Task

Ranking

已登录

Bee登录

Twitter 授权

TG 授权

Discord 授权

去签到

下一页

关闭

获取登录状态

My XP

0

0

+0

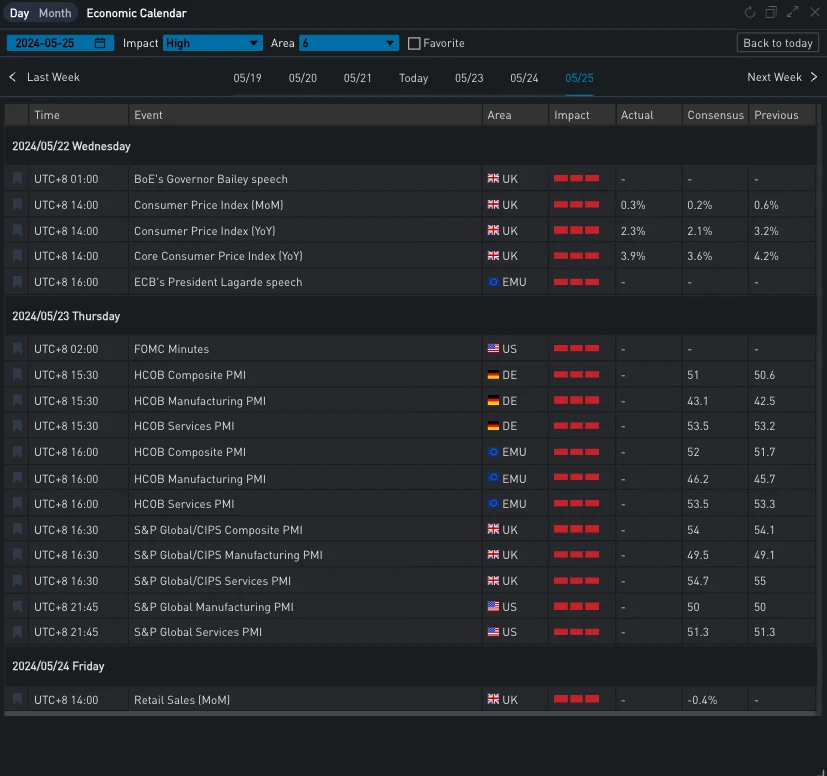

昨天(5月21日)據金石報道,聯準會理事沃勒表示,未來三到五個月通膨數據疲弱,將讓聯準會考慮年底降息,沒有必要升息眼下。聯準會副主席巴爾也重申,高利率需要維持較長一段時間。 10年期美國公債殖利率五天來首度下跌,一度跌至4.40%,但今日已收復大部分失地,現報4.437%。美股三大指數收高,標普、納指分別上漲0.26%/0.2%,再度創歷史新高。

資料來源:SignalPlus、經濟日曆

資料來源:投資

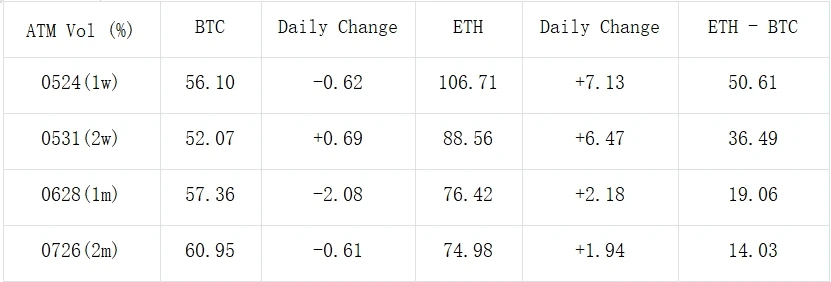

數位貨幣方面,隨著以太坊現貨ETF決策日的臨近,ETH整體IV水準再次上漲,價格成功突破3,700大關。比特幣價格小幅疲軟,幣價調整回US$70,000左右。

資料來源:Deribit(截至 22 月 16 日:00 UTC+ 8)

來源:SignalPlus

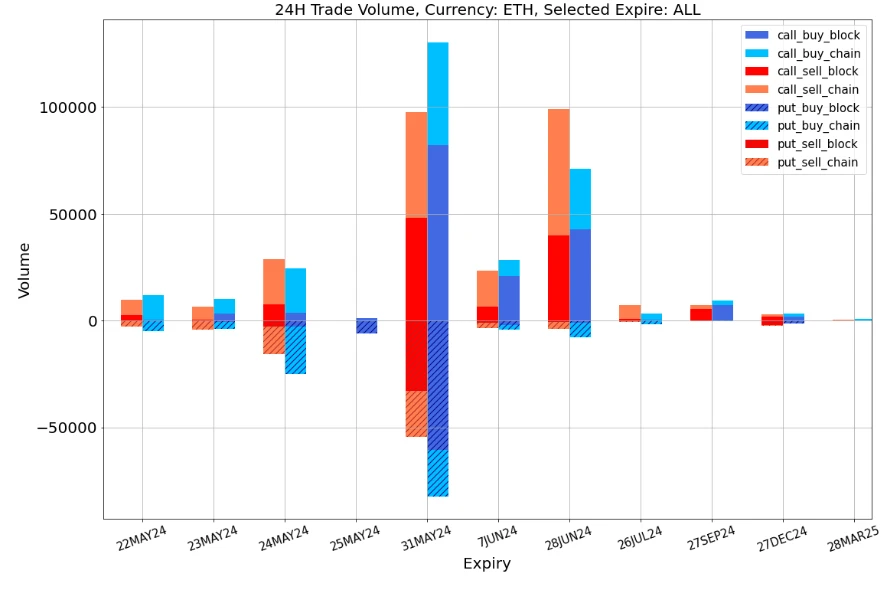

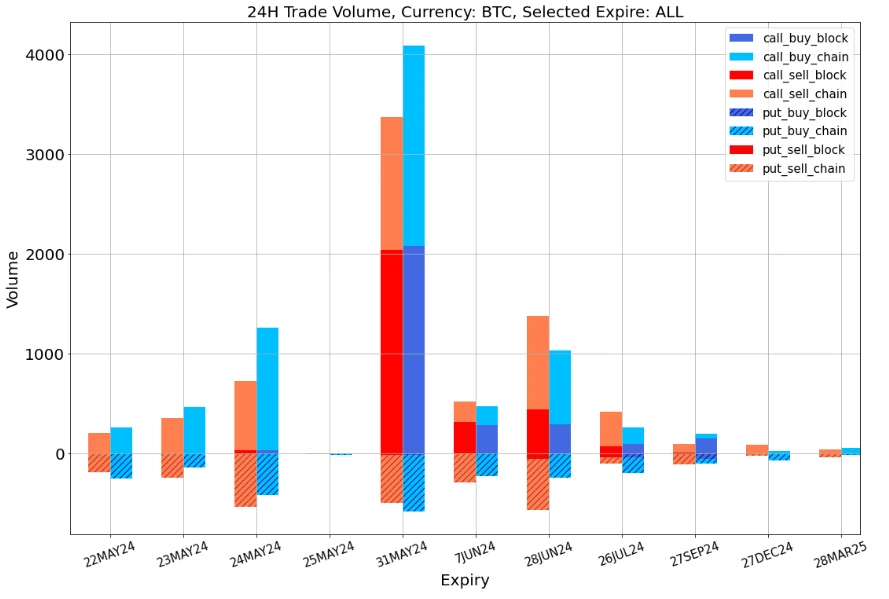

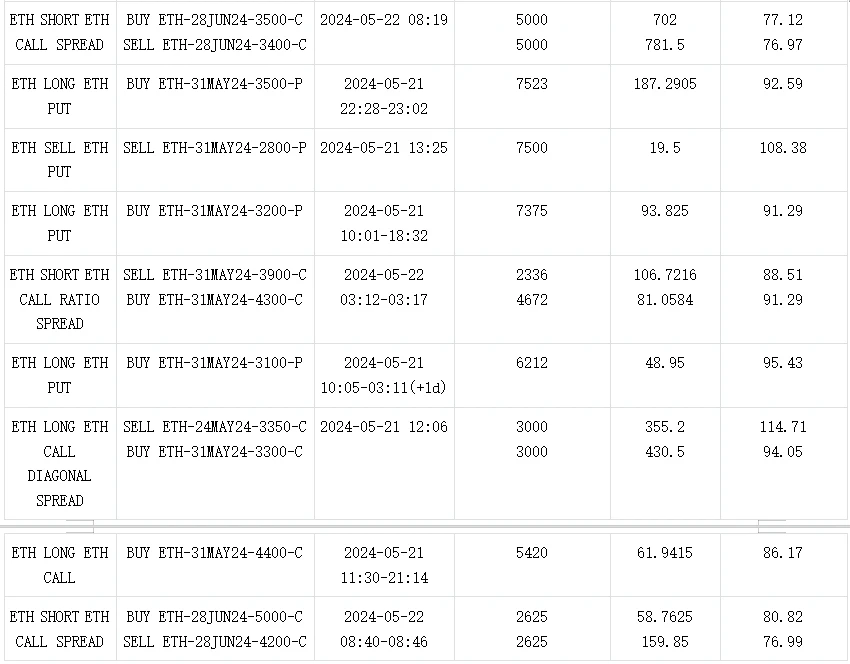

交易方面,BTC主要採取看漲策略,其中5月31日77000 vs 81000看漲期權單腳交易量接近1400 BTC,成為昨日焦點。 ETH方面,幣價大幅上漲引發大量停損止盈單,其中5月31日3000-C回購停損約19500ETH, 24 JUN 28 3600-C 賣出獲利約18000 ETH,是昨天最顯著的減倉點;大宗平台交易火爆,主要包括6月看漲看漲期權價差、5月底多頭3400看跌期權、Wing看漲期權的賣出和看跌期權的買入,解釋了昨天上行行情中ETH Vol Skew整體大幅下滑的情況。

來源:SignalPlus

資料來源:Deribit,ETH交易整體分佈

資料來源:Deribit,BTC交易整體分佈

來源:Deribit 大宗交易

來源:Deribit 大宗交易

您可以在ChatGPT 4.0的插件商店中搜尋SignalPlus來取得即時加密資訊。如果您想在第一時間收到我們的更新,請關注我們的 Twitter 帳號@SignalPlus_Web3,或加入我們的微信群(新增助手微信:SignalPlus 123)、Telegram 群和 Discord 社區,與更多朋友交流互動。 SignalPlus 官方網站:https://www.signalplus.com

本文來源於網路:SignalPlus波動率專欄(20240522):明天決議ETF

相關:Polygon (MATIC) 價格陷入盤整,但牛市反彈可能即將來臨

簡而言之,Polygon 價格目前陷入盤整,正向阻力位 $0.746 邁進。 MATIC 持有者表現出潛在增持的跡象,這在歷史上曾導致反彈。 Polygon 原生代幣供應中只有 33% 實現盈利,使其有資格獲得可觀的收益。 Polygon (MATIC) 價格等待強勁的看漲線索,這可能會推動山寨幣擺脫目前陷入的盤整。 Polygon 投資者暗示吸籌 如果投資者採取相應行動,MATIC 價格可能會突破 $0.74 障礙。只要這些 MATIC 持有者不拋售,整合就可以繼續,而累積就可以實現上漲。這是 MATIC 可能的結果…