原作者:Matt Hougan,Bitwise 首席投資官

編譯:Odaily 星球日報 Azuma

Editors note: This article is an analysis by Matt Hougan, a well-known bull and Bitwise Chief Investment Officer, on the upcoming spot Ethereum ETF resolution and the current change in the attitude of US regulators towards cryptocurrencies. It is worth mentioning that when Matt published this article, the expectation of ETF approval had not yet undergone a sudden change, but Matt still gave a bullish judgment in the article and emphasized that the significance of the bill to overturn SAB 121 passed the Senate vote last week is far greater than ETF, so whether the ETF can be approved or not, the arrival of a new high is doomed.

The following is Matt’s full text, translated by Odaily Planet Daily.

Later this week, the U.S. Securities and Exchange Commission (SEC) will decide the fate of a spot Ethereum ETF.

You might think Im holding my breath as the market is split over whether the ETF will be approved or rejected, but theres actually a much bigger change happening in Washington right now that will reshape the trajectory of crypto for years to come . While this does worry me a bit (for reasons Ill explain later), its a huge positive catalyst in terms of market movement, and I think it will drive crypto to new all-time highs, regardless of the outcome of the Ethereum ETF.

In the following, I will explain this in detail.

A vote

Late last week, something significant happened in Washington, as senators from both parties voted for the first time to pass a pro-cryptocurrency legislation.

More importantly, although the White House threatened to veto the bill before the vote, the majority of lawmakers still chose to vote in favor of it. This is a very positive signal for the future of cryptocurrency.

-

Odaily Planet Daily Note: This paragraph can be found in Has the policy direction changed? In addition to ETFs, these two major events reveal a new attitude towards crypto regulation .

What exactly happened?

In April 2022, the U.S. SEC issued the so-called Staff Accounting Bulletin No. 121 (SAB 121), the implementation of which made it almost impossible for Wall Street banks to help their clients custody crypto assets.

具體來說, SAB 121 requires banks that provide crypto asset custody services to treat these custody assets as a liability on their own balance sheets. In other words, if a bank helps a client custody $1 billion in Bitcoin, it must find $1 billion in cash to hedge it, and if the price of Bitcoin doubles, the bank must also find another $1 billion to maintain balance on the books.

This rule is quite ridiculous and does not apply to any other assets either. After all, assets in custody do not belong to the bank, they belong only to the customers, so it makes no sense to treat them as liabilities.

The implementation of this rule makes it completely unfeasible for banks to provide crypto asset custody services. Custody fees are generally less than 1% per year, while the cost of borrowing cash (to balance the books) is 5-7% per year. From a mathematical point of view, this is obviously not a viable business.

That’s why, currently, only entities regulated by trust charters like Coinbase Custody Trust Company LLC and Fidelity Digital Assets can provide crypto custody services, not banks; this is also why all major banks, including Bank of New York Mellon and State Street, have given up on opening crypto custody businesses in the past year.

This is a terrible rule that is extremely unfair to banks and unhelpful to cryptocurrencies and investors as it will only make custody services more expensive and relatively less secure.

Worse still, the SEC did not follow standard rulemaking procedures when implementing SAB 121. The SEC is supposed to follow a formal process to implement new rules, such as setting up an open market comment period to allow the public and industry to provide input, but the SEC skipped that process and instead tried to quietly push through SAB 121 using non-standard procedures.

In October 2023, the U.S. Government Accountability Office (Government Accountability Office, an independent, nonpartisan government agency that generally acts as a congressional oversight agency) pointed out that SAB 121s procedures were not in compliance with regulations and pointed out that the SEC should follow standard procedures. This opened the door for Congress to review the rule, so last week, both parties had the opportunity to vote to overturn the rule.

Why do the two parties have the same attitude?

Why has opposition to SAB 121 become a collective consensus among lawmakers from both parties? Historically, the Democratic Party has always supported the SEC (which tends to oppose cryptocurrencies), which is why Washington has never passed any bill supporting cryptocurrencies in history. So now, is there any new change in the situation?

The answer is simple – money!

The approval of the spot Bitcoin ETF has made Wall Street realize that crypto asset custody services can bring huge profits, and they certainly don’t want to let all of this pie fall into the hands of native companies in the cryptocurrency field.

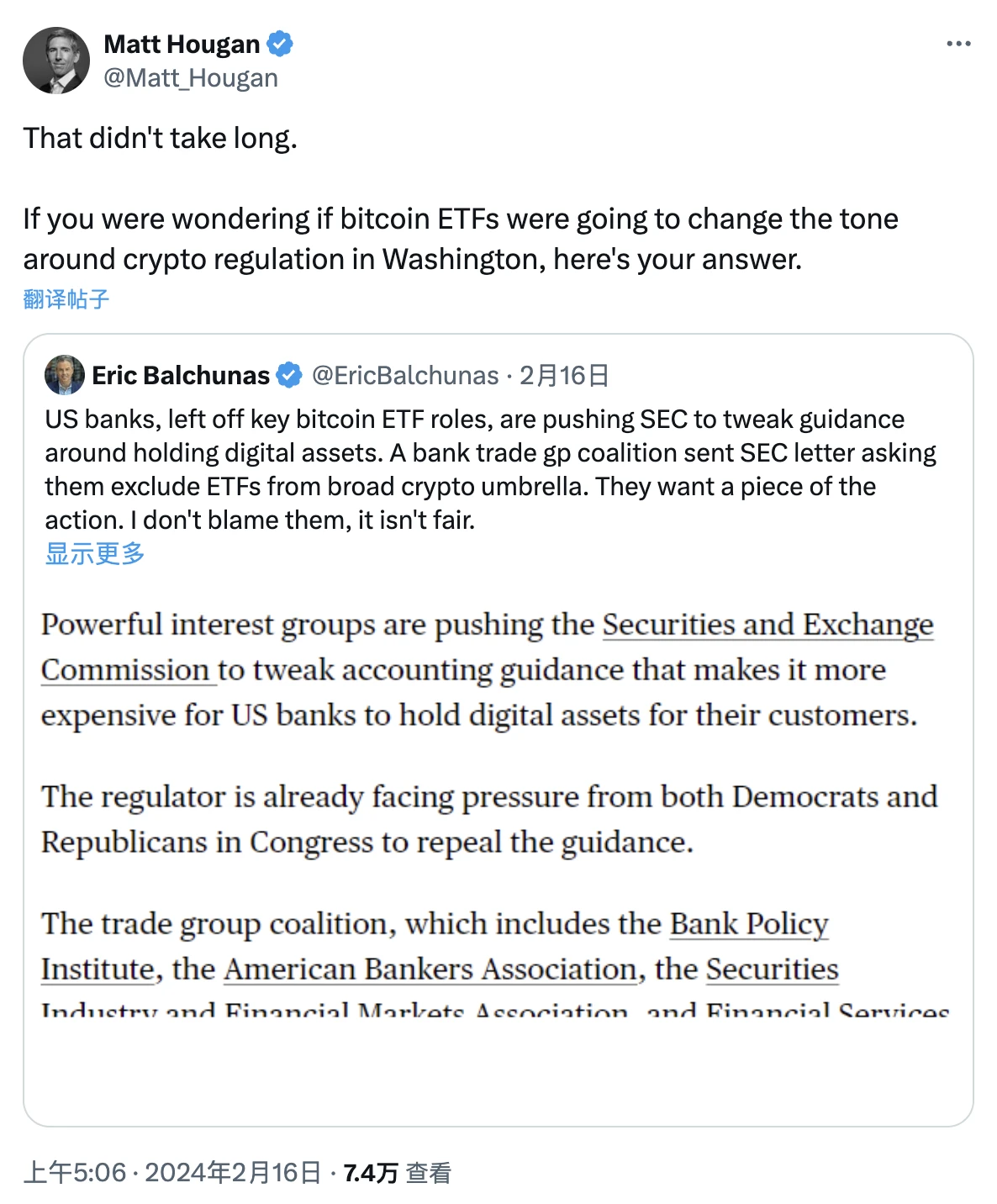

This is not just speculation. When the spot Bitcoin ETF was launched, a series of bank lobbying organizations (Bank Policy Institute, American Bankers Association, Securities Industry and Financial Markets Association, Financial Services Forum, etc.) jointly sent a letter to the SEC opposing SAB 121. I also explained it on X at the time: If you want to know whether Bitcoin ETF will change the attitude of Washington on cryptocurrency regulation, here is your answer.

Wall Streets attitude was the reason behind Democratic Congressman and Senate Majority Leader Chuck Schumers vote to repeal SAB 121, as the largest donor to Schumers campaign funds came from Wall Street.

Schumer is not alone. Ten other Democratic members of the Senate also voted in favor of the bill to repeal SAB 121. Previously, 21 Democratic members of the House of Representatives voted in favor . It is worth emphasizing that although the Biden administration rarely stated before the vote that it would oppose the bill to overturn SAB 121, these members still chose to express their support.

Wall Streets attitude is powerful enough to make Democratic lawmakers feel they can oppose their president.

The “new alliance” between cryptocurrencies, Wall Street, and Washington

The real significance of this phenomenon is not how the custody method of cryptocurrencies will change. No one really cares whether the giants on Wall Street will actually provide custody services. Of course, it would be better if more giants entered the market, but the custodians we have available today are already quite good.

The real significance of this phenomenon is that it marks the emergence of a larger trend – a new alliance is forming between cryptocurrencies, Wall Street and Washington.

Evidence of the Covenant is everywhere, including its apparent role as a driving force behind the repeal of SAB 121, the approval of a spot Bitcoin ETF following BlackRock’s involvement, and my suggestion two weeks ago that we would definitely see Congress pass a comprehensive stablecoin bill later this year — Wall Street will not sit idly by while Tether makes more money than Goldman Sachs.

Of course, this isn’t a perfect alliance, as Wall Street clearly doesn’t care about the values of cryptocurrency (such as permissionless financial services, or users always keeping ownership of the property), but that may not matter, as every step this alliance takes (whether it’s about custody services or stablecoins) will open the door to further growth.

If Wall Street cares about profits from services, moves to expand custody demand (like more ETFs) will be pushed forward; if Wall Street cares about returns from stablecoins, moves to expand stablecoin demand will also occur. This is undoubtedly a huge improvement over the past decade of overt hostility that cryptocurrencies have been subjected to in Washington.

All in all, Bitwise’s view is that cryptocurrencies are gradually moving towards mainstream adoption, and this progress will drive cryptocurrencies to new all-time highs.

Regardless of whether the spot Ethereum ETF will be approved, the change in attitude in Washington is the best example.

This article is sourced from the internet: Bitwise injects faith again: Whether the ETF is passed or not, new highs will surely come

相關:分析Filecoin(FIL):$5會支援持有還是折疊?

簡而言之,隨著投資者後退一步,Filecoin 價格可能會繼續下跌趨勢。在價值 $3100 萬多頭 FIL 合約被清算後,多頭將從樂觀押注中撤退。這在未平倉合約中已經可見,未平倉合約已從 $380 百萬減半至 $176 百萬。 Filecoin(FIL)的價格是眾多山寨幣之一,由於看跌的市場暗示,價格可能會繼續出現調整。投資者興趣和資金流入的減少將是價格下跌的關鍵因素。 Filecoin 失去支持者 Filecoin 的價格從月初的 $10 跌至今天的 $5.9 市值。考慮到龐大的…,這種劇烈的調整似乎讓投資者相當震驚。