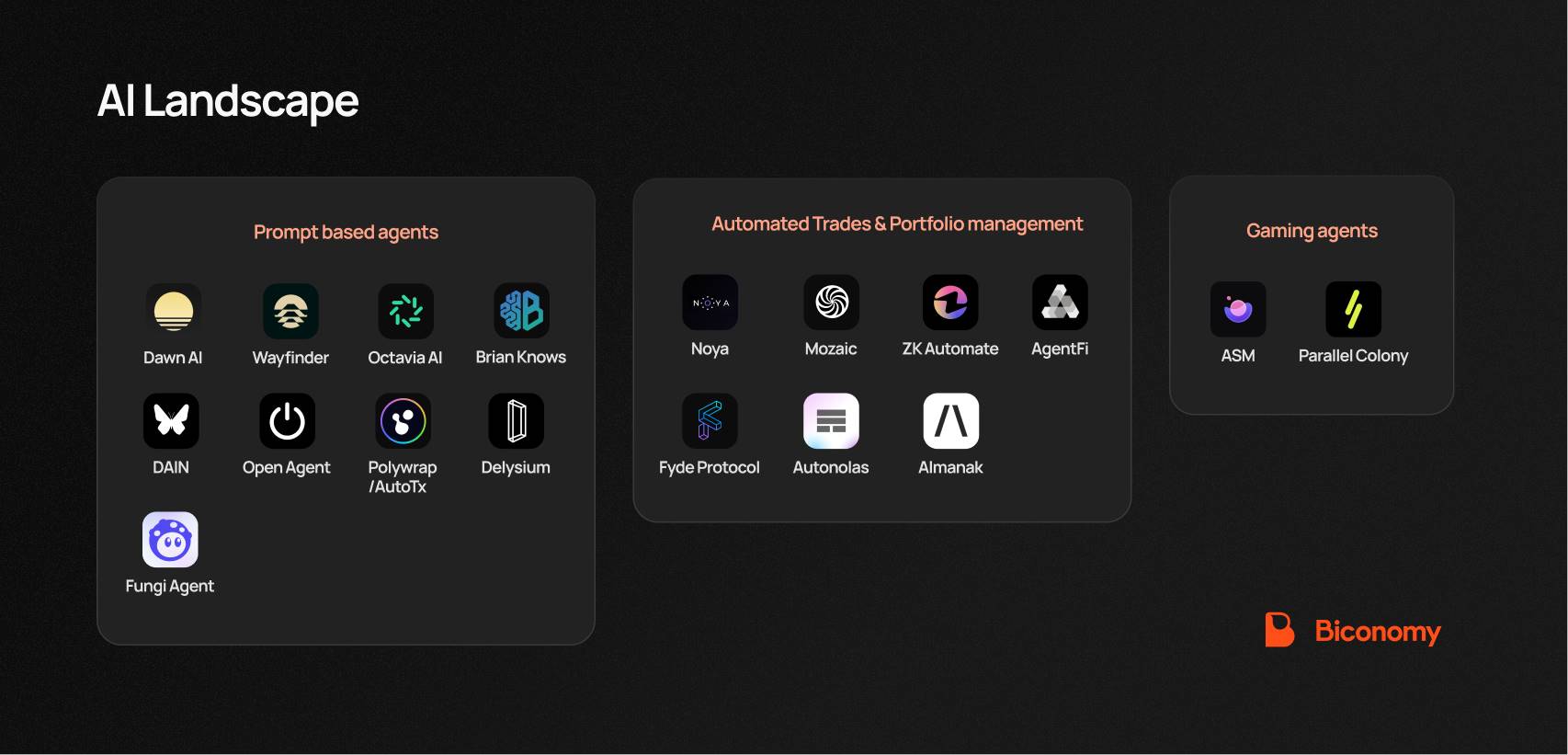

The evolving field of AI agents can be broadly categorized into the following categories based on the type of use cases and value-added brought by the protocols:

Classification of AI Agents

Game AI Agent:

Teams like Parallel Colony are developing gaming AI agents to enhance the user’s gaming experience. These AI agents run in a Web3 environment and interact with players and game elements through on-chain smart contracts. AI agents can act on behalf of users or serve as pets/assistants in games. These agents can also interact with other agents and trade assets.

Some web2 and web3 games are also actively using AI to design dynamic non-playable characters (NPCs) in games. However, this article only focuses on AI agents that can perform transactions and actions on behalf of users.

Self-directed portfolio agent:

These AI agents can manage pools of assets from different users. The goal of the AI agent is to maximize returns by allocating assets to various DeFi strategies by leveraging off-chain AI data streams. This is actually a portfolio management service that leverages AI capabilities. To ensure that the trust of the protocol is minimized, some projects also enable zero-knowledge proofs (ZK) through protocols such as Modulus to provide on-chain AI reasoning proofs.

Prompt-based AI agents:

Imagine a future where you can simply tell an AI agent what you want to achieve on-chain, and it will automatically write and execute the necessary transactions for you.

This is the goal of most AI agent projects, and we can imagine a future where prompts may become the preferred way for average users to interact with blockchains.

Projects like Wayfinder, Brian Knows, Aperture Finance, etc. are developing interfaces similar to ChatGPT, where users can conduct intelligent transactions directly on the blockchain by chatting with AI agents. These protocols use large language models (LLMs) to translate user prompts and intentions into executable transactions.

Let’s discuss some of these AI agent protocols in detail:

Autonolas Agent

Autonolas is a platform that supports the creation and management of autonomous agent services. These services are called agent services and operate independently off-chain as multi-agent systems (MAS) to work together to achieve common goals. Autonolas enables developers to build and deploy autonomous agents that work seamlessly off-chain while leveraging blockchain technology to enhance on-chain functionality. BabyDegen is one such agent. ( Directory of other agents built on Olas Network )

AutoTX by Polywrap

Polywrap is building a network of specialized AI agents that perform complex tasks for web3 users and protocols. These agents leverage crowdsourced insights, on-chain and off-chain data sources, task planning, and batch transactions to efficiently solve problems and make decisions. Current agents include those for payments, market research and trading, social content curation, forecasting, and public goods financing. Polywraps future plans include expanding the scope of specialized agents, decentralizing their execution, and evolving the system through community-driven governance. AutoTx is one such AI agent.

AutoTx can translate advanced user goals into a series of blockchain transactions. This means you no longer need to be an expert in each protocol, nor do you need to spend hours learning how to manually write different types of transactions. Just tell AutoTx what you want to achieve, and it will do the rest.

Parallel Colony

Parallel Studios takes a fresh approach to AI agents with Colony, a new AI-driven Web3 survival game. In Colony, highly autonomous AI agents, or “avatars,” continuously learn from their environment. Players must guide and work with these avatars, each with different skills and abilities, to survive competing colonies on a futuristic Earth.

Colony stands out by incorporating continuous learning into its gameplay. AI avatars develop unique personalities and worldviews, learning from their own experiences, identities, and goals. In addition, these avatars can autonomously manage digital assets through a dedicated Web3 wallet, allowing them to trade with other in-game avatars. (Whitepaper reference)

Wayfinder

Wayfinder is creating a map for AI agents to handle tasks and simplify on-chain activities for users. Through open source development and incentivizing builders with $PROMPT tokens, Wayfinder will expand the navigation instruction network. Wayfinders path will continuously enhance the capabilities of AI agents, making them smarter over time. It aims to connect blockchain and off-chain data sources, allowing users to easily perform tasks through the command prompt. Their innovation aims to make blockchain interactions more efficient and accessible, improving users lives by reducing complexity and stress. Youll love this analogy and explanation from @tiggity_tc on Wayfinder. ( Video reference of Wayfinder agent in action whitepaper reference )

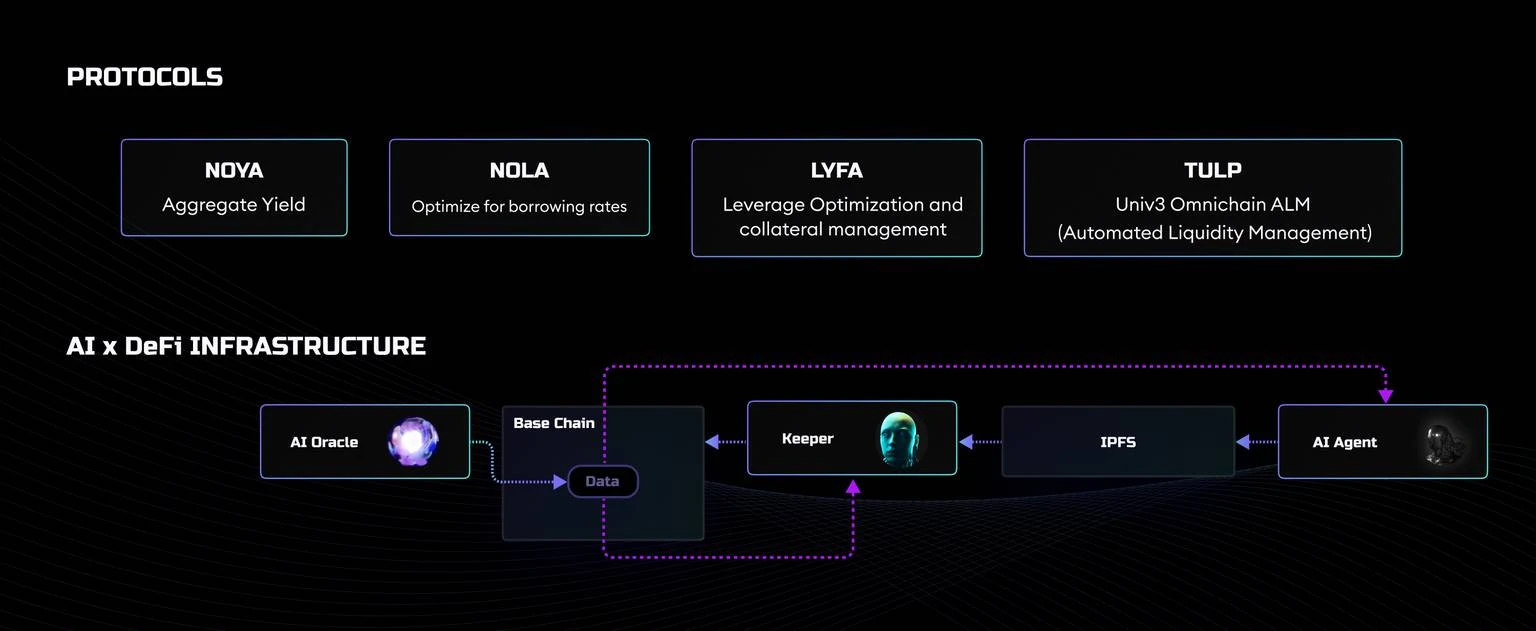

Noya

NOYA is a decentralized finance (DeFi) protocol that enables AI agents to securely and precisely manage liquidity across multiple blockchains. It uses a composable system built from the ground up, including a private gatekeeper network, an AI-compatible oracle, and a competitive environment for AI and strategy managers. Noya has multiple vaults, each targeting a different user intent profile. The protocol has its own AI oracle designed to read various DeFi markets and pass the information to the AI agent.

NOYAs infrastructure uses advanced technologies such as zero-knowledge machine learning (ZKML) to support multiple functions such as liquidity configuration, leverage management, and lending rate optimization. It aims to set new standards for full-chain liquidity management and financial strategies. The team is launching access to the protocol.

Brian Knows

Brian provides an API that developers can integrate into their applications, enabling users to generate web3 transactions via prompts, such as “Can you swap 10 USDC for ETH on Uniswap on Ethereum mainnet?” They also provide smart contract deployment services via prompts. On the backend, the team uses LLM to convert prompts into web3 transactions, which are then executed via their preferred protocol and solver integration.

The team has also developed a Brian app that you can use to explore the feature set. The team hopes to expand their service by offering users features like recurring and automatic payment setup.

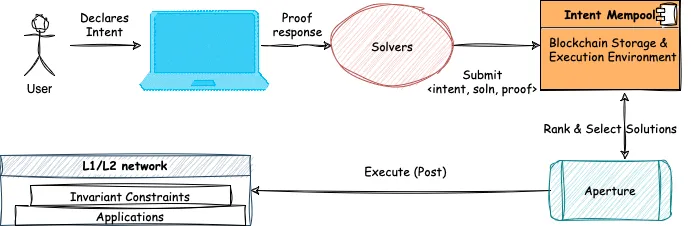

光圈財經

Aperture Finance revolutionizes DeFi by providing liquidity management services through a user-friendly protocol. It aims to enhance the DeFi user experience through an intuitive chatbox interface inspired by GPT, allowing users to express their goals in natural language. Third-party participants (called solvers) handle requests by optimizing the process to ensure efficient and cost-effective execution.

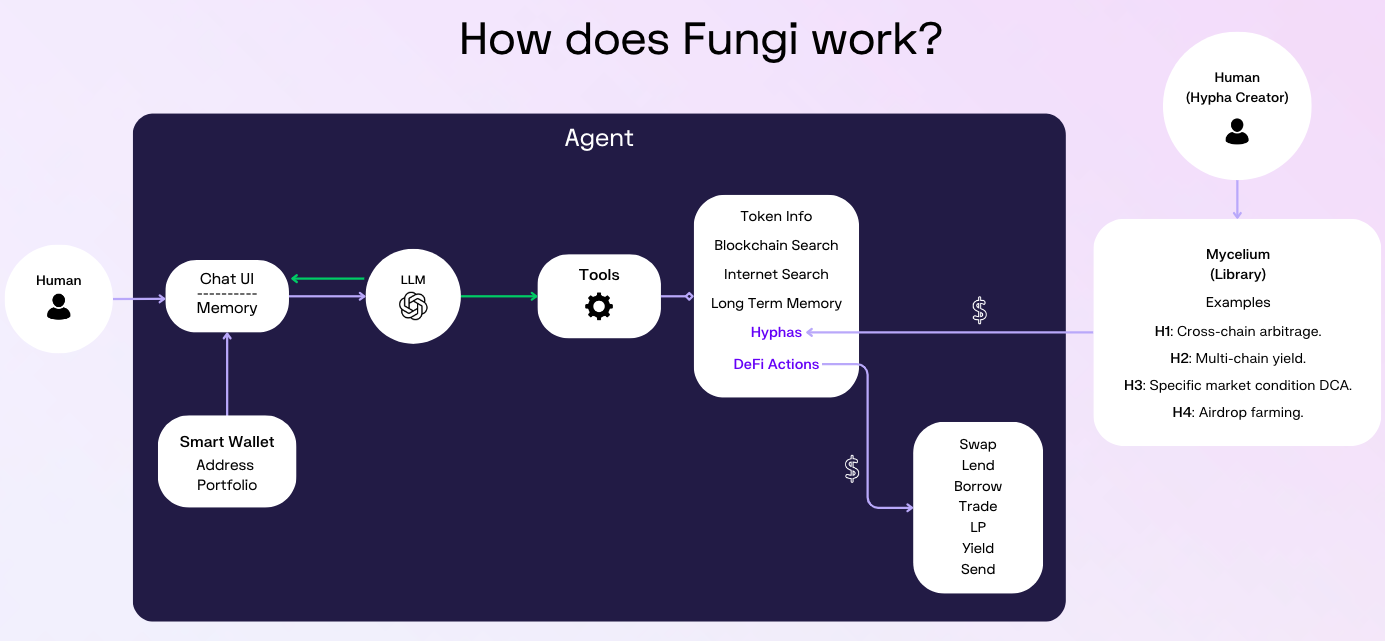

Fungi Agent

Fungi leverages the power of Smart Accounts and Account Abstraction to provide a self-hosted AI agent experience. Fungi allows users to instruct a command prompt through its interface, which then processes real-time blockchain data and autonomously performs actions based on the users instructions.

Users can chat with Fungi to deepen their understanding of cryptocurrencies, get personalized guidance, perform on-chain transactions, create customized DeFi strategies (Hyphas), and even earn money by sharing these Hyphas with the community. Fungi is a network of agents that interact with each other and learn from past experiences – financial superintelligence that everyone can use. Heres how Fungi Agent works .

Fyde Protocol

Fyde enables users to grow their cryptocurrency holdings faster by depositing into diversified AI-managed vaults that lock in gains and reallocate assets based on market performance and reduced volatility.

Users can deposit various tokens into these vaults and receive $TRSY, a token representing their share of the vault assets. Suishi aims to maintain liquidity of $TRSY in various market conditions, enabling users to trade easily.

The Need for an AI Authentication Layer for Intelligent Agents

Among all these upcoming AI and intent-related projects, potential use cases range from handling simple tasks to empowering AI agents to execute complex DeFi strategies to find the best returns. However, these AI agents face two main challenges:

-

They are not truly autonomous : currently, AI agents can recommend on-chain actions and prepare transactions for users, but they still require user signature or approval.

-

If they choose automation, they lose security : Protocols tend to explore alternatives to automation, such as approvals, centralized vaults, shared private key pairs, etc., which make the protocol the custodian of your assets and introduce significant risks.

We need guardrails for the AI in the form of user-defined permissions — strictly defining what actions the AI is allowed to sign and what it is not allowed to sign. Therefore, we need a solution that can delegate transaction authorization to the AI agent, but only within specific permissions and rules.

This article is sourced from the internet: In-depth exploration: analysis of various types of AI agents and potential projects

簡而言之,XRP 價格正在嘗試突破對稱三角形模式,這表明可能會上漲 27%。 Ripple 交易者似乎對 XRP 的上漲持懷疑態度,這在他們的看跌押注中顯而易見,他們傾向於價格下跌。如果相對強弱指數(RSI)突破中性線,則可以確認看跌無效。瑞波幣(XRP)價格反彈很大程度上取決於更廣泛的加密貨幣市場和投資者的行為。然而,雙方都不贊成價格上漲,這可能會對 XRP 持有者造成相當大的損害。 Ripple 投資者後退一步 XRP 價格試圖上漲,但從表面上看,這項努力將受挫。這是因為 Ripple 注意到投資者,尤其是交易員的看跌情緒。期貨中對 XRP 的看跌押注有所增加…