Cryptocurrency prices saw significant volatility on Thursday, with liquidations of all leveraged crypto derivatives positions surging to over $360 million that day, the highest level since May 1:

-

The sectors with strong wealth-creating effects are: RWA sector and Ethereum staking sector;

-

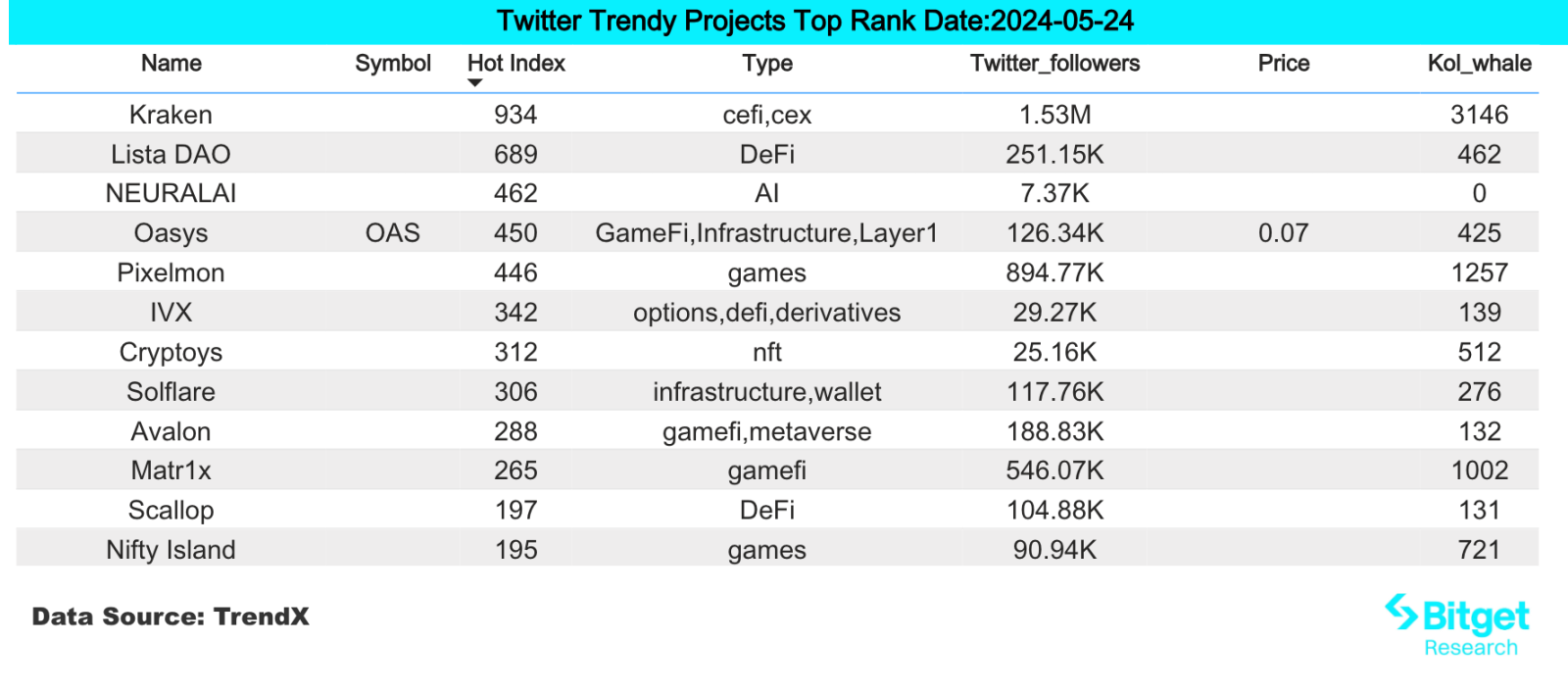

Hot search tokens and topics by users are: Plume Network, Lista (LISTA);

-

Potential airdrop opportunities include: Sanctum, Synthr;

Data statistics time: May 24, 2024 4: 00 (UTC + 0)

1、市場環境

Cryptocurrency prices saw significant volatility on Thursday. Before the approval, ETH first fell to $3,500 around the closing time of the traditional U.S. market, then soared to around $3,900, and finally stabilized above $3,800 after confirmation. Bitcoin also fell to a low of $66,000, then soared to $68,300 before falling back below $68,000.

According to data from CoinGlass, during this turbulent period, liquidations of all leveraged crypto derivatives positions soared to more than $360 million that day, the highest level since May 1. Most of the liquidated positions were long positions, worth about $250 million, indicating that highly leveraged traders were concentrated on betting on an immediate surge after the ETF was approved. ETH traders were hit the hardest, with liquidations reaching $132 million.

2. 致富領域

1) Sector changes: RWA sector (ONDO)

Main reason: This bull market mainly originated from the traditional market buying brought by ETFs. As a way to introduce traditional financial markets, RWA has been constantly updating its products and raising funds. Recently, RWA layer 2 network Plume Network completed a $10 million seed round of financing.

Rising situation: ONDOs daily increase today is 13.46%;

影響後市的因素:

-

Changes in macro monetary policy: In terms of the macro environment, the rise in the yield of the 10-year U.S. Treasury bond supports the fundamentals of the RWA track; we need to pay attention to the subsequent changes in the U.S. dollar index, U.S. Treasury yields and the crypto market, and dynamically adjust trading strategies;

-

Changes in project TVL: RWA track projects are basically supported by TVL. You can pay attention to the changes in TVL of the RWA track. If the TVL of a project continues to rise/suddenly rises, it is usually a signal to buy;

2) Sector changes: Ethereum staking sector (LDO, SSV, ETHFI)

Main reason: The U.S. Securities and Exchange Commission today approved the 19 b-4 forms of multiple Ethereum spot ETFs, including those from BlackRock, Fidelity and Grayscale. Since ETFs only allow Ethereum tokens and do not allow staking, this regulation greatly reduces the attractiveness to ETF investors, so the Ethereum re-staking sector will usher in substantial benefits.

Rising situation: LDO rose 10.8% in the past 4 days, SSV rose 7.97% in the past 7 days, and ETHFI rose 22.85% in the past 4 days;

影響後市的因素:

-

Fund inflow after ETH ETF is approved: At present, the ETF is in the countdown for listing after approval. If a large amount of funds flow in after approval, it will further push up the ETH price.

-

Protocol trends: The cash flow of staking sector projects is relatively stable and easy to predict. They are a type of project whose token prices can be estimated more accurately. The main influencing factors are the protocol TVL, income distribution method, token destruction, etc.

3) The sector that needs to be focused on in the future: TON ecosystem

主要原因:

-

Panteras 對 TON 的投資可能至少超過 US$2.5 億美元,這是 Panteras 歷史上對加密貨幣最大的投資。

-

TON 生態中的高流量項目 Notcoin 已在幣安上市,但 TON 代幣本身尚未在幣安上市。市場預計TON在幣安上市只是時間問題。

-

TON 生態系的基礎設施尚處於早期階段。目前,Notcoin、Catizen 等高流量項目已經湧現,展現了 Telegram 背後龐大的使用者基礎。

-

生態系中穩定幣發行量的增加帶來了金融活力。 TON鏈上的USDT供應量在兩週內達到1.3億枚,成為USDT發行量第八的區塊鏈。

具體項目清單:

-

TON: The native token of the Ton chain, currently listed on exchanges such as OKX and Bitget.

-

FISH: Ton ecosystem head meme token.

-

REDO: A dog-themed meme coin on the Ton chain.

3.用戶熱搜

1) 流行的Dapp

Plume Network:

Modular RWA L2 network Plume Network announced its launch on Arbitrum Orbit. Plume is a modular L2 blockchain dedicated to real-world assets (RWA), integrating asset tokenization and compliance providers directly into the chain. Plume Network team members come from companies and projects such as Coinbase, Robinhood, LayerZero, Binance, Galaxy Digital, JP Morgan, dYdX, etc. Yesterday, it completed a $10 million seed round of financing, led by Haun Ventures, and participated by Galaxy Ventures, Superscrypt, A Capital, SV Angel, Portal Ventures and Reciprocal Ventures. The funds raised will be used to recruit more employees in engineering design, marketing and community functions. The Plume Network open incentive testnet will be launched in the next few weeks, followed by the mainnet later this year.

2)推特

Lista (LISTA):

Binance Megadrop will launch Lista (LISTA), a liquidity staking and decentralized stablecoin protocol. The maximum supply of the token is 1 billion, the initial circulation is 230 million (23% of the supply), and the total Megadrop is 100 million (10% of the supply). Binance will list LISTA after the Megadrop is completed, and the specific listing plan will be announced separately. Lista DAO is a liquidity staking and decentralized stablecoin lending protocol. Users can stake and liquidity stake on Lista, as well as borrow lisUSD using a range of decentralized collateral. The report also introduces the LISTA token: LISTA is the governance token of Lista DAO, which is used for the following functions: governance, protocol incentives, voting, and fee sharing. The protocol consists of the following main parts that work together: decentralized stablecoin lisUSD and BNB liquid staking token slisBNB.

3) 谷歌搜尋區域

從全球角度來看:

ETH ETF: A new compliance milestone in the crypto world: Ethereum spot ETF finally approved. On May 23rd, local time in the United States, the U.S. Securities and Exchange Commission (SEC) officially approved all Ethereum ETFs, providing investors with a new opportunity to invest in Ethereum through traditional financial channels. This decision is seen as a major endorsement of the cryptocurrency industry, becoming the second cryptocurrency ETF approved by the SEC after the spot Bitcoin ETF. After approval, the price of Ethereum rose slightly and fluctuated around $3,800, reaching a high of $3,856. It is currently reported at $3,807, a 24-hour increase of 1.3%. After the news landed, the fluctuation was not as large as in the previous few days, but it caused a lot of attention on the entire Twitter social media.

從各地區熱搜來看:

(1) Europe and CIS regions show a certain degree of interest in MEME:

As the crypto market rebounded significantly, PEPE tokens continued to hit new highs, and users began to buy back their chips into MEME coins to gain higher returns. From the searches of European users, it can be seen that European users generally search for MEME coins more frequently, which also means that users in the European market are more involved in the MEME coin market.

(2) The Asian region has shown a clear increase in attention to BTC, ETH ETFs, etc.:

Influenced by Bloombergs report that Hong Kong may pass BTC and ETH ETFs this week, searches in the Asian region have clearly increased their attention to the event. As the core region of Asian finance, Hong Kong has always been at the forefront of financial innovation. With the passage of ETFs, it has once again become the focus of Asia. Traditional finance and large funds can enter the encryption field through this channel, which has a positive impact on both industry development and retail investment.

潛在的 空投 機會

聖所

Solana Ecosystem LST Protocol Sanctum officially announced the launch of the loyalty program Sanctum Wonderland. According to reports, Sanctum Wonderland aims to make full use of SOL to gain benefits through a gamified experience. Users can collect pets and earn experience points to upgrade by staking SOL, and earn EXP through pets.

Previously, the Solana ecosystem liquidity staking service protocol Sanctum completed its seed round extension round of financing, led by Dragonfly, with participation from Solana Ventures, CMS Holdings, DeFiance Capital, Genblock Capital, Jump Capital, Marin Digital Ventures and others. The total financing has now reached US$6.1 million.

Specific participation method: open the link, connect the wallet, fill in the invitation code, ② exchange Sol for Infinity, deposit at least 0.122 SOL + 0.05. The deposit wallet needs to prepare at least 0.172 SOL, and deposit at least 0.11 SOL. The pet will automatically grow and earn EXP. Once the LST balance is lower than 0.1 SOL, the pet will enter hibernation and stop earning EXP. Those who are capable are recommended to deposit more than 1 SOL. 1 SOL will earn 10 EXP per minute, which can be withdrawn at any time, and the GAS fee is extremely low.

Synthr

Synthr is a full-chain synthetic protocol that allows cross-chain minting and transfer of synthetic assets without the need for cross-chain bridges. The project mints assets on-chain through synthetic assets (Synthetix), which means that its technology can easily bring RWA to the chain, such as real estate, bonds or stocks, for cross-chain transactions and transfers.

The project raised $4.25 million from top funds including MorningStar Ventures, Kronos Research, and Axelar Fdn.

Specific participation method: The project has just been opened for testing. Users can participate in early interactions by entering the test network, registering a wallet, and receiving test coins through the faucet. Continue to pay attention to the subsequent progress of the project and actively participate in various on-chain interactions.

更多關於Bitget研究院的資訊:https://www.bitget.fit/zh-CN/research

Bitget研究院專注於鏈上數據,挖掘有價值的資產。它透過即時監測鏈上數據和區域熱搜,挖掘前沿價值投資,為加密貨幣愛好者提供機構級洞察。目前已為Bitgets全球用戶提供了【Arbitrum生態系統】、【AI生態系統】、【SHIB生態系統】等多個熱門領域的早期有價值資產。透過深入的數據驅動研究,為Bitgets全球用戶創造更好的財富效應。

【免責聲明】市場有風險,投資需謹慎。本文不構成投資建議,使用者應考慮本文中的任何意見、觀點或結論是否適合自己的具體情況。根據此資訊進行投資的風險由您自行承擔。

This article is sourced from the internet: Bitget Research Institute: US SEC approves Ethereum spot ETF 19b-4, ETHFi and other ecological assets are expected to continue to rise

相關:鏈遊週報| NYAN代幣將於5月21日上線BYBIT; DMT週漲幅超100%(5.13-5.19)

原創| Odaily 星球日報 作者 | Asher 過去一周,隨著比特幣價格的強勢反彈,GameFi板塊也出現了不錯的漲幅。也許現在是投資 GameFi 領域的好時機。因此,Odaily星球日報對近期熱門或有熱門活動的區塊鏈遊戲專案進行了總結和整理。區塊鏈遊戲板塊二級市場表現 根據Coingecko數據,Gaming(GameFi)板塊近一周上漲6.9%;目前總市值為$20,475,708,280,位居板塊排名第28位,較上週總市值板塊排名下降三位。過去一周,GameFi板塊代幣數量從360個增加到365個,新增5個項目,排名…